Baby Feeding Bottles Market Synopsis

Global Baby Feeding Bottles Market Size Was Valued at USD 292.07 Million in 2023 and is Projected to Reach USD 634.34 Million by 2032, Growing at a CAGR of 9.0% From 2024-2032

Baby feeding bottles are crucial accessories for infants, made from safe materials like plastic, glass, or silicone. They offer convenience and control, allowing parents to provide nourishment anytime and anywhere. Modern bottles prioritize safety, comfort, and ease of use, featuring innovations like anti-colic systems and ergonomic shapes.

- Baby feeding bottles play a vital role in infant care, offering a convenient method to nourish babies with breast milk or formula. Their primary application involves facilitating feeding sessions and aiding in the growth and development of infants. The benefits of baby feeding bottles include their versatility, allowing caregivers to feed babies at any time and place, and their ease of use, ensuring controlled feeding portions.

- Market trends indicate a rising demand for baby feeding bottles, propelled by factors like increasing birth rates, heightened awareness of infant nutrition, and advancements in bottle design and materials. Consumers prioritize bottles with features such as anti-colic systems, ergonomic shapes, and BPA-free materials, emphasizing safety and convenience. Additionally, there's a growing preference for eco-friendly options, driving demand for bottles made from recyclable or biodegradable materials.

- Baby feeding bottles are crucial for infant care, providing breast milk or formula nourishment, and facilitating feeding sessions. They offer adaptability, allowing caregivers to feed babies at any time and in various settings, and user-friendly designs for precise portions. Market trends show a growing demand for these bottles due to rising birth rates, increased infant nutrition awareness, and ongoing bottle design innovations. Consumers prioritize features like anti-colic systems, ergonomic shapes, and BPA-free materials, while also a preference for eco-friendly options, leading manufacturers to offer recyclable or biodegradable bottles.

Baby Feeding Bottles Market Trend Analysis

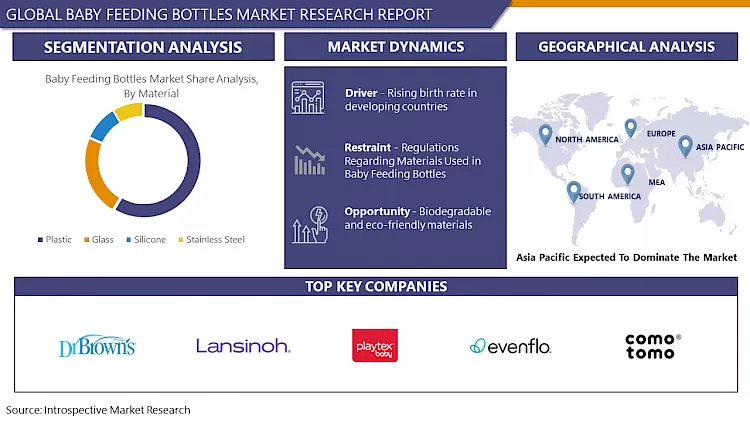

Rising birth rate in developing countries

- The escalation of birth rates in developing nations emerges as a pivotal catalyst propelling the demand for baby feeding bottles. With these regions witnessing demographic transitions and burgeoning populations, there arises a corresponding surge in the populace of newborns and infants necessitating feeding solutions. As parents seek practical and convenient options for nourishing their infants, the requisition for baby feeding bottles intensifies.

- Developing countries often undergo urbanization and modernization, which triggers shifts in lifestyle and familial dynamics. This evolution, coupled with the proliferation of dual-income households, accentuates the dependence on baby feeding bottles as indispensable instruments for infant care. Furthermore, societal and cultural transformations, including the encouragement of women to participate in the workforce, contribute to the upsurge in demand for feeding bottles.

- Manufacturers in the baby care industry seize upon this trend by offering an array of feeding bottles tailored to cater to the exigencies and preferences of consumers in developing nations. Consequently, the burgeoning birth rates in these regions herald a lucrative avenue for market expansion and advancement in the baby feeding bottles sector.

