Automated Truck Loading Systems Market Synopsis

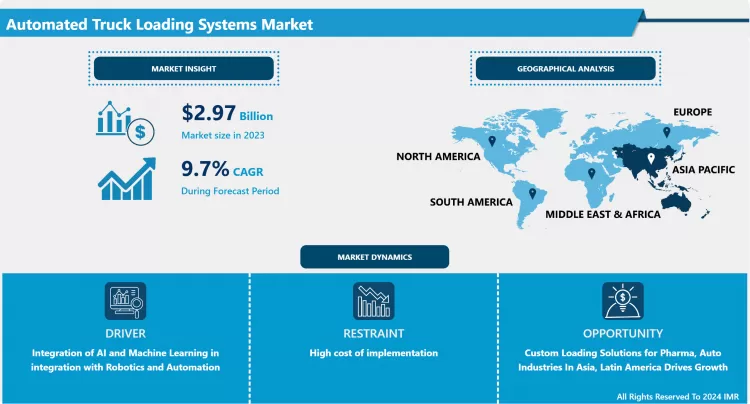

Automated Truck Loading Systems Market Size Was Valued at USD 2.97 Billion in 2023, and is Projected to Reach USD 6.83 Billion by 2032, Growing at a CAGR of 9.7% From 2024-2032.

Automated Truck Loading Systems are technologies and solutions designed to perform the loading of goods into trucks with minimal or no human intervention. These systems use various automation technologies, including conveyors, robotics, sensors, and software, to manage the loading process efficiently. The Automated Truck Loading Systems (ATLS) market involves the development, deployment, and management of systems designed to automate the process of loading goods into trucks. These systems are used to streamline and enhance the efficiency, speed, and accuracy of loading operations within logistics and supply chain management.

- The ATLS market is changing as major players continue to create new products and grow their offerings. Big companies like Vanderlande, Beumer Group, Dematic, and Siemens Logistics compete with each other by focusing on technology advancements, cost, reliability, and service offerings. It is anticipated that the market will experience substantial growth in the future due to factors such as the increased use of AI, the development of flexible and scalable systems, and the integration with broader supply chain management. The demand for automated truck loading systems is increasing due to industries wanting to improve efficiency and reduce costs. In general, the market is constantly changing due to advancements in technology and the demands of the industry.

- The Automated Truck Loading System market has been experiencing significant transformations, driven by technological advancements, shifting consumer preferences, and evolving regulatory landscapes. As a market analyst, it is crucial to understand these dynamics to provide accurate forecasts and strategic insights. Over the past year, the market has seen a robust growth trajectory, largely fueled by increased digitalization and the integration of AI and machine learning in operational processes. These technologies have enhanced efficiency, reduced costs, and opened new avenues for product and service innovation, thereby attracting substantial investments and driving competitive advantage.

Automated Truck Loading Systems Market Trend Analysis

Integration of AI and Machine Learning in integration with Robotics and Automation

- AI and machine learning are more and more utilized in truck loading systems, enabling learning, predicting maintenance, and optimizing loading. This enhances effectiveness, as robotics progress results in more flexible robots for various types of cargo and loading situations. These technologies improve system efficiency, minimize system downtime, and increase loading capacity.

- Integration of IoT enhances supply chain efficiency by enabling real-time monitoring and connectivity. Focusing on sustainability results in energy-saving logistics operations. Businesses are embracing more eco-friendly technologies to comply with environmental laws and meet sustainability objectives, while also improving the handling of loading procedures and logistical processes.

- Companies are looking more and more for adaptable automated systems that can efficiently manage different amounts of cargo. Modular and scalable solutions are favored for their flexibility. Hybrid systems, which blend manual and automated processes, provide a cost-efficient equilibrium. The rise of online shopping is fueling the need for automated loading systems to effectively handle large quantities of orders. There is a growing trend towards greater investment in automation technologies to fulfill the demands of e-commerce logistics.

Custom Loading Solutions for Pharma, Auto Industries in Asia, Latin America Drives Growth.

