Aircraft Flight Control Systems Market Synopsis

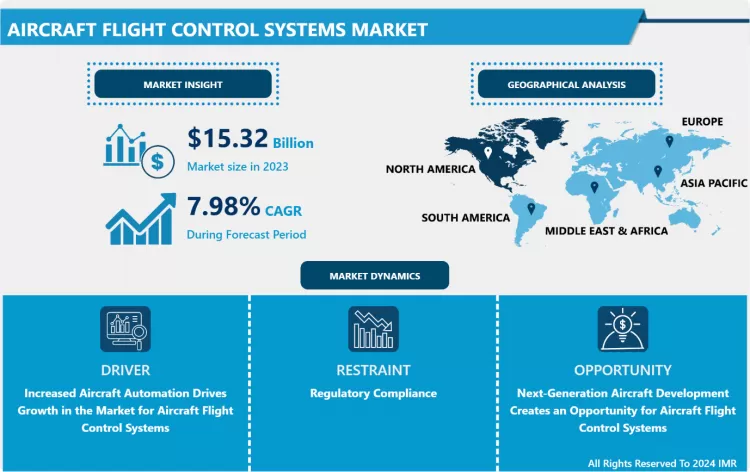

Aircraft Flight Control Systems Market Size Was Valued at USD 15.32 Billion in 2023, and is Projected to Reach USD 30.60 Billion by 2032, Growing at a CAGR of 7.99% From 2024-2032

A control system is a collection of mechanical and electronic equipment that allows an aircraft to be flown with exceptional precision and reliability. A conventional fixed-wing aircraft flight control system consists of flight control surfaces, the respective cockpit controls, connecting linkages, and the necessary operating mechanisms to control an aircraft's direction in flight. Aircraft engine controls are also considered as flight controls as they change speed.

- The development of increasingly complex flight control systems is a result of advancements in aviation technology. Innovations like fly-by-wire technology, which offers more precision, efficiency, and dependability over conventional mechanical control systems, are included in these systems. Further developments in materials, sensors, and computer power have made it possible to create flight control systems that are lighter and more effective.

- The global aviation authorities enforce strict safety laws and standards, which propel the uptake of sophisticated flight control systems. According to these rules, aircraft must have up-to-date, dependable equipment installed in order to operate safely. In order to comply with these requirements and improve safety, aircraft manufacturers and operators make investments in modernizing or retrofitting their fleets with the newest flight control systems.

- The increasing use of unmanned aerial vehicles (UAVs) across various sectors, including defense, commercial, and civil applications, contributes to the growth of the flight control systems market. UAVs rely heavily on sophisticated autonomous flight control systems to navigate and operate effectively without human intervention. As the UAV market expands, so does the demand for advanced flight control technologies.

Global Aircraft Flight Control Systems Market Trend Analysis

Increased Aircraft Automation Drives Growth in the Market for Aircraft Flight Control Systems

- The aviation sector is undergoing a change as a result of increased aircraft automation, which has emerged as a major growth driver for the aircraft flight control systems (FCS) market. Automation in aviation is the incorporation of cutting-edge systems and technology to support or take the place of human intervention in a variety of flight activities. The goal of improving aviation safety, efficiency, and dependability is what is driving this movement toward automation.

- Increasing the automation of aircraft involves implementing fly-by-wire (FBW) technology. With FBW, electronic technologies take the place of conventional mechanical flight controls, enabling smoother and more accurate aircraft control. Modern airplanes are safer and perform better because of enhanced features like envelope protection, autonomous flight control modes, and adaptive control algorithms made possible by this technology.

- In May 2022, a report released by the International Civil Aviation Organization, a specialized agency of the United Nations with its headquarters in Canada, stated that between January and April 2022, there were 65% more air travellers and 30% more aircraft departures than there were at the same time in 2021. Furthermore, the International Air Transport Association (IATA), a trade association for airlines worldwide with its headquarters in Canada, projects that the total number of air travellers will reach 4.0 billion in 2024. Consequently, the market for aircraft flight control systems is being driven by the increase in air travel worldwide.

