Agricultural Sprayer Market Synopsis

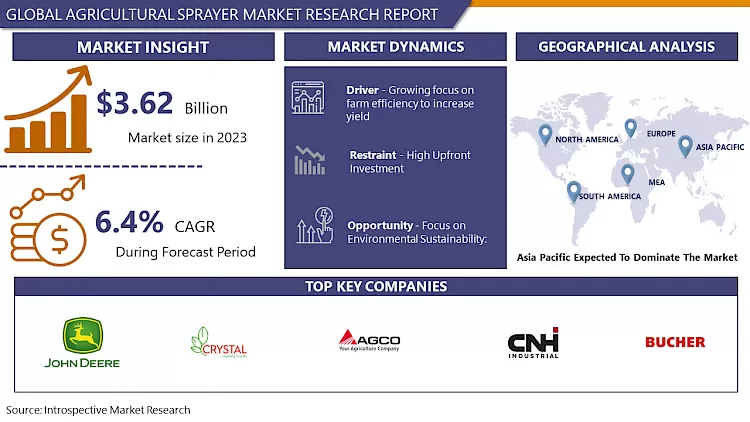

Agricultural Sprayer Market Size Was Valued at USD 3.62 Billion in 2023, and is Projected to Reach USD 6.32 Billion by 2032, Growing at a CAGR of 6.4% From 2024-2032.

- The most important piece of equipment in modern farming is an agricultural sprayer, the tool used to quickly and accurately apply pesticides, fertilizers, and other chemicals to the crops that protect plants and enhance their growth. It is a designated device developed to perfectly cover the liquids based on the needs of the agricultural fields.

- These sprayers are offered in different forms including small handheld varieties for smaller farms to large-scale mountain tractors or self-propelled ones for commercial farming. The design and functioning of agricultural sprayers nowadays are astonishing as they continuously evolve along with breakthrough technologies to ensure accuracy, save waste, and reduce noxious environmental impact.

- The distribution instrument can be either booms or nozzles to evenly spray the liquid across the crop canopy. The tank keeps the liquid solution and the pump exerts pressure and distributes it to the field. Today’s modern agricultural sprayers, featuring advanced control systems like variable rate technology and GPS guidance, help farmers to apply inputs precisely, depending on different variables like crop type, field topography, and certain bugs or pests.

- The agro-sprayers are a central part of the sustainable farming practices for crop yields increase and resources and environmental protection through efficient spraying of agrochemicals and fertilizers..

Agricultural Sprayer Market Trend Analysis

Growing Need for Crop Protection

- Crop protection becomes an important issue while shaping agricultural sprayer market for several reasons. In the first place, the requirement for food production is increasing in order to address the issue of increasing population size.

- Farmers are struggling to maximize yields from their existing farming lands due to the scarcity of arable fields. As a result, agricultural methods have been intensified. Weed, pest, and disease control with agrochemicals like pesticides and herbicides in order to increase crop yields is a common part of this intensification. These crop protection techniques cannot work without agricultural sprayers that will let you target your treatments precisely and make sure that your crops get all the treatments they need to thrive.

- Apart from that, emergence of pests and diseases and a shift in weather patterns make the task of crop production much more difficult. There is a high dynamic of pests and diseases which is caused by global climate change leading to infection of crops and lower production. To protect their crops, farmers might need to adjust their pest management plan and be more proactive.

- Due to the ability of agricultural sprayers using the latest technologies to react quickly to changing conditions and apply appropriate treatments, unnecessary adverse effects of pests and diseases on crops can be minimized. To conclude, the necessity of agriculture sprayers as a key equipment in present-day crop farming is being driven by the rising food demand and the changing environment and weather situations...

The growing use of precision farming techniques

- The increased adoption of precision agriculture methods is a major chance for the sprayer market in agriculture. Making use of modern technologies such as sensors, GPS, and data analysis, precision farming optimize crop yield in various ways. These include: input application.