- Emerging markets in Asia-Pacific and Latin America present growth prospects for businesses with customized solutions. Tailored automated loading solutions for industries such as pharmaceuticals, automotive, and food & beverage can access untapped market segments and offer a competitive advantage.

- Small and medium-sized businesses can take advantage of incorporating advanced technologies such as AI, robotics, and IoT into automated loading systems. Funding research and development for creating new solutions can assist these firms in enhancing effectiveness and rivaling bigger corporations, fostering market expansion and distinctiveness.

- Differentiating businesses can be achieved by giving attention to customer support and maintenance services. Creating strong customer connections and providing additional services can enhance customer satisfaction. Investing in eco-friendly technologies is by lessening environmental impact. Engaging with technology providers, logistics firms, and research institutions may result in new ideas and business prospects, enhancing networks and advancing technology.

Automated Truck Loading Systems Market Segment Analysis:

Automated Truck Loading Systems Market Segmented based on Loading Type, System Type, Loading Dock Type, Component, Truck Type, And End-User.

By Loading Type, Belt Conveyor Segment Is Expected to Dominate the Market During the Forecast Period

- Belt Conveyor Systems are a leading sector in the ATLS industry because of their adaptability and effectiveness. They are appropriate for a diverse array of industries and capable of processing different products. These systems can be adjusted to various amounts of workload and personalized as needed. They guarantee a seamless loading procedure, lessening loading durations, and enhancing operational productivity. Furthermore, they can also be seamlessly incorporated with automated controls to ensure accurate and effective loading procedures.

- Belt conveyor systems provide cost savings through reduced operational expenses and increased energy efficiency. Their main focus is on safety, achieved by automated processes that minimize manual labor, consequently reducing the likelihood of workplace accidents. Consistent operation is crucial in preventing damage to products during loading, particularly in industries that handle delicate goods. In general, belt conveyors are a dependable, effective, and secure option for companies.

- Belt conveyor systems provide flexible options that can be tailored for companies of any size, easily blending into current infrastructure. They have a reputation for being dependable and using sturdy materials, which results in prolonged functionality and little interruption. Furthermore, belt conveyors offer versatility in design layout, featuring customizable pathways and a modular structure for simple expansion or reconfiguration, making them a flexible option for maximizing space and adjusting to evolving requirements.

By System Type, Fully Automated Segment Held the Largest Share

- Automated Systems are the primary choice in the ATLS market for their high efficiency, quickness, reduced labor costs, accuracy, and reliability. Advanced robotics and software are utilized to autonomously load goods efficiently, without the need for human involvement. This automation cuts down on loading times, reduces expenses, and guarantees uniform handling and organization of cargo, leading to an enhancement in the overall quality of logistics.

- Systems that are scalable and versatile can adjust to varying types and quantities of cargo, which is crucial for businesses with a wide range of products or those looking to grow rapidly. Advanced technologies such as AI, IoT, and Big Data are utilized for real-time monitoring and safety features to prevent workplace injuries.

- Automated systems guarantee adherence to rules and the ability to trace in sectors such as automotive, food & beverage, pharmaceuticals, and e-commerce. Although the initial costs are high, the long-term advantages including lower labor expenses and increased efficiency result in a positive return on investment.

Automated Truck Loading Systems Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- Factors such as advanced industrial automation and a strong automotive industry are behind Europe's leading position in the Automated Truck Loading Systems (ATLS) market. High demand for ATLS has been driven by the region's emphasis on Industry 4.0 and smart manufacturing practices, as well as the requirement for efficient logistics solutions in the automotive sector.

- European nations enforce stringent labor laws, leading businesses to adopt automation to decrease reliance on manual labor. The area puts a strong emphasis on sustainability, favoring automated systems for their energy efficiency. Sophisticated infrastructure and logistics systems in Europe facilitate the implementation of automated technologies such as ATLS in supply chains.

