Auto-Injectors Market Synopsis

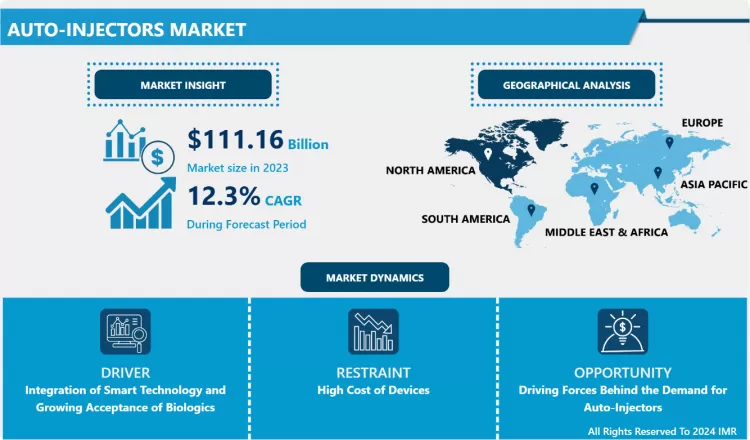

Auto-Injectors Market Size Was Valued at USD 111.16 Billion in 2023 and is Projected to Reach USD 315.77 Billion by 2032, Growing at a CAGR of 12.30% From 2024-2032.

Auto-injectors are defined as the segment of the industry that is involved in the production and supply of auto-injector systems intended for the use of medicine in cases of emergencies or for long-term treatment. These devices help in the administration of therapeutic agents like epinephrine for anaphylaxis, and biologics for autoimmune diseases and allow patients to get a quick and efficient dosing of medicine without requiring medical help. It stated that increasing incidence of diseases, shift in focus to self-attain home healthcare solutions, and continuous innovation in the tech world to make auto-injectors’ use more secure are the key drivers of this market.

- The auto-injectors market is expanding globally, especially due to the growing rates of chronic disorders, progress in delivery systems, and growing interest in self- administering devices. Self-injectors are among the most efficient delivery systems especially when it comes to prescription biologics and emergency drug Epinephrine for anaphylaxis. AUTO-INJECTORS While patients and healthcare providers give preference to easy to use, safe and accurate systems of drug delivery, the uptake of auto injectors is extending across several therapeutic areas, including diabetes, rheumatoid arthritis, multiple sclerosis and allergy.

- On a geographical basis, North America represents the largest market for auto-injectors due to factors such as well-established healthcare markets, a large number of pharmaceutical firms, and awareness of auto-injector systems among patients. The conditions of reimbursement policies of the region and the instances of the rise in allergic reactions and chronic diseases also add to the growth of the market. On the other hand, the Asia-Pacific region is expected to show the highest CAGR level in the forecast period. This growth is due to increasing health care cost, better health care facilities, and a growing population base that is suffering from several diseases.

- The developments in the auto-injector technology and its design and operation are also pivotal in the market development. Technological advancements for instance smart auto injectors which have connectivity factors allows patients to schedule their medications and give feedback to the health care givers in real time hence improving on the compliance to dosage regimens. Furthermore, partnerships with other companies are promoting the creation of easy-to-use astounding gadgets which can suit the needs of patients of different groups among pharmaceutical companies. Therefore, there exists a tremendous unmet market need for advanced auto-injectors providing better patient value enhancements and health care delivery systems.

- Hence, a great future is expected for the auto-injectors market, much owing to the need for personal use systems, advancement in technologies and advanced rates of chronic diseases. Despite North America occupying the largest market, the Asia-Pacific region is most likely to grow at a faster rate, so the stakeholders in this industry need to be able to adapt the changes in customer habits and innovations to fully explore potential opportunities. This is why in the future, auto-injectors will remain to have a focus in the way that they will supporting healthcare patient-centred care services.

Auto-Injectors Market Trend Analysis

Integration of Smart Technology and Growing Acceptance of Biologics

- Smart technology is another clear factor that has rapidly emerged as the key development for auto-injectors; it helps to improve patient compliance and overall patient experience. Several smart auto-injectors come with options for connectivity, and patients can use their smartphones and other gadgets to track the medication they are administering. Apart from enhancing the patient’s autonomy by offering firsthand feedback concerning their medication time table it simplifies interaction between a patient and his/her caregiver also. This is because as patients put efforts into disease management they yield better health results hence a compliance boost.