- In combination with precision farming technologies, agricultural sprayers can offer more accurate and efficient application of fertilizers and agrochemicals than before. Farmers can achieve maximum crop yields and input waste minimization through precise targeting based on crop health, soil conditions, and insect severity in specific areas. In addition, it prevents adverse environmental impact.

- In addition, the technique of variable rate application, which implies the variation of input rates in real-time depending on spatial variability in the field, is an advantage of precision farming technology. The variability of agricultural landscapes where crop conditions, topography, and soil types can diversify within a single field, brings this skill into evidence.

- Varying rate technology in agricultural sprayers facilitates the precise spraying of specialized treatments in different fields to match their particular needs, thus resulting in higher resource efficiency and overall crop performance. As farmers adopt precision farming methods to try and enhance productivity and sustainability, the demand for smart agricultural sprayers that can support the practice is likely to increase in proportion. This will be the stimulus for new markets and innovations..

Agricultural Sprayer Market Segment Analysis:

Agricultural Sprayer Market is segmented based on Type, Farm Size, Nozzel Size, Power Sources, Capacity, Crop Type and Usage.

By Type, the Tractor-mounted sprayers segment is expected to dominate the market during the forecast period

- The most common type of agricultural sprayer that is mounted on a tractor is the one that is mounted on this machine. Because of their adaptability, efficiency, and the fact that they can be used with farm equipment that is commonly in use, these sprayers are extremely popular. In the sprayers mounted on tractors, the strength and maneuverability of tractors are utilized to overlay tremendous areas of agricultural land. They cater for different sizes of farms at various operating scales since they are availed in different sizes and connections.

- The sprayers offer flexibility of application and can be custom designed to various crop types and field conditions due to their easy attachment to and operation from tractors. The ability of tractor-mounted sprayers to apply accurate and efficient pesticides has also been improved by technological advancement like GPS guidance and variable rate application, which has made them more attractive to farmers who are seeking to maximize crop output and optimize utilization of inputs.

- Self-driving sprayers are yet another market share that agricultural sprayers are enjoying. In contrast to the tractor-mounted variants, these sprayers are autonomous and agile therefore suited for big scale farming operations and difficult terrain. Self-propelled sprayers can move around the field without a second tractor because they have their own power and steering mechanism.

- Thanks to their speed, accuracy while dealing with large areas, and control over the application, self-propelled sprayers boost the effectiveness of the whole process. Self-driven sprayers may be more and more popular in the future as the farms continue to increase in size and complexity and farmers pay more attention to productivity and efficiency. This will increase the company’s credibility in the agricultural sprayer market.

By Farm Size, the large and medium Size segment held the largest share in 2023

- Agricultural sprayer market is the segment which varies regionally, but in general the large and medium farm size segments are more dominating. Large farms, which are known for their large land holdings and automated operations, usually have the financial capabilities and the operational size to purchase advanced agricultural machinery and equipment, such as sprayers.

- These very farms are usually as obsessed with productivity and efficiency as they can be in order to obtain high yields for low input costs. They are therefore tend to favor the use of more massive, high-capacity sprinklers that can readily handle big areas. In order to achieve the application of agrochemicals on time over the wide tracts of land their farms may own, large farms will continue to invest in many sprayers which will make up the demand in the market.

- Besides that, medium-sized farms are also a significant market participant in the category of agricultural sprayers. These farms either adopt mechanized or semi-mechanized agricultural systems and medium-scale farmlands. Despite the fact that they have smaller size, nevertheless, medium farms must have reliable and efficient equipment in order to remain profitable and competitive with giant farms. Therefore, agro-chemical applicators are among the users of sprayers and they often choose the mid-range models that emphasize price, performance and capacity.

- Moreover, medium-sized farms may pay more attention to the adaptability and versatility of their equipment when selecting a sprayer and prefer the ones that can be easily adjusted to different crop varieties and field conditions. The market in agricultural sprayers is mainly occupied by the large and medium sized farms, which reflect the diversity of requirements and goals in modern farming activities...

