Antiseptic Market Synopsis:

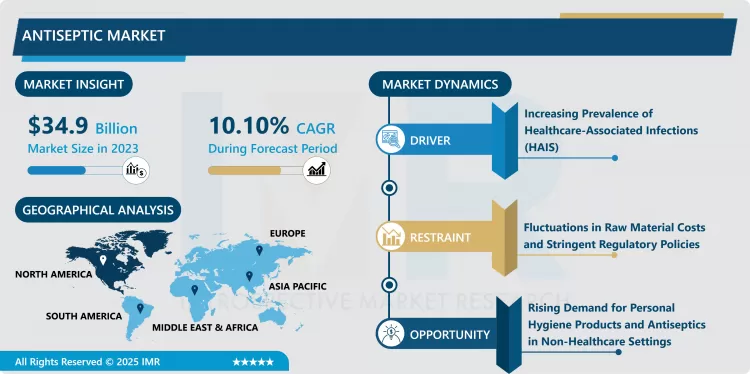

Antiseptic Market Size Was Valued at USD 34.9 Billion in 2023, and is Projected to Reach USD 82.96 Billion by 2032, Growing at a CAGR of 10.10% From 2024-2032.

The antiseptic market is a segment of products which inhibit the growth of pathogenic microorganisms on living tissue including the skin or on a surface of instruments. These products are principally gotten in the hospitals, clinics and in the homes as well. They are used to minimise bacterial growth on the body especially during operations, dressing of wounds or during other invasive procedures. The market has solutions, gels, aerosols, and creams containing active substances such as alcohol, iodine and chlorhexidine.

The market for antiseptics has been trending upward over the last several years primarily because of the rising rates of HAIs, growing understanding of the importance of personal cleanliness, and the elevated frequency of elderly people who constantly require professional care. Another factor has been increased access to better infrastructure in the healthcare facilities and increasing numbers of operations all across the world. Moreover, the outbreak of COVID-19 has led to rapid use of antiseptic products since people and HCWs have embraced high standards of disinfection to check the spread of the virus.

It is also the reason why the market is expanding even more because in recent ear there are more approvals of products such as new antiseptic products .. Increased usage of over-the-counter antiseptics together with increased demand from the emerging economies has triggered the growth in sales. Moreover, higher disposable income and especially in the developing countries has an impact on the overall healthcare expenditure which in a turn Develops the market more. However, changes in the price of raw material and the stringent rules governing the use of some of the chemical that may be used in making of the product might act as a constraint to the growth of the market.

Antiseptic Market Trend Analysis:

Rising Demand for Natural Antiseptics

- Another aspect that gaining its momentum in the global antiseptic market is a shift towards the improved natural and organic antiseptics. Since the consumer is now more aware of the negative impacts of using chemicals in form of antiseptic solutions, which may cause skin irritation and allergies the consumer is now in the lookout for natural solutions. New trends include the use of natural antiseptics which include oils such as tea tree oil, aloe vera, and eucalyptus oils which have antibiotics without affecting the skin negatively. Such a change in the kind of products towards more environmental and less hazardous products puts pressure on the organizations to come up with research on modifying natural antiseptic substances in the market.

Expanding Use in Non-Healthcare Settings

- Although, the health care organizations are the largest user of antiseptics they are finding increasing chance in other than health care sectors. now-a-days the utilization of antiseptics in households, schools, gyms and public places are on a high rise due to the new standard of cleanliness adopted in the day-to-day human life patterns. A relatively young category, largely due to the increasing attention to infectious diseases and the use of preventive products, combined with an increase in consumer expenditure in the care industry, open a huge potential for expanding the market. Manufacturers are stepping into the market for this purpose to develop new ranges of antiseptics and their uses such as for home and other application, increasing the market size.

Antiseptic Market Segment Analysis:

Antiseptic Market is Segmented on the basis of Type, Product, End User, and Region

By Type, Quaternary Ammonium Compounds segment is expected to dominate the market during the forecast period

- Segment wise, Quaternary Ammonium Compounds (QACs) is anticipated to lead the antiseptic industry throughout the market forecast period because of the effectiveness in use and applications in healthcare as well as non-healthcare sectors.. QACs are generally very effective against bacterial, viral and fungal structures, and are widely used as biocides and for sanitizing in hospital and clinical settings and in laboratories. Due to their effective microbial appeal, low toxicity and high extended-spectrum inhibitory action on surfaces, they are suitable for use in health care facilities where germ control is paramount. Also, higher use of QAC-based antiseptics in the formulation of household cleaning products gives the market more demand. This presence is further supported by current research and development endeavors directed toward the optimization of formulation effectiveness and ecofriendliness of QACs.

