Airless Packaging Market Synopsis

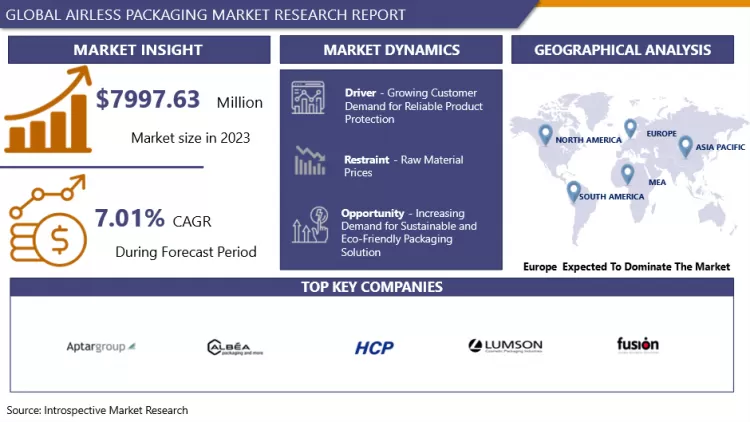

Airless Packaging Market Size Was Valued at USD 7997.63 Million in 2023, and is Projected to Reach USD 14715.69 Million by 2032, Growing at a CAGR of 7.01% From 2024-2032.

Airless packaging is specially designed to shield delicate products from air exposure, contamination, and degradation. Usually, it consists of a container and a dispensing system that operates by preventing air from getting back into the container, thereby maintaining the quality of the product and prolonging its durability.

- Innovative packaging differentiates brands in the market. Tailored designs attract customers, helping with brand distinction and market placement for improved competitiveness. Air-less packaging shields products from contamination and oxidation, maintaining effectiveness and cleanliness. Consumers want high-quality products that are seen as valuable and efficient, leading to a greater need for airless packaging. Consumer awareness of benefits like product preservation and accurate dispensing is increasing.

- Airless packaging plays a crucial role in the personal care and cosmetics sector, particularly for items such as anti-aging creams, serums, and lotions. It is particularly advantageous for natural and organic products that do not have preservatives and require a longer shelf life. Advancements in materials and production methods have enhanced airless packaging, making it more effective, affordable, and available. Incorporating smart packaging technologies such as RFID tags and QR codes provides tracking and consumer interaction capabilities.

- Current packaging sustainability trends emphasize the importance of minimizing waste and employing recyclable materials to meet both consumer expectations and regulatory requirements. Adherence to strict safety regulations in areas such as Europe and North America motivates the use of airless packaging solutions. Airless packaging maintains the effectiveness and safety of the product for its entire shelf life, in accordance with regulatory standards. Airless packaging is essential for safe delivery of items in online retail, maintaining their condition and minimizing the chance of harm and deterioration, offering convenience to customers.

Airless Packaging Market Trend Analysis

Growing Customer Demand for Reliable Product Protection

- Airless packaging systems prevent contamination and oxidation by forming an airtight seal that blocks air from getting inside the container. Ensuring the integrity of delicate formulations is essential, particularly in cosmetics, skincare, and pharmaceutical products that may lose effectiveness or deteriorate when in contact with air. Moreover, packaging without air reduces oxidation, thus protecting beneficial components such as vitamin C and retinoids found in skincare products. Airless packaging systems provide precise and regulated dispensing for items such as skincare products and drugs. This guarantees accurate dosing, enhancing user satisfaction and experience. Being accurate in giving out products results in increased customer loyalty to the brand.

- Airless packaging helps prolong the shelf life of products by shielding them from air and contaminants, which is advantageous for manufacturers, retailers, and consumers as it ensures the products maintain their effectiveness for a longer period of time. This packaging is also favored in the natural and organic beauty market, as it reduces the necessity for preservatives and appeals to consumers who prefer products with minimal synthetic additives. Airless packaging is a premium and innovative option that provides aesthetic appeal and helps products stand out in a competitive market. The modern appearance appeals to customers, indicating premium quality and dependability for distinction.