Agricultural Sprayer Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Agricultural Sprayer Market is dominated by the Asia-Pacific Region and the reasons are many. Initially, the region can be mentioned as the original home of some of the world's best agricultural economies, for example China and India with enormous fertile land and mainly depend on agriculture for their economic growth as well as food security. To promote efficient crop production in the agriculture sector, it is necessary to have enough agricultural machinery and equipment, for example, sprayers, which are brought by the size of the agricultural sectors.

- Fast adoption technology and farming techniques innovation made the Asia-Pacific region become the leader in the market. To improve production and sustainability the farmers from countries like China, India, and Japan are embracing precision agriculture and other modern crop practices. Maximizing the input applications and increasing crop yields foster a more substantial demand for high-tech agricultural machinery and tools for instance precision-equipped sprayers.

- The Asia-Pacific agricultural sprayer market is being driven by government plans and initiatives that were put in place to promote modernizing and mechanizing agriculture. Farmer is stimulated to acquire new technologies including the latest agricultural machinery like sprayers through the means of subsidies, incentives and agricultural infrastructure and technology developments which consequently leads to the market growth. Generally, the Asia-Pacific is considered a significant player in the world agricultural sprayer market because of the massive agricultural economy coupled with growing adoption of advanced farming methods and government-friendly policies.

Active Key Players in the Agricultural Sprayer Market

- AGCO Corporation (Duluth, Georgia, USA)

- ASPEE India (Mumbai, Maharashtra, India)

- Avison Sprayers (Boston, Lincolnshire, UK)

- Boston Crop Sprayers Limited (Boston, Lincolnshire, UK)

- Bucher Industries AG (Niederweningen, Switzerland)

- CNH Industrial N.V. (London, United Kingdom)

- Crystal Crop Protection Limited (New Delhi, India)

- Deere and Company (Moline, Illinois, USA)

- EXEL Industries (Paris, France)

- Foggers India Pvt. Ltd. (Mumbai, Maharashtra, India)

- Househam Sprayers Limited (Leadenham, Lincolnshire, UK)

- Jacto Inc. (Pompano Beach, Florida, USA)

- John Rhodes AS Limited (Worcestershire, England, UK)

- KUBOTA Corporation (Osaka, Japan)

- Mahindra and Mahindra Limited (Mumbai, India)

- STIHL (Waiblingen, Germany)

- Taizhou Sunny Crop Machinery Co., Ltd. (Zhejiang, China)

- Yamaha Motor Co., Ltd. (Iwata, Shizuoka, Japan)

- Zhejiang Ousen Machinery Co. Ltd. (Zhejiang, China)

- Other Key Players

Key Industry Developments in the Agricultural Sprayer Market:

- In November 2022, John Deere closed a deal to introduce C&Spray technology in Europe, which is capable of weeds identification and tailor treatments. This system recognizes color variations in the given area using camera technology. Along with this, cameras are built in the frames of the crane or machine.

- At the end of November 2022, DJI brought out the T50, T25, and Mavic 3 Multispectral products. Two sets of active phased array radars, two sets of binocular vision, and a dual atomization sprinkling system that combines aerial survey and defense flight are added in the T50. The T50 has a maximum cargo spreading and spraying capacity of 40kg and it can also perform a 50kg load lift. Its maximum wheel base is 2200 mm, its spraying at 16 L/min, and its sow at 108 kg/min.

|

Global Agricultural Sprayer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 3.62 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.4 % |

Market Size in 2032: |

USD 6.32 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Farm Size |

|

||

|

By Nozzle Type |

|

||

|

By Power Source |

|

||

|

By Capacity |

|

||

|

By Crop Type |

|

||

|

By Usage |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Agricultural Sprayer Market by By Type (2018-2032)

4.1 Agricultural Sprayer Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Handheld

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Self-Propelled

4.5 Low HP

4.6 Medium HP

4.7 High HP

4.8 Tractor Mounted

4.9 Trailed

4.10 Aerial

Chapter 5: Agricultural Sprayer Market by By Farm Size (2018-2032)

