Automotive Battery Market Synopsis

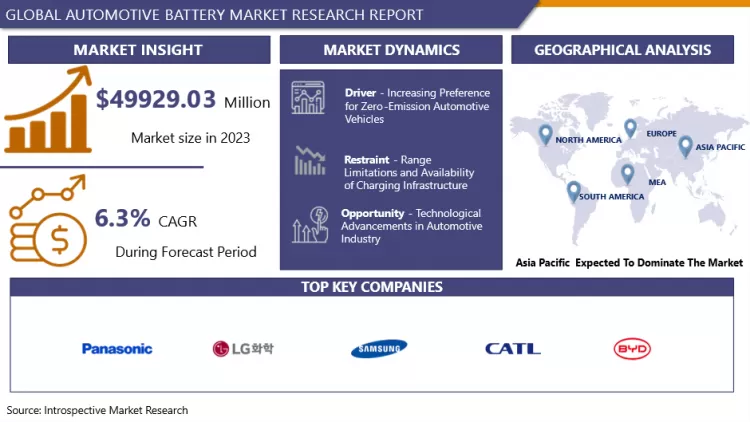

Automotive Battery Market Size Was Valued at USD 49929.03 Million in 2023, and is Projected to Reach USD 86527.17 Million by 2032, Growing at a CAGR of 6.3% From 2024-2032.

Automotive batteries are rechargeable batteries that provide electric power to motor vehicles. There are various types of automotive batteries such as Lithium-ion, lead-acid, nickel, and sodium-ion. These usually consist of six cells and are the central component of the vehicle's electrical setup. The primary objective of the part is to initiate the engine, after which the alternator provides power for the electrical system.

- The rising desire from consumers for electric and hybrid vehicles without pollution is fuelling the necessity for automotive batteries with sufficient reserve capacity. Different aspects such as cold cranking amperes, amp-hours, power, and reserve capacity are utilized to evaluate battery efficiency. New hybrid and electric models, government policies, and sustainable manufacturing of electric vehicles all impact the market.

- Electric utility companies are striving to create a standardized platform for electric vehicles, with regulatory policies, increased vehicle production and sales, expanding transportation options, technological advancements, evolving lifestyles, and higher disposable incomes all playing a role in the growth of the automotive battery market.

- Increased understanding of climate change has led to an increase in the need for more environmentally friendly energy options such as electric vehicles (EVs). Tougher emissions standards are driving customers and producers towards electric vehicles on a global scale. Authorities are establishing goals to decrease greenhouse gas emissions and eliminate vehicles that run on internal combustion engines.

- Investments in renewable energy projects and electric vehicles are influencing the automotive industry as global investment focus shifts towards clean energy sources. The emphasis in economic recovery after the pandemic is on sustainable technologies and electric mobility in order to promote growth and create jobs.

Automotive Battery Market Trend Analysis

Increasing Preference for Zero-Emission Automotive Vehicles

- The increasing global demand for electric vehicles is driven by both consumer and government efforts to decrease carbon emissions and reliance on fossil fuels. The rise is also causing a higher need for lithium-ion batteries necessary for fuelling these cars. Advancements in battery technology from research and development for zero-emission vehicles have led to innovations in chemistry, energy density, charging times, and performance.

- Major car manufacturers and battery companies are investing heavily to increase the production capacity of car batteries, which is driving down costs and making electric vehicles more attractive to buyers. Numerous nations employ measures and rewards to promote the uptake of electric cars, such as subsidies and tax incentives. More rigorous emissions regulations also increase the need for car batteries.

- The rise of electric vehicles is causing the automotive industry to undergo changes, resulting in traditional automakers, battery manufacturers, and technology companies competing more and forming collaborations to meet the growing demand for EVs. Zero-emission vehicles help decrease emissions and enhance air quality, tackling environmental issues. Consumer demand for electric vehicles is increasing because of a heightened focus on sustainability.

Opportunity

Technological Advancements in Automotive Industry

- The increase in popularity of electric cars has led to a need for batteries that have higher energy density, longer life spans, and quicker charging speeds. Advancements in battery technology, such as solid-state batteries, are enhancing both energy storage capabilities and safety features. Integrating smart technologies into vehicles helps improve energy efficiency and maximize battery usage. Integration of Vehicle-to-Grid enables vehicles to both receive and give back power to the grid, enhancing efficiency and performance.