- Augmented interest in airless packaging for skincare products is driving higher demand in the cosmetics and personal care sector. Growing awareness leads to demand for products featuring airless packaging. The increase in popularity of niche markets such as clean beauty and cosmeceuticals is also driving the need for advanced packaging solutions. Compliance with rules is essential in packaging to ensure the safety and efficiency of the product. Manufacturers prefer airless packaging because it complies with strict regulatory standards and fosters consumer trust by ensuring reliable product protection.

Opportunity

Increasing Demand for Sustainable and Eco-Friendly Packaging Solution

- Consumer choices are moving towards sustainability, emphasizing eco-friendly values and environmentally-friendly companies. The demand for improved product sustainability is met by sustainable airless packaging, which utilizes recyclable materials and reduces waste. This trend has the potential to improve brand reputation and customer allegiance. International rules are getting tougher, with an emphasis on decreasing plastic waste and advancing sustainability. Companies that choose to invest in sustainable airless packaging can adhere to rules and sidestep fines or limitations in the market.

- Extended Producer Responsibility policies mandate that companies must handle their products' entire lifecycle, making sustainable packaging essential. Advancements in materials science have resulted in the creation of biodegradable and compostable plastics suitable for airless packaging, which helps to decrease environmental impact. The emphasis on recyclable and recycled materials in packaging is intended to decrease waste and promote the circular economy.

- Bio-based plastics, derived from sources such as corn starch or sugarcane, have a reduced carbon footprint compared to traditional plastics, providing a sustainable option for packaging materials. Businesses are establishing ambitious ESG objectives by adopting sustainable airless packaging to minimize environmental footprint and comply with sustainable principles. Sustainable packaging assists brands in standing out, attracting a wider range of customers, and demonstrating a dedication to sustainability.

Airless Packaging Market Segment Analysis:

Airless Packaging Market is segmented on the basis of Packaging Type, Material, Category, Distribution Channel, End-User, And Region.

By Material, Plastic Segment Is Expected to Dominate the Market During the Forecast Period

- Plastic offers a variety of choices such as PP, PE, and PET, allowing for flexibility in design and versatility. Plastic can be tailored to suit particular requirements, offering versatility in each variation. The capacity to be formed into various shapes and sizes enables innovative packaging designs, crucial for differentiation in the competitive personal care and cosmetics industry. Plastic is a more affordable option for manufacturing because it has lower material and manufacturing expenses than glass or metal. The plastic industry benefits from economies of scale, enabling the production of large quantities of airless packaging at an affordable cost.

- Plastic packaging, being both strong and light, guarantees items are protected while being transported. Plastic is less heavy than glass or metal, which lowers shipping expenses and simplifies handling for consumers. The maintenance of airless packaging relies heavily on its durability. Plastic packaging without air creates a strong barrier against air, moisture, and contaminants, preserving product effectiveness. This helps preserve products for longer by stopping contamination, which is important for personal care and cosmetics items.

- Plastic provides a wide range of options for customized packaging, including different colours, finishes, and levels of transparency, allowing for aesthetic versatility. It permits branding, usage instructions, and important information to be directly printed on the surface, improving the aesthetic appeal. Development of recyclable plastic materials increases appeal to environmentally conscious consumers. Biodegradable plastics also emerging, decomposing more easily and reducing environmental impact in the industry.

By End-User, Personal Care and Cosmetics Segment Held the Largest Share In 2023

- Air-less packaging systems shield products from air pollution, maintaining the quality of delicate formulas. This is crucial for cosmetics and skincare products that can degrade when in contact with air. Moreover, the shelf life of personal care products, especially those that are natural and organic and do not contain preservatives, is prolonged by airless packaging. Customers appreciate airless packaging for accurate dispensing and a high-quality user experience. The smooth appearance and precise distribution of items such as serums, creams, and lotions improve the overall feel and attract customers.

