Antimicrobial Susceptibility Testing Market Synopsis:

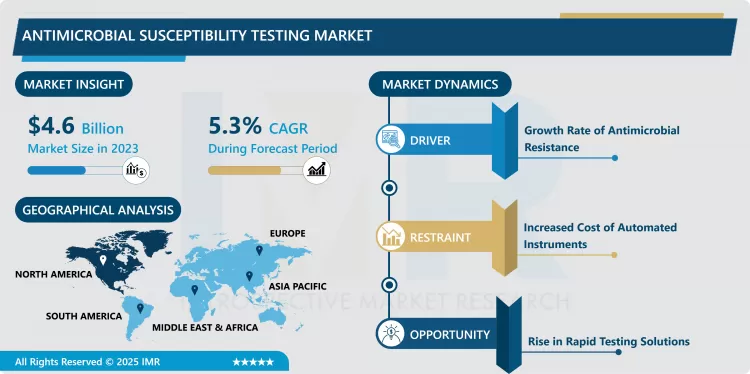

Antimicrobial Susceptibility Testing Market Size Was Valued at USD 4.6 Billion in 2023, and is Projected to Reach USD 7.3 Billion by 2032, Growing at a CAGR of 5.3% From 2024-2032.

The antimicrobial susceptibility testing (AST) market has been growing across the world owing to the growing incidences of antimicrobial-resistant (AMR) infections and the need to diagnose them well. AST involves testing a bacterial or fungal pathogen check its reaction to different antimicrobial substances and it helps in enhancing the patient’s clinical prognosis. More so, it can be seen that AST is required to help clinicians choose the right antibiotics for resistant pathogens, thereby improving patient’s and health care costs since the wrong treatments are averted.

Growth in the market related to antimicrobial susceptibility testing is fueled by the development of diagnostic technologies such as automated systems, molecular assays and technologies novelties of incorporation of rapid testing solutions with a comparatively high percentage of accuracy compared to conventional methods.. They decrease the time of the results that would help in treatment intervention and also quicken patient healing. It also enjoys growing attention in infection control measures and the awareness of the danger that multidrug-resistant organisms present and this makes the AST efficient, especially in the hospitals and the diagnostic laboratories.• Thus, the current problems while using antimicrobial susceptibility testing are present: high costs of modern AST systems, and their absence in LMICs.e accurate results than traditional methods. These technologies reduce the turnaround time for results, enabling timely treatment adjustments and improving patient recovery. Additionally, the increasing focus on infection control measures and the awareness of the threat posed by multidrug-resistant organisms (MDROs) are further fueling demand for AST, particularly in hospitals and diagnostic laboratories.

Despite the growth in the antimicrobial susceptibility testing market, challenges remain, including the high cost of advanced AST systems and the lack of access to these technologies in low- and middle-income countries. In addition, various interferences that interfere with these modern and sophisticated techniques have emerged as factors limiting equal utilisation of more advanced molecular techniques and next-generation sequencing. Nevertheless, current studies or research activities also include consistent development of AST technologies together with increasing government concern on AMR and subsequent activities to extend the market of AST technologies to eliminate the negative impact of AMR on global healthcare.

Antimicrobial Susceptibility Testing Market Trend Analysis:

Rising Demand for Rapid Diagnostic Tests

- One other trend that are emerging in the antimicrobial susceptibility testing market is the increasing need for rapidly diagnostic tests.. With antimicrobial resistance (AMR) increasing across the world, there is the need to have better and faster tools to identify pathogen and his or her resistance. These solutions such as point of care testing and molecular diagnostic platforms are becoming popular as results can be produced within hours, instead of days allowing the clinicians make proper treatment plans. : it is supporting the prevention of the abuse of antibiotics and enhancing the lives of patient through early and appropriate interventions.

Integration of Automation and Artificial Intelligence

- Another emerging aspect of interest is the robotic and AI implementation in the AST systems.. Automation affects clinical laboratories in that it makes the testing process easy to manage, minimize human interference hence increase throughput. While human analytics often struggle to process extensive testing data, making predictions, or even recommending further antibiotics and treatment regarding the patient’s history and microbiological reports, AI-driven algorithms can do all that. The integration of automation and AI in AST is expected to improve efficiency, accuracy, and consequently optimise the management of AMR.

