Asthma Spacers Market Synopsis:

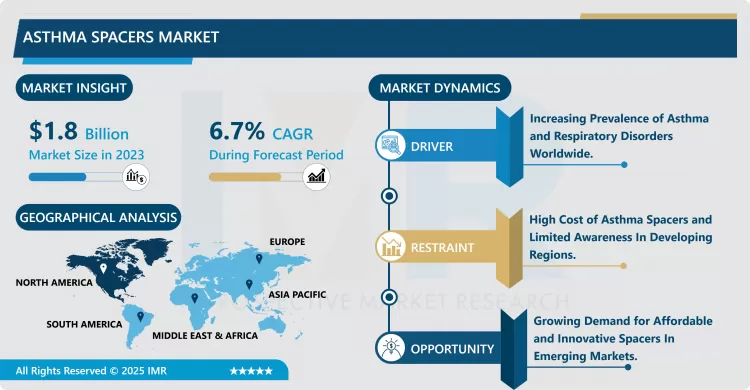

Asthma Spacers Market Size Was Valued at USD 1.8 Billion in 2023, and is Projected to Reach USD 3.2 Billion by 2032, Growing at a CAGR of 6.7% From 2024-2032.

The asthma spacers market encompasses products that are used on asthma patients to facilitate delivery of inhaled medication. These accessories, which snap onto the mouthpiece of an inhaler, assist in getting medication precisely to the lungs as the chamber makes it easier to inhale the aerosolized medication. Asthma spacers help in reducing the amount of drug used by clients, side effects associated with drugs, and the effectiveness of the drugs used in asthma hence should be used in the management of asthma especially in children, and older adults who are unable to use the standard metered dose inhaler properly.

The market for asthma spacers has been moderate growth in the past few years mainly due to rising incidence of asthma and other conditions affecting the respiratory system. International morbidity and mortality due to respiratory disorders are caused by an increase in pollution levels, smoking, and the adoption of unhealthy life attitudes. Therefore, asthma spacers have gained popularity because they are important for the treatment and control of the illness in patients. Growing consciousness of patients and healthcare practitioners about the benefits of asthma spacers also adds to the overall market momentum, as do innovation in spacer technology that creates products more comfortable, transportable, and efficient.

Furthermore, US government, and other healthcare organization in many nations have adopted measures to improve asthma care. Although recent evidences dictate patient education and awareness through various related programs are some of the primary factors fuelling the growth of the market. Health care consumers are demanding treatments that are affordable and regarding chronic respiratory health issues, asthma spacers are being incorporated in the management of asthma. New technologies like disposable spacers and paediatric spacers are the new area for growth, the basic reason being that manufacturers are continuously working and introducing products relevant to the different ages and usage requirements.

Asthma Spacers Market Trend Analysis:

Technological Advancements and Product Innovation

- Another interesting trend is active use of innovations in manufacturing of asthma spacers where new technologies are employed in the development of products that are not only high in performance but also easy to use. New spacer designs now include sensors that will allow patients as well as healthcare givers to be able to see how often the spacer is being used and even whether the patients are taking their medicine as prescribed. These ‘smart spacers’ may also be branded with interfaces to link potential users such as, mobile applications with live feeds to enhance compliance with treatment regimens. These are useful features in the pediatric and geriatric populations in which compliance with the medications is critical, but it is still difficult to achieve.

- Another phenomenon includes the introduction of the disposable as well as environment friendly asthma spacers. As people become more conscious of the environment, they will always seek product that will help in the reduction of plastics and have a natural degradation tendency. Disposable spacers are especially important in clinical practices, and in emergency situations, when reuse of equipment may become dangerous. These are in line with the market needs by a patient as well as environment by ensuring that the asthma spacers meet the latest trends in technology.

Opportunities in Emerging Markets: Expanding Healthcare Access

- Asthma spacers market contains significant business prospect in emerging economies where accessibility to healthcare services enriches and bias about respiratory health rises. More and more developing nations are reporting higher instances of asthma which is attributed to worsening pollution standards and continuing industrialization hence a large market for asthma control tools. So, the rising availability of asthma spacers based on new government health care projects in these countries is boosting the market’s growth.

