Automotive Armrest Market Synopsis

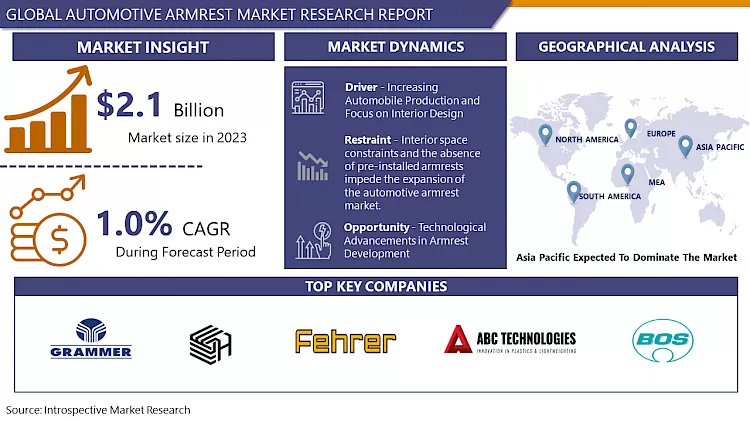

Automotive Armrest Market Size Was Valued at USD 2.1 Billion in 2023, and is Projected to Reach USD 2.3 Billion by 2032, Growing at a CAGR of 1.0% From 2024-2032.

- Automobiles are the vehicles that have automotive armrests, which is a place for drivers to rest their hands or hide some important things in order to get them easily while driving. The specific functions of a non-vital vehicle, cup holder, and ample space are among its features. The automobile backseat armrest, which is foldable, serves dual purposes: it can take in a third person and a person who wants to sleep on their side. This feature is only available in luxury cars. For the most part, all car doors have an armrest that you can rest your wrists on or use it to keep the door open while you operate the car.

- Seating or doors may be equipped with an automotive armrest. No matter what the height of the driver or where he is sitting, armrests are a great addition to his driving comfort. A few car armrests are totally collapsible, bendable and can withstand the heavy use. Besides, the armrests that contain soft materials like cloth, vinyl, leather or PUR which have an additional aesthetic value and are also functional enough to provide wireless charging and portability are increasingly becoming popular among consumers. Thus, the armrests need are growing.

- The automotive armrest market is driven by an increase in vehicle manufacturing and sales, rental car demand, after-market demand as well as a growing trend of automobile aesthetics.

Automotive Armrest Market Trend Analysis

Rise in the production and sales of new vehicles

- The more the road journeys are on, the bigger is going to be the market for automotive armrests. The automotive armrest market is booming due to the increasing demand for armrests from original equipment manufacturers (OEMs) which in turn, is driven by the rising production and sales of new vehicles. Also, a growing car rental market and the focus on automobile interior design are expected to be the driving force of the automotive armrest market in future.

- It is projected that the global automotive armrest market will grow with the increasing e-commerce era. The transportation costs, for example, public transport or gasoline and the impossibility of comparing the prices among retail establishments can be a great factor in increasing the overall cost of purchase for customers. On the other hand, online shopping provides goods at prices that are almost non-existent. The process of getting a product from an online retailer is quick and can be done easily through a mobile device thus the user does not have to be in person at the establishment. Hence, the leading armrest manufacturers are now selling their products online with the aim of getting a bigger share in the international automotive armrest market.

Vehicle Comfort Features Drive the market

- The topmost priority of the owners is to maintain the highest level of convenience for their cars. An armrest is an automotive accessory that significantly adds up to the comfort of a car. The armrest does not block the way of changing speeds and applying the handbrake. Usually, a soft cushioning is had on the armrests' tops to make it comfortable for those who are seating. The strength and quality are guaranteed by the steel reinforcement of each armrest. The car armrest has been changed from its original use as a stowage compartment to the function of the console, which allows you to control features like air conditioning, windows and seat massagers. The vehicle's equipment may also include the electrical system's control console and the practical stowage compartment. The armrest is perfect for the mini-refrigerators and electronic devices that are sensitive to temperature by having the thermal insulation features incorporated in it. Besides, a variety of shapes and styles can be made from this advanced plastic processing technology. Following the Pabla Enterprise model, for the Maruti Suzuki Dzire you get a wooden armrest console. So, the automotive armrests market will have a boost because of the increasing demand for comfortable and technologically advanced armrests.