By Product, Enzymatic Cleaners segment expected to held the largest share

- The Enzymatic Cleaners segment will dominate the antiseptic market by product type in the forecast period because of its efficiency to clean the tough stains effectively along with outstanding feature such as degradability of bio-color such as blood, tissue, and others.. Medical enzymatic cleaners have found application for cleaning operating instruments and other medical equipment before sterilization because the cleaners effectively remove bio-organic contamination that may lead to infection spread. This also make them capable of clean efficiently without using substance that harm the environment and are safe for use in sensitive area. The rising concerns over the usage of highly-effective, non-toxic and more advanced cleaners in the healthcare facility will therefore help the enzymatic cleaners segment to sustain it dominant position within the market.

Antiseptic Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- By 2023 the North America has become the largest consumer of the antiseptic and disinfectant controlling 34.3% of the total market revenue. The leadership of the region is attributed to the rising number of surgeries, surgeries enhance the need of antiseptics and disinfectants to discourage contamination and spread of infections during the surgeries and in medical research. Repeated occurrences of HAIs have helped to heighten the demand for disinfection solutions, as more doctors prescribe their usage. Some of the other factors for growth include the increase in awareness of infection control in hospitals and other healthcare facilities Maggio, this makes North America the leading market for the growth of the market in the forecast period.

Active Key Players in the Antiseptic Market:

- 3M (USA)

- B. Braun Melsungen AG (Germany)

- Bio-Cide International Inc. (USA)

- Cardinal Health (USA)

- Colgate-Palmolive Company (USA)

- GlaxoSmithKline (UK)

- Johnson & Johnson (USA)

- Kimberly-Clark Corporation (USA)

- Medline Industries (USA)

- Procter & Gamble (USA)

- Purdue Pharma L.P. (USA)

- Reckitt Benckiser (UK)

- Schülke & Mayr GmbH (Germany)

- STERIS Corporation (USA)

- The Himalaya Drug Company (India)

- Other Active Players

Key Industry Developments in the Antiseptic Market:

- In March 2024, A partnership was launched by Novo Nordisk and Actylis, a pharmaceutical industry supplier and manufacturer based in the United States, to deliver benzalkonium chloride, an antiseptic and disinfectant, to Spain, Germany, Portugal, the United Kingdom, and Ireland.

- In September 2023, Byotrol introduced Chemgene MedLab, a new line of disinfectants. In laboratory settings, this multi-surface disinfectant can be used to clean and disinfect surfaces, tools, and equipment.

|

Antiseptic Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 34.9 Billion |

|

Forecast Period 2024-32 CAGR: |

10.1% |

Market Size in 2032: |

USD 82.6 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Antiseptic Market by By Type (2018-2032)

4.1 Antiseptic Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Quaternary Ammonium Compounds

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Chlorine Compounds

4.5 Alcohols

4.6 Aldehyde Products

4.7 Others

Chapter 5: Antiseptic Market by By Product (2018-2032)

5.1 Antiseptic Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Enzymatic Cleaners

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Medical Device Disinfectants

5.5 Surface Disinfectants

Chapter 6: Antiseptic Market by By End User (2018-2032)

6.1 Antiseptic Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Clinics

6.5 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Antiseptic Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 3M (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 B. BRAUN MELSUNGEN AG (GERMANY)

7.4 BIO-CIDE INTERNATIONAL INC. (USA)

7.5 CARDINAL HEALTH (USA)

7.6 COLGATE-PALMOLIVE COMPANY (USA)

7.7 GLAXOSMITHKLINE (UK)

7.8 JOHNSON & JOHNSON (USA)

7.9 KIMBERLY-CLARK CORPORATION (USA)

7.10 MEDLINE INDUSTRIES (USA)

7.11 PROCTER & GAMBLE (USA)

7.12 PURDUE PHARMA L.P. (USA)

7.13 RECKITT BENCKISER (UK)

7.14 SCHÜLKE & MAYR GMBH (GERMANY)

7.15 STERIS CORPORATION (USA)

7.16 THE HIMALAYA DRUG COMPANY (INDIA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Antiseptic Market By Region

8.1 Overview

8.2. North America Antiseptic Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Quaternary Ammonium Compounds

8.2.4.2 Chlorine Compounds

8.2.4.3 Alcohols

8.2.4.4 Aldehyde Products

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size By By Product

8.2.5.1 Enzymatic Cleaners

8.2.5.2 Medical Device Disinfectants

8.2.5.3 Surface Disinfectants

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Hospitals

8.2.6.2 Clinics

8.2.6.3 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Antiseptic Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Quaternary Ammonium Compounds

