Antidote Market Synopsis

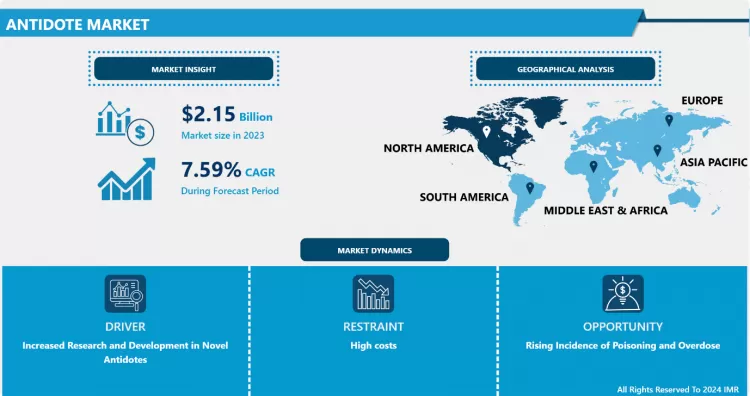

Antidote Market Size Was Valued at USD 2.15 Billion in 2023, and is Projected to Reach USD 4.15 Billion by 2032, Growing at a CAGR of 7.59% From 2024-2032.

The antidote market can be defined as the market for products or solutions that are used to neutralise the effect of poison or toxin within the human system. Antidotes are important in emergency medicine and are agents that counteract, mitigate or reverse the effect of specific toxins such as drugs, chemicals or venoms and biological agents. This market concerns a broad variety of antidotes for various poisoning situations containing but not reduced to, overdoses of medicines, snake venom, or poisons such as cyanide or organophosphates.

- This form of store is in a category of pharma and health basket and is particularly crucial in the cyclic thorough frame of emergency treatment. New generations, with growing anxieties regarding poisoning by different agents, for example, overdose of medications, industrial chemicals, and animal bites, have stimulated a new interest in years in search for efficient antidotes. These drugs are typically given in hospital emergency departments, clinics offering poison control and sometimes at the scene by first care givers. The market has expanded greatly over the time because the rate of poisoning grows and the range of illnesses, requiring an antidote intervention, extends. Trends include increased healthcare consciousness, availability of prehospital care, and improvements in the sophistication of the antidote products themselves.

- In addition, as the world population expands the incidence of non-communicable diseases and substance abuse there is heightened demand for remedies. The main demand for antidotes in developed countries comes from such categories as hospitals and governments as part of their public service providing activities. At the same time, the countries of the third world are increasing the demand for accesible and cheap antidote treatments. Enterprise and research institution are also paying much attention on enhancing the treatment rate and eliminating side effects in cases of severe poisoning and overdosage. This is about creating a nice outlook across the antidote industry and inspiring innovations as well as investments in different fields.

Antidote Market Trend Analysis

Increased Research and Development in Novel Antidotes

- Probably one of the trends at the current stage, which is most expressed in the antidote market, is to increase research in the search for new and more effective antidotes. This is quite relevant for new emerging toxins like synthetic opioids which have recently assumed the mantle of a global pest to health systems. Emerging epidemics such as the opioid overdose has in fact led to the innovation of such products as naloxone which is used to counter the toxicity of opioids.

- The research focus is also broadening to encompass countermeasures for chemical and biological warfare toxins, topics that are growing in the biodefense arena. Given the appearance of new toxins, scientists and pharma businesses are looking for the means to control new substances in the shortest possible time. However, the market is increasingly focusing on the advancement of therapeutic products which can be used away from the operating theatre and prior to arrival at the hospital in life threatening situations.

Rising Incidence of Poisoning and Overdose

- The prospects for the antidote market are favorable, thanks to the increasing rates of poisonings and overdose observed worldwide. For instance, the sparsity of organizations treating opioid-associated deaths has created the need for goods such as naloxone, which is a popular treatment for opioid poisoning. Similarly, an increase in pesticide poisoning, especially in agricultural areas, has cast an agonizing demand for antagonists for certain chemicals. Since poisoning incidents constitute a significant threat to populations, healthcare organizations are gradually taking steps to provide antidotes.