5.1 Agricultural Sprayer Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Large

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Medium

5.5 Small

Chapter 6: Agricultural Sprayer Market by By Nozzle Type (2018-2032)

6.1 Agricultural Sprayer Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hydraulic

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Gaseous

6.5 Centrifugal

6.6 Thermal

Chapter 7: Agricultural Sprayer Market by By Power Source (2018-2032)

7.1 Agricultural Sprayer Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Fuel Based

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Electric and Battery Driven

7.5 Solar

7.6 Manual

Chapter 8: Agricultural Sprayer Market by By Capacity (2018-2032)

8.1 Agricultural Sprayer Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Ultra-Low Volume

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Low Volume

8.5 High Volume

Chapter 9: Agricultural Sprayer Market by By Crop Type (2018-2032)

9.1 Agricultural Sprayer Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Cereals

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Oilseeds

9.5 Fruits and Vegetables

9.6 Others

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Agricultural Sprayer Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 LOREAL GROUP (FRANCE)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 MAX FACTOR (UNITED STATES)

10.4 OPERA (PIAS) (SOUTH KOREA)

10.5 THEFACESHOP (SOUTH KOREA)

10.6 BENEFIT (UNITED STATES)

10.7 CHANEL (FRANCE)

10.8 LVMH (FRANCE)

10.9 DHC (JAPAN)

10.10 SHISEIDO (JAPAN)

10.11

Chapter 11: Global Agricultural Sprayer Market By Region

11.1 Overview

11.2. North America Agricultural Sprayer Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size By By Type

11.2.4.1 Handheld

11.2.4.2 Self-Propelled

11.2.4.3 Low HP

11.2.4.4 Medium HP

11.2.4.5 High HP

11.2.4.6 Tractor Mounted

11.2.4.7 Trailed

11.2.4.8 Aerial

11.2.5 Historic and Forecasted Market Size By By Farm Size

11.2.5.1 Large

11.2.5.2 Medium

11.2.5.3 Small

11.2.6 Historic and Forecasted Market Size By By Nozzle Type

11.2.6.1 Hydraulic

11.2.6.2 Gaseous

11.2.6.3 Centrifugal

11.2.6.4 Thermal

11.2.7 Historic and Forecasted Market Size By By Power Source

11.2.7.1 Fuel Based

11.2.7.2 Electric and Battery Driven

11.2.7.3 Solar

11.2.7.4 Manual

11.2.8 Historic and Forecasted Market Size By By Capacity

11.2.8.1 Ultra-Low Volume

11.2.8.2 Low Volume

11.2.8.3 High Volume

11.2.9 Historic and Forecasted Market Size By By Crop Type

11.2.9.1 Cereals

11.2.9.2 Oilseeds

11.2.9.3 Fruits and Vegetables

11.2.9.4 Others

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Agricultural Sprayer Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size By By Type

11.3.4.1 Handheld

11.3.4.2 Self-Propelled

11.3.4.3 Low HP

11.3.4.4 Medium HP

11.3.4.5 High HP

11.3.4.6 Tractor Mounted

11.3.4.7 Trailed

11.3.4.8 Aerial

11.3.5 Historic and Forecasted Market Size By By Farm Size

11.3.5.1 Large

11.3.5.2 Medium

11.3.5.3 Small

11.3.6 Historic and Forecasted Market Size By By Nozzle Type

11.3.6.1 Hydraulic

11.3.6.2 Gaseous

11.3.6.3 Centrifugal

11.3.6.4 Thermal

11.3.7 Historic and Forecasted Market Size By By Power Source

11.3.7.1 Fuel Based

11.3.7.2 Electric and Battery Driven

11.3.7.3 Solar

11.3.7.4 Manual

11.3.8 Historic and Forecasted Market Size By By Capacity

11.3.8.1 Ultra-Low Volume

11.3.8.2 Low Volume

11.3.8.3 High Volume

11.3.9 Historic and Forecasted Market Size By By Crop Type

11.3.9.1 Cereals

11.3.9.2 Oilseeds

11.3.9.3 Fruits and Vegetables

11.3.9.4 Others

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Agricultural Sprayer Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size By By Type