8.3.4.2 Chlorine Compounds

8.3.4.3 Alcohols

8.3.4.4 Aldehyde Products

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size By By Product

8.3.5.1 Enzymatic Cleaners

8.3.5.2 Medical Device Disinfectants

8.3.5.3 Surface Disinfectants

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Hospitals

8.3.6.2 Clinics

8.3.6.3 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Antiseptic Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Quaternary Ammonium Compounds

8.4.4.2 Chlorine Compounds

8.4.4.3 Alcohols

8.4.4.4 Aldehyde Products

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size By By Product

8.4.5.1 Enzymatic Cleaners

8.4.5.2 Medical Device Disinfectants

8.4.5.3 Surface Disinfectants

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Hospitals

8.4.6.2 Clinics

8.4.6.3 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Antiseptic Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Quaternary Ammonium Compounds

8.5.4.2 Chlorine Compounds

8.5.4.3 Alcohols

8.5.4.4 Aldehyde Products

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size By By Product

8.5.5.1 Enzymatic Cleaners

8.5.5.2 Medical Device Disinfectants

8.5.5.3 Surface Disinfectants

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Hospitals

8.5.6.2 Clinics

8.5.6.3 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Antiseptic Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Quaternary Ammonium Compounds

8.6.4.2 Chlorine Compounds

8.6.4.3 Alcohols

8.6.4.4 Aldehyde Products

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size By By Product

8.6.5.1 Enzymatic Cleaners

8.6.5.2 Medical Device Disinfectants

8.6.5.3 Surface Disinfectants

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Hospitals

8.6.6.2 Clinics

8.6.6.3 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Antiseptic Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Quaternary Ammonium Compounds

8.7.4.2 Chlorine Compounds

8.7.4.3 Alcohols

8.7.4.4 Aldehyde Products

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size By By Product

8.7.5.1 Enzymatic Cleaners

8.7.5.2 Medical Device Disinfectants

8.7.5.3 Surface Disinfectants

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Hospitals

8.7.6.2 Clinics

8.7.6.3 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Antiseptic Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 34.9 Billion |

|

Forecast Period 2024-32 CAGR: |

10.1% |

Market Size in 2032: |

USD 82.6 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Antiseptic Market research report is 2024-2032.

3M (USA), B. Braun Melsungen AG (Germany), Bio-Cide International Inc. (USA), Cardinal Health (USA), Colgate-Palmolive Company (USA), GlaxoSmithKline (UK), Johnson & Johnson (USA), Kimberly-Clark Corporation (USA), Medline Industries (USA), Procter & Gamble (USA), Purdue Pharma L.P. (USA), Reckitt Benckiser (UK), Schülke & Mayr GmbH (Germany), STERIS Corporation (USA), The Himalaya Drug Company (India), and Other Active Players.

The Antiseptic Market is segmented into Type, Product, End User and region. By Type, the market is categorized into Quaternary Ammonium Compounds, Chlorine Compounds, Alcohols & Aldehyde Products, Others. By Product, the market is categorized into Enzymatic Cleaners, Medical Device Disinfectants, Surface Disinfectants. By End User, the market is categorized into Hospitals, Clinics, Others. By region, it is analyzed across North America (U.S., Canada, Mexico),Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The antiseptic market is a segment of products which inhibit the growth of pathogenic microorganisms on living tissue including the skin or on a surface of instruments. These products are principally gotten in the hospitals, clinics and in the homes as well. They are used to minimise bacterial growth on the body especially during operations, dressing of wounds or during other invasive procedures. The market has solutions, gels, aerosols and creams containing active substances such as alcohol, iodine and chlorhexidine.

Antiseptic Market Size Was Valued at USD 34.9 Billion in 2023, and is Projected to Reach USD 82.96 Billion by 2032, Growing at a CAGR of 10.10% From 2024-2032.