Antimicrobial Susceptibility Testing Market Segment Analysis:

Antimicrobial Susceptibility Testing Market is Segmented on the basis of Product Type, Methods, Type , Application , End User, Distribution Channel, and Region

By Product Type, Instruments segment is expected to dominate the market during the forecast period

- The antimicrobial susceptibility testing (AST) market is categorized based on the product type into Instruments, Consumables & Accessories and Services & Software.. The market is entirely instrument driven and some of the instruments used in diagnostics include automatic systems, microbiology analyzers, and special testing machines. These instruments allow the large scale and precise screening of pathogens for their susceptibility to a range of antimicrobials. Culture media, reagents, and test kits are the products necessary for conducting the AST with a stable rate of sales due to high frequency of test in clinical practices. Moreover, services and software are gaining prominence as diagnosing tools are frequently complex when utilising them as platforms necessitating the services for installation, debugging or analysis. Software applications with seamless integration in AST systems incorporate artificial intelligence and machine learning algorithms for improving the result analysis and for clinical decision support thus contributing to the growth of the market. This broad segmentation cater, to the increasing practice of optimal antimicrobial resistance worldwide.

By Distribution Channel, Direct Sales segment expected to held the largest share

- In assessing the factors that influence the LM, the distribution channels are crucial in the antimicrobial susceptibility testing (AST) market where testing solutions are mainly required to be available and accessible.. The direct selling method is evidence where manufacturers use it for large or specialized lab equipment, because client demonstrations and essential services need are crucial. Retail sales are more focused on the lower value diagnostic kits and products which can be easily purchased through a medical equipment store or a pharmacy for access by a healthcare center or physician. Third-party distributors are major on the propagation of the AST solutions as manufacturers maybe lacking the infrastructure to penetrate certain areas or for certain products it requires distributorship with regional experience and network. These distributors generally supply numerous forms of testing systems such as rapid diagnostics tests, kits and reagents that helped in expanding the use of AST in hospitals, clinics and diagnostic centers worldwide.

Antimicrobial Susceptibility Testing Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Among the regions, North America is anticipated to account for the largest share during the entire forecast period of 2021-2028 due to increased investment in healthcare infrastructure, the high rate of acceptance of emerging diagnostics and higher government focus on curb antimicrobial resistance (AMR).. The United States is a major market contributor to the growth of the market because of the advanced and developed healthcare system, coupled with the high concentration of diagnostic laboratories along with the growing concern over AMR across the country. Further, the existence of numerous key market players, coupled with highly positive environment for the approval of advanced AST solutions, is an additional reason for the leadership of the North American region. These aspects, combined with increasing concern from the public on the upswing of drug-resistant infections, should help fuel a great deal of growth in this region.

Active Key Players in the Antimicrobial Susceptibility Testing Market:

- Bio-Rad Laboratories Inc. (USA)

- Merck & Co., Inc. (USA)

- Thermo Fisher Scientific Inc. (USA)

- Danaher Corporation (USA)

- BD (USA), bioMérieux SA (France)

- Creative Diagnostics (USA)

- Hi-Media Laboratories Pvt. Ltd. (India)

- ELITechGroup (France)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Other Active Players

|

Antimicrobial Susceptibility Testing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.6 Billion |

|

Forecast Period 2024-32 CAGR: |

5.3% |

Market Size in 2032: |

USD 7.3 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Methods |

|

||

|

By Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Antimicrobial Susceptibility Testing Market by By Product Type (2018-2032)

4.1 Antimicrobial Susceptibility Testing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Instruments

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Consumables & Accessories

4.5 Services & Software

Chapter 5: Antimicrobial Susceptibility Testing Market by By Methods (2018-2032)