- Rising numbers of electric vehicles and batteries being produced result in decreased costs due to economies of scale. Advancements in manufacturing techniques, such as automation, are decreasing the total production expenses of car batteries, which in turn is increasing the competitiveness of electric vehicles. Safety and sustainability are improved by advancements in battery management and thermal systems, as a focus on sustainable materials and recycling complies with global regulations and consumer preferences.

- Collaborations in different sectors, such as car manufacturers partnering with technology, battery, and energy companies, as well as research institutions teaming up with industry leaders, are progressing battery technologies to speed up their commercial availability. Innovations in technology are leading to the emergence of new markets, such as electric buses, trucks, and aircraft. The increasing popularity of electric vehicles in developing nations is driving the growth of the worldwide automotive battery market.

Automotive Battery Market Segment Analysis:

Automotive Battery Market is segmented on the basis of Battery Type, Functions, Engine Type, Vehicle Type, and Region.

By Battery Type, Lithium- Ion Segment is Expected to Dominate the Market During the Forecast Period

- Lithium-ion (Li-ion) batteries have become the preferred power source for electric vehicles (EVs) due to their high energy density, low self-discharge rate, and long cycle life. Over the past decade, technological enhancements accompanied by massive cost reductions have enabled the growing market diffusion of EVs. This diffusion has resulted in customized and cost-effective Li-ion battery cell designs tailored to automotive requirements.

- Global market for Li-ion batteries is in an early stage of development, it is still possible for the EU to establish a competitive advantage in the production of Li-ion battery cells and systems. Increased levels of public R&D investment should be provided in order to anticipate new products and support pre-competitive research project. The increase in demand for large-format lithium-ion batteries will improve economies of scale, directly lowering cost. Battery manufacturers are currently working to design simplified systems ready for large automation.

- The advantages of lead–acid batteries are the low material costs, intrinsic safety and high recycling quotes (with a value of more than 95 %, the highest of all battery technologies). In spite of their high weight, lead– acid batteries are still a promising option also for future development. Battery manufacturers are also working to increase the power density of lithium-ion cells, something that is especially important for plug-in hybrid and hybrid applications.

- The global demand for lithium-ion batteries has risen significantly from 2019 to 2023, with a compound annual growth rate of about 35%. This increase is attributed to the expanding electric vehicle market, where lithium-ion batteries are favored for their energy density, efficiency, and longevity. The surge in demand reflects the shift from internal combustion engine vehicles to electric ones, driven by environmental awareness, technological progress, and government initiatives promoting sustainable transportation.

By Engine, Electric Vehicles Segment Held the Largest Share in 2023

- Increasing demand for electric vehicles (EVs) has created the need for high-performance, cost-effective, and safe energy storage systems. Lithium-ion (Li-ion) batteries have emerged as the preferred power source for EVs due to their high energy density, low self-discharge rate, adequate chemical potential, and long cycle life. Technological enhancements accompanied by massive cost reductions of Li-ion batteries have been critical for the growing market diffusion of EVs and, thus, the transition to more sustainable road transport.

- EVs early on and established OEMs that are now also transforming their product portfolios from internal combustion engine-powered vehicles to EV. Electric vehicles are locally emission free. The total emissions of today’s electric vehicles are highly dependent on the power-producing energy mixture. Reduction in the CO2 emissions can be achieved when the power is produced from renewable energy sources.

- The need for machine maintenance is expected to be less for electric vehicles as the electric motor works almost without attrition. Thus, the traction battery system constitutes the main cost factor. However, even with slightly higher initial costs, electric vehicles can compete on the market with lower maintenance and lower fuel costs. Consumers are more willing to adopt electric vehicles as charging infrastructure grows and more models become available. Consumers and fleet operators find the lower total cost of ownership, which includes decreased fuel and maintenance costs, to be appealing.

Automotive Battery Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- China is a major production center for automotive batteries, specifically lithium-ion batteries. Major companies such as CATL and BYD are situated in China, which boasts the world's biggest production scale. The government of China provides support for electric vehicles through subsidies, incentives, tax breaks, and refunds. Requirements such as the NEV mandate encourage the manufacturing and acceptance of electric vehicles by mandating that car manufacturers produce a specific proportion of electric vehicles.

