Amitriptyline Market Synopsis:

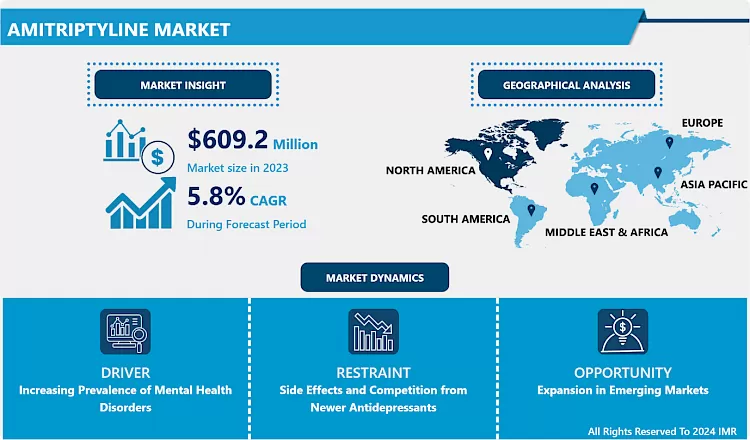

Amitriptyline Market Size was valued at USD 609.2 Million in 2023, and is Projected to Reach USD 1,011.9 Million by 2032, Growing at a CAGR of 5.8% From 2024-2032.

Amitriptyline Industry includes the manufacturing, distributing and selling of the amitriptyline which is a tricyclic antidepressant in the medical field basically used to treat depression, and other disorders including neuropathic pain, migraines and sleep disorders. The market includes the application in various therapeutic areas, the availability in the different dosage forms, and global geographical distribution.

The Amitriptyline market has expanded constantly because of the broad utilization of this medication to treat mental sufferance and pain. Amitriptyline is the most typical representative of the group of tricyclic antidepressants and is highly appreciated by growers for its low price and versatility of application. It’s popular due to the increased rate of depression within the global population, which has many individuals seeking treatment for mental illness every year. Moreover, neuropathic pain and migraine have become more recognised as chronic disabling conditions, and therefore, the use of amitriptyline has increased its range and market size. The development of factories and availability of a broad spectrum of dosage forms, such as tablets and capsules, oral solutions have allowed amitriptyline to reach wider population. The market remains competitive due to various players dealing with both generic and branded formulations, and hence has high market liquidity.

The market is not without its threats, for example, as customers opt to gain access to the newer generation of antidepressants that have a better safety profile and few side effects. Yet another characteristic is that this market experiences high levels of regulation and necessarily high compliance with complicated drug approval processes. Nevertheless, the low cost of amitriptyline and its applicability in the treatment of various conditions guarantee its continuous consumption flow. New opportunities for market expansion could be observed in growing markets, especially in countries with a constantly increasing focus on the healthcare industry.

Amitriptyline Market Trend Analysis:

Rising Use in Neuropathic Pain Management

- The key trend that emerged in the Amitriptyline market is the application of the drug in treatment of neuropathic pain. Chronic pain arising from nerve damage called neuropathic pain has major therapeutic relevance in guiding the quality of patients’ lives. Amitriptyline is usually used as the first option for treatment in states like diabetic neuropathy and post herpetic neuralgia given the fact that the medicine is effective in the management of pain.

- New cases of diabetes and other chronic diseases are on the rise across the world, and neuropathic pain is therefore becoming more common. Mental health clinicians are utilising amitriptyline primarily due to its cost-saving advantage over other drugs such as gabapentinoids. Further, clinical practice is yielding deeper insights into the effectiveness of amitriptyline showing its role in pain management as practitioners apply this knowledge to their work. This growing focus place the company amitriptyline as strategic to meeting the needs of patients suffering from chronic pain ailment.

Expansion in Emerging Markets

- One key untapped market opportunity participant see in the Amitriptyline market is the increasing need for effective and cheap mental health and pain relief products in new markets. As for Asia-Pacific, Latin America and some of the African countries the healthcare investments are growing alongside with the degree of awareness of mental disorders and chronic pain. This makes amitriptyline the most suited product because currently, these markets are more concerned with cheap products.

- Further, the governments as well as non-governmental organizations in these regions are performing great effort to improve the availability of these basic medications. These factors help in creating the right market for the distribution as well as increasing the usage of amitriptyline. On this regard, the key opportunities for pharmaceutical companies are to increase their market existence, open local production facilities, and cooperate with local medical organizations. The cost-effectiveness coupled with the multi-faceted uses of amitriptyline are contributing factors to its pertinence especially to the expanding economies of the countries.