- Also, with increased preference for biologics and specialty drugs, which often require an injection, there is the increasing need for auto injectors. Since many doctors and nurses recommend such sophisticated drugs to patients with chronic diseases like rheumatoid arthritis and multiple sclerosis, the population in need of simpler regimens for self-administration is expanding. Self-acting pens for injections are convenient and efficient for patients, allowing them to receive treatment at home and not at hospitals often. The new shift of focusing on home care not only contribute to the patient preference but also reinforces the concept of individualized therapies, which also greatly fuel the growth of Auto-Injectors market.

Opportunity

Driving Forces Behind the Demand for Auto-Injectors

- New culture of chronic diseases such as diabetes, rheumatoid arthritis, multiple sclerosis and other autoimmune diseases are key factors that accelerate the convenience of drug delivery systems. These diseases demand NT es involving frequent administrations of drugs to the patients. Auto-injectors can be easily used by people for self injections making it easier for compliance in adherence to prescribed set standard regimens. Such self-administration capacity not only enhances patient compliance with treatment plans but also cuts away on the need for many follow-up visits that are required when patients with chronic illnesses require constant check-ups and monitoring.

- Furthermore, there is considerable pressure from the shift towards individualized medicine that requires new approaches to dosing and administration also creating the need for a new auto-injector technology. Given that today’s care is moving toward person-centered care, auto-injectors can be programmed to release a required volume of the medication in response to patient characteristics. Adaptability is critical in chronic diseases to manage or treat since alterations in medications can be made using real-time information on a patient’s health. Hence, there are always developments of smart technology incorporated into auto-injecting systems to fulfill the various needs of patients, as well as to improve on the efficiency and security of the treatment processes.

Auto-Injectors Market Segment Analysis:

Auto-Injectors Market is segmented based on Type, Indication, Use, and Region

By Type, Disposable auto-injectors segment is expected to dominate the market during the forecast period

- Single-use Auto injectors are used and designed for a single administration and as such are easy to use and safe because they do not have to be cleaned before the next use. This one-time use aspect is particularly useful in reducing contamination risks, something crucial for people who use injectors for possibly lifesaving drugs. These injectors are commonly autoabled or builtin meaning it is almost easy to use especially during emergencies such as anaphylactic reaction where one needs to release a shot as soon as possible. The ease of use of ready to use auto-injectors minimize patient concern, as no needles needs to be handled, no medication needs to be reloaded, making it easy to use even for a layman.

- Global disposable auto-injectors are experiencing a gradual increase in demand with the increase in severe allergies, diabetics, and autoimmune diseases, among other diseases requiring constant or emergency use of injections. As these conditions become more widespread, the demand for easy DIY approaches that patients can implement on their own at home grows. Furthermore, the disposable auto-injectors are useful in the increasing self-administration market because they are a reliable portable device that increases patients’ compliance to treatment. This demand is believed to rise in the future due to higher levels of awareness of disposable auto-injectors among patients and the healthcare industry practitioners.

By End Use, Homecare Settings segment expected to held the largest share

- Such as auto-injectors in homecare settings to rise with healthcare moving towards home and self-administration care. These devices help patients monitor treatment by themselves, which is particularly beneficial for persons with chronic diseases that require injections several times a day, for example, with diabetes, rheumatoid arthritis, or allergies. Due to the easy use at home, auto-injectors take time before the patient has to visit the healthcare facilities which may lower the overall charge, hence, easing the workload on health professionals. Also, this convenience simplifies the treatment process since patients with complications with movements or transport will be able to receive treatment at their homes.

- Using auto-injectors has been more advantageous to homecare settings than the conventional ampoules and vials in element of simplicity, safety and transportability. The compact size and small portions reduce possible discrepancies, and the use of safety measures such as an automatic retraction of the needle increases patient satisfaction and fewer threats of a needle stick. In addition, due to the portable nature of these devices they are recommendable for patients with an active agenda or patients that need treatment on the move. Combined these have a positive effect on compliance, since patients are less constrained by having to inject themselves at odd hours, and patients are more likely to be satisfied and healthier.

Auto-Injectors Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- On a regional level, North America especially; the United States the market for auto-injectors is quite impacted by some of the global key players in the pharmaceuticals and medical device industries. Amgen, Mylan, and AbbVie are market leaders within the industry, leading innovation and the broadening of their portfolios. Today, the region has one of the highest healthcare costs making it possible to quickly spread the adoption of new and improved health care technologies. Self-injection devices are widely used in diabetes and severe allergic reactions, for example; the usage of autoinjectors are convenient, and easy to use. Furthering this trend is increased encouragement of the self-management, mobilising patients to continue with their prescribed forms of medication.