- In the Asia-Pacific region, there is more convenient access to raw materials such as lithium, cobalt, and nickel needed for producing batteries. They make investments worldwide in order to ensure a consistent supply for production. China dominates the global EV market due to high domestic demand supported by both consumers and government initiatives. Electric vehicle adoption in Chinese cities increases due to urbanization and pollution issues.

- In Asia-Pacific, the mass production results in cost savings due to economies of scale, reducing the price of batteries. Expertise concentration fuels innovation, securing a competitive edge in battery technology progress. Established integrated supply chains in the area for battery manufacturing take advantage of logistical benefits such as being close to raw material sources and effective transportation networks, which enhance production efficiency and cut down on expenses.

Automotive Battery Market Active Players

- Panasonic Corporation (Japan)

- LG Chem Ltd. (South Korea)

- Samsung SDI Co., Ltd. (South Korea)

- Contemporary Amperex Technology Co., Limited (China)

- BYD Company Limited (China)

- Johnson Controls International plc (USA)

- GS Yuasa Corporation (Japan)

- Exide Technologies (USA)

- EnerSys (USA)

- Saft Groupe S.A. (France)

- East Penn Manufacturing Co. (USA)

- Toshiba Corporation (Japan)

- Amara Raja Batteries Ltd. (India)

- Northvolt AB (Sweden)

- Sanyo Electric Co., Ltd. (Japan)

- Hitachi Chemical Co., Ltd. (Japan)

- Leoch International Technology Limited (China)

- Furukawa Electric Co., Ltd. (Japan)

- Banner Batteries (Austria)

- Energizer Holdings, Inc. (USA)

- Primearth EV Energy Co., Ltd. (Japan)

- SK Innovation Co., Ltd. (South Korea)

- Microvast, Inc. (USA)

- AtlasBX Co., Ltd. (South Korea)

- Lishen Battery Co., Ltd. (China)

- VARTA AG (Germany)

Key Industry Developments in the Automotive Battery Market:

-

Global Automotive Battery Market

Base Year:

2023

Forecast Period:

2024-2032

Historical Data:

2017 to 2023

Market Size in 2023:

USD 49929.03 Mn.

Forecast Period 2024-32 CAGR:

6.3 %

Market Size in 2032:

USD 86527.17 Mn.

Segments Covered:

By Battery Type

- Lithium- Ion

- Lead- Acid

- Nickel

- Sodium- Ion

By Functions

- Ignition

- Lighting

- Electric Propulsion

- Start

By Engine Type

- Internal Combustion Engine (ICE)

- Electric Vehicles (EV)

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles

- Two-Wheelers

By Region

- North America (U.S., Canada, Mexico)

- Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe)

- Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe)

- Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC)

- Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa)

- South America (Brazil, Argentina, Rest of SA)

Key Market Drivers:

- Increasing Preference for Zero-Emission Automotive Vehicles

Key Market Restraints:

- Range Limitations and availability of Charging Infrastructure

Key Opportunities:

- Technological Advancements in Automotive Industry

Companies Covered in the report:

- Panasonic Corporation (Japan), LG Chem Ltd. (South Korea), Samsung SDI Co., Ltd. (South Korea), Contemporary Amperex Technology Co., Limited (China), BYD Company Limited (China), and Other Active Players.

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Automotive Battery Market by By Battery Type (2018-2032)

4.1 Automotive Battery Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Lithium- Ion

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Lead- Acid

4.5 Nickel

4.6 Sodium- Ion

Chapter 5: Automotive Battery Market by By Functions (2018-2032)

5.1 Automotive Battery Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Ignition

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Lighting

5.5 Electric Propulsion

5.6 Start

Chapter 6: Automotive Battery Market by By Engine Type (2018-2032)

6.1 Automotive Battery Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Internal Combustion Engine (ICE)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Electric Vehicles (EV)

Chapter 7: Automotive Battery Market by By Vehicle Type (2018-2032)

7.1 Automotive Battery Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Passenger Cars

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Commercial Vehicles

7.5 Electric Vehicles

7.6 Two-Wheelers

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Automotive Battery Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 PANASONIC CORPORATION (JAPAN)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 LG CHEM LTD. (SOUTH KOREA)