- Personal care and cosmetics brands are using innovative airless packaging to stand out in a competitive market. This contemporary strategy improves the reputation of a brand, establishes products as high-end, and appeals to discerning customers, thus supporting increased pricing. The industry is moving towards clean beauty and natural products, which requires the use of airless packaging to maintain the quality of the formulas. Compliance with regulations in Europe and North America requires packaging that ensures product safety and efficacy, and airless packaging is highly favored.

- Airless packaging helps minimize waste by ensuring all the product is used, in line with both consumers' and brands' sustainability objectives. Created using materials that can be recycled, attractive to eco-friendly shoppers, and compliant with environmental laws. The global personal care and cosmetics industry widely adopts airless packaging to improve product protection during e-commerce deliveries. This trend shows how airless packaging is being widely used in different areas because of its strong and contamination-resistant properties, leading to its dominant position in the market.

- From this graph it is shown that the market value of cosmetic packaging worldwide from 2019 to 2023. There is growing trend of air-less packaging material use in cosmetics packaging .

??????????????

??????????????

Airless Packaging Market Regional Insights:

Europe is Expected to Dominate the Market Over the Forecast Period

- Europe has a robust cosmetics and personal care sector with significant demand, especially in countries such as France, Germany, Italy, and the UK. Top beauty brands opt for premium packaging solutions, fuelling the need for airless packaging. Europe is furthermore a center for innovation, consistently creating new products that demand advanced packaging solutions. European nations have advanced manufacturing plants and technology to produce high-quality airless packaging. European countries are encouraging a circular economy by promoting the reuse and recycling of products, with the use of airless packaging supporting this initiative.

- Advanced infrastructure facilitates innovation and upholds high standards. Significant investment in research and development results in ongoing progress, maintaining Europe's competitive edge in the market. European rules demand strict packaging regulations for cosmetics and pharmaceuticals, emphasizing safety, efficacy, and sustainability. Airless packaging adheres to these criteria and encourages sustainability by minimizing litter and utilizing materials that can be recycled.

- European consumers are well-informed about the advantages of airless packaging, such as extending product shelf life and shielding from contamination. Their preference for products utilizing airless packaging is motivated by this consciousness. They also expect high-quality products and are drawn to the elegant look and practical advantages of airless packaging, raising the product's perceived worth. This region is at the forefront of sustainability initiatives, particularly in the area of eco-friendly packaging such as airless packaging, which reduces material usage and is able to be recycled.

Airless Packaging Market Active Players

- AptarGroup, Inc. (USA)

- Albea S.A. (France)

- HCP Packaging (China)

- Silgan Dispensing Systems Corporation (USA)

- LUMSON S.p.A. (Italy)

- FusionPKG (USA)

- Quadpack Industries, S.A. (Spain)

- Libo Cosmetics Company, Ltd. (China)

- Raepak Ltd. (United Kingdom)

- Yonwoo Co., Ltd. (South Korea)

- CCL Industries Inc. (Canada)

- RPC Group Plc (United Kingdom)

- ABC Packaging Ltd. (United Kingdom)

- Graham Packaging Company (USA)

- Takemoto Packaging Inc. (Japan)

- 3C Inc. (USA)

- APC Packaging (USA)

- Gerresheimer AG (Germany)

- Stölzle-Oberglas GmbH (Austria)

- Plastohm (France)

- Inotech (Switzerland)

- Mitani Valve Co., Ltd. (Japan)

Global Airless Packaging Market

Base Year:

2023

Forecast Period:

2024-2032

Historical Data:

2017 to 2023

Market Size in 2023:

USD 7997.63 Mn.

Forecast Period 2024-32 CAGR:

7.01 %

Market Size in 2032:

USD 14715.69 Mn.

