Aseptic Processing Market Synopsis:

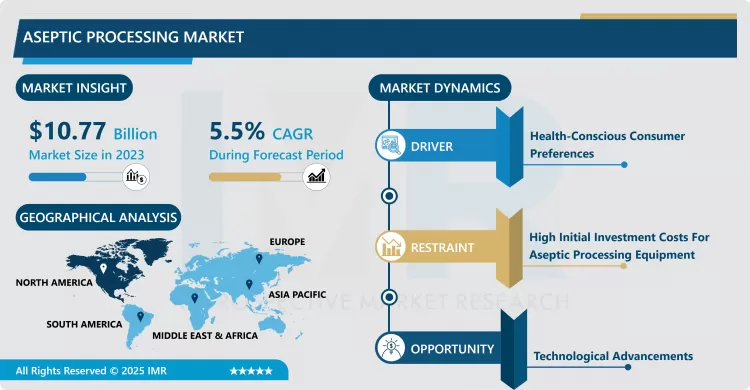

Aseptic Processing Market Size Was Valued at USD 10.77 Billion in 2023, and is Projected to Reach USD 16.40 Billion by 2032, Growing at a CAGR of 5.50% From 2024-2032.

This market forms an important part of food and beverages where heat sensitive products are sterilized the product as well as the containers separately in the aseptic processing method and filled later. It preserves perishable materials, which otherwise may have a short life span, hence fulfilling the ever-growing demand for convenience and longer lasting products by manufacturers. The market has experienced high growth primarily from the increased health consciousness level among the consumers related to foods along with the increasing trend towards packaged & processed foods which requires appropriate methods to preserve from getting spoiled.

Other driving factors for the market have been improved sterilization techniques and packaging materials for aseptic processing technology enhancing the market growth exponentially. Newer technologies like UHT processing and the development in filling machinery have helped improve the aseptic operations which produced better quality of products and cuts down on wastage. Also there is new chance on the modern market of different plant-based or organic products appeared, the problem of food preservation is great among producers searching for ways to retain the nutrients and qualities if such manufactures.

In the aseptic processing market, North America and Europe are showing a promising market share due to developed food and beverages sectors, and increased focus on food safety. Nonetheless, the Asia-Pacific is anticipated to have the highest growth rate owing to increased disposable income, increased percentage of urban population and changing consumption patterns. The aseptic processing industry is expected to experience continued growth for similar reasons as increasing numbers of consumers opt for easy to prepare and shelf-stable products, prompting manufacturers to adapt as aseptic processing becomes more pertinent.

Aseptic Processing Market Trend Analysis:

Growing Demand for Sustainable Packaging

- The environmentally friendly aspect is ever becoming important and influences the aseptic processing market as both the consumer and producer are aware of the impact caused by negative packaging methods. Most organizations are now concerning themselves with the use of recyclable and biodegradable material in aseptic packaging as the world tries to come up with ways of eradicating plastic use. This is contributing to consumer awareness in environmental influences and their ability to identify products that will pose as little harm to the natural environment. Consequently, the production companies are focusing on the production of better materials and approaches that will create satisfying and safe packaging material as well as sustainable packaging material.

Advancements in Aseptic Technology

- The sustainable progress in the aseptic processing technology is a key driver to the market as it enhances efficiency, safety and quality of end products. Technologies including smart sensors and automation in the filling and sealing processes are improving the accuracy and cutting out procedural mistakes while improving the efficiency of the production line. Also, new methods of sterilization are available in the market including pulsed electric field technology and microwave assisted thermal sterilization through which makers are able to work with higher efficiency and maintain the qualities of the products in a better way. In addition to aiding in helping firms meet regulatory requirements, such improvements serve the increasing consumer demand for fresher and healthier packaged food and beverages.

Aseptic Processing Market Segment Analysis:

Aseptic Processing Market is Segmented on the basis of Source, Application, and Region

By Type, Bottles and Cans segment is expected to dominate the market during the forecast period

- The aseptic processing market has been classified based on type of the aseptic packaging products namely cartons, bottles and cans, bags and pouches, vials and ampoules, pre-filled syringes, and others. Cartons are common in packaging of liquid foods and beverages since they are light with an appropriate design that makes them shield the food from cases of contamination. The packaging type that mainly incorporates the bottles and the cans is the beverage packaging type. Both food and non-food products prefer bags and pouches since they offer convenience in shelve life by requiring minimal exposure to air. Pharmaceutical companies cannot function without pharmaceutical vials and ampoules as these are products that need accuracy and most importantly cleanliness. In the healthcare market, the use of prefilled syringes is slowly increasing due to its features such as convenience and safety to the patients, and healthcare givers. Altogether, these types can fit numerous industries; thus, they help to ensure the development of the aseptic processing market, as producers look for modern technologies to satisfy the consumers’ expectations concerning quality and durability of the products.