11.4.4.1 Handheld

11.4.4.2 Self-Propelled

11.4.4.3 Low HP

11.4.4.4 Medium HP

11.4.4.5 High HP

11.4.4.6 Tractor Mounted

11.4.4.7 Trailed

11.4.4.8 Aerial

11.4.5 Historic and Forecasted Market Size By By Farm Size

11.4.5.1 Large

11.4.5.2 Medium

11.4.5.3 Small

11.4.6 Historic and Forecasted Market Size By By Nozzle Type

11.4.6.1 Hydraulic

11.4.6.2 Gaseous

11.4.6.3 Centrifugal

11.4.6.4 Thermal

11.4.7 Historic and Forecasted Market Size By By Power Source

11.4.7.1 Fuel Based

11.4.7.2 Electric and Battery Driven

11.4.7.3 Solar

11.4.7.4 Manual

11.4.8 Historic and Forecasted Market Size By By Capacity

11.4.8.1 Ultra-Low Volume

11.4.8.2 Low Volume

11.4.8.3 High Volume

11.4.9 Historic and Forecasted Market Size By By Crop Type

11.4.9.1 Cereals

11.4.9.2 Oilseeds

11.4.9.3 Fruits and Vegetables

11.4.9.4 Others

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Agricultural Sprayer Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size By By Type

11.5.4.1 Handheld

11.5.4.2 Self-Propelled

11.5.4.3 Low HP

11.5.4.4 Medium HP

11.5.4.5 High HP

11.5.4.6 Tractor Mounted

11.5.4.7 Trailed

11.5.4.8 Aerial

11.5.5 Historic and Forecasted Market Size By By Farm Size

11.5.5.1 Large

11.5.5.2 Medium

11.5.5.3 Small

11.5.6 Historic and Forecasted Market Size By By Nozzle Type

11.5.6.1 Hydraulic

11.5.6.2 Gaseous

11.5.6.3 Centrifugal

11.5.6.4 Thermal

11.5.7 Historic and Forecasted Market Size By By Power Source

11.5.7.1 Fuel Based

11.5.7.2 Electric and Battery Driven

11.5.7.3 Solar

11.5.7.4 Manual

11.5.8 Historic and Forecasted Market Size By By Capacity

11.5.8.1 Ultra-Low Volume

11.5.8.2 Low Volume

11.5.8.3 High Volume

11.5.9 Historic and Forecasted Market Size By By Crop Type

11.5.9.1 Cereals

11.5.9.2 Oilseeds

11.5.9.3 Fruits and Vegetables

11.5.9.4 Others

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Agricultural Sprayer Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size By By Type

11.6.4.1 Handheld

11.6.4.2 Self-Propelled

11.6.4.3 Low HP

11.6.4.4 Medium HP

11.6.4.5 High HP

11.6.4.6 Tractor Mounted

11.6.4.7 Trailed

11.6.4.8 Aerial

11.6.5 Historic and Forecasted Market Size By By Farm Size

11.6.5.1 Large

11.6.5.2 Medium

11.6.5.3 Small

11.6.6 Historic and Forecasted Market Size By By Nozzle Type

11.6.6.1 Hydraulic

11.6.6.2 Gaseous

11.6.6.3 Centrifugal

11.6.6.4 Thermal

11.6.7 Historic and Forecasted Market Size By By Power Source

11.6.7.1 Fuel Based

11.6.7.2 Electric and Battery Driven

11.6.7.3 Solar

11.6.7.4 Manual

11.6.8 Historic and Forecasted Market Size By By Capacity

11.6.8.1 Ultra-Low Volume

11.6.8.2 Low Volume

11.6.8.3 High Volume

11.6.9 Historic and Forecasted Market Size By By Crop Type

11.6.9.1 Cereals

11.6.9.2 Oilseeds

11.6.9.3 Fruits and Vegetables

11.6.9.4 Others

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Agricultural Sprayer Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size By By Type

