Aviation Fuel Market Synopsis

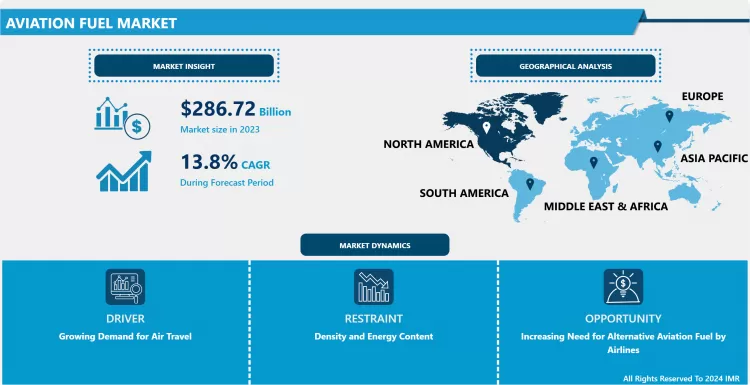

The Aviation Fuel Market was valued at USD 286.72 Billion in 2023 and is projected to reach USD 917.78 Billion by 2032, growing at a CAGR of 13.8% from 2024 to 2032.

Aviation fuel, also known as aviation gasoline or jet fuel, is a specialized type of fuel designed for use in aircraft engines. It is a highly refined, lightweight, and stable petroleum-based product that is specifically formulated to meet the demanding requirements of aviation.

- Avgas is primarily used in piston-engine aircraft, which are typically smaller, general aviation planes. It has a higher-octane rating compared to automotive gasoline, allowing it to withstand the high compression ratios and temperatures found in aircraft engines. This higher-octane rating helps prevent detonation and ensures smooth engine operation during flight.

- Jet fuel, on the other hand, is used in turbine-powered aircraft, including commercial airliners and military jets. It is a type of kerosene that is carefully refined to meet strict specifications, including flash point, freezing point, and sulfur content. Jet fuel provides the high energy density necessary for jet engines to produce the thrust required for flight. Both types of aviation fuel undergo rigorous testing and quality control measures to ensure consistency and safety. Additionally, they are often dyed to indicate specific formulations and to prevent unauthorized use in ground vehicles.

- Efforts are being made within the aviation industry to develop alternative fuels, such as biofuels and synthetic fuels, to reduce the environmental impact of air travel. These fuels aim to be more sustainable and have the potential to lower carbon emissions associated with aviation.

Aviation Fuel Market Trend Analysis

Growing Demand for Air Travel

- Growing demand for air travel is a combination of various economic, social, and technological factors. Firstly, globalization has led to an interconnected world where businesses and individuals increasingly rely on air travel to facilitate trade, tourism, and cultural exchange. This has created a consistent demand for air transportation services across the globe.

- Moreover, rising incomes and a growing middle class in emerging economies have empowered more people to afford air travel, further boosting demand. As disposable incomes increase, individuals are increasingly prioritizing convenience and speed in their travel choices, making air travel an attractive option.

- Additionally, advancements in aircraft technology have made flying more efficient, safer, and environmentally friendly, reducing barriers to entry for both airlines and passengers. The development of more fuel-efficient engines and lighter materials has also contributed to the overall growth in air travel demand.

- Moreover, it is important to consider the significant role that aviation fuel plays in this equation. The cost and availability of aviation fuel directly impact ticket prices and operational expenses for airlines. Fluctuations in oil prices, geopolitical tensions, and environmental concerns surrounding fossil fuels can lead to volatility in the aviation industry. As such, the search for alternative, sustainable aviation fuels have become a critical focus for the industry to ensure long-term viability and reduce its environmental footprint. Balancing these factors is crucial in managing the demand for air travel while striving for a more sustainable aviation sector.

The above graph shows that there is growing Worldwide Revenue with Passengers in Air Traffic in 2022 as compared to previous year. As increase in passenger help to boost the Global Aviation Fuel Market.