Automotive Armrest Market Segment Analysis:

Automotive Armrest Market is segmented based on type, material, and sales channel.

By type, passenger vehicles segment is expected to dominate the market during the forecast period

- The more the per capita income goes up, the greater is the need for new cars in the automobile industry; thus this creates a demand for automotive armrests. According to the OICA, in 2017, cars production all over the world was about 97 million and this number is expected to grow in future. The automotive armrest market will be boosted in general by these factors during the forecast period.

By sales chgannel, aftermarkets segment held the largest share in 2023

- It is expected that the aftermarket will be ruling over the automotive armrest sector in future years. The growing demand among vehicle owners to retrofit older cars with the same comforts and technologies as those provided by original equipment manufacturers (OEMs) in newer models is mainly responsible for this dominance. On the other hand, as the age of vehicles worldwide increases, so does the demand for replacement parts and enhancements which in turn expands the aftermarket armrest segment.

Automotive Armrest Market Regional Insights:

Asia Pacific, is Expected to Dominate the Market Over the Forecast period

- Asia-Pacific has the biggest market share in the world and it is expected to retain this position during the forecast period because of its rapid urbanization and increasing per capita purchasing power. This place is the heart of the global automotive manufacturing industry. Car sales are on the increase, and so is armrest market that goes hand in hand with car demand. Besides, the automotive armrest market of this region is also driven by the development of e-commerce industry and a well-established supply chain network for automobile production and shipbuilding sectors besides having strong economies like China, India, Japan, South Korea. These factors are the main causes of the increasing need for transportation and thus, the market for automotive armrests is also growing. North America and Europe are the next major regions in the global market because they have significant automotive companies and a well-established vehicle market.

Active Key Players in the Automotive Armrest Market

- Grammer

- EFH Armrests

- Fehrer

- ABC Group

- BOS

- Master Molded Products Corporation

- Irvin Automotive Products

- Accuride

- Bentex Automotive

- Yangfeng Johnson Controls

- Intap

- Proseat, Other Key Players

|

Global Automotive Armrest Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 2.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

1.0 % |

Market Size in 2032: |

USD 2.3 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Armrest Market by By Type (2018-2032)

4.1 Automotive Armrest Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Passenger Vehicles

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Commercial Vehicles

Chapter 5: Automotive Armrest Market by By Material (2018-2032)

5.1 Automotive Armrest Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Wood

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Plastic

5.5 Steel

5.6 Aluminium

Chapter 6: Automotive Armrest Market by By Sales Channel (2018-2032)

6.1 Automotive Armrest Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Aftermarket

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 OEMs

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Automotive Armrest Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABB LTD. (SWITZERLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 YASKAWA ELECTRIC CORPORATION (JAPAN)

7.4 EFFORT INTELLIGENCE EQUIPMENT CO. LTD. (CHINA)

7.5 STAUBLI INTERNATIONAL AG (SWITZERLAND)

7.6 KAWASAKI HEAVY INDUSTRY CO. LTD. (JAPAN)

7.7 DURR GROUP (GERMANY)

7.8 GIFFIN (U.S.)

7.9 FANUC CORPORATION (JAPAN)

7.10 KUKA AG (GERMANY)

7.11 SAIMA MECCANICA S.P.A. (ITALY)

7.12 AND OTHER KEY PLAYERS

Chapter 8: Global Automotive Armrest Market By Region

8.1 Overview

8.2. North America Automotive Armrest Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Passenger Vehicles

8.2.4.2 Commercial Vehicles

8.2.5 Historic and Forecasted Market Size By By Material

8.2.5.1 Wood

8.2.5.2 Plastic

8.2.5.3 Steel

8.2.5.4 Aluminium

8.2.6 Historic and Forecasted Market Size By By Sales Channel

8.2.6.1 Aftermarket

8.2.6.2 OEMs

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Automotive Armrest Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Passenger Vehicles