Segments Covered:

By Packaging Type

- Bags

- Pouches

- Bottles

- Jars

- Tubes

- Pumps

By Material

- Plastic

- Glass

- Aluminium

- Bio-based Materials

By Category

- Premium

- Mass

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- E-Commerce Platform

By End-User

- Personal Care and Cosmetics

- Healthcare

- Food and Beverages

- Homecare

By Region

- North America (U.S., Canada, Mexico)

- Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

- Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

- Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

- Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

- South America (Brazil, Argentina, Rest of SA)

Key Market Drivers:

- Growing Customer Demand for Reliable Product Protection

Key Market Restraints:

- Raw Material Prices

Key Opportunities:

- Increasing Demand for Sustainable and Eco-Friendly Packaging Solution

Companies Covered in the report:

- AptarGroup, Inc. (USA), Albea S.A. (France), HCP Packaging (China), Silgan Dispensing Systems Corporation (USA), LUMSON S.p.A. (Italy), and Other Active Players.

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Airless Packaging Market by By Packaging Type (2018-2032)

4.1 Airless Packaging Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Bags

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Pouches

4.5 Bottles

4.6 Jars

4.7 Tubes

4.8 Pumps

Chapter 5: Airless Packaging Market by By Material (2018-2032)

5.1 Airless Packaging Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Plastic

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Glass

5.5 Aluminium

5.6 Bio-based Materials

Chapter 6: Airless Packaging Market by By Category (2018-2032)

6.1 Airless Packaging Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Premium

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Mass

Chapter 7: Airless Packaging Market by By Distribution Channel (2018-2032)

7.1 Airless Packaging Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Supermarkets/Hypermarkets

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Specialty Stores

7.5 Convenience Stores

7.6 E-Commerce Platform

Chapter 8: Airless Packaging Market by By End-User (2018-2032)

8.1 Airless Packaging Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Personal Care and Cosmetics

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Healthcare

8.5 Food and Beverages

8.6 Homecare

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Airless Packaging Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 CROWN AUTOMOTIVE (US)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 STANDARD MOTOR PRODUCTS INC.(US)

9.4 INTEVA PRODUCTS (US)

9.5 DORMAN PRODUCTS INC. (US)

9.6 ACDELCO (US)

9.7 BROSE FAHRZEUGTEILE SE & CO. KG (GERMANY)

9.8 KÜSTER HOLDING GMBH (GERMANY)

9.9 VALEO (FRANCE)

9.10 GRUPO ANTOLIN (SPAIN)

9.11 SONTIAN AUTOMOTIVE COLTD. (CHINA)

9.12 WONH INDUSTRIES CO LTD. (CHINA)

9.13 SHIROKI CORPORATION (JAPAN)

9.14 HI-LEX CORPORATION (JAPAN)

9.15 JOHNAN MANUFACTURING INC. (JAPAN)

9.16 AISIN CORPORATION (JAPAN)

9.17 CI CAR INTERNATIONAL PVT LTD. (INDIA)

9.18 TYC BROTHER INDUSTRIAL COLTD. (TAIWAN)

9.19 I YUAN PRECISION INDUSTRIAL COLTD. (TAIWAN)

9.20

Chapter 10: Global Airless Packaging Market By Region

10.1 Overview

10.2. North America Airless Packaging Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Packaging Type

10.2.4.1 Bags

10.2.4.2 Pouches

10.2.4.3 Bottles

10.2.4.4 Jars

10.2.4.5 Tubes

10.2.4.6 Pumps

10.2.5 Historic and Forecasted Market Size By By Material

10.2.5.1 Plastic

10.2.5.2 Glass

10.2.5.3 Aluminium

10.2.5.4 Bio-based Materials

10.2.6 Historic and Forecasted Market Size By By Category

10.2.6.1 Premium

10.2.6.2 Mass

10.2.7 Historic and Forecasted Market Size By By Distribution Channel

10.2.7.1 Supermarkets/Hypermarkets

10.2.7.2 Specialty Stores

10.2.7.3 Convenience Stores

10.2.7.4 E-Commerce Platform

10.2.8 Historic and Forecasted Market Size By By End-User

10.2.8.1 Personal Care and Cosmetics

10.2.8.2 Healthcare

10.2.8.3 Food and Beverages

10.2.8.4 Homecare

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Airless Packaging Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Packaging Type