- The retail and e-commerce industry in Europe is booming, with companies such as Amazon and Zalando making investments in automated logistics to ensure quick order processing. Government assistance and rewards promote the adoption of automation. Europe is at the forefront due to technological advancements in automation, robotics, and AI. Major industry players such as Vanderlande and Beumer Group are leading the way in promoting innovation and acceptance of automated truck-loading systems in the area.

Automated Truck Loading Systems Market Active Players

- Vanderlande (Netherlands)

- Beumer Group (Germany)

- Dematic (USA)

- Siemens Logistics (Germany)

- Honeywell Intelligrated (USA)

- Daifuku (Japan)

- Swisslog (Switzerland)

- Jungheinrich (Germany)

- Schaefer Systems International (Germany)

- Mitsubishi Logisnext (Japan)

- Toshiba Logistics (Japan)

- Cimcorp (Finland)

- KION Group (Germany)

- Egemin Automation (Belgium)

- Toshiba Infrastructure Systems & Solutions Corporation (Japan)

- Murata Machinery (Japan)

- Fives (France)

- Palletiser (Netherlands)

- Locus Robotics (USA)

- Adept Technology (USA)

- Groupe Charles André (France)

- Interroll (Switzerland)

- FlexLink (Sweden)

- KUKA Robotics (Germany)

- Bastian Solutions (USA)

- Kardex Remstar (Germany)

- Zebra Technologies (USA)

- JBT Corporation (USA)

- Sick AG (Germany)

- SPL International (Spain), and other Active players.

Key Industry Developments in the Automated Truck Loading Systems Market:

- In Jan 2023, Dematic signed a partnership with Vinpac International to provide automated guided vehicles for boosting productivity and efficiency at the South Australian facility of Vinpac. The AGVs are capable of lifting a load of 1,500 kg to four meters in height.

- In Mar 2023, KEITH Manufacturing Co. exhibited at the Mid America Trucking Show that was conducted between March 30 – April 1, 2023, in Louisville. At the event, the company exhibited its product offerings, answering questions about KEITH WALKING FLOOR systems, including troubleshooting and maintenance tips.

|

Global Automated Truck Loading Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.97 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.7 % |

Market Size in 2032: |

USD 6.83 Bn. |

|

Segments Covered: |

By Loading Type |

|

|

|

By System Type |

|

||

|

By Loading Dock Type |

|

||

|

By Component |

|

||

|

By Truck Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automated Truck Loading Systems Market by By Loading Type (2018-2032)

4.1 Automated Truck Loading Systems Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Belt Conveyor

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Chain Conveyor

4.5 Skate Conveyor

4.6 Slat Conveyor

4.7 Automated Guided Vehicles (AGVs)

Chapter 5: Automated Truck Loading Systems Market by By System Type (2018-2032)

5.1 Automated Truck Loading Systems Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fully Automated

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Semi-Automated

5.5 Hybrid

Chapter 6: Automated Truck Loading Systems Market by By Loading Dock Type (2018-2032)

6.1 Automated Truck Loading Systems Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Flush Dock

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Open Dock

6.5 Enclosed Dock

Chapter 7: Automated Truck Loading Systems Market by By Component (2018-2032)

7.1 Automated Truck Loading Systems Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hardware

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Software

7.5 Services

Chapter 8: Automated Truck Loading Systems Market by By Truck Type (2018-2032)

8.1 Automated Truck Loading Systems Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Non-Modified Truck

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Modified Truck

Chapter 9: Automated Truck Loading Systems Market by By End-User (2018-2032)

9.1 Automated Truck Loading Systems Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Automotive

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Food & Beverage

9.5 Pharmaceuticals

9.6 FMCG {Fast-Moving Consumer Goods}

9.7 Retail

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Automated Truck Loading Systems Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 VANDERLANDE (NETHERLANDS)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 BEUMER GROUP (GERMANY)