Asthma Spacers Market Segment Analysis:

Asthma Spacers Market is Segmented on the basis of Drug, Product, End User, and Region

By Type, Anti-inflammatory segment is expected to dominate the market during the forecast period

- Considering the application, the anti-inflammatory segment is expected to reign the asthma spacers market throughout the forecast period because of its significant function to control asthma complications and inflammation in the airway. Asthma cannot be fully managed without the use of drugs that have anti-inflammatory properties, most preferred being corticosteroids, which work to reduce inflammation and sensitization within the respiratory tract which is known to cause asthmatic attacks. The anti-inflammatory inhaler issued with a spacer to optimise the delivery of the medication has become popular in that many healthcare providers are placing a great emphasis on the long-term control of asthma. Also, an increase in knowledge on preventive asthma care and the increase in the prevalence of asthma in all age brackets causes the increase in demand for this segment. Recent development of new drug delivery formulations and spacer technology makes the anti-inflammatory segment receptacle for a considerable revenue uplift as it forms the core of asthma management.

By Product, Inhalers segment expected to held the largest share

- By the product, the inhalers segment is expected to encompass the biggest market share in asthma spacers due to its effectiveness that ensures that asthma medication reaches the lungs. When using inhalers accompanied by spacers, the outcome of medication is aimed as well as the odds of side effects will also be reduced. As asthma incidence continues to grow across the globe, health care practitioners and patients turn to inhalers with spacers for chronic asthma management. It is also driven by technology as metered-dose and dry powder inhalers have been redesigned to be easier to operate and provide a more accurate administration of doses of drugs. This segment further strengthens its leadership because of its easy availability, convenience and effectiveness that it has portrayed in the field of asthma management cutting across the age barriers of pediatric patients right up to geriatric patients.

Asthma Spacers Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- And as it came out in the previous years, North America captures the largest sales of asthma spacers due to stringent healthcare expenditure policies, well-awareness of the residing population regarding respiratory disorders, and strong uptake of innovative health care products and services. The United States contributes most of this market by using about 35% of its revenue in buying these products. The rapid increase of asthma cases accompanied with well-developed general healthcare and appropriate access to modern medical equipment also influenced the leading position of the region. However, better reimbursement policies and patient programs have supported the use of asthma spacers among the providers and patients.

Active Key Players in the Asthma Spacers Market:

- AstraZeneca (UK)

- Boehringer Ingelheim (Germany)

- Cipla Inc. (India)

- Drive DeVilbiss Healthcare (USA)

- Fisons PLC (UK)

- GF Health Products Inc. (USA)

- GlaxoSmithKline (UK)

- HealthCo (USA)

- Koninklijke Philips N.V. (Netherlands)

- Medical Development International (Australia)

- Merck & Co. (USA)

- Teleflex Incorporated (USA)

- Teva Pharmaceuticals (Israel)

- Trudell Medical International (Canada)

- Vyaire Medical (USA)

- Other Active Players

|

Asthma Spacers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.8 Billion |

|

Forecast Period 2024-32 CAGR: |

6.7 % |

Market Size in 2032: |

USD 3.2 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Asthma Spacers Market by By Type (2018-2032)

4.1 Asthma Spacers Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Anti-inflammatory

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Bronchodilators

4.5 Combination Therapy

Chapter 5: Asthma Spacers Market by By Product (2018-2032)

5.1 Asthma Spacers Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Inhalers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Nebulizers

5.5 End Users

5.6 Retail Pharmacy

5.7 Hospital Pharmacy

5.8 E-Commerce

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Asthma Spacers Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ASTRAZENECA (UK)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BOEHRINGER INGELHEIM (GERMANY)

6.4 CIPLA INC. (INDIA)

6.5 DRIVE DEVILBISS HEALTHCARE (USA)

6.6 FISONS PLC (UK)

6.7 GF HEALTH PRODUCTS INC. (USA)

6.8 GLAXOSMITHKLINE (UK)

6.9 HEALTHCO (USA)

6.10 KONINKLIJKE PHILIPS N.V. (NETHERLANDS)

6.11 MEDICAL DEVELOPMENT INTERNATIONAL (AUSTRALIA)

6.12 MERCK & CO. (USA)

6.13 TELEFLEX INCORPORATED (USA)

6.14 TEVA PHARMACEUTICALS (ISRAEL)

6.15 TRUDELL MEDICAL INTERNATIONAL (CANADA)

6.16 VYAIRE MEDICAL (USA)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Asthma Spacers Market By Region

7.1 Overview

7.2. North America Asthma Spacers Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Type

7.2.4.1 Anti-inflammatory

7.2.4.2 Bronchodilators

7.2.4.3 Combination Therapy

7.2.5 Historic and Forecasted Market Size By By Product

7.2.5.1 Inhalers

7.2.5.2 Nebulizers

7.2.5.3 End Users

7.2.5.4 Retail Pharmacy

7.2.5.5 Hospital Pharmacy

7.2.5.6 E-Commerce

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Asthma Spacers Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Type