Biodegradable and eco-friendly materials

- Utilizing biodegradable and environmentally friendly materials in the production of baby feeding bottles represents a significant market opportunity. With a growing global focus on sustainability, there is increasing demand for products that minimize environmental impact. Biodegradable materials, such as plant-based plastics and compostable materials, offer a more sustainable alternative to conventional plastics, which often contribute to pollution and landfill waste.

- Incorporating biodegradable and eco-friendly materials into baby feeding bottles allows manufacturers to cater to environmentally conscious consumers seeking sustainable solutions for their infants. This not only aligns with modern parenting values but also addresses concerns about the ecological footprint of disposable baby products.

- Adopting such materials can enhance brand image and distinguish products in the competitive baby care market, leading to greater market share and customer loyalty. Overall, leveraging biodegradable and eco-friendly materials presents an opportunity for manufacturers to meet the demand for sustainable baby feeding options while contributing to environmental conservation endeavors.

Baby Feeding Bottles Market Segment Analysis:

Baby Feeding Bottles Market Segmented on the basis of Material, Capacity, Design, and Distribution Channel.

By Material, Plastic segment is expected to dominate the market during the forecast period

- The plastic segment is projected to maintain dominance in the baby feeding bottle market for several reasons. Plastic bottles offer versatility in design, accommodating various shapes, sizes, and features to meet diverse preferences and caregiver needs. Moreover, plastic bottles are lightweight and resilient, ensuring convenience for regular use and minimizing the risk of breakage compared to glass alternatives.

- Plastic bottles tend to be more cost-effective than glass or stainless-steel options, ensuring accessibility to a broader consumer base, including those with budget constraints. Furthermore, advancements in material technology have yielded BPA-free and phthalate-free plastics, addressing consumer concerns regarding health and safety.

- Plastic bottles are known for their ease of cleaning and sterilization, making them a popular choice among busy parents seeking practicality. While there is a growing demand for eco-friendly and biodegradable materials, the enduring prevalence of plastic in the baby feeding bottle market is anticipated due to its widespread availability, affordability, and convenience for everyday use.

By Design, Standard Neck segment is expected to dominate the market during the forecast period

- These bottles have been a long-standing favorite among parents and caregivers, enjoying widespread acceptance and familiarity. This established preference translates to a higher demand for standard neck bottles over other types. Standard neck bottles offer compatibility with a diverse array of accessories like nipples, caps, and cleaning brushes, making them versatile and user-friendly. This compatibility simplifies part replacement and allows for easy customization based on the baby's preferences or feeding needs.

- Standard neck bottles tend to be more cost-effective compared to specialized counterparts, ensuring accessibility to a wider consumer base, particularly in cost-conscious markets. Their durability and reliability further bolster their market dominance, as they provide a trusted solution for feeding infants that can withstand daily use and sterilization procedures.

- Standard Neck baby feeding bottles are widely available in retail stores, supermarkets, online platforms, and specialty stores worldwide. They are preferred by healthcare professionals due to their simplicity and reliability, solidifying their position as the preferred choice for infant feeding. This accessibility, endorsement, and consumer preference contribute to the Standard Neck segment's dominance in the market.

Baby Feeding Bottles Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia-Pacific region is poised to take the lead in the baby feeding bottles market, propelled by several key factors. First and foremost, its large population base, especially in countries like China, India, and Indonesia, with high birth rates, drives the demand for essential baby care products, including feeding bottles. Furthermore, the rapid urbanization and the rise of dual-income households in Asia-Pacific have led to a shift towards convenient feeding solutions, notably baby feeding bottles.

- Additionally, the increasing disposable incomes in emerging economies within the region empower consumers to invest in premium baby products like high-quality feeding bottles. Moreover, the adoption of Western parenting practices alongside global influences further boosts the demand for baby feeding bottles in Asia-Pacific.