Next-Generation Aircraft Development Creates an Opportunity for Aircraft Flight Control Systems

- The market for aircraft flight control systems (AFCS) has a lot of potential due to the development of next-generation aircraft. Advanced innovations, increased performance, improved safety measures, and increased fuel efficiency are characteristics of next-generation aircraft. These developments need for complex flight control systems to guarantee both safety and maximum performance while in flight. Consequently, the market for AFCS is expected to gain from the increasing need for creative flight control solutions.

- Advanced automation technologies like autopilot systems, autothrottles, and flight management systems (FMS) are becoming more and more common in next-generation aircraft. For these systems to guarantee accurate control of the aircraft during different flight phases, such as take-off, cruise, and landing, they considerably rely on advanced AFCS components. Reliable AFCS solutions are in more demand as airlines and operators look to increase operational efficiency and decrease human error.

Global Aircraft Flight Control Systems Market Segment Analysis:

Global Aircraft Flight Control Systems Market Segmented on the basis of type, technology, component, application, and end-users.

By Type, Primary Control Surface System segment is expected to dominate the market during the forecast period

- Aircraft control surfaces are the parts of an aircraft that move to help control its movement through the air. These include things like the ailerons, elevators, and rudder. The design of control surfaces is a complex process that involves considering a variety of factors such as the size and shape of the aircraft, the materials it is made from, and the forces that will act on it in flight.

- The need for contemporary primary control surface systems has increased as a result of improvements in aircraft technology, which have produced more complex and effective flight control systems. These technologies are essential to maintaining the stability and mobility of aircraft, making them part of the commercial and military aviation industries.

By Application, Fly-By-Wire System segment held the largest share of 32.8% in 2022

- Fly-By-Wire System (FBW) systems offer significant advancements in aircraft control by replacing traditional mechanical linkages with electronic interfaces. This results in lighter and more efficient control systems, reducing aircraft weight and enhancing fuel efficiency. Additionally, FBW systems provide unparalleled precision and responsiveness in aircraft maneuvering, leading to improved safety and performance.

- The Fly-By-Wire System technology segment's growth in the Aircraft Flight Control Systems Market is propelled by its ability to offer superior performance, safety, and efficiency, meeting the evolving needs of the aerospace industry in the 21st century.

- Moreover, technological advancements in sensors, actuators, and computer processing have made FBW systems more reliable and cost-effective, driving their adoption across various aircraft types, including commercial airliners, military aircraft, and unmanned aerial vehicles (UAVs).

Global Aircraft Flight Control Systems Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is indeed experiencing significant growth in the aircraft flight control systems market. North America is home to several leading manufacturers of aircraft flight control systems, such as Honeywell, Parker Hannifin, Moog, and Rockwell Collins. These companies possess extensive experience, R&D capabilities, and established supply chains, which give them a competitive advantage in the region.

- The North American aviation industry is witnessing strong demand for new aircraft, both for commercial and military purposes. This is fueled by factors like rising passenger traffic, increasing defense budgets, and the need to replace aging fleets. New aircraft often come equipped with advanced flight control systems, driving the market growth.

- Boeing reported 774 commercial orders last year after cancellations and conversions, including 561 orders for the 737 family and 213 orders for the company's market-leading twin-aisle airplanes. Boeing delivered 69 commercial jets in December, including 53 737 MAX, bringing total deliveries for 2022 to 480 airplanes. Moreover, the Boeing Company secured a USD 796 million contract from the US Army Contracting Command supply aircraft. The contract is expected to be concluded by 2027.

Global Aircraft Flight Control Systems Market Top Key Players:

- Honeywell International Inc. (U.S.)

- Northrop Grumman Corporation (U.S.)

- General Dynamics Mission Systems Inc. (U.S.)