10.4 DEMATIC (USA)

10.5 SIEMENS LOGISTICS (GERMANY)

10.6 HONEYWELL INTELLIGRATED (USA)

10.7 DAIFUKU (JAPAN)

10.8 SWISSLOG (SWITZERLAND)

10.9 JUNGHEINRICH (GERMANY)

10.10 SCHAEFER SYSTEMS INTERNATIONAL (GERMANY)

10.11 MITSUBISHI LOGISNEXT (JAPAN)

10.12 TOSHIBA LOGISTICS (JAPAN)

10.13 CIMCORP (FINLAND)

10.14 KION GROUP (GERMANY)

10.15 EGEMIN AUTOMATION (BELGIUM)

10.16 TOSHIBA INFRASTRUCTURE SYSTEMS & SOLUTIONS CORPORATION (JAPAN)

10.17 MURATA MACHINERY (JAPAN)

10.18 FIVES (FRANCE)

10.19 PALLETISER (NETHERLANDS)

10.20 LOCUS ROBOTICS (USA)

10.21 ADEPT TECHNOLOGY (USA)

10.22 GROUPE CHARLES ANDRÉ (FRANCE)

10.23 INTERROLL (SWITZERLAND)

10.24 FLEXLINK (SWEDEN)

10.25 KUKA ROBOTICS (GERMANY)

10.26 BASTIAN SOLUTIONS (USA)

10.27 KARDEX REMSTAR (GERMANY)

10.28 ZEBRA TECHNOLOGIES (USA)

10.29 JBT CORPORATION (USA)

10.30 SICK AG (GERMANY)

10.31 SPL INTERNATIONAL (SPAIN)

10.32 AND

Chapter 11: Global Automated Truck Loading Systems Market By Region

11.1 Overview

11.2. North America Automated Truck Loading Systems Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size By By Loading Type

11.2.4.1 Belt Conveyor

11.2.4.2 Chain Conveyor

11.2.4.3 Skate Conveyor

11.2.4.4 Slat Conveyor

11.2.4.5 Automated Guided Vehicles (AGVs)

11.2.5 Historic and Forecasted Market Size By By System Type

11.2.5.1 Fully Automated

11.2.5.2 Semi-Automated

11.2.5.3 Hybrid

11.2.6 Historic and Forecasted Market Size By By Loading Dock Type

11.2.6.1 Flush Dock

11.2.6.2 Open Dock

11.2.6.3 Enclosed Dock

11.2.7 Historic and Forecasted Market Size By By Component

11.2.7.1 Hardware

11.2.7.2 Software

11.2.7.3 Services

11.2.8 Historic and Forecasted Market Size By By Truck Type

11.2.8.1 Non-Modified Truck

11.2.8.2 Modified Truck

11.2.9 Historic and Forecasted Market Size By By End-User

11.2.9.1 Automotive

11.2.9.2 Food & Beverage

11.2.9.3 Pharmaceuticals

11.2.9.4 FMCG {Fast-Moving Consumer Goods}

11.2.9.5 Retail

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Automated Truck Loading Systems Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size By By Loading Type

11.3.4.1 Belt Conveyor

11.3.4.2 Chain Conveyor

11.3.4.3 Skate Conveyor

11.3.4.4 Slat Conveyor

11.3.4.5 Automated Guided Vehicles (AGVs)

11.3.5 Historic and Forecasted Market Size By By System Type

11.3.5.1 Fully Automated

11.3.5.2 Semi-Automated

11.3.5.3 Hybrid

11.3.6 Historic and Forecasted Market Size By By Loading Dock Type

11.3.6.1 Flush Dock

11.3.6.2 Open Dock

11.3.6.3 Enclosed Dock

11.3.7 Historic and Forecasted Market Size By By Component

11.3.7.1 Hardware

11.3.7.2 Software

11.3.7.3 Services

11.3.8 Historic and Forecasted Market Size By By Truck Type

11.3.8.1 Non-Modified Truck

11.3.8.2 Modified Truck

11.3.9 Historic and Forecasted Market Size By By End-User

11.3.9.1 Automotive

11.3.9.2 Food & Beverage

11.3.9.3 Pharmaceuticals

11.3.9.4 FMCG {Fast-Moving Consumer Goods}

11.3.9.5 Retail

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Automated Truck Loading Systems Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size By By Loading Type