Density and Energy Content

- Density, measured in kilograms per liter (kg/L) or pounds per gallon (lb/gal), impacts fuel storage, transportation, and handling. Higher density fuels require less storage space, which is crucial for airlines seeking to optimize payload capacity. Additionally, dense fuels are advantageous for long-haul flights where minimizing refueling stops is essential.

- Energy content is expressed in energy units like megajoules (MJ) or British thermal units (BTU) per unit volume. Jet fuels with higher energy content provide more energy for propulsion, enabling enhanced range and efficiency. This is particularly crucial for modern aviation, where fuel efficiency is a paramount concern for environmental and economic reasons.

- Jet A-1, the most widely used aviation fuel, has a density of approximately 0.8 kg/L and an energy content of around 42-43 MJ/kg. This combination strikes a balance between storage efficiency and energy provision. However, ongoing research is focused on developing alternative fuels with even higher energy content and lower environmental impact.

Increasing Need for Alternative Aviation Fuel by Airlines

- As the aviation industry continues to expand, so does its impact on the environment. The growing need for alternative aviation fuels has become a pressing concern for airlines worldwide. Traditional jet fuels, primarily derived from fossil sources, contribute significantly to greenhouse gas emissions and other pollutants. This has spurred a concerted effort to find sustainable alternatives that can reduce the industry's carbon footprint.

- Biofuels, one prominent alternative, have gained traction in recent years. These fuels are derived from organic materials such as algae, plant oils, and agricultural residues. They offer a promising solution as they can be produced in a manner that is carbon-neutral or even carbon-negative. Additionally, biofuels can be used in existing aircraft engines without the need for extensive modifications, making them a feasible option for airlines looking to transition away from conventional jet fuels.

Aviation Fuel Market Segment Analysis

Global Aviation Fuel Market is segmented into Type, Aircraft Type, End User. By Type, Sustainable Fuel- Biofuel segment is anticipated to dominate the Market Over the Forecast period.

- Biofuels are derived from renewable feedstocks, such as plant oils, agricultural residues, and algae. They can be blended with or replace conventional jet fuels. Hydrogen, on the other hand, is considered a promising future option for aviation due to its high energy content per unit mass and potential for zero-emission flight.

- By Aircraft Type, Unmanned Aerial Vehicle segment is anticipated to dominate the Market Over the Forecast period. UAVs, or drones, have been an area of rapid growth in aviation. However, in terms of total fuel consumption, they represent a relatively small fraction compared to fixed-wing and rotary-wing aircraft. The majority of UAVs are small and used for applications like surveillance, photography, and small-scale cargo transport.

Aviation Fuel Market Regional Analysis

North America is expected to Dominate the Market over the Forecast period

- North America has witnessed a consistent rise in air travel demand over the years. The growing population, increased disposable income, and a robust tourism industry have all contributed to a higher number of people choosing air travel as their preferred mode of transportation. This surge in passenger numbers has led to increased flights and subsequently, higher demand for aviation fuel.

- The North American economy, particularly that of the United States and Canada, has been relatively stable and growing. A strong economy often correlates with increased business and leisure travel, further boosting the aviation sector and its fuel requirements.

- Beyond passenger flights, the North American region has also seen growth in cargo transportation. E-commerce and global trade have driven the need for efficient cargo shipping, which heavily relies on air transport. This necessitates a consistent supply of aviation fuel. The aviation industry is continually evolving, with airlines investing in more fuel-efficient aircraft. This reduces operating costs for airlines and also lowers their carbon footprint, making air travel a more attractive and sustainable option.

Key Players:

- Vitol (Switzerland)

- Exxon Mobil (U.S.)

- Chevron Corporation (U.S.)

- Shell Plc (U.K.)

- Indian Oil Corporation Limited (India)

- Total Energies SE (France)

- BP Plc (U.K.)

- Valero Energy Corporation (U.S.)

- Marathon Petroleum Corporation (U.S.)

- World Fuel Services Corporation (U.S.)

- Essar Oil(UK) Limited (U.K.)

- Bharat Petroleum Corporation Limited (India)

- Rosneft Deutschland GmbH (Germany)

- LUKOIL (Russia)

- China Aviation Oil (Singapore)

- Corporation Ltd (Singapore)

- Viva Energy Group (Australia)

- Q8Aviation (U.K.)