10.3.4.1 Bags

10.3.4.2 Pouches

10.3.4.3 Bottles

10.3.4.4 Jars

10.3.4.5 Tubes

10.3.4.6 Pumps

10.3.5 Historic and Forecasted Market Size By By Material

10.3.5.1 Plastic

10.3.5.2 Glass

10.3.5.3 Aluminium

10.3.5.4 Bio-based Materials

10.3.6 Historic and Forecasted Market Size By By Category

10.3.6.1 Premium

10.3.6.2 Mass

10.3.7 Historic and Forecasted Market Size By By Distribution Channel

10.3.7.1 Supermarkets/Hypermarkets

10.3.7.2 Specialty Stores

10.3.7.3 Convenience Stores

10.3.7.4 E-Commerce Platform

10.3.8 Historic and Forecasted Market Size By By End-User

10.3.8.1 Personal Care and Cosmetics

10.3.8.2 Healthcare

10.3.8.3 Food and Beverages

10.3.8.4 Homecare

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Airless Packaging Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Packaging Type

10.4.4.1 Bags

10.4.4.2 Pouches

10.4.4.3 Bottles

10.4.4.4 Jars

10.4.4.5 Tubes

10.4.4.6 Pumps

10.4.5 Historic and Forecasted Market Size By By Material

10.4.5.1 Plastic

10.4.5.2 Glass

10.4.5.3 Aluminium

10.4.5.4 Bio-based Materials

10.4.6 Historic and Forecasted Market Size By By Category

10.4.6.1 Premium

10.4.6.2 Mass

10.4.7 Historic and Forecasted Market Size By By Distribution Channel

10.4.7.1 Supermarkets/Hypermarkets

10.4.7.2 Specialty Stores

10.4.7.3 Convenience Stores

10.4.7.4 E-Commerce Platform

10.4.8 Historic and Forecasted Market Size By By End-User

10.4.8.1 Personal Care and Cosmetics

10.4.8.2 Healthcare

10.4.8.3 Food and Beverages

10.4.8.4 Homecare

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Airless Packaging Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Packaging Type

10.5.4.1 Bags

10.5.4.2 Pouches

10.5.4.3 Bottles

10.5.4.4 Jars

10.5.4.5 Tubes

10.5.4.6 Pumps

10.5.5 Historic and Forecasted Market Size By By Material

10.5.5.1 Plastic

10.5.5.2 Glass

10.5.5.3 Aluminium

10.5.5.4 Bio-based Materials

10.5.6 Historic and Forecasted Market Size By By Category

10.5.6.1 Premium

10.5.6.2 Mass

10.5.7 Historic and Forecasted Market Size By By Distribution Channel

10.5.7.1 Supermarkets/Hypermarkets

10.5.7.2 Specialty Stores

10.5.7.3 Convenience Stores

10.5.7.4 E-Commerce Platform

10.5.8 Historic and Forecasted Market Size By By End-User

10.5.8.1 Personal Care and Cosmetics

10.5.8.2 Healthcare

10.5.8.3 Food and Beverages

10.5.8.4 Homecare

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Airless Packaging Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Packaging Type

10.6.4.1 Bags

10.6.4.2 Pouches

10.6.4.3 Bottles

10.6.4.4 Jars

10.6.4.5 Tubes

10.6.4.6 Pumps

10.6.5 Historic and Forecasted Market Size By By Material

10.6.5.1 Plastic

10.6.5.2 Glass

10.6.5.3 Aluminium

10.6.5.4 Bio-based Materials

10.6.6 Historic and Forecasted Market Size By By Category

10.6.6.1 Premium

10.6.6.2 Mass

10.6.7 Historic and Forecasted Market Size By By Distribution Channel

10.6.7.1 Supermarkets/Hypermarkets

10.6.7.2 Specialty Stores

10.6.7.3 Convenience Stores

10.6.7.4 E-Commerce Platform

10.6.8 Historic and Forecasted Market Size By By End-User

10.6.8.1 Personal Care and Cosmetics

10.6.8.2 Healthcare

10.6.8.3 Food and Beverages

10.6.8.4 Homecare

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Airless Packaging Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Packaging Type