7.3.4.1 Anti-inflammatory

7.3.4.2 Bronchodilators

7.3.4.3 Combination Therapy

7.3.5 Historic and Forecasted Market Size By By Product

7.3.5.1 Inhalers

7.3.5.2 Nebulizers

7.3.5.3 End Users

7.3.5.4 Retail Pharmacy

7.3.5.5 Hospital Pharmacy

7.3.5.6 E-Commerce

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Asthma Spacers Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Type

7.4.4.1 Anti-inflammatory

7.4.4.2 Bronchodilators

7.4.4.3 Combination Therapy

7.4.5 Historic and Forecasted Market Size By By Product

7.4.5.1 Inhalers

7.4.5.2 Nebulizers

7.4.5.3 End Users

7.4.5.4 Retail Pharmacy

7.4.5.5 Hospital Pharmacy

7.4.5.6 E-Commerce

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Asthma Spacers Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Type

7.5.4.1 Anti-inflammatory

7.5.4.2 Bronchodilators

7.5.4.3 Combination Therapy

7.5.5 Historic and Forecasted Market Size By By Product

7.5.5.1 Inhalers

7.5.5.2 Nebulizers

7.5.5.3 End Users

7.5.5.4 Retail Pharmacy

7.5.5.5 Hospital Pharmacy

7.5.5.6 E-Commerce

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Asthma Spacers Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Type

7.6.4.1 Anti-inflammatory

7.6.4.2 Bronchodilators

7.6.4.3 Combination Therapy

7.6.5 Historic and Forecasted Market Size By By Product

7.6.5.1 Inhalers

7.6.5.2 Nebulizers

7.6.5.3 End Users

7.6.5.4 Retail Pharmacy

7.6.5.5 Hospital Pharmacy

7.6.5.6 E-Commerce

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Asthma Spacers Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Type

7.7.4.1 Anti-inflammatory

7.7.4.2 Bronchodilators

7.7.4.3 Combination Therapy

7.7.5 Historic and Forecasted Market Size By By Product

7.7.5.1 Inhalers

7.7.5.2 Nebulizers

7.7.5.3 End Users

7.7.5.4 Retail Pharmacy

7.7.5.5 Hospital Pharmacy

7.7.5.6 E-Commerce

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Asthma Spacers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.8 Billion |

|

Forecast Period 2024-32 CAGR: |

6.7 % |

Market Size in 2032: |

USD 3.2 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Asthma Spacers Market research report is 2024-2032.

AstraZeneca (UK), Boehringer Ingelheim (Germany), Cipla Inc. (India), Drive DeVilbiss Healthcare (USA), Fisons PLC (UK), GF Health Products Inc. (USA), GlaxoSmithKline (UK), HealthCo (USA), Koninklijke Philips N.V. (Netherlands), Medical Development International (Australia), Merck & Co. (USA), Teleflex Incorporated (USA), Teva Pharmaceuticals (Israel), Trudell Medical International (Canada), Vyaire Medical (USA), and Other Active Players.

The Asthma Spacers Market is segmented into Type, Application, End User and region. By Type, the market is categorized into Anti-inflammatory, Bronchodilators, and Combination Therapy. By Application, the market is categorized into Inhalers and Nebulizers. By End User, the market is categorized into Retail Pharmacy, Hospital Pharmacy, and E-Commerce. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The asthma spacers market encompasses products that are used on asthma patients to facilitate delivery of inhaled medication. These accessories, which snap onto the mouthpiece of an inhaler, assist in getting medication precisely to the lungs as the chamber makes it easier to inhale the aerosolized medication. Asthma spacers help in reducing the amount of drug used by clients, side effects associated with drugs, and the effectiveness of the drugs used in asthma hence should be used in the management of asthma especially in children, and older adults who are unable to use the standard metered dose inhaler properly.

Asthma Spacers Market Size Was Valued at USD 1.8 Billion in 2023, and is Projected to Reach USD 3.2 Billion by 2032, Growing at a CAGR of 6.7% From 2024-2032.