5.1 Antimicrobial Susceptibility Testing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Mass Spectrometry Method

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Dilution

5.5 Disk Diffusion

5.6 E-Test

5.7 Genotypic Methods

5.8 Others

Chapter 6: Antimicrobial Susceptibility Testing Market by By Type (2018-2032)

6.1 Antimicrobial Susceptibility Testing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Antibacterial Testing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Antifungal Testing

6.5 Rapid-AST

Chapter 7: Antimicrobial Susceptibility Testing Market by By Application (2018-2032)

7.1 Antimicrobial Susceptibility Testing Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Clinical Diagnostics

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Drug Discovery and Development

7.5 Epidemiology

7.6 Others

Chapter 8: Antimicrobial Susceptibility Testing Market by By End User (2018-2032)

8.1 Antimicrobial Susceptibility Testing Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Hospitals

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Pharmaceuticals and Biotechnology Companies

8.5 Diagnostic Laboratories

8.6 Contract Research Organizations

8.7 Research Centres and Academic Institutes

8.8 Others

8.9 Distribution Channel

8.10 Direct Sales

8.11 Retail Sales & Third Party Distributor

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Antimicrobial Susceptibility Testing Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 BIO-RAD LABORATORIES INC. (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 MERCK & CO. INC. (USA)

9.4 THERMO FISHER SCIENTIFIC INC. (USA)

9.5 DANAHER CORPORATION (USA)

9.6 BD (USA)

9.7 BIOMÉRIEUX SA (FRANCE)

9.8 CREATIVE DIAGNOSTICS (USA)

9.9 HI-MEDIA LABORATORIES PVT. LTD. (INDIA)

9.10 ELITECHGROUP (FRANCE)

9.11 F. HOFFMANN-LA ROCHE LTD (SWITZERLAND)

9.12 OTHER ACTIVE PLAYERS

Chapter 10: Global Antimicrobial Susceptibility Testing Market By Region

10.1 Overview

10.2. North America Antimicrobial Susceptibility Testing Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By By Product Type

10.2.4.1 Instruments

10.2.4.2 Consumables & Accessories

10.2.4.3 Services & Software

10.2.5 Historic and Forecasted Market Size By By Methods

10.2.5.1 Mass Spectrometry Method

10.2.5.2 Dilution

10.2.5.3 Disk Diffusion

10.2.5.4 E-Test

10.2.5.5 Genotypic Methods

10.2.5.6 Others

10.2.6 Historic and Forecasted Market Size By By Type

10.2.6.1 Antibacterial Testing

10.2.6.2 Antifungal Testing

10.2.6.3 Rapid-AST

10.2.7 Historic and Forecasted Market Size By By Application

10.2.7.1 Clinical Diagnostics

10.2.7.2 Drug Discovery and Development

10.2.7.3 Epidemiology

10.2.7.4 Others

10.2.8 Historic and Forecasted Market Size By By End User

10.2.8.1 Hospitals

10.2.8.2 Pharmaceuticals and Biotechnology Companies

10.2.8.3 Diagnostic Laboratories

10.2.8.4 Contract Research Organizations

10.2.8.5 Research Centres and Academic Institutes

10.2.8.6 Others

10.2.8.7 Distribution Channel

10.2.8.8 Direct Sales

10.2.8.9 Retail Sales & Third Party Distributor

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Antimicrobial Susceptibility Testing Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By By Product Type

10.3.4.1 Instruments

10.3.4.2 Consumables & Accessories

10.3.4.3 Services & Software

10.3.5 Historic and Forecasted Market Size By By Methods

10.3.5.1 Mass Spectrometry Method

10.3.5.2 Dilution

10.3.5.3 Disk Diffusion

10.3.5.4 E-Test

10.3.5.5 Genotypic Methods

10.3.5.6 Others

10.3.6 Historic and Forecasted Market Size By By Type

10.3.6.1 Antibacterial Testing

10.3.6.2 Antifungal Testing

10.3.6.3 Rapid-AST

10.3.7 Historic and Forecasted Market Size By By Application

10.3.7.1 Clinical Diagnostics

10.3.7.2 Drug Discovery and Development

10.3.7.3 Epidemiology

10.3.7.4 Others

10.3.8 Historic and Forecasted Market Size By By End User

10.3.8.1 Hospitals

10.3.8.2 Pharmaceuticals and Biotechnology Companies

10.3.8.3 Diagnostic Laboratories

10.3.8.4 Contract Research Organizations

10.3.8.5 Research Centres and Academic Institutes

10.3.8.6 Others

10.3.8.7 Distribution Channel

10.3.8.8 Direct Sales

10.3.8.9 Retail Sales & Third Party Distributor

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Antimicrobial Susceptibility Testing Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By By Product Type