- Furthermore, manufacturers in the region are intensifying their focus on product innovation and customization to cater to diverse consumer preferences and market demands. With all these factors considered, Asia-Pacific is on track to emerge as a dominant force in the baby feeding bottles market, driving significant growth and expansion in the foreseeable future.

Baby Feeding Bottles Market Top Key Players:

- Dr. Brown's (US)

- Playtex Baby (US)

- Comotomo (US)

- Lansinoh (US)

- Evenflo Feeding (US)

- Boon (US)

- Munchkin (US)

- Joovy (US)

- Gerber BabyNes (US)

- Twist Breastfeeding (US)

- Lifefactory (US)

- Green Sprouts (US)

- Happy Baby (US)

- Philips Avent (Netherlands)

- Tommee Tippee (UK)

- Medela (Switzerland)

- NUK (Germany)

- MAM Baby (Austria)

- Twistshake (Sweden)

- Coddlelife (Australia)

- Minbie (Australia)

- Chicco (Italy)

- Pigeon Corporation (Japan)

- Bébé Confort (France)

- Heorshe (South Korea), and Other Major Players.

Key Industry Developments in the Baby Feeding Bottles Market:

- In February 2022, Pigeon Corporation inaugurated its Tsukuba Engineering Center, marking a significant milestone in its commitment to innovation. The center is dedicated to researching and developing environmentally sustainable methods and materials for manufacturing baby feeding bottles. It serves as a hub for enhancing productivity and exploring novel approaches to creating eco-friendly baby products. Additionally, the center facilitates training programs focused on baby-feeding bottle-related goods, furthering the company's efforts towards sustainability and excellence in infant care.

|

Global Baby Feeding Bottles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 292.07 Mn. |

|

Forecast Period 2024-32 CAGR: |

9.0% |

Market Size in 2032: |

USD 634.34 Mn. |

|

Segments Covered: |

By Material |

|

|

|

By Capacity |

|

||

|

By Design |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Baby Feeding Bottles Market by By Material (2018-2032)

4.1 Baby Feeding Bottles Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Plastic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Glass

4.5 Silicone

4.6 Stainless Steel

Chapter 5: Baby Feeding Bottles Market by By Capacity (2018-2032)

5.1 Baby Feeding Bottles Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Small (4 ounces or less)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Medium (5-8 ounces)

5.5 Large (9 ounces or more)

Chapter 6: Baby Feeding Bottles Market by By Design (2018-2032)

6.1 Baby Feeding Bottles Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Standard Neck

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Wide Neck

6.5 Angled Neck

6.6 Anti-colic design

6.7 Ergonomic design

Chapter 7: Baby Feeding Bottles Market by By Distribution Channel (2018-2032)

7.1 Baby Feeding Bottles Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Supermarkets and hypermarkets

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Specialty stores

7.5 Online retailers

7.6 Direct-to-consumer brands

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Baby Feeding Bottles Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 DR. BROWN'S (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 PLAYTEX BABY (US)