- PT Pertamina (Persero) (Indonesia)

- ADNOC (Abu Dhabi National Oil Company)

- Distribution (United Arab Emirates)

- Neste (Finland)

Key Industry Development of Aviation Fuel Market

- In April 2024, Vitol, in collaboration with General Aviation Modifications Inc., proudly announced the commercial availability of G100UL AvGas, the first unleaded 100-octane aviation gasoline. Approved by the FAA for all certified piston engines, G100UL AvGas serves as a direct replacement for 100LL fuel without requiring any aircraft modifications. This innovative fuel can be mixed with 100LL or other approved fuels, enabling immediate use at airports. G100UL AvGas represents a significant step towards sustainable aviation fuel solutions.

- In July 2023, Exxon Mobil Corporation announced it has entered into a definitive agreement to acquire Denbury Inc. (NYSE: DEN), an experienced developer of carbon capture, utilization and storage (CCS) solutions and enhanced oil recovery. By Leading CCS network underpins ExxonMobil’s commitment to low carbon value chains including CCS, hydrogen, ammonia, biofuels, and direct air capture.

|

Global Aviation Fuel Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 286.72 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.8 % |

Market Size in 2032: |

USD 917.78 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Aircraft Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Aviation Fuel Market by By Type (2018-2032)

4.1 Aviation Fuel Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Conventional Fuel-Air Turbine Fuel

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Avgas

4.5 Sustainable Fuel- Biofuel

4.6 Hydrogen Fuel

4.7 Power-To-Liquid

4.8 Gas-To-Liquid

Chapter 5: Aviation Fuel Market by By Aircraft Type (2018-2032)

5.1 Aviation Fuel Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fixed Wing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Rotary Wing

5.5 Unmanned Aerial Vehicle

Chapter 6: Aviation Fuel Market by By End User (2018-2032)

6.1 Aviation Fuel Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Commercial

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Private

6.5 Military

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Aviation Fuel Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 PARKER HANNIFIN (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GKD (GERMANY)

7.4 ALFA LAVAL (SWEDEN)

7.5 DRAEGERWERK AG (GERMANY)

7.6 FILTRATION GROUP (USA)

7.7 EATON CORPORATION (USA)

7.8 SULZER LTD. (SWITZERLAND)

7.9 CAMERON (SCHLUMBERGER) (USA)

7.10 HENGST SE (GERMANY)

7.11 LYDALL INC. (USA)

7.12 OTHERS KEY PLAYER

Chapter 8: Global Aviation Fuel Market By Region

8.1 Overview

8.2. North America Aviation Fuel Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Conventional Fuel-Air Turbine Fuel

8.2.4.2 Avgas

8.2.4.3 Sustainable Fuel- Biofuel

8.2.4.4 Hydrogen Fuel

8.2.4.5 Power-To-Liquid

8.2.4.6 Gas-To-Liquid

8.2.5 Historic and Forecasted Market Size By By Aircraft Type

8.2.5.1 Fixed Wing

8.2.5.2 Rotary Wing

8.2.5.3 Unmanned Aerial Vehicle

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Commercial

8.2.6.2 Private

8.2.6.3 Military

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Aviation Fuel Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Conventional Fuel-Air Turbine Fuel

8.3.4.2 Avgas

8.3.4.3 Sustainable Fuel- Biofuel

8.3.4.4 Hydrogen Fuel

8.3.4.5 Power-To-Liquid

8.3.4.6 Gas-To-Liquid

8.3.5 Historic and Forecasted Market Size By By Aircraft Type

8.3.5.1 Fixed Wing

8.3.5.2 Rotary Wing

8.3.5.3 Unmanned Aerial Vehicle

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Commercial

8.3.6.2 Private

8.3.6.3 Military

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Aviation Fuel Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Conventional Fuel-Air Turbine Fuel

