Aircraft Ceramic Armor Panels Market Synopsis

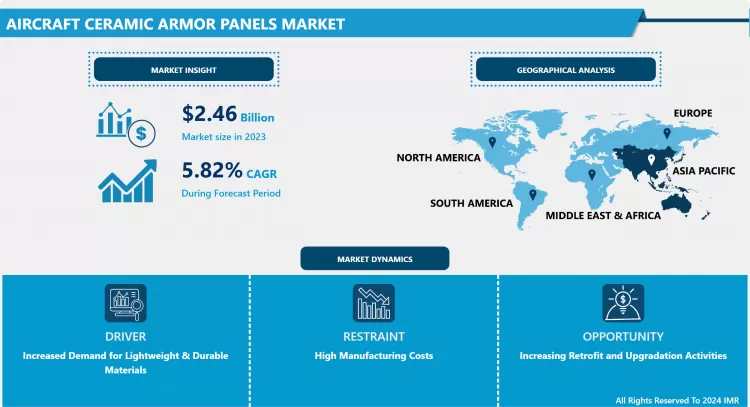

Aircraft Ceramic Armor Panels Market Size Was Valued at USD 2.46 Billion in 2023, and is Projected to Reach USD 4.09 Billion by 2032, Growing at a CAGR of 5.82% From 2024-2032.

Aircraft Ceramic Armor Panels are advanced protective components designed for aerospace applications, constructed from durable ceramic materials such as alumina or silicon carbide. These panels provide enhanced ballistic resistance to military and civil aircraft, safeguarding critical areas like cockpits, cabins, engines, and wings from various threats.

- Their lightweight and high-strength properties make them integral in mitigating potential damage from projectiles, contributing to improved aircraft survivability and overall safety in hostile environments. Aircraft Ceramic Armor Panels are gaining popularity in the aerospace industry due to their lightweight nature, high strength-to-weight ratio, and excellent hardness, durability, and abrasion resistance.

- These panels offer enhanced protection without compromising aircraft weight and performance and contribute to extended service life and reduced maintenance requirements. The market trend for these panels is increasing due to the growing emphasis on enhancing aircraft in both the military and civil aviation sectors.

- There is an increasing need to protect critical assets, and the evolving nature of modern warfare has spurred investments in advanced armor solutions. In the civil aviation sector, concerns about terrorism and passenger safety also contribute to the adoption of aircraft armor solutions. As security concerns persist and technological advancements continue, the demand for Aircraft Ceramic Armor Panels is expected to rise, driven by both military applications and the appreciation of the importance of protective measures in civil aviation.

Aircraft Ceramic Armor Panels Market Trend Analysis

Increased Demand for Lightweight & Durable Materials

- The aviation industry is increasingly focusing on lightweight and durable materials, particularly ceramic materials like alumina and silicon carbide. These materials offer high strength and low weight, making them ideal for protective applications without compromising aircraft mass. Military aviation requires agility and flexibility making lightweight armor panels essential for enhancing durability without compromising operational capabilities.

- Ceramic armor panels offer exceptional wear and tear resistance. As military and civil aviation entities pursue to address the growing threats and enhance overall safety, the demand for lightweight and durable materials, exhibited by Aircraft Ceramic Armor Panels, continues to rise as a crucial component in modern aircraft design and security strategies.

Increasing Retrofit and Upgradation Activities

- The retrofit and upgrading activities are enhancing the safety and survivability of existing aircraft fleets. Retrofitting involves upgrading advanced protective solutions like Ceramic Armor Panels into older models, ensuring their sustained operational significance and evolving threats. Upgradation activities, including the integration of modern armor technologies, are driven by the need for aircraft defensive capabilities to match emerging threats.

- The Upgradation has created a substantial market opportunity for manufacturers specializing in Aircraft Ceramic Armor Panels. Additionally, retrofitting and upgrading coordinate with sustainability goals, allowing organizations to enhance safety without the environmental impact of manufacturing new platforms. The demand for retrofit and upgrade solutions is expected to grow, presenting a profitable path for the Aircraft Ceramic Armor Panels market to expand its marks.

Aircraft Ceramic Armor Panels Market Segment Analysis:

Aircraft Ceramic Armor Panels Market Segmented Based on Product Type and Applications.