11.7.4.1 Handheld

11.7.4.2 Self-Propelled

11.7.4.3 Low HP

11.7.4.4 Medium HP

11.7.4.5 High HP

11.7.4.6 Tractor Mounted

11.7.4.7 Trailed

11.7.4.8 Aerial

11.7.5 Historic and Forecasted Market Size By By Farm Size

11.7.5.1 Large

11.7.5.2 Medium

11.7.5.3 Small

11.7.6 Historic and Forecasted Market Size By By Nozzle Type

11.7.6.1 Hydraulic

11.7.6.2 Gaseous

11.7.6.3 Centrifugal

11.7.6.4 Thermal

11.7.7 Historic and Forecasted Market Size By By Power Source

11.7.7.1 Fuel Based

11.7.7.2 Electric and Battery Driven

11.7.7.3 Solar

11.7.7.4 Manual

11.7.8 Historic and Forecasted Market Size By By Capacity

11.7.8.1 Ultra-Low Volume

11.7.8.2 Low Volume

11.7.8.3 High Volume

11.7.9 Historic and Forecasted Market Size By By Crop Type

11.7.9.1 Cereals

11.7.9.2 Oilseeds

11.7.9.3 Fruits and Vegetables

11.7.9.4 Others

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Global Agricultural Sprayer Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 3.62 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.4 % |

Market Size in 2032: |

USD 6.32 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Farm Size |

|

||

|

By Nozzle Type |

|

||

|

By Power Source |

|

||

|

By Capacity |

|

||

|

By Crop Type |

|

||

|

By Usage |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Agricultural Sprayer Market research report is 2024-2032.

AGCO Corporation, Bucher Industries AG, Buhler Industries Inc. (Rostselmash), CNH Industrial N.V., Deere and Company, EXEL Industries, Jacto Inc., KUBOTA Corporation, Mahindra and Mahindra Limited, STIHL, Yamaha Motor Co., Ltd., Crystal Crop Protection Limited, Househam Sprayers Limited, John Rhodes AS Limited, Boston Crop Sprayers Limited, Avison Sprayers, ASPEE India, Taizhou Sunny Crop Machinery Co., Ltd.,Zhejiang Ousen Machinery Co. Ltd., Foggers India Pvt. Ltd. and Other Major Players.

The Agricultural Sprayer Market is segmented into Type, Farm Size, Nozzle Type, Power Source, Capacity, Crop Type, Usage and region. By Type, the market is categorized into Handheld, Self-Propelled, {Low HP, Medium HP, High HP}Tractor Mounted, Trailed, Aerial. By Farm Size, the market is categorized into Large, Medium, Small. By Nozzle Type, the market is categorized into Hydraulic, Gaseous, Centrifugal, Thermal. By Power Source, the market is categorized into Fuel Based, Electric and Battery Driven, Solar, Manual. By Capacity, the market is categorized into Ultra-Low Volume, Low Volume, High Volume. By Crop Type, the market is categorized into Cereals, Oilseeds, Fruits and Vegetables, Other Crop. By Usage, the market is categorized into Field Sprayers, Orchard Sprayers, Gardening Sprayers. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An agricultural sprayer is a device used to apply pesticides, herbicides, and fertilizers to crops. It typically consists of a tank to hold the liquid, a pump to pressurize it, and a distribution system such as nozzles to spray it onto crops. Sprayers come in various types, from handheld to tractor-mounted, catering to different farm sizes and needs.

Agricultural Sprayer Market Size Was Valued at USD 3.62 Billion in 2023, and is Projected to Reach USD 6.32 Billion by 2032, Growing at a CAGR of 6.4% From 2024-2032.