- Lockheed Martin Corporation (U.S.)

- The Boeing Company (U.S.)

- Woodward Inc. (U.S.)

- Parker Hannifin Corporation (US)

- Curtiss-Wright Corporation (US)

- Moog Inc. (US)

- Raytheon Technologies Corporation (US)

- Safran SA (France)

- Thales (France)

- BAE Systems PLC (UK)

- Collins Aerospace (U.S.)

- BAE Systems (U.K.)

- Leonardo SpA (Italy)

- Airbus SAS (France)

- Nabtesco Corporation (Japan)

- Heroux-Devtek Inc. (Canada)

- Meggitt PLC (UK)

Key Industry Developments in the Global Aircraft Flight Control Systems Market:

- In November 2024, JetZero has completed partnership deals with top suppliers for the main parts of the Flight Control System on its large Blended Wing Body (BWB) prototype. Signing the contracts is a crucial milestone in the journey toward construction and testing.

- In April 2023, BAE Systems and Microsoft signed a strategic agreement to accelerate and simplify the development, deployment, and management of digital defense capabilities in an increasingly data-centric world. This partnership combines BAE Systems' knowledge of building complex digital systems for the military and government with Microsoft's approach to application development using the Azure Cloud platform.

- In May 2023, Spirit AeroSystems signed a partnership agreement with MAB Engineering Services SDN BHD (MAB Engineering) to provide maintenance, repair, and overhaul (MRO) services for nacelle and flight control surfaces to Malaysia Airlines and other operators at Kuala Lumpur International Airport, Malaysia.

|

Aircraft Flight Control Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 15.32 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.99 % |

Market Size in 2032: |

USD 30.60 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Component |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Aircraft Flight Control Systems Market by By Type (2018-2032)

4.1 Aircraft Flight Control Systems Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Primary Control Surfaces System

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Secondary Control Surfaces System

Chapter 5: Aircraft Flight Control Systems Market by By Technology (2018-2032)

5.1 Aircraft Flight Control Systems Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fly-By-Wire System

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Power-By-Wire

5.5 Hydromechanical Systems

5.6 Digital Fly-By-Wire

Chapter 6: Aircraft Flight Control Systems Market by By Component (2018-2032)

6.1 Aircraft Flight Control Systems Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Cockpit Controls

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Flight Control Computers

6.5 Aircraft Actuators

Chapter 7: Aircraft Flight Control Systems Market by By Application (2018-2032)

7.1 Aircraft Flight Control Systems Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Business Aviation

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Commercial Aviation

7.5 Military Aviation

Chapter 8: Aircraft Flight Control Systems Market by By End User (2018-2032)

8.1 Aircraft Flight Control Systems Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Linefit

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Retrofit

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Aircraft Flight Control Systems Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 CHROMALOX (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 WATLOW (USA)