Amitriptyline Market Segment Analysis:

Amitriptyline Market is segmented on the basis of Dosage Form, Application, Distribution Channel, and Region

By Dosage Form, Tablets segment is expected to dominate the market during the forecast period

- The Amitriptyline market is categorized by the dosage forms as tablets or capsules, and oral solution. Tablets continue to be the most preferred segment because they are easy to administer, have longer shelf-life, and are easily availed. It is the most often utilized type of oral anticoagulants, particularly in Office-based care, to attend to the populace’s primary needs.

- administrator and small amount preparations are becoming popular especially among patients with problems swallowing tablets or those requiring specific doses. Oral formulations, especially, are described as preferred for pediatric and geriatric populations. The development of these different forms of dosage maintains the accessibility of amitriptyline and continuously fits the needs of distinct populations of patients and clinical circumstances.

By Application, Depression segment expected to held the largest share

- Some uses of the drug include treating depression, neuropathic pain, migraines, and insomnia amongst others. The original indication remains as depression owing to the significance of the condition globally and its responsiveness with the help of the drug. Because of its low cost and wide access Amitriptyline is widely used in LMICs.

- Others include neuropathic pain and migraine prophylaxis as those two market segments rise with awareness from the medical practitioners of these two as major public health issues. Peaceful use of the drug to control chronic pain and avoid migraines is the other factor that has expanded the market for the drug. Another off-label use is insomnia and they all point to the fact that amitriptyline has many uses.

Amitriptyline Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America takes the largest share in the Amitriptyline market, majorly due to the improved infrastructure of healthcare facilities in the region, increased concern towards mental ailment and chronic pain, and active research and development activities by pharma industries. Moreover, there is well-defined regulatory environment and reimbursement process in the region for the amitriptyline that has boosted its usage.

- Market revenue is significantly generated from the United States because of a high rate of depression and neuropathic pain. Moreover, due to the accessibility of key pharmaceutical industries in the locations and clinical studies to perpetuity, the drug is readily accessible and utilized. This regional dominance is also expected to sustain in the future because of the further investments in health care as well as mental health more especially in the developed nations.

Active Key Players in the Amitriptyline Market

- Teva Pharmaceuticals (Israel)

- Mylan N.V. (United States)

- Novartis AG (Switzerland)

- Aurobindo Pharma (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Zydus Cadila (India)

- Lupin Limited (India)

- Cipla Inc. (India)

- Pfizer Inc. (United States)

- Dr. Reddy’s Laboratories (India)

- Torrent Pharmaceuticals Ltd. (India)

- Sandoz (Germany)

- Other Active Players

Key Industry Developments in the Amitriptyline Market:

- In March 2023, AlgoTx, a France-based clinical stage biotechnology company, announced that the U.S. Food and Drug Administration (FDA) had cleared the Investigational New Drug Application (IND) for its Phase 2 first-in-class candidate ATX01 (amitriptyline) in the treatment of erythromelalgia.

- In March 2023, AlgoTx, a France-based clinical stage biotechnology company, announced that the first patients have been randomized into the "ATX01 for the pain of ChemoTherapy" (ACT) study in Chemotherapy-Induced Peripheral Neuropathy (CIPN).

|

Amitriptyline Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 609.2 Million |

|

Forecast Period 2024-32 CAGR: |

5.8% |

Market Size in 2032: |

USD 1,011.9 Million |

|

Segments Covered: |

By Dosage Form |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Amitriptyline Market by By Dosage Form (2018-2032)

4.1 Amitriptyline Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Tablets

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Capsules

4.5 Oral Solutions

Chapter 5: Amitriptyline Market by By Application (2018-2032)

5.1 Amitriptyline Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Depression

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Neuropathic Pain

5.5 Migraine Prophylaxis

5.6 Insomnia

5.7 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Amitriptyline Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 TEVA PHARMACEUTICALS (ISRAEL)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 MYLAN N.V. (UNITED STATES)