8.4 COMOTOMO (US)

8.5 LANSINOH (US)

8.6 EVENFLO FEEDING (US)

8.7 BOON (US)

8.8 MUNCHKIN (US)

8.9 JOOVY (US)

8.10 GERBER BABYNES (US)

8.11 TWIST BREASTFEEDING (US)

8.12 LIFEFACTORY (US)

8.13 GREEN SPROUTS (US)

8.14 HAPPY BABY (US)

8.15 PHILIPS AVENT (NETHERLANDS)

8.16 TOMMEE TIPPEE (UK)

8.17 MEDELA (SWITZERLAND)

8.18 NUK (GERMANY)

8.19 MAM BABY (AUSTRIA)

8.20 TWISTSHAKE (SWEDEN)

8.21 CODDLELIFE (AUSTRALIA)

8.22 MINBIE (AUSTRALIA)

8.23 CHICCO (ITALY)

8.24 PIGEON CORPORATION (JAPAN)

8.25 BÉBÉ CONFORT (FRANCE)

8.26 HEORSHE (SOUTH KOREA)

8.27

Chapter 9: Global Baby Feeding Bottles Market By Region

9.1 Overview

9.2. North America Baby Feeding Bottles Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Material

9.2.4.1 Plastic

9.2.4.2 Glass

9.2.4.3 Silicone

9.2.4.4 Stainless Steel

9.2.5 Historic and Forecasted Market Size By By Capacity

9.2.5.1 Small (4 ounces or less)

9.2.5.2 Medium (5-8 ounces)

9.2.5.3 Large (9 ounces or more)

9.2.6 Historic and Forecasted Market Size By By Design

9.2.6.1 Standard Neck

9.2.6.2 Wide Neck

9.2.6.3 Angled Neck

9.2.6.4 Anti-colic design

9.2.6.5 Ergonomic design

9.2.7 Historic and Forecasted Market Size By By Distribution Channel

9.2.7.1 Supermarkets and hypermarkets

9.2.7.2 Specialty stores

9.2.7.3 Online retailers

9.2.7.4 Direct-to-consumer brands

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Baby Feeding Bottles Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Material

9.3.4.1 Plastic

9.3.4.2 Glass

9.3.4.3 Silicone

9.3.4.4 Stainless Steel

9.3.5 Historic and Forecasted Market Size By By Capacity

9.3.5.1 Small (4 ounces or less)

9.3.5.2 Medium (5-8 ounces)

9.3.5.3 Large (9 ounces or more)

9.3.6 Historic and Forecasted Market Size By By Design

9.3.6.1 Standard Neck

9.3.6.2 Wide Neck

9.3.6.3 Angled Neck

9.3.6.4 Anti-colic design

9.3.6.5 Ergonomic design

9.3.7 Historic and Forecasted Market Size By By Distribution Channel

9.3.7.1 Supermarkets and hypermarkets

9.3.7.2 Specialty stores

9.3.7.3 Online retailers

9.3.7.4 Direct-to-consumer brands

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Baby Feeding Bottles Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Material

9.4.4.1 Plastic

9.4.4.2 Glass

9.4.4.3 Silicone

9.4.4.4 Stainless Steel

9.4.5 Historic and Forecasted Market Size By By Capacity

9.4.5.1 Small (4 ounces or less)

9.4.5.2 Medium (5-8 ounces)

9.4.5.3 Large (9 ounces or more)

9.4.6 Historic and Forecasted Market Size By By Design

9.4.6.1 Standard Neck

9.4.6.2 Wide Neck

9.4.6.3 Angled Neck

9.4.6.4 Anti-colic design

9.4.6.5 Ergonomic design

9.4.7 Historic and Forecasted Market Size By By Distribution Channel

9.4.7.1 Supermarkets and hypermarkets

9.4.7.2 Specialty stores

9.4.7.3 Online retailers

9.4.7.4 Direct-to-consumer brands

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Baby Feeding Bottles Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Material

9.5.4.1 Plastic

9.5.4.2 Glass

9.5.4.3 Silicone

9.5.4.4 Stainless Steel

9.5.5 Historic and Forecasted Market Size By By Capacity

9.5.5.1 Small (4 ounces or less)

9.5.5.2 Medium (5-8 ounces)

9.5.5.3 Large (9 ounces or more)

9.5.6 Historic and Forecasted Market Size By By Design

9.5.6.1 Standard Neck

9.5.6.2 Wide Neck

9.5.6.3 Angled Neck

9.5.6.4 Anti-colic design

9.5.6.5 Ergonomic design

9.5.7 Historic and Forecasted Market Size By By Distribution Channel

9.5.7.1 Supermarkets and hypermarkets

9.5.7.2 Specialty stores

9.5.7.3 Online retailers

9.5.7.4 Direct-to-consumer brands

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Baby Feeding Bottles Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Material