10.4.4.1 Instruments

10.4.4.2 Consumables & Accessories

10.4.4.3 Services & Software

10.4.5 Historic and Forecasted Market Size By By Methods

10.4.5.1 Mass Spectrometry Method

10.4.5.2 Dilution

10.4.5.3 Disk Diffusion

10.4.5.4 E-Test

10.4.5.5 Genotypic Methods

10.4.5.6 Others

10.4.6 Historic and Forecasted Market Size By By Type

10.4.6.1 Antibacterial Testing

10.4.6.2 Antifungal Testing

10.4.6.3 Rapid-AST

10.4.7 Historic and Forecasted Market Size By By Application

10.4.7.1 Clinical Diagnostics

10.4.7.2 Drug Discovery and Development

10.4.7.3 Epidemiology

10.4.7.4 Others

10.4.8 Historic and Forecasted Market Size By By End User

10.4.8.1 Hospitals

10.4.8.2 Pharmaceuticals and Biotechnology Companies

10.4.8.3 Diagnostic Laboratories

10.4.8.4 Contract Research Organizations

10.4.8.5 Research Centres and Academic Institutes

10.4.8.6 Others

10.4.8.7 Distribution Channel

10.4.8.8 Direct Sales

10.4.8.9 Retail Sales & Third Party Distributor

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Antimicrobial Susceptibility Testing Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By By Product Type

10.5.4.1 Instruments

10.5.4.2 Consumables & Accessories

10.5.4.3 Services & Software

10.5.5 Historic and Forecasted Market Size By By Methods

10.5.5.1 Mass Spectrometry Method

10.5.5.2 Dilution

10.5.5.3 Disk Diffusion

10.5.5.4 E-Test

10.5.5.5 Genotypic Methods

10.5.5.6 Others

10.5.6 Historic and Forecasted Market Size By By Type

10.5.6.1 Antibacterial Testing

10.5.6.2 Antifungal Testing

10.5.6.3 Rapid-AST

10.5.7 Historic and Forecasted Market Size By By Application

10.5.7.1 Clinical Diagnostics

10.5.7.2 Drug Discovery and Development

10.5.7.3 Epidemiology

10.5.7.4 Others

10.5.8 Historic and Forecasted Market Size By By End User

10.5.8.1 Hospitals

10.5.8.2 Pharmaceuticals and Biotechnology Companies

10.5.8.3 Diagnostic Laboratories

10.5.8.4 Contract Research Organizations

10.5.8.5 Research Centres and Academic Institutes

10.5.8.6 Others

10.5.8.7 Distribution Channel

10.5.8.8 Direct Sales

10.5.8.9 Retail Sales & Third Party Distributor

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Antimicrobial Susceptibility Testing Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By By Product Type