6.4 NOVARTIS AG (SWITZERLAND)

6.5 AUROBINDO PHARMA (INDIA)

6.6 SUN PHARMACEUTICAL INDUSTRIES LTD. (INDIA)

6.7 ZYDUS CADILA (INDIA)

6.8 LUPIN LIMITED (INDIA)

6.9 CIPLA INC. (INDIA)

6.10 PFIZER INC. (UNITED STATES)

6.11 DR. REDDY’S LABORATORIES (INDIA)

6.12 TORRENT PHARMACEUTICALS LTD. (INDIA)

6.13 SANDOZ (GERMANY)

6.14

Chapter 7: Global Amitriptyline Market By Region

7.1 Overview

7.2. North America Amitriptyline Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Dosage Form

7.2.4.1 Tablets

7.2.4.2 Capsules

7.2.4.3 Oral Solutions

7.2.5 Historic and Forecasted Market Size By By Application

7.2.5.1 Depression

7.2.5.2 Neuropathic Pain

7.2.5.3 Migraine Prophylaxis

7.2.5.4 Insomnia

7.2.5.5 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Amitriptyline Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Dosage Form

7.3.4.1 Tablets

7.3.4.2 Capsules

7.3.4.3 Oral Solutions

7.3.5 Historic and Forecasted Market Size By By Application

7.3.5.1 Depression

7.3.5.2 Neuropathic Pain

7.3.5.3 Migraine Prophylaxis

7.3.5.4 Insomnia

7.3.5.5 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Amitriptyline Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Dosage Form

7.4.4.1 Tablets

7.4.4.2 Capsules

7.4.4.3 Oral Solutions

7.4.5 Historic and Forecasted Market Size By By Application

7.4.5.1 Depression

7.4.5.2 Neuropathic Pain

7.4.5.3 Migraine Prophylaxis

7.4.5.4 Insomnia

7.4.5.5 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Amitriptyline Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Dosage Form

7.5.4.1 Tablets

7.5.4.2 Capsules

7.5.4.3 Oral Solutions

7.5.5 Historic and Forecasted Market Size By By Application

7.5.5.1 Depression

7.5.5.2 Neuropathic Pain

7.5.5.3 Migraine Prophylaxis

7.5.5.4 Insomnia

7.5.5.5 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Amitriptyline Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Dosage Form

7.6.4.1 Tablets

7.6.4.2 Capsules

7.6.4.3 Oral Solutions

7.6.5 Historic and Forecasted Market Size By By Application

7.6.5.1 Depression

7.6.5.2 Neuropathic Pain

7.6.5.3 Migraine Prophylaxis

7.6.5.4 Insomnia

7.6.5.5 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Amitriptyline Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Dosage Form

7.7.4.1 Tablets

7.7.4.2 Capsules

7.7.4.3 Oral Solutions

7.7.5 Historic and Forecasted Market Size By By Application

7.7.5.1 Depression

7.7.5.2 Neuropathic Pain

7.7.5.3 Migraine Prophylaxis

7.7.5.4 Insomnia

7.7.5.5 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Amitriptyline Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 609.2 Million |

|

Forecast Period 2024-32 CAGR: |

5.8% |

Market Size in 2032: |

USD 1,011.9 Million |

|

Segments Covered: |

By Dosage Form |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Amitriptyline Market research report is 2024-2032.

Teva Pharmaceuticals (Israel), Mylan N.V. (United States), Novartis AG (Switzerland), Aurobindo Pharma (India), Sun Pharmaceutical Industries Ltd. (India), Zydus Cadila (India), Lupin Limited (India), Cipla Inc. (India), Pfizer Inc. (United States), and Other Active Players.

The Amitriptyline Market is segmented into Dosage Form, Application, Distribution Channel and region. By Application, the market is categorized into Depression, Neuropathic Pain, Migraine Prophylaxis, Insomnia, Others. By Dosage Form, the market is categorized into Tablets, Capsules, Oral Solutions. By Distribution Channel, the market is categorized into Hospital Pharmacies, Retail Pharmacies, Online Pharmacies. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Amitriptyline Industry includes the manufacturing, distributing and selling of the amitriptyline which is a tricyclic antidepressant in the medical field basically used to treat depression, and other disorders including neuropathic pain, migraines and sleep disorders. The market includes the application in various therapeutic areas, the availability in the different dosage forms, and global geographical distribution.

Amitriptyline Market Size Was Valued at USD 609.2 Million in 2023, and is Projected to Reach USD 1,011.9 Million by 2032, Growing at a CAGR of 5.8% From 2024-2032.