8.4.4.2 Avgas

8.4.4.3 Sustainable Fuel- Biofuel

8.4.4.4 Hydrogen Fuel

8.4.4.5 Power-To-Liquid

8.4.4.6 Gas-To-Liquid

8.4.5 Historic and Forecasted Market Size By By Aircraft Type

8.4.5.1 Fixed Wing

8.4.5.2 Rotary Wing

8.4.5.3 Unmanned Aerial Vehicle

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Commercial

8.4.6.2 Private

8.4.6.3 Military

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Aviation Fuel Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Conventional Fuel-Air Turbine Fuel

8.5.4.2 Avgas

8.5.4.3 Sustainable Fuel- Biofuel

8.5.4.4 Hydrogen Fuel

8.5.4.5 Power-To-Liquid

8.5.4.6 Gas-To-Liquid

8.5.5 Historic and Forecasted Market Size By By Aircraft Type

8.5.5.1 Fixed Wing

8.5.5.2 Rotary Wing

8.5.5.3 Unmanned Aerial Vehicle

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Commercial

8.5.6.2 Private

8.5.6.3 Military

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Aviation Fuel Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Conventional Fuel-Air Turbine Fuel

8.6.4.2 Avgas

8.6.4.3 Sustainable Fuel- Biofuel

8.6.4.4 Hydrogen Fuel

8.6.4.5 Power-To-Liquid

8.6.4.6 Gas-To-Liquid

8.6.5 Historic and Forecasted Market Size By By Aircraft Type

8.6.5.1 Fixed Wing

8.6.5.2 Rotary Wing

8.6.5.3 Unmanned Aerial Vehicle

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Commercial

8.6.6.2 Private

8.6.6.3 Military

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Aviation Fuel Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Conventional Fuel-Air Turbine Fuel

8.7.4.2 Avgas

8.7.4.3 Sustainable Fuel- Biofuel

8.7.4.4 Hydrogen Fuel

8.7.4.5 Power-To-Liquid

8.7.4.6 Gas-To-Liquid

8.7.5 Historic and Forecasted Market Size By By Aircraft Type

8.7.5.1 Fixed Wing

8.7.5.2 Rotary Wing

8.7.5.3 Unmanned Aerial Vehicle

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Commercial

8.7.6.2 Private

8.7.6.3 Military

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Aviation Fuel Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 286.72 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.8 % |

Market Size in 2032: |

USD 917.78 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Aircraft Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Aviation Fuel Market research report is 2024-2032.

Vitol (Switzerland),Exxon Mobil (U.S.), Chevron Corporation (U.S.), Shell Plc (U.K.), Indian Oil Corporation Limited (India), Total Energies SE (France), BP Plc (U.K.), Valero Energy Corporation (U.S.), Marathon Petroleum Corporation (U.S.), World Fuel Services Corporation (U.S.), Essar Oil (UK) Limited (U.K.), Bharat Petroleum Corporation Limited (India), Rosneft Deutschland GmbH (Germany), LUKOIL (Russia),China Aviation Oil (Singapore), Corporation Ltd (Singapore), Viva Energy Group (Australia), Q8Aviation (U.K.), PT PERTAMINA (Indonesia), ADNOC (Abu Dhabi National Oil Company), Distribution (United Arab Emirates), Neste (Finland), and Other major players.

The Aviation Fuel Market is segmented into Type, Aircraft Type, End User, and region. By Type, the market is categorized into Conventional Fuel-Air Turbine Fuel, Avgas, Sustainable Fuel- Biofuel, Hydrogen Fuel, Power-To-Liquid, Gas-To-Liquid. By Aircraft Type, the market is categorized into Fixed Wing, Rotary Wing, Unmanned Aerial Vehicle. By End User, the market is categorized into Commercial, Private, Military. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Russia, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Aviation fuel, also known as aviation gasoline or jet fuel, is a specialized type of fuel designed for use in aircraft engines. It is a highly refined, lightweight, and stable petroleum-based product that is specifically formulated to meet the demanding requirements of aviation.

The Aviation Fuel Market was valued at USD 286.72 Billion in 2023 and is projected to reach USD 917.78 Billion by 2032, growing at a CAGR of 13.8% from 2024 to 2032.