9.4 VULCAN ELECTRIC (USA)

9.5 TUTCO (USA)

9.6 DUREX INDUSTRIES (USA)

9.7 BACKER HOTWATT (USA)

9.8 MARATHON HEATER (USA)

9.9 WARREN ELECTRIC CORPORATION (USA)

9.10 EXHEAT (UNITED KINGDOM)

9.11 ELMATIC (UNITED KINGDOM)

9.12 AUZHAN ELECTRIC APPLIANCES (CHINA)

9.13 GAUMER PROCESS (USA)

9.14 DELTA MFG (USA)

9.15 NIBE INDUSTRIER AB (SWEDEN)

9.16 HOTSTART (USA)

9.17 TEMPCO ELECTRIC HEATER CORPORATION (USA)

9.18 HYNDMAN INDUSTRIAL PRODUCTS (CANADA)

9.19 WINKLER GMBH (GERMANY)

9.20 VALIN CORPORATION (USA)

9.21 THERMO HEATING ELEMENTS

9.22 LLC (USA)

9.23 INDUSTRIAL HEATER CORPORATION (USA)

9.24 THERMAL CORPORATION (USA)

9.25 ZOPPAS INDUSTRIES (ITALY)

9.26 BACKER BHV (SWEDEN)

9.27 SINOMAS (CHINA)

9.28

Chapter 10: Global Aircraft Flight Control Systems Market By Region

10.1 Overview

10.2. North America Aircraft Flight Control Systems Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Type

10.2.4.1 Primary Control Surfaces System

10.2.4.2 Secondary Control Surfaces System

10.2.5 Historic and Forecasted Market Size By By Technology

10.2.5.1 Fly-By-Wire System

10.2.5.2 Power-By-Wire

10.2.5.3 Hydromechanical Systems

10.2.5.4 Digital Fly-By-Wire

10.2.6 Historic and Forecasted Market Size By By Component

10.2.6.1 Cockpit Controls

10.2.6.2 Flight Control Computers

10.2.6.3 Aircraft Actuators

10.2.7 Historic and Forecasted Market Size By By Application

10.2.7.1 Business Aviation

10.2.7.2 Commercial Aviation

10.2.7.3 Military Aviation

10.2.8 Historic and Forecasted Market Size By By End User

10.2.8.1 Linefit

10.2.8.2 Retrofit

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Aircraft Flight Control Systems Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Type

10.3.4.1 Primary Control Surfaces System

10.3.4.2 Secondary Control Surfaces System

10.3.5 Historic and Forecasted Market Size By By Technology

10.3.5.1 Fly-By-Wire System

10.3.5.2 Power-By-Wire

10.3.5.3 Hydromechanical Systems

10.3.5.4 Digital Fly-By-Wire

10.3.6 Historic and Forecasted Market Size By By Component

10.3.6.1 Cockpit Controls

10.3.6.2 Flight Control Computers

10.3.6.3 Aircraft Actuators

10.3.7 Historic and Forecasted Market Size By By Application

10.3.7.1 Business Aviation

10.3.7.2 Commercial Aviation

10.3.7.3 Military Aviation

10.3.8 Historic and Forecasted Market Size By By End User

10.3.8.1 Linefit

10.3.8.2 Retrofit

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Aircraft Flight Control Systems Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Type

10.4.4.1 Primary Control Surfaces System

10.4.4.2 Secondary Control Surfaces System

10.4.5 Historic and Forecasted Market Size By By Technology

10.4.5.1 Fly-By-Wire System

10.4.5.2 Power-By-Wire

10.4.5.3 Hydromechanical Systems

10.4.5.4 Digital Fly-By-Wire

10.4.6 Historic and Forecasted Market Size By By Component

10.4.6.1 Cockpit Controls

10.4.6.2 Flight Control Computers

10.4.6.3 Aircraft Actuators

10.4.7 Historic and Forecasted Market Size By By Application

10.4.7.1 Business Aviation

10.4.7.2 Commercial Aviation

10.4.7.3 Military Aviation

10.4.8 Historic and Forecasted Market Size By By End User

10.4.8.1 Linefit

10.4.8.2 Retrofit

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Aircraft Flight Control Systems Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Type

10.5.4.1 Primary Control Surfaces System

10.5.4.2 Secondary Control Surfaces System

10.5.5 Historic and Forecasted Market Size By By Technology

10.5.5.1 Fly-By-Wire System

10.5.5.2 Power-By-Wire

10.5.5.3 Hydromechanical Systems

10.5.5.4 Digital Fly-By-Wire

10.5.6 Historic and Forecasted Market Size By By Component

10.5.6.1 Cockpit Controls

10.5.6.2 Flight Control Computers

10.5.6.3 Aircraft Actuators

10.5.7 Historic and Forecasted Market Size By By Application

10.5.7.1 Business Aviation

10.5.7.2 Commercial Aviation

10.5.7.3 Military Aviation

10.5.8 Historic and Forecasted Market Size By By End User

10.5.8.1 Linefit

10.5.8.2 Retrofit

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Aircraft Flight Control Systems Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Type