8.4 SAMSUNG SDI COLTD. (SOUTH KOREA)

8.5 CONTEMPORARY AMPEREX TECHNOLOGY COLIMITED (CHINA)

8.6 BYD COMPANY LIMITED (CHINA)

8.7 JOHNSON CONTROLS INTERNATIONAL PLC (USA)

8.8 GS YUASA CORPORATION (JAPAN)

8.9 EXIDE TECHNOLOGIES (USA)

8.10 ENERSYS (USA)

8.11 SAFT GROUPE S.A. (FRANCE)

8.12 EAST PENN MANUFACTURING CO. (USA)

8.13 TOSHIBA CORPORATION (JAPAN)

8.14 AMARA RAJA BATTERIES LTD. (INDIA)

8.15 NORTHVOLT AB (SWEDEN)

8.16 SANYO ELECTRIC COLTD. (JAPAN)

8.17 HITACHI CHEMICAL COLTD. (JAPAN)

8.18 LEOCH INTERNATIONAL TECHNOLOGY LIMITED (CHINA)

8.19 FURUKAWA ELECTRIC COLTD. (JAPAN)

8.20 BANNER BATTERIES (AUSTRIA)

8.21 ENERGIZER HOLDINGS INC. (USA)

8.22 PRIMEARTH EV ENERGY COLTD. (JAPAN)

8.23 SK INNOVATION COLTD. (SOUTH KOREA)

8.24 MICROVAST INC. (USA)

8.25 ATLASBX COLTD. (SOUTH KOREA)

8.26 LISHEN BATTERY COLTD. (CHINA)

8.27 VARTA AG (GERMANY)

Chapter 9: Global Automotive Battery Market By Region

9.1 Overview

9.2. North America Automotive Battery Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Battery Type

9.2.4.1 Lithium- Ion

9.2.4.2 Lead- Acid

9.2.4.3 Nickel

9.2.4.4 Sodium- Ion

9.2.5 Historic and Forecasted Market Size By By Functions

9.2.5.1 Ignition

9.2.5.2 Lighting

9.2.5.3 Electric Propulsion

9.2.5.4 Start

9.2.6 Historic and Forecasted Market Size By By Engine Type

9.2.6.1 Internal Combustion Engine (ICE)

9.2.6.2 Electric Vehicles (EV)

9.2.7 Historic and Forecasted Market Size By By Vehicle Type

9.2.7.1 Passenger Cars

9.2.7.2 Commercial Vehicles

9.2.7.3 Electric Vehicles

9.2.7.4 Two-Wheelers

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Automotive Battery Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Battery Type

9.3.4.1 Lithium- Ion

9.3.4.2 Lead- Acid

9.3.4.3 Nickel

9.3.4.4 Sodium- Ion

9.3.5 Historic and Forecasted Market Size By By Functions

9.3.5.1 Ignition

9.3.5.2 Lighting

9.3.5.3 Electric Propulsion

9.3.5.4 Start

9.3.6 Historic and Forecasted Market Size By By Engine Type

9.3.6.1 Internal Combustion Engine (ICE)

9.3.6.2 Electric Vehicles (EV)

9.3.7 Historic and Forecasted Market Size By By Vehicle Type

9.3.7.1 Passenger Cars

9.3.7.2 Commercial Vehicles

9.3.7.3 Electric Vehicles

9.3.7.4 Two-Wheelers

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Automotive Battery Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Battery Type

9.4.4.1 Lithium- Ion

9.4.4.2 Lead- Acid

9.4.4.3 Nickel

9.4.4.4 Sodium- Ion

9.4.5 Historic and Forecasted Market Size By By Functions

9.4.5.1 Ignition

9.4.5.2 Lighting

9.4.5.3 Electric Propulsion

9.4.5.4 Start

9.4.6 Historic and Forecasted Market Size By By Engine Type

9.4.6.1 Internal Combustion Engine (ICE)

9.4.6.2 Electric Vehicles (EV)

9.4.7 Historic and Forecasted Market Size By By Vehicle Type

9.4.7.1 Passenger Cars

9.4.7.2 Commercial Vehicles

9.4.7.3 Electric Vehicles

9.4.7.4 Two-Wheelers

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Automotive Battery Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Battery Type

9.5.4.1 Lithium- Ion

9.5.4.2 Lead- Acid

9.5.4.3 Nickel

9.5.4.4 Sodium- Ion

9.5.5 Historic and Forecasted Market Size By By Functions

9.5.5.1 Ignition

9.5.5.2 Lighting

9.5.5.3 Electric Propulsion

9.5.5.4 Start

9.5.6 Historic and Forecasted Market Size By By Engine Type

9.5.6.1 Internal Combustion Engine (ICE)

9.5.6.2 Electric Vehicles (EV)

9.5.7 Historic and Forecasted Market Size By By Vehicle Type

9.5.7.1 Passenger Cars

9.5.7.2 Commercial Vehicles

9.5.7.3 Electric Vehicles

9.5.7.4 Two-Wheelers

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Automotive Battery Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Battery Type