11.4.4.1 Belt Conveyor

11.4.4.2 Chain Conveyor

11.4.4.3 Skate Conveyor

11.4.4.4 Slat Conveyor

11.4.4.5 Automated Guided Vehicles (AGVs)

11.4.5 Historic and Forecasted Market Size By By System Type

11.4.5.1 Fully Automated

11.4.5.2 Semi-Automated

11.4.5.3 Hybrid

11.4.6 Historic and Forecasted Market Size By By Loading Dock Type

11.4.6.1 Flush Dock

11.4.6.2 Open Dock

11.4.6.3 Enclosed Dock

11.4.7 Historic and Forecasted Market Size By By Component

11.4.7.1 Hardware

11.4.7.2 Software

11.4.7.3 Services

11.4.8 Historic and Forecasted Market Size By By Truck Type

11.4.8.1 Non-Modified Truck

11.4.8.2 Modified Truck

11.4.9 Historic and Forecasted Market Size By By End-User

11.4.9.1 Automotive

11.4.9.2 Food & Beverage

11.4.9.3 Pharmaceuticals

11.4.9.4 FMCG {Fast-Moving Consumer Goods}

11.4.9.5 Retail

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Automated Truck Loading Systems Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size By By Loading Type

11.5.4.1 Belt Conveyor

11.5.4.2 Chain Conveyor

11.5.4.3 Skate Conveyor

11.5.4.4 Slat Conveyor

11.5.4.5 Automated Guided Vehicles (AGVs)

11.5.5 Historic and Forecasted Market Size By By System Type

11.5.5.1 Fully Automated

11.5.5.2 Semi-Automated

11.5.5.3 Hybrid

11.5.6 Historic and Forecasted Market Size By By Loading Dock Type

11.5.6.1 Flush Dock

11.5.6.2 Open Dock

11.5.6.3 Enclosed Dock

11.5.7 Historic and Forecasted Market Size By By Component

11.5.7.1 Hardware

11.5.7.2 Software

11.5.7.3 Services

11.5.8 Historic and Forecasted Market Size By By Truck Type

11.5.8.1 Non-Modified Truck

11.5.8.2 Modified Truck

11.5.9 Historic and Forecasted Market Size By By End-User

11.5.9.1 Automotive

11.5.9.2 Food & Beverage

11.5.9.3 Pharmaceuticals

11.5.9.4 FMCG {Fast-Moving Consumer Goods}

11.5.9.5 Retail

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Automated Truck Loading Systems Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size By By Loading Type

11.6.4.1 Belt Conveyor

11.6.4.2 Chain Conveyor

11.6.4.3 Skate Conveyor

11.6.4.4 Slat Conveyor

11.6.4.5 Automated Guided Vehicles (AGVs)

11.6.5 Historic and Forecasted Market Size By By System Type

11.6.5.1 Fully Automated

11.6.5.2 Semi-Automated

11.6.5.3 Hybrid

11.6.6 Historic and Forecasted Market Size By By Loading Dock Type

11.6.6.1 Flush Dock

11.6.6.2 Open Dock

11.6.6.3 Enclosed Dock

11.6.7 Historic and Forecasted Market Size By By Component

11.6.7.1 Hardware

11.6.7.2 Software

11.6.7.3 Services

11.6.8 Historic and Forecasted Market Size By By Truck Type

11.6.8.1 Non-Modified Truck

11.6.8.2 Modified Truck

11.6.9 Historic and Forecasted Market Size By By End-User

11.6.9.1 Automotive

11.6.9.2 Food & Beverage

11.6.9.3 Pharmaceuticals

11.6.9.4 FMCG {Fast-Moving Consumer Goods}

11.6.9.5 Retail

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Automated Truck Loading Systems Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size By By Loading Type