10.6.4.1 Primary Control Surfaces System

10.6.4.2 Secondary Control Surfaces System

10.6.5 Historic and Forecasted Market Size By By Technology

10.6.5.1 Fly-By-Wire System

10.6.5.2 Power-By-Wire

10.6.5.3 Hydromechanical Systems

10.6.5.4 Digital Fly-By-Wire

10.6.6 Historic and Forecasted Market Size By By Component

10.6.6.1 Cockpit Controls

10.6.6.2 Flight Control Computers

10.6.6.3 Aircraft Actuators

10.6.7 Historic and Forecasted Market Size By By Application

10.6.7.1 Business Aviation

10.6.7.2 Commercial Aviation

10.6.7.3 Military Aviation

10.6.8 Historic and Forecasted Market Size By By End User

10.6.8.1 Linefit

10.6.8.2 Retrofit

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Aircraft Flight Control Systems Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Type

10.7.4.1 Primary Control Surfaces System

10.7.4.2 Secondary Control Surfaces System

10.7.5 Historic and Forecasted Market Size By By Technology

10.7.5.1 Fly-By-Wire System

10.7.5.2 Power-By-Wire

10.7.5.3 Hydromechanical Systems

10.7.5.4 Digital Fly-By-Wire

10.7.6 Historic and Forecasted Market Size By By Component

10.7.6.1 Cockpit Controls

10.7.6.2 Flight Control Computers

10.7.6.3 Aircraft Actuators

10.7.7 Historic and Forecasted Market Size By By Application

10.7.7.1 Business Aviation

10.7.7.2 Commercial Aviation

10.7.7.3 Military Aviation

10.7.8 Historic and Forecasted Market Size By By End User

10.7.8.1 Linefit

10.7.8.2 Retrofit

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Aircraft Flight Control Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 15.32 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.99 % |

Market Size in 2032: |

USD 30.60 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Component |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Global Aircraft Flight Control Systems Market research report is 2024-2032.

Honeywell International Inc. (US), Northrop Grumman Corporation (U.S.), General Dynamics Mission Systems Inc. (U.S.), Lockheed Martin Corporation (U.S.), The Boeing Company (U.S.), Woodward Inc. (U.S.), Parker Hannifin Corporation (US), Curtiss-Wright Corporation (US), Moog Inc. (US), Raytheon Technologies Corporation (US), Safran SA (France), Thales (France), BAE Systems PLC (UK), Collins Aerospace (U.S.), BAE Systems (U.K.), Leonardo SpA (Italy), Airbus SAS (France), Nabtesco Corporation (Japan), Heroux-Devtek Inc. (Canada), Meggitt PLC (UK), and Other Major Players.

The Global Aircraft Flight Control Systems Market is segmented into Type, Technology, Component, Application, End Users, and region. By Type, the market is categorized into Primary Control Surfaces System and Secondary Control Surfaces System. By Technology, the market is categorized into Fly-By-Wire System, Power-By-Wire, Hydromechanical Systems, and Digital Fly-By-Wire. By Component, the market is categorized into Cockpit Controls, Flight Control Computers, and Aircraft Actuators. By Application, the market is categorized into Business Aviation, Commercial Aviation, and Military Aviation. By End Users, the market is categorized into Linefit, Retrofit. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A control system is a collection of mechanical and electronic equipment that allows an aircraft to be flown with exceptional precision and reliability. A conventional fixed-wing aircraft flight control system consists of flight control surfaces, the respective cockpit controls, connecting linkages, and the necessary operating mechanisms to control an aircraft's direction in flight. Aircraft engine controls are also considered as flight controls as they change speed.

Aircraft Flight Control Systems Market Size Was Valued at USD 15.32 Billion in 2023, and is Projected to Reach USD 30.60 Billion by 2032, Growing at a CAGR of 7.99% From 2024-2032