9.6.4.1 Plastic

9.6.4.2 Glass

9.6.4.3 Silicone

9.6.4.4 Stainless Steel

9.6.5 Historic and Forecasted Market Size By By Capacity

9.6.5.1 Small (4 ounces or less)

9.6.5.2 Medium (5-8 ounces)

9.6.5.3 Large (9 ounces or more)

9.6.6 Historic and Forecasted Market Size By By Design

9.6.6.1 Standard Neck

9.6.6.2 Wide Neck

9.6.6.3 Angled Neck

9.6.6.4 Anti-colic design

9.6.6.5 Ergonomic design

9.6.7 Historic and Forecasted Market Size By By Distribution Channel

9.6.7.1 Supermarkets and hypermarkets

9.6.7.2 Specialty stores

9.6.7.3 Online retailers

9.6.7.4 Direct-to-consumer brands

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Baby Feeding Bottles Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Material

9.7.4.1 Plastic

9.7.4.2 Glass

9.7.4.3 Silicone

9.7.4.4 Stainless Steel

9.7.5 Historic and Forecasted Market Size By By Capacity

9.7.5.1 Small (4 ounces or less)

9.7.5.2 Medium (5-8 ounces)

9.7.5.3 Large (9 ounces or more)

9.7.6 Historic and Forecasted Market Size By By Design

9.7.6.1 Standard Neck

9.7.6.2 Wide Neck

9.7.6.3 Angled Neck

9.7.6.4 Anti-colic design

9.7.6.5 Ergonomic design

9.7.7 Historic and Forecasted Market Size By By Distribution Channel

9.7.7.1 Supermarkets and hypermarkets

9.7.7.2 Specialty stores

9.7.7.3 Online retailers

9.7.7.4 Direct-to-consumer brands

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Baby Feeding Bottles Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 292.07 Mn. |

|

Forecast Period 2024-32 CAGR: |

9.0% |

Market Size in 2032: |

USD 634.34 Mn. |

|

Segments Covered: |

By Material |

|

|

|

By Capacity |

|

||

|

By Design |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Frequently Asked Questions :

The forecast period in the Baby Feeding Bottles Market research report is 2023-2032.

Dr. Brown's (US), Playtex Baby (US), Comotomo (US), Lansinoh (US), Evenflo Feeding (US), Boon (US), Munchkin (US), Joovy (US), Gerber BabyNes (US), Twist Breastfeeding (US), Lifefactory (US), Green Sprouts (US), Happy Baby (US),Philips Avent (Netherlands), Tommee Tippee (UK), Medela (Switzerland), NUK (Germany), MAM Baby (Austria), Twistshake (Sweden), Coddlelife (Australia), Minbie (Australia), Chicco (Italy), Pigeon Corporation (Japan), Bébé Confort (France), Heorshe (South Korea), and Other Major Players.

The Baby Feeding Bottles Market is segmented into Material, Capacity, Design, Distribution Channel, and region. By Material, the market is categorized into Plastic, Glass, Silicone, and Stainless Steel. By Capacity, the market is categorized into Small (4 ounces or less), Medium (5-8 ounces), and Large (9 ounces or more). By Design, the market is categorized into Standard Neck, Wide Neck, Angled Neck, Anti-colic design, and Ergonomic design. By Distribution Channel, the market is categorized into Supermarkets and hypermarkets, Specialty stores, Online retailers, and Direct-to-consumer brands. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Baby feeding bottles are crucial accessories for infants, made from safe materials like plastic, glass, or silicone. They offer convenience and control, allowing parents to provide nourishment anytime and anywhere. Modern bottles prioritize safety, comfort, and ease of use, featuring innovations like anti-colic systems and ergonomic shapes.

Global Baby Feeding Bottles Market Size Was Valued at USD 292.07 Million in 2023 and is Projected to Reach USD 634.34 Million by 2032, Growing at a CAGR of 9.0% From 2024-2032