10.6.4.1 Instruments

10.6.4.2 Consumables & Accessories

10.6.4.3 Services & Software

10.6.5 Historic and Forecasted Market Size By By Methods

10.6.5.1 Mass Spectrometry Method

10.6.5.2 Dilution

10.6.5.3 Disk Diffusion

10.6.5.4 E-Test

10.6.5.5 Genotypic Methods

10.6.5.6 Others

10.6.6 Historic and Forecasted Market Size By By Type

10.6.6.1 Antibacterial Testing

10.6.6.2 Antifungal Testing

10.6.6.3 Rapid-AST

10.6.7 Historic and Forecasted Market Size By By Application

10.6.7.1 Clinical Diagnostics

10.6.7.2 Drug Discovery and Development

10.6.7.3 Epidemiology

10.6.7.4 Others

10.6.8 Historic and Forecasted Market Size By By End User

10.6.8.1 Hospitals

10.6.8.2 Pharmaceuticals and Biotechnology Companies

10.6.8.3 Diagnostic Laboratories

10.6.8.4 Contract Research Organizations

10.6.8.5 Research Centres and Academic Institutes

10.6.8.6 Others

10.6.8.7 Distribution Channel

10.6.8.8 Direct Sales

10.6.8.9 Retail Sales & Third Party Distributor

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Antimicrobial Susceptibility Testing Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By By Product Type

10.7.4.1 Instruments

10.7.4.2 Consumables & Accessories

10.7.4.3 Services & Software

10.7.5 Historic and Forecasted Market Size By By Methods

10.7.5.1 Mass Spectrometry Method

10.7.5.2 Dilution

10.7.5.3 Disk Diffusion

10.7.5.4 E-Test

10.7.5.5 Genotypic Methods

10.7.5.6 Others

10.7.6 Historic and Forecasted Market Size By By Type

10.7.6.1 Antibacterial Testing

10.7.6.2 Antifungal Testing

10.7.6.3 Rapid-AST

10.7.7 Historic and Forecasted Market Size By By Application

10.7.7.1 Clinical Diagnostics

10.7.7.2 Drug Discovery and Development

10.7.7.3 Epidemiology

10.7.7.4 Others

10.7.8 Historic and Forecasted Market Size By By End User

10.7.8.1 Hospitals

10.7.8.2 Pharmaceuticals and Biotechnology Companies

10.7.8.3 Diagnostic Laboratories

10.7.8.4 Contract Research Organizations

10.7.8.5 Research Centres and Academic Institutes

10.7.8.6 Others

10.7.8.7 Distribution Channel

10.7.8.8 Direct Sales

10.7.8.9 Retail Sales & Third Party Distributor

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Antimicrobial Susceptibility Testing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.6 Billion |

|

Forecast Period 2024-32 CAGR: |

5.3% |

Market Size in 2032: |

USD 7.3 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Methods |

|

||

|

By Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Antimicrobial Susceptibility Testing Market research report is 2024-2032.

Bio-Rad Laboratories Inc. (USA), Merck & Co., Inc. (USA), Thermo Fisher Scientific Inc. (USA), Danaher Corporation (USA), BD (USA), bioMérieux SA (France), Creative Diagnostics (USA), Hi-Media Laboratories Pvt. Ltd. (India), ELITechGroup (France), F. Hoffmann-La Roche Ltd (Switzerland), and Other Active Players.

The Antimicrobial Susceptibility Testing Market is segmented into By Product Type, Methods, Type , Application, End User, Distribution Channel and region. By Product Type (Instruments, Consumables & Accessories, and Services & Software), Methods (Mass Spectrometry Method, Dilution, Disk Diffusion, E-Test, Genotypic Methods & Others), Type (Antibacterial Testing, Antifungal Testing & Rapid-AST), Application (Clinical Diagnostics, Drug Discovery and Development, Epidemiology & Others), End User (Hospitals, Pharmaceuticals and Biotechnology Companies, Diagnostic Laboratories, Contract Research Organizations, Research Centres and Academic Institutes & Others), Distribution Channel (Direct Sales, Retail Sales & Third Party Distributor). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The antimicrobial susceptibility testing (AST) market has been growing across the world thanks to the growing incidences of antimicrobial-resistant (AMR) infections and the need to diagnose them well. AST involves testing a bacterial or fungal pathogen check its reaction to different antimicrobial substances and it helps in enhancing the patient’s clinical prognosis. More so, it can be seen that AST is required to help clinicians choose the right antibiotics for resistant pathogens, thereby improving patient’s and health care costs since the wrong treatments are averted.

Antimicrobial Susceptibility Testing Market Size Was Valued at USD 4.6 Billion in 2023, and is Projected to Reach USD 7.3 Billion by 2032, Growing at a CAGR of 5.3% From 2024-2032.