8.3.4.2 Commercial Vehicles

8.3.5 Historic and Forecasted Market Size By By Material

8.3.5.1 Wood

8.3.5.2 Plastic

8.3.5.3 Steel

8.3.5.4 Aluminium

8.3.6 Historic and Forecasted Market Size By By Sales Channel

8.3.6.1 Aftermarket

8.3.6.2 OEMs

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Automotive Armrest Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Passenger Vehicles

8.4.4.2 Commercial Vehicles

8.4.5 Historic and Forecasted Market Size By By Material

8.4.5.1 Wood

8.4.5.2 Plastic

8.4.5.3 Steel

8.4.5.4 Aluminium

8.4.6 Historic and Forecasted Market Size By By Sales Channel

8.4.6.1 Aftermarket

8.4.6.2 OEMs

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Automotive Armrest Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Passenger Vehicles

8.5.4.2 Commercial Vehicles

8.5.5 Historic and Forecasted Market Size By By Material

8.5.5.1 Wood

8.5.5.2 Plastic

8.5.5.3 Steel

8.5.5.4 Aluminium

8.5.6 Historic and Forecasted Market Size By By Sales Channel

8.5.6.1 Aftermarket

8.5.6.2 OEMs

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Automotive Armrest Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Passenger Vehicles

8.6.4.2 Commercial Vehicles

8.6.5 Historic and Forecasted Market Size By By Material

8.6.5.1 Wood

8.6.5.2 Plastic

8.6.5.3 Steel

8.6.5.4 Aluminium

8.6.6 Historic and Forecasted Market Size By By Sales Channel

8.6.6.1 Aftermarket

8.6.6.2 OEMs

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Automotive Armrest Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Passenger Vehicles

8.7.4.2 Commercial Vehicles

8.7.5 Historic and Forecasted Market Size By By Material

8.7.5.1 Wood

8.7.5.2 Plastic

8.7.5.3 Steel

8.7.5.4 Aluminium

8.7.6 Historic and Forecasted Market Size By By Sales Channel

8.7.6.1 Aftermarket

8.7.6.2 OEMs

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Automotive Armrest Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 2.1 Bn. |

|

Forecast Period 2024-32 CAGR: |

1.0 % |

Market Size in 2032: |

USD 2.3 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Sales Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Automotive Armrest Market research report is 2024-2032.

Grammer, EFH Armrests, Fehrer, ABC Group, BOS, and Other major players.

The Automotive Armrest Market is segmented into type, material, sales channel, and region. By type, the market is categorized into passenger vehicles, and commercial vehicles. By material, the market is categorized into wood, plastic, steel, and aluminium. By sales channel, the market is categorized into aftermarket, and OEMs. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The purpose of an automotive armrest is to offer support and convenience to the occupants of a vehicle by providing a location to rest the arm while operating the vehicle. For the purpose of side support, it is frequently positioned between the front seats and may also be observed on door panels. Contemporary armrests frequently integrate supplementary features, including cup holders, stowage compartments, and control panels that regulate diverse automobile functions such as windows and air conditioning. The integration of sophisticated designs with the vehicle's electrical system and thermal insulation are two examples of features that can improve the vehicle's comfort and functionality.

Automotive Armrest Market Size Was Valued at USD 2.1 Billion in 2023, and is Projected to Reach USD 2.3 Billion by 2032, Growing at a CAGR of 1.0% From 2024-2032.