By Application, Beverage’s segment expected to held the largest share

- The aseptic processing is useful in various sectors, which include food and beverages, pharmaceuticals among others and it has made its contributions to each of this sectors in one way or the other. The application of aseptic processing is evident in the food processing area in cases of soups, sauces as well as ready to eat meals to stretch shelf-life without compromising taste and nutritional value. The beverage industry also largely utilizes aseptic techniques for products such as juices, dairy products and plant based beverages since such products can be processed and packed in aseptic containers to give them extended shelf lives minimising the use of preservatives. In pharmaceutical industry particularly in production of injectable and biologic products aseptic processing is essential to ensure that the product is not contaminated during manufacturing process. Other uses include personal care products and cosmetics; the physical characteristics of aseptic packaging provides additional consumer benefits of safety and longer shelf life underscore the growth and cross sector importance of aseptic processing.

Aseptic Processing Market Regional Insights:

North America is expected to grow at the fastest rate in the aseptic processing industry.

- North America is expected to be the largest growing segment in the global aseptic processing market due to the rising demand from the consumers towards convenience and shelf life products, especially in the F&B industry. From past records, sustained food processing structure of the region, and more importantly the emerging food safety phrases so long enacted in the region makes the conditions rightly fit for procurement of aseptic processing technologies. Furthermore, growing consumer awareness for healthy eating, incorporating organic and plant-based products, in the diets, is also driving the market higher. Due to the consistent improvement in aseptic machinery and packaging films North American manufacturers are in a good position to continue to serve the dynamic needs of the consumers hence opening the market for new inventions and discoveries in the next few years.

Active Key Players in the Aseptic Processing Market:

- Robert Bosch GmbH (Germany)

- DuPont (U.S.)

- Dow (U.S.)

- Tetra Laval Group (Switzerland)

- Merck KGaA (Germany)

- SPX FLOW, Inc. (U.S.)

- I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A. (Italy)

- Amcor plc (Australia)

- JBT (U.S.)

- Steuben Foods Inc. (U.S.)

- GEA Group Aktiengesellschaft (Germany)

- Greatview Aseptic Packaging Manufacturing GmbH (China)

- BD (U.S.)

- Unilever (U.K.)

- Sealed Air (U.S.)

- SCHOTT AG (Germany)

- Other Active Players

|

Aseptic Processing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.77 Billion |

|

Forecast Period 2024-32 CAGR: |

5.50% |

Market Size in 2032: |

USD 16.40 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Aseptic Processing Market by By Type (2018-2032)

4.1 Aseptic Processing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cartons

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Bottles and Cans

4.5 Bags and Pouches

4.6 Vials and Ampoules

4.7 Pre- Filled Syringes

4.8 Other

Chapter 5: Aseptic Processing Market by By Application (2018-2032)

5.1 Aseptic Processing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Food

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Beverages

5.5 Pharmaceutical

5.6 Others

Chapter 6: Aseptic Processing Market by By Material (2018-2032)

6.1 Aseptic Processing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Paper and Paperboard

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Plastic

6.5 Metal

6.6 Glass and Wood

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Aseptic Processing Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ROBERT BOSCH GMBH (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DUPONT (U.S.)

7.4 DOW (U.S.)

7.5 TETRA LAVAL GROUP (SWITZERLAND)

7.6 MERCK KGAA (GERMANY)

7.7 SPX FLOW INC. (U.S.)

7.8 I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A. (ITALY)

7.9 AMCOR PLC (AUSTRALIA)

7.10 JBT (U.S.)

7.11 STEUBEN FOODS INC. (U.S.)

7.12 GEA GROUP AKTIENGESELLSCHAFT (GERMANY)

7.13 GREATVIEW ASEPTIC PACKAGING MANUFACTURING GMBH (CHINA)

7.14 BD (U.S.)

7.15 UNILEVER (U.K.)

7.16 SEALED AIR (U.S.)

7.17 SCHOTT AG (GERMANY)

7.18 OTHER ACTIVE PLAYERS

Chapter 8: Global Aseptic Processing Market By Region

8.1 Overview

8.2. North America Aseptic Processing Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Cartons

8.2.4.2 Bottles and Cans

8.2.4.3 Bags and Pouches

8.2.4.4 Vials and Ampoules

8.2.4.5 Pre- Filled Syringes

8.2.4.6 Other

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Food

8.2.5.2 Beverages

8.2.5.3 Pharmaceutical

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size By By Material

8.2.6.1 Paper and Paperboard

8.2.6.2 Plastic

8.2.6.3 Metal

8.2.6.4 Glass and Wood

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Aseptic Processing Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Cartons