- Further, recently attacks on the environment and various chemicals also the requirement of an antidote for toxic gems like heavy metals and industrial chemicals also on the rise. The market remains open for the pharma companies to formulate specific antidotes corresponding to these requirements , and the governments will remain in favour of funding the research as well as stocking up the antidotes to facilitate appropriate measures to a poisoning occurrence.

Antidote Market Segment Analysis:

Antidote Market is segmented on the basis of type, Administration, Distribution Channel and end user.

By Type, Chemical Antidote, segment is expected to dominate the market during the forecast period

- Antidote chemical segment remained dominant in the market with a market share of 42.89% in the forecast year of 2023. The chemical antidotes are specific, quick and most appropriate in management of the toxins that a specific chemical may cause to the body. Managed by experienced personnel they work promptly; they limit long term health repercussions and offer consistent emergency scenarios. These specific dosing patterns, along with the ability to titrate individual doses further magnify their therapeutic utility; pointing out that they cannot be done without in specialty care involving poisoning and toxicology. Furthermore, the leading players in the market are present with a new chemical antidote for the treatment of different health issues such as drug overdose. For instance, Hikma Pharmaceuticals PLC focuses on Narcan naloxone HCl Substance for the managing of opioid ODs and it comes in a 4mg dose. These are factors that are driving the segment.

- Thus, pharmacological segment is expected to grow with steep CAGR over the forecast period. More than 75% of existing antidote only offer partial neutralization of the toxins. They affect the body tissues triggering effects counter to the effects of poisoning poison. Compared to physical and chemical antidote, pharmacological antidote does not have any adverse effect. They include, cyanide and amyl nitirate crosses a barbiturate and picrotoxin or amphetamine are some of the few available pharmacological antidote available. ACHE inhibitor-morphine is one example of a pharmacological antagonist which acts by restoring normal function to rapidly and wholly remove toxins. Altogether these aspects play an essential role in creation of high growth potential of the antidote markets.

By Administration, Oral segment expected to held the largest share in 2023

- Injectable segment emerged as the largest market share of 42.38% in the year 2023. Subcutaneous, intravenous or intra muscular injections provide speedy, accurate and selective therapy because it neutralizes or antagonizes the toxins or drug effects. It neutralises toxic effects of various substances, which makes them extremely useful in a number of emergency cases. Moreover, they act on the intact toxicity in poisoning, overdose or toxicants and exposures inherent to specific pathologies. Antidote injections are very targeted, having set patterns of keeping the concentration of the toxins at working levels but very efficient in treatment. They give a more refined technique because they make it difficult for patients to receive wrong proportions of a particular medication or even the wrong drug altogether. In its usually medical specialty application, antidote injections help to a great extent to reduce or prevent further organ damage that may ensue due largely to toxic exposures. Nine capabilities are specifically propelling the segment growth:

- Oral segment is expected to grow at rapid CAGR over the course of the study period. The increase in acceptability of dosage form has seen oral delivery of antidates receive attention because of it. Oral antidotes have some benefits in that; they are not as painful and uncomfortable as injections; thus they are more acceptable to patient. Sometimes patients can take pills which can reverse the effects of the toxin on their own, this is especially important when the person needs to act instantly before a medical professional can assist him. They also have a lower incidence of causing infections which in turn means less risk for non-medical staff to contract. Hence, the afore mentioned factors are expected to drive the segment growth throughout the course of this research period.

Antidote Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- For the year 2023 the research shows that North America will remain the largest consumer in antidote market and it globalization. This area, but especially the United states, is the largest consumer of antidotes due to the continuous expansion of the healthcare sector, frequently occurring poisonings (including overdose of drugs), and support provided by the authorities to emergency services. Evaluating the market trends, it can be concluded that, at the present, North American region dominates the antidote market to the extent of 40-45%.