By Product Type, the Aluminum Oxides segment is expected to dominate the market during the forecast period

- Aluminum oxide, also known as alumina, offers a convincing combination of high hardness, durability, and excellent ballistic resistance. These characteristics make it a preferred choice for manufacturing armor panels, as it effectively withstands impact and penetration while remaining comparatively lightweight.

- Aluminum oxide is known for its cost-effectiveness compared to some other ceramic materials, contributing to its widespread adoption in the aerospace industry. The material's track record in providing effective protection against ballistic threats positions the Aluminum Oxides segment as a key player in the market.

By Application, Military Aviation Aircraft segment held the largest share of xx% in 2022

- Military aviation demands the highest levels of protection against ballistic threats to ensure the safety of personnel and the integrity of critical assets. Aircraft Ceramic Armor Panels, with their lightweight yet robust properties, are especially to meet the stringent requirements of military applications, providing effective protection without compromising aircraft performance.

- The increasing global geopolitical tensions and the evolving nature of modern war further underscore the necessity for advanced armor solutions in military aviation. As defense budgets continue to allocate resources to enhance aircraft survivability, the demand for Ceramic Armor Panels in military aviation is expected to remain robust, its dominance in the market.

Aircraft Ceramic Armor Panels Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- There is growing commercial aviation demand in the Asia Pacific, driven by growing economies, expanding middle classes, and tourism, necessitating the use of ceramic armor panels for protection against bird strikes. Additionally, Asian countries like China, India, and South Korea are investing heavily in modernizing their military forces, requiring reliable ballistic protection. Ceramic armor panels, with their superior strength-to-weight ratio, offer a suitable solution for these upgrades. The Asia Pacific region faces security concerns, including terrorism and cross-border conflicts, leading to a growing focus on aircraft security.

- Ceramic armor panels offer effective protection against potential threats like gunfire and shrapnel, making them a desirable safety measure. Cost-effectiveness is a key concern for Asian airlines and militaries, as Asian manufacturers offer cost-competitive ceramic armor panel solutions compared to Western countries. This price advantage has more market growth. Governments are also actively supporting the development and production of aircraft ceramic armor panels, providing research grants, establishing special economic zones, and incentivizing investments. This government support plays a crucial role in accelerating market growth.

Aircraft Ceramic Armor Panels Market Top Key Players:

- CoorsTek (United States)

- 3M (United States)

- Paxis (United States)

- ArmorWorks (United States)

- FMS (United States)

- Permali Gloucester Ltd. (United Kingdom)

- QinetiQ (United Kingdom)

- Schunk Carbon Technology (Germany)

- CeramTec (Germany)

- Saint-Gobain (France)

- SM Group (South Korea)

- Nurol Teknoloji (Turkey), and Other Major Players

Key Industry Developments in the Aircraft Ceramic Armor Panels Market:

In July 2023, in Golden, CO, CoorsTek, a prominent global advanced ceramics manufacturer, completed the acquisition of assets from Avon Protection's Lexington, Kentucky facility. The acquisition, initially announced by CoorsTek and Avon on December 5, 2022, outlined the strategic move, with the closing officially taking place on July 1, 2023, earlier than initially anticipated by the end of 2023. This acquisition marks a significant step for CoorsTek, strengthening its presence and capabilities in the realm of advanced ceramics and aligning with the company's strategic objectives.

|

Aircraft Ceramic Armor Panels Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.46 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.82 % |

Market Size in 2032: |

USD 4.09 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Aircraft Ceramic Armor Panels Market by By Product Type (2018-2032)

4.1 Aircraft Ceramic Armor Panels Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Aluminium Oxides

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Boron Carbides

4.5 Silicon Carbides

Chapter 5: Aircraft Ceramic Armor Panels Market by By Application (2018-2032)

5.1 Aircraft Ceramic Armor Panels Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Civil Aviation Aircraft

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Military Aviation Aircraft

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Aircraft Ceramic Armor Panels Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 PENSTOCKS MARKET TOP KEY PLAYERSSPECTRA COMPANY (UNITED STATES)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 WATERFRONT FLUID CONTROLS (CANADA)