9.6.4.1 Lithium- Ion

9.6.4.2 Lead- Acid

9.6.4.3 Nickel

9.6.4.4 Sodium- Ion

9.6.5 Historic and Forecasted Market Size By By Functions

9.6.5.1 Ignition

9.6.5.2 Lighting

9.6.5.3 Electric Propulsion

9.6.5.4 Start

9.6.6 Historic and Forecasted Market Size By By Engine Type

9.6.6.1 Internal Combustion Engine (ICE)

9.6.6.2 Electric Vehicles (EV)

9.6.7 Historic and Forecasted Market Size By By Vehicle Type

9.6.7.1 Passenger Cars

9.6.7.2 Commercial Vehicles

9.6.7.3 Electric Vehicles

9.6.7.4 Two-Wheelers

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Automotive Battery Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Battery Type

9.7.4.1 Lithium- Ion

9.7.4.2 Lead- Acid

9.7.4.3 Nickel

9.7.4.4 Sodium- Ion

9.7.5 Historic and Forecasted Market Size By By Functions

9.7.5.1 Ignition

9.7.5.2 Lighting

9.7.5.3 Electric Propulsion

9.7.5.4 Start

9.7.6 Historic and Forecasted Market Size By By Engine Type

9.7.6.1 Internal Combustion Engine (ICE)

9.7.6.2 Electric Vehicles (EV)

9.7.7 Historic and Forecasted Market Size By By Vehicle Type

9.7.7.1 Passenger Cars

9.7.7.2 Commercial Vehicles

9.7.7.3 Electric Vehicles

9.7.7.4 Two-Wheelers

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Automotive Battery Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 49929.03 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.3 % |

Market Size in 2032: |

USD 86527.17 Mn. |

|

Segments Covered: |

By Battery Type |

|

|

|

By Functions |

|

||

|

By Engine Type |

|

||

|

By Vehicle Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Automotive Battery Market research report is 2024-2032.

Panasonic Corporation (Japan), LG Chem Ltd. (South Korea), Samsung SDI Co., Ltd. (South Korea), Contemporary Amperex Technology Co., Limited (China), BYD Company Limited (China), Johnson Controls International plc (USA), GS Yuasa Corporation (Japan), Exide Technologies (USA), EnerSys (USA), Saft Groupe S.A. (France), East Penn Manufacturing Co. (USA), Toshiba Corporation (Japan), Amara Raja Batteries Ltd. (India), Northvolt AB (Sweden), Sanyo Electric Co., Ltd. (Japan), Hitachi Chemical Co., Ltd. (Japan), Leoch International Technology Limited (China), Furukawa Electric Co., Ltd. (Japan), Banner Batteries (Austria), Energizer Holdings, Inc. (USA), Primearth EV Energy Co., Ltd. (Japan), SK Innovation Co., Ltd. (South Korea), Microvast, Inc. (USA), AtlasBX Co., Ltd. (South Korea), Lishen Battery Co., Ltd. (China), VARTA AG (Germany) and Other Active Players.

The Automotive Battery Market is segmented into Battery Type, Functions, Engine Type, Vehicle Type, and region. By Battery Type, the market is categorized into Lithium- Ion, Lead- Acid, Nickel, Sodium- Ion. By Functions, the market is categorized into Ignition, Lighting, Electric Propulsion, Start. By Engine Type, the market is categorized into Internal Combustion Engine (ICE), Electric Vehicles (EV). By Vehicle Type, the market is categorized into Passenger Cars, Commercial Vehicles, Electric Vehicles, Two-Wheelers. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Automotive batteries are rechargeable batteries that provide electric power to motor vehicles. There are various types of automotive batteries such as Lithium-ion, lead-acid, nickel, and sodium-ion. These usually consist of six cells and are the central component of the vehicle's electrical setup. The primary objective of the part is to initiate the engine, after which the alternator provides power for the electrical system.

Automotive Battery Market Size Was Valued at USD 49929.03 Million in 2023, and is Projected to Reach USD 86527.17 Million by 2032, Growing at a CAGR of 6.3% From 2024-2032.