- The U.S. leads this share, and has increasingly employed commodities such as naloxone for opioid overdoses, alongside other antidotes for toxicological emergencies. Drug overdose cases, and other public health programs like distribution of naloxone kits to fight the problem of opioids in the community, have contributed in raising the stanadard of the regional market. Furthermore, a well-developed research focus on medical advancement fosters ongoing improvement of new kinds of antidotes for the region, thereby enhancing the leading role of the sector.

Active Key Players in the Antidote Market

- Amgen Inc. (USA)

- Baxter International Inc. (USA)

- Bayer AG (Germany)

- BMS (Bristol-Myers Squibb) (USA)

- Boehringer Ingelheim (Germany)

- Eli Lilly and Co. (USA)

- F. Hoffmann-La Roche AG (Switzerland)

- GSK (GlaxoSmithKline) (UK)

- Hikma Pharmaceuticals Plc (UK)

- Johnson & Johnson (USA)

- Merck & Co., Inc. (USA)

- Mylan N.V. (USA)

- Novartis AG (Switzerland)

- Pfizer Inc. (USA)

- Sanofi S.A. (France), Other Key Players.

|

Global Antidote Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.15 Billion |

|

Forecast Period 2024-32 CAGR: |

7.59% |

Market Size in 2032: |

USD 4.15 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Administration |

|

||

|

Distribution Channel |

|

||

|

By End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Antidote Market by By Type (2018-2032)

4.1 Antidote Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Chemical Antidote

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Physical Antidote

4.5 Pharmacological antidote

Chapter 5: Antidote Market by By Administration (2018-2032)

5.1 Antidote Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Oral

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Topical

5.5 Injectable

5.6 Others

5.7 Distribution Channel

5.8 Hospital Pharmacies

5.9 Retail Pharmacies

5.10 Online Pharmacies

Chapter 6: Antidote Market by By End user (2018-2032)

6.1 Antidote Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospital

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Homecare

6.5 Specialty Clinics

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Antidote Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMGEN INC. (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BAXTER INTERNATIONAL INC. (USA)

7.4 BAYER AG (GERMANY)

7.5 BMS (BRISTOL-MYERS SQUIBB) (USA)

7.6 BOEHRINGER INGELHEIM (GERMANY)

7.7 ELI LILLY AND CO. (USA)

7.8 F. HOFFMANN-LA ROCHE AG (SWITZERLAND)

7.9 GSK (GLAXOSMITHKLINE) (UK)

7.10 HIKMA PHARMACEUTICALS PLC (UK)

7.11 JOHNSON & JOHNSON (USA)

7.12 MERCK & COINC. (USA)

7.13 MYLAN N.V. (USA)

7.14 NOVARTIS AG (SWITZERLAND)

7.15 PFIZER INC. (USA)

7.16 SANOFI S.A. (FRANCE)

7.17 OTHER KEY PLAYERS

Chapter 8: Global Antidote Market By Region

8.1 Overview

8.2. North America Antidote Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Chemical Antidote

8.2.4.2 Physical Antidote

8.2.4.3 Pharmacological antidote

8.2.5 Historic and Forecasted Market Size By By Administration

8.2.5.1 Oral

8.2.5.2 Topical

8.2.5.3 Injectable

8.2.5.4 Others

8.2.5.5 Distribution Channel

8.2.5.6 Hospital Pharmacies

8.2.5.7 Retail Pharmacies

8.2.5.8 Online Pharmacies

8.2.6 Historic and Forecasted Market Size By By End user

8.2.6.1 Hospital

8.2.6.2 Homecare

8.2.6.3 Specialty Clinics

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Antidote Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Chemical Antidote

8.3.4.2 Physical Antidote

8.3.4.3 Pharmacological antidote

8.3.5 Historic and Forecasted Market Size By By Administration

8.3.5.1 Oral

8.3.5.2 Topical

8.3.5.3 Injectable

8.3.5.4 Others

8.3.5.5 Distribution Channel

8.3.5.6 Hospital Pharmacies

8.3.5.7 Retail Pharmacies

8.3.5.8 Online Pharmacies

8.3.6 Historic and Forecasted Market Size By By End user

8.3.6.1 Hospital

8.3.6.2 Homecare

8.3.6.3 Specialty Clinics

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Antidote Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Chemical Antidote