6.4 INDUSTRIAL PENSTOCKS (UNITED KINGDOM)

6.5 INVICTA (UNITED KINGDOM)

6.6 HAM BAKER GROUP (UNITED KINGDOM)

6.7 ABS ARMATUREN (GERMANY)

6.8 AVK HOLDING (DENMARK)

6.9 WAMGROUP (ITALY)

6.10 AUSTRALIAN PENSTOCK & DAMPER VALVE COMPANY (AUSTRALIA)

6.11 AWMA WATER CONTROL SOLUTIONS (AUSTRALIA)

6.12 SKC ENGINEERING (SOUTH KOREA)

6.13 KAWASAKI (JAPAN)

6.14 PVS IMPEX (INDIA)

6.15 JASH ENGINEERING (INDIA)

6.16 HINDUSTAN WATER ENGINEERING COMPANY (INDIA)

6.17 ORBINOX (SPAIN)

6.18 FKB VALVULAS (SPAIN)

6.19 BUSCH TECHNOLOGY (GERMANY)

6.20 VAG VALVES (GERMANY)

6.21

Chapter 7: Global Aircraft Ceramic Armor Panels Market By Region

7.1 Overview

7.2. North America Aircraft Ceramic Armor Panels Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Product Type

7.2.4.1 Aluminium Oxides

7.2.4.2 Boron Carbides

7.2.4.3 Silicon Carbides

7.2.5 Historic and Forecasted Market Size By By Application

7.2.5.1 Civil Aviation Aircraft

7.2.5.2 Military Aviation Aircraft

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Aircraft Ceramic Armor Panels Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Product Type

7.3.4.1 Aluminium Oxides

7.3.4.2 Boron Carbides

7.3.4.3 Silicon Carbides

7.3.5 Historic and Forecasted Market Size By By Application

7.3.5.1 Civil Aviation Aircraft

7.3.5.2 Military Aviation Aircraft

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Aircraft Ceramic Armor Panels Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Product Type

7.4.4.1 Aluminium Oxides

7.4.4.2 Boron Carbides

7.4.4.3 Silicon Carbides

7.4.5 Historic and Forecasted Market Size By By Application

7.4.5.1 Civil Aviation Aircraft

7.4.5.2 Military Aviation Aircraft

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Aircraft Ceramic Armor Panels Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Product Type

7.5.4.1 Aluminium Oxides

7.5.4.2 Boron Carbides

7.5.4.3 Silicon Carbides

7.5.5 Historic and Forecasted Market Size By By Application

7.5.5.1 Civil Aviation Aircraft

7.5.5.2 Military Aviation Aircraft

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Aircraft Ceramic Armor Panels Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Product Type

7.6.4.1 Aluminium Oxides

7.6.4.2 Boron Carbides

7.6.4.3 Silicon Carbides

7.6.5 Historic and Forecasted Market Size By By Application

7.6.5.1 Civil Aviation Aircraft

7.6.5.2 Military Aviation Aircraft

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Aircraft Ceramic Armor Panels Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Product Type

7.7.4.1 Aluminium Oxides

7.7.4.2 Boron Carbides

7.7.4.3 Silicon Carbides

7.7.5 Historic and Forecasted Market Size By By Application

7.7.5.1 Civil Aviation Aircraft

7.7.5.2 Military Aviation Aircraft

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Aircraft Ceramic Armor Panels Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.46 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.82 % |

Market Size in 2032: |

USD 4.09 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Aircraft Ceramic Armor Panels Market research report is 2024-2032.

CoorsTek (United States), 3M (United States), Paxis (United States), ArmorWorks (United States), FMS (United States), Permali Gloucester Ltd. (United Kingdom), QinetiQ (United Kingdom), Schunk Carbon Technology (Germany), CeramTec (Germany), Saint-Gobain (France), SM Group (South Korea), Nurol Teknoloji (Turkey), and Other Major Players.

The Aircraft Ceramic Armor Panels Market is segmented into Product Type, Applications, and regions. By Product Type, the market is categorized into Aluminium Oxides, Boron Carbides, and Silicon Carbides. By Applications, the market is categorized into Civil Aviation Aircraft and Military Aviation Aircraft. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Aircraft Ceramic Armor Panels are advanced protective components designed for aerospace applications, constructed from durable ceramic materials such as alumina or silicon carbide. These panels provide enhanced ballistic resistance to military and civil aircraft, safeguarding critical areas like cockpits, cabins, engines, and wings from various threats. Their lightweight and high-strength properties make them integral in mitigating potential damage from projectiles, contributing to improved aircraft survivability and overall safety in hostile environments.

Aircraft Ceramic Armor Panels Market Size Was Valued at USD 2.46 Billion in 2023, and is Projected to Reach USD 4.09 Billion by 2032, Growing at a CAGR of 5.82% From 2024-2032.