10.7.4.1 Bags

10.7.4.2 Pouches

10.7.4.3 Bottles

10.7.4.4 Jars

10.7.4.5 Tubes

10.7.4.6 Pumps

10.7.5 Historic and Forecasted Market Size By By Material

10.7.5.1 Plastic

10.7.5.2 Glass

10.7.5.3 Aluminium

10.7.5.4 Bio-based Materials

10.7.6 Historic and Forecasted Market Size By By Category

10.7.6.1 Premium

10.7.6.2 Mass

10.7.7 Historic and Forecasted Market Size By By Distribution Channel

10.7.7.1 Supermarkets/Hypermarkets

10.7.7.2 Specialty Stores

10.7.7.3 Convenience Stores

10.7.7.4 E-Commerce Platform

10.7.8 Historic and Forecasted Market Size By By End-User

10.7.8.1 Personal Care and Cosmetics

10.7.8.2 Healthcare

10.7.8.3 Food and Beverages

10.7.8.4 Homecare

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Airless Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7997.63 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.01 % |

Market Size in 2032: |

USD 14715.69 Mn. |

|

Segments Covered: |

By Packaging Type |

|

|

|

By Material |

|

||

|

By Category |

|

||

|

By Distribution Channel |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Airless Packaging Market research report is 2024-2032.

AptarGroup, Inc. (USA), Albea S.A. (France), HCP Packaging (China), Silgan Dispensing Systems Corporation (USA), LUMSON S.p.A. (Italy), FusionPKG (USA), Quadpack Industries, S.A. (Spain), Libo Cosmetics Company, Ltd. (China), Raepak Ltd. (United Kingdom), Yonwoo Co., Ltd. (South Korea), CCL Industries Inc. (Canada), RPC Group Plc (United Kingdom), ABC Packaging Ltd. (United Kingdom), Graham Packaging Company (USA), Takemoto Packaging Inc. (Japan), 3C Inc. (USA), APC Packaging (USA), Gerresheimer AG (Germany), Stölzle-Oberglas GmbH (Austria), Plastohm (France), Inotech (Switzerland), Mitani Valve Co., Ltd. (Japan), PKG Group, LLC (USA), Lanzhou Heli Technology Co., Ltd. (China), Ningbo Vision Plastic Co., Ltd. (China), Lumson USA (USA), Mega Airless (France) and Other Active Players.

The Airless Packaging Market is segmented into Packaging Type, Material, Category, Distribution Channel, End-User, Segment6, and region. By Packaging Type, the market is categorized into Bags, Pouches , Bottles, Jars, Tubes, And Pumps. By Material, the market is categorized into Plastic, Glass, Aluminum, Bio-based Materials. By Category, the market is categorized into Premium, Mass. By Distribution Channel, the market is categorized into Supermarkets/Hypermarkets, Specialty Stores, Convenience Stores, E-Commerce Platform. By End-User, The Market Is Categorized into Personal Care and Cosmetics, Healthcare, Food and Beverages, Homecare. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Airless packaging is specially designed to shield delicate products from air exposure, contamination, and degradation. Usually, it consists of a container and a dispensing system that operates by preventing air from getting back into the container, thereby maintaining the quality of the product and prolonging its durability.

Airless Packaging Market Size Was Valued at USD 7997.63 Million in 2023, and is Projected to Reach USD 14715.69 Million by 2032, Growing at a CAGR of 7.01% From 2024-2032.