11.7.4.1 Belt Conveyor

11.7.4.2 Chain Conveyor

11.7.4.3 Skate Conveyor

11.7.4.4 Slat Conveyor

11.7.4.5 Automated Guided Vehicles (AGVs)

11.7.5 Historic and Forecasted Market Size By By System Type

11.7.5.1 Fully Automated

11.7.5.2 Semi-Automated

11.7.5.3 Hybrid

11.7.6 Historic and Forecasted Market Size By By Loading Dock Type

11.7.6.1 Flush Dock

11.7.6.2 Open Dock

11.7.6.3 Enclosed Dock

11.7.7 Historic and Forecasted Market Size By By Component

11.7.7.1 Hardware

11.7.7.2 Software

11.7.7.3 Services

11.7.8 Historic and Forecasted Market Size By By Truck Type

11.7.8.1 Non-Modified Truck

11.7.8.2 Modified Truck

11.7.9 Historic and Forecasted Market Size By By End-User

11.7.9.1 Automotive

11.7.9.2 Food & Beverage

11.7.9.3 Pharmaceuticals

11.7.9.4 FMCG {Fast-Moving Consumer Goods}

11.7.9.5 Retail

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Global Automated Truck Loading Systems Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.97 Bn. |

|

Forecast Period 2024-32 CAGR: |

9.7 % |

Market Size in 2032: |

USD 6.83 Bn. |

|

Segments Covered: |

By Loading Type |

|

|

|

By System Type |

|

||

|

By Loading Dock Type |

|

||

|

By Component |

|

||

|

By Truck Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Automated Truck Loading Systems Market research report is 2024-2032.

Vanderlande (Netherlands), Beumer Group (Germany), Dematic (USA), Siemens Logistics (Germany), Honeywell Intelligrated (USA), Daifuku (Japan), Swisslog (Switzerland), Jungheinrich (Germany), Schaefer Systems International (Germany), Mitsubishi Logisnext (Japan), Toshiba Logistics (Japan), Cimcorp (Finland), KION Group (Germany), Egemin Automation (Belgium), Toshiba Infrastructure Systems & Solutions Corporation (Japan), Murata Machinery (Japan), Fives (France), Palletiser (Netherlands), Locus Robotics (USA), Adept Technology (USA), Groupe Charles André (France), Interroll (Switzerland), FlexLink (Sweden), KUKA Robotics (Germany), Bastian Solutions (USA), Kardex Remstar (Germany), Zebra Technologies (USA), JBT Corporation (USA), Sick AG (Germany), SPL International (Spain) and Other Active Players.

The Automated Truck Loading Systems Market is segmented into Loading Type, System Type, Loading Dock Type, Component, Truck Type, End-User, and Region. By Loading Type, the market is categorized into Belt Conveyors, Chain Conveyors, Skate Conveyors, Slat Conveyors, and Automated Guided Vehicles (AGVs). By System Type, the market is categorized into Fully Automated, Semi-Automated, and Hybrid. By Loading Dock Type, the market is categorized into Flush Dock, Open Dock, and Enclosed Dock. By Component, the market is categorized into Hardware, Software, and Services. By Truck Type, The Market Is Categorized into Non-Modified Truck and Modified Truck. By End-User, the market is categorized into Automotive, Food & Beverage, Pharmaceuticals, FMCG {Fast-Moving Consumer Goods}, and Retail. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Automated Truck Loading Systems are technologies and solutions designed to perform the loading of goods into trucks with minimal or no human intervention. These systems use various automation technologies, including conveyors, robotics, sensors, and software, to manage the loading process efficiently. The Automated Truck Loading Systems (ATLS) market involves the development, deployment, and management of systems designed to automate the process of loading goods into trucks. These systems are used to streamline and enhance the efficiency, speed, and accuracy of loading operations within logistics and supply chain management.

Automated Truck Loading Systems Market Size Was Valued at USD 2.97 Billion in 2023, and is Projected to Reach USD 6.83 Billion by 2032, Growing at a CAGR of 9.7% From 2024-2032.