- Also, the United States has strict laws governing auto-injectors as administered by the Food and Drug Administration within that jurisdiction. Besides, these regulations increase confidence in consumers and make manufacturers do more in trying to develop their devices. Consequently, the market is flooded with new and enhanced auto-injectors to address different therapeutic applications. There will always be a strong demand for auto-injectors in North America due to strong healthcare facilities and high per capita income, together with favorable regulatory environment making the region influential in the global auto-injector market.

Active Key Players in the Auto-Injectors Market

- Eli Lilly

- SHL Medical AG

- AbbVie, Inc.

- Amgen

- Owen Mumford

- Ypsomed

- Teva Pharmaceutical

- Biogen Idec

- Mylan N.V.

- Pfizer, Inc.

- Sanofi

- Gerresheimer and Other key Players

Key Industry Developments in the Auto-Injectors Market:

- In March 2024, Ypsomed is selling its insulin pen needle and blood sugar monitoring operations to MTD Group to focus on smart pumps and autoinjector development. This shift allows Ypsomed to invest over USD 111 million in expanding its Solothurn site. The transition, which will retain jobs until the end of 2024, will see Ypsomed as a contract manufacturer until mid-2025.

- In October 2023, Altaviz introduced the AltaVISC auto-injector platform for drug delivery, designed to handle high-volume and high-viscosity biologics. Pico-cylinders enable precise and sustainable drug administration by controlling temperature and gas composition. This platform supports various drug formulations, including shear-sensitive molecules, and with its innovative technology, it aims to improve at-home treatments.

- In May 2023, Revive Innovations, an InnovationRCA start-up, created a stylish, compact auto-injector designed to fit easily into a pocket or handbag, reducing stigma and inconvenience for users. The device aims to make it easier for people to carry life-saving auto-injectors for allergic emergencies.

|

Global Auto-Injectors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 111.16 Billion |

|

Forecast Period 2024-32 CAGR: |

12.30% |

Market Size in 2032: |

USD 315.77 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Indication |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Auto-Injectors Market by By Type (2018-2032)

4.1 Auto-Injectors Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Disposable auto-injectors

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Reusable auto-injectors

4.5 Prefilled

4.6 Empty

Chapter 5: Auto-Injectors Market by By Indication (2018-2032)

5.1 Auto-Injectors Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Rheumatoid Arthritis

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Multiple Sclerosis

5.5 Diabetes

5.6 Anaphylaxis

5.7 Other Therapies

Chapter 6: Auto-Injectors Market by By End Use (2018-2032)

6.1 Auto-Injectors Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Homecare Settings

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Hospitals & Clinics

6.5 Ambulatory Surgical Centers

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Auto-Injectors Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ELI LILLY

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 SHL MEDICAL AG

7.4 ABBVIE INCAMGEN

7.5 OWEN MUMFORD

7.6 YPSOMED

7.7 TEVA PHARMACEUTICAL

7.8 BIOGEN IDEC

7.9 MYLAN N.VPFIZER INCSANOFI

7.10 GERRESHEIMER AND OTHER KEY PLAYERS

Chapter 8: Global Auto-Injectors Market By Region

8.1 Overview

8.2. North America Auto-Injectors Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Disposable auto-injectors

8.2.4.2 Reusable auto-injectors

8.2.4.3 Prefilled

8.2.4.4 Empty

8.2.5 Historic and Forecasted Market Size By By Indication

8.2.5.1 Rheumatoid Arthritis

8.2.5.2 Multiple Sclerosis

8.2.5.3 Diabetes

8.2.5.4 Anaphylaxis

8.2.5.5 Other Therapies

8.2.6 Historic and Forecasted Market Size By By End Use

8.2.6.1 Homecare Settings

8.2.6.2 Hospitals & Clinics

8.2.6.3 Ambulatory Surgical Centers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Auto-Injectors Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Disposable auto-injectors

8.3.4.2 Reusable auto-injectors

8.3.4.3 Prefilled

8.3.4.4 Empty

8.3.5 Historic and Forecasted Market Size By By Indication

8.3.5.1 Rheumatoid Arthritis

8.3.5.2 Multiple Sclerosis

8.3.5.3 Diabetes

8.3.5.4 Anaphylaxis

8.3.5.5 Other Therapies

8.3.6 Historic and Forecasted Market Size By By End Use

8.3.6.1 Homecare Settings

8.3.6.2 Hospitals & Clinics

8.3.6.3 Ambulatory Surgical Centers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Auto-Injectors Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Disposable auto-injectors