8.4.4.2 Physical Antidote

8.4.4.3 Pharmacological antidote

8.4.5 Historic and Forecasted Market Size By By Administration

8.4.5.1 Oral

8.4.5.2 Topical

8.4.5.3 Injectable

8.4.5.4 Others

8.4.5.5 Distribution Channel

8.4.5.6 Hospital Pharmacies

8.4.5.7 Retail Pharmacies

8.4.5.8 Online Pharmacies

8.4.6 Historic and Forecasted Market Size By By End user

8.4.6.1 Hospital

8.4.6.2 Homecare

8.4.6.3 Specialty Clinics

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Antidote Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Chemical Antidote

8.5.4.2 Physical Antidote

8.5.4.3 Pharmacological antidote

8.5.5 Historic and Forecasted Market Size By By Administration

8.5.5.1 Oral

8.5.5.2 Topical

8.5.5.3 Injectable

8.5.5.4 Others

8.5.5.5 Distribution Channel

8.5.5.6 Hospital Pharmacies

8.5.5.7 Retail Pharmacies

8.5.5.8 Online Pharmacies

8.5.6 Historic and Forecasted Market Size By By End user

8.5.6.1 Hospital

8.5.6.2 Homecare

8.5.6.3 Specialty Clinics

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Antidote Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Chemical Antidote

8.6.4.2 Physical Antidote

8.6.4.3 Pharmacological antidote

8.6.5 Historic and Forecasted Market Size By By Administration

8.6.5.1 Oral

8.6.5.2 Topical

8.6.5.3 Injectable

8.6.5.4 Others

8.6.5.5 Distribution Channel

8.6.5.6 Hospital Pharmacies

8.6.5.7 Retail Pharmacies

8.6.5.8 Online Pharmacies

8.6.6 Historic and Forecasted Market Size By By End user

8.6.6.1 Hospital

8.6.6.2 Homecare

8.6.6.3 Specialty Clinics

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Antidote Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Chemical Antidote

8.7.4.2 Physical Antidote

8.7.4.3 Pharmacological antidote

8.7.5 Historic and Forecasted Market Size By By Administration

8.7.5.1 Oral

8.7.5.2 Topical

8.7.5.3 Injectable

8.7.5.4 Others

8.7.5.5 Distribution Channel

8.7.5.6 Hospital Pharmacies

8.7.5.7 Retail Pharmacies

8.7.5.8 Online Pharmacies

8.7.6 Historic and Forecasted Market Size By By End user

8.7.6.1 Hospital

8.7.6.2 Homecare

8.7.6.3 Specialty Clinics

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Antidote Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.15 Billion |

|

Forecast Period 2024-32 CAGR: |

7.59% |

Market Size in 2032: |

USD 4.15 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Administration |

|

||

|

Distribution Channel |

|

||

|

By End user |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Antidote Market research report is 2024-2032.

Pfizer, Baxter, Hikma, Mylan, Amgen and Other Major Players.

The Antidote Market is segmented into Type, Administration, Distribution Channel, End User and region. By Type, the market is categorized into Chemical Antidote, Physical Antidote, Pharmacological antidote. By Administration, the market is categorized into Oral, Topical, Injectable, Others. By Distribution, the market is categorized into Hospital Pharmacies ,Retail Pharmacies ,Online Pharmacies By End User, the market is categorized into Hospital ,Homecare ,Specialty Clinics ,Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The antidote market can be defined as the market for products or solutions that are used to neutralise the effect of poison or toxin within the human system. Antidotes are important in emergency medicine and are agents that counteract, mitigate or reverse the effect of specific toxins such as drugs, chemicals or venoms and biological agents. This market concerns a broad variety of antidotes for various poisoning situations containing but not reduced to, overdoses of medicines, snake venom, or poisons such as cyanide or organophosphates.

Antidote Market Size Was Valued at USD 2.15 Billion in 2023, and is Projected to Reach USD 4.15 Billion by 2032, Growing at a CAGR of 7.59% From 2024-2032.