8.3.4.2 Bottles and Cans

8.3.4.3 Bags and Pouches

8.3.4.4 Vials and Ampoules

8.3.4.5 Pre- Filled Syringes

8.3.4.6 Other

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Food

8.3.5.2 Beverages

8.3.5.3 Pharmaceutical

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size By By Material

8.3.6.1 Paper and Paperboard

8.3.6.2 Plastic

8.3.6.3 Metal

8.3.6.4 Glass and Wood

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Aseptic Processing Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Cartons

8.4.4.2 Bottles and Cans

8.4.4.3 Bags and Pouches

8.4.4.4 Vials and Ampoules

8.4.4.5 Pre- Filled Syringes

8.4.4.6 Other

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Food

8.4.5.2 Beverages

8.4.5.3 Pharmaceutical

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size By By Material

8.4.6.1 Paper and Paperboard

8.4.6.2 Plastic

8.4.6.3 Metal

8.4.6.4 Glass and Wood

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Aseptic Processing Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Cartons

8.5.4.2 Bottles and Cans

8.5.4.3 Bags and Pouches

8.5.4.4 Vials and Ampoules

8.5.4.5 Pre- Filled Syringes

8.5.4.6 Other

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Food

8.5.5.2 Beverages

8.5.5.3 Pharmaceutical

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size By By Material

8.5.6.1 Paper and Paperboard

8.5.6.2 Plastic

8.5.6.3 Metal

8.5.6.4 Glass and Wood

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Aseptic Processing Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Cartons

8.6.4.2 Bottles and Cans

8.6.4.3 Bags and Pouches

8.6.4.4 Vials and Ampoules

8.6.4.5 Pre- Filled Syringes

8.6.4.6 Other

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Food

8.6.5.2 Beverages

8.6.5.3 Pharmaceutical

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size By By Material

8.6.6.1 Paper and Paperboard

8.6.6.2 Plastic

8.6.6.3 Metal

8.6.6.4 Glass and Wood

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Aseptic Processing Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Cartons

8.7.4.2 Bottles and Cans

8.7.4.3 Bags and Pouches

8.7.4.4 Vials and Ampoules

8.7.4.5 Pre- Filled Syringes

8.7.4.6 Other

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Food

8.7.5.2 Beverages

8.7.5.3 Pharmaceutical

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size By By Material

8.7.6.1 Paper and Paperboard

8.7.6.2 Plastic

8.7.6.3 Metal

8.7.6.4 Glass and Wood

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Aseptic Processing Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 10.77 Billion |

|

Forecast Period 2024-32 CAGR: |

5.50% |

Market Size in 2032: |

USD 16.40 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Material |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Aseptic Processing Market research report is 2024-2032.

Robert Bosch GmbH (Germany), DuPont (U.S.), Dow (U.S.), Tetra Laval Group (Switzerland), Merck KGaA (Germany), SPX FLOW, Inc. (U.S.), I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A. (Italy), Amcor plc (Australia), JBT (U.S.), Steuben Foods Inc. (U.S.), GEA Group Aktiengesellschaft (Germany), Greatview Aseptic Packaging Manufacturing GmbH (China), BD (U.S.), Unilever (U.K.), Sealed Air (U.S.), SCHOTT AG (Germany), and Other Active Players.

The Aseptic Processing Market is segmented into By Type, Application, Material and region. By Type (Cartons, Bottles and Cans, Bags and Pouches, Vials and Ampoules, Pre- Filled Syringes, Other), Application (Food, Beverages, Pharmaceutical, Others), Material (Paper and Paperboard, Plastic, Metal, Glass and Wood). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Aseptic processing is a method used in the food and beverage industry to extend the shelf life of products without the need for refrigeration. This technique involves sterilizing both the product and its packaging separately and then combining them in a sterile environment to prevent microbial contamination. Aseptic processing is commonly applied to liquid foods, such as juices, dairy products, and soups, allowing them to be stored for extended periods without preservatives. The process helps maintain the nutritional quality, flavor, and safety of the product, making it a preferred choice for manufacturers aiming to deliver high-quality, shelf-stable items to consumers.

Aseptic Processing Market Size Was Valued at USD 10.77 Billion in 2023, and is Projected to Reach USD 16.40 Billion by 2032, Growing at a CAGR of 5.50% From 2024-2032