8.4.4.2 Reusable auto-injectors

8.4.4.3 Prefilled

8.4.4.4 Empty

8.4.5 Historic and Forecasted Market Size By By Indication

8.4.5.1 Rheumatoid Arthritis

8.4.5.2 Multiple Sclerosis

8.4.5.3 Diabetes

8.4.5.4 Anaphylaxis

8.4.5.5 Other Therapies

8.4.6 Historic and Forecasted Market Size By By End Use

8.4.6.1 Homecare Settings

8.4.6.2 Hospitals & Clinics

8.4.6.3 Ambulatory Surgical Centers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Auto-Injectors Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Disposable auto-injectors

8.5.4.2 Reusable auto-injectors

8.5.4.3 Prefilled

8.5.4.4 Empty

8.5.5 Historic and Forecasted Market Size By By Indication

8.5.5.1 Rheumatoid Arthritis

8.5.5.2 Multiple Sclerosis

8.5.5.3 Diabetes

8.5.5.4 Anaphylaxis

8.5.5.5 Other Therapies

8.5.6 Historic and Forecasted Market Size By By End Use

8.5.6.1 Homecare Settings

8.5.6.2 Hospitals & Clinics

8.5.6.3 Ambulatory Surgical Centers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Auto-Injectors Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Disposable auto-injectors

8.6.4.2 Reusable auto-injectors

8.6.4.3 Prefilled

8.6.4.4 Empty

8.6.5 Historic and Forecasted Market Size By By Indication

8.6.5.1 Rheumatoid Arthritis

8.6.5.2 Multiple Sclerosis

8.6.5.3 Diabetes

8.6.5.4 Anaphylaxis

8.6.5.5 Other Therapies

8.6.6 Historic and Forecasted Market Size By By End Use

8.6.6.1 Homecare Settings

8.6.6.2 Hospitals & Clinics

8.6.6.3 Ambulatory Surgical Centers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Auto-Injectors Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Disposable auto-injectors

8.7.4.2 Reusable auto-injectors

8.7.4.3 Prefilled

8.7.4.4 Empty

8.7.5 Historic and Forecasted Market Size By By Indication

8.7.5.1 Rheumatoid Arthritis

8.7.5.2 Multiple Sclerosis

8.7.5.3 Diabetes

8.7.5.4 Anaphylaxis

8.7.5.5 Other Therapies

8.7.6 Historic and Forecasted Market Size By By End Use

8.7.6.1 Homecare Settings

8.7.6.2 Hospitals & Clinics

8.7.6.3 Ambulatory Surgical Centers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Auto-Injectors Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 111.16 Billion |

|

Forecast Period 2024-32 CAGR: |

12.30% |

Market Size in 2032: |

USD 315.77 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Indication |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Auto-Injectors Market research report is 2024-2032.

Eli Lilly; Scandinavian Health Ltd.; AbbVie, Inc.; Amgen; Owen Mumford; Ypsomed; Teva Pharmaceutical; Biogen Idec; Mylan N.V.; Pfizer, Inc.; Sanofi; Gerresheimer AG and Other Major Players.

The Auto-Injectors Market is segmented into By Type, By Indication, By End Use and region. By Type, the market is categorized into Disposable auto-injectors and Reusable auto-injectors. By Indication, the market is categorized into Rheumatoid Arthritis, Multiple Sclerosis, Diabetes, Anaphylaxis and Other Therapies. By End Use, the market is categorized into Homecare Settings, Hospitals & Clinics and Ambulatory Surgical Centers.By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The auto-injectors market refers to the sector focused on the development, manufacturing, and distribution of auto-injector devices designed for the self-administration of medications, particularly in emergency situations or for chronic conditions. These devices facilitate the rapid delivery of therapeutic agents, such as epinephrine for anaphylaxis or biologics for autoimmune diseases, by providing a user-friendly interface that enables patients to administer their medication quickly and effectively without the need for professional assistance. The market is driven by factors such as the increasing prevalence of chronic diseases, the growing demand for home healthcare solutions, and advancements in technology that enhance the usability and safety of auto-injectors.

Auto-Injectors Market Size Was Valued at USD 111.16 Billion in 2023, and is Projected to Reach USD 315.77 Billion by 2032, Growing at a CAGR of 12.30% From 2024-2032.