Baby Food Packaging Market Synopsis

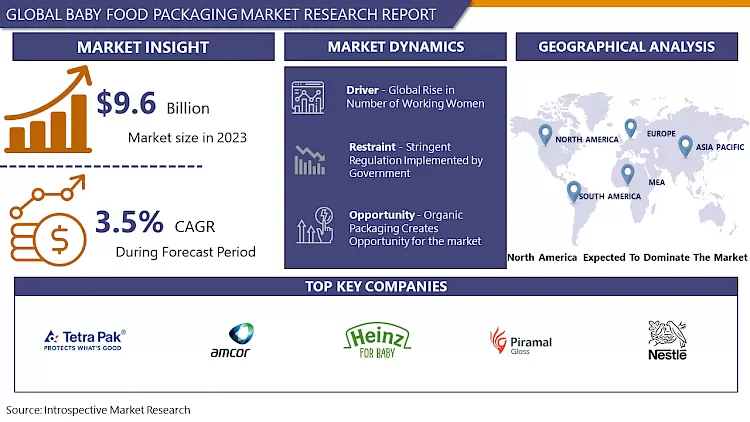

Baby Food Packaging Market Size Was Valued at USD 9.6 Billion in 2023, and is Projected to Reach USD 13.1 Billion by 2032, Growing at a CAGR of 3.5% From 2024-2032.

- The baby food packaging is made of a variety of materials and designs that are tailored to meet the specific needs of infant nutrition. To adapt to the needs of parents and caregivers, these packaging solutions are designed in such a way that safety, freshness, and usability come first. Manufacturers often use aesthetic finishes, sterile closures, BPA-free materials and ergonomic designs to ensure the safety of handling and ingesting infant food products. Besides, baby food packaging may be designed to give consumers useful information on allergens, nutritional content and age-appropriate feeding recommendations. Thus they will have the chance to make a well-informed choice for their infants.

- A heightened awareness of the food origins has created a crisis in the baby food industry. The nutrition science that is related to the food in question is nowadays more and more commonly taken into account when people decide what infant food products they should buy. Safety, the high speed of urbanization and the requirement for eco-friendly packaging in infant food products are some of the factors that will drive the market. Many baby food companies are choosing spouted pouches as a better stand in for glass jars which used to be the primary packaging of their products. The market leaders are stressing on the packaging solutions with prints in lively colors, sizes and shapes to attract infants and give parents who have no time for them some convenience.

- The primary growth drivers of the market are an increase in the number of working parents, a surge in demand for environmentally friendly packaging, user safety concerns and technological advances.

- The growth of the market sector of organic and natural baby foods makes it necessary to have packaging solutions that are eco-friendly. Customers are now more aware of the environmental effect that non-biodegradable packaging has and thus, they look for alternatives which are sustainable and environmentally friendly. Besides, the penetration of e-commerce has greatly intensified the sale of infant food by increasing the demand for packaging options that transport products safely. The use of materials such as PET, Polypropylene, and Polyethylene is the result of the growing need for lightweight, durable and flexible packaging solutions.

Baby Food Packaging Market Trend Analysis

Increasing number of strategies implemented by market leaders

- The main driver of the infant food packaging market CAGR is the massive amount of strategies implemented by market leaders. The leading companies in the industry are those that have a positive attitude to introducing various strategies of development, such as increasing their capacities, merging with other firms or forming alliances, extending their geographical areas of operation and launching new products or enhancing existing ones by means of innovations. Such a scenario is likely to result in the considerable expansion of the market. Thus, the infant food packaging market will grow at a higher pace than was expected because of the development and production of new solutions. To illustrate, Silgan Holdings Inc. in September 2021 made a public announcement about the acquisition of Gateway Plastics. Mainly for the food and beverage industries, this company produces and supplies integrated dispensing packaging solutions and dispensing closures, such as 100% recyclable liquid capsules dispensers and collective containers with closings to clients' product companies.

Changing lifestyles and an increasing number of working parents

- The change in the lifestyles and a growing number of working parents are expected to be the main drivers for substantial revenue growth in the infant food packaging market during the forecast period, as they will want bigger pack sizes and more convenient packaging. In the sector of prepared infant food where there is expected to be a strong demand, aluminum/plastic pouches, thin-walled plastic containers and flexible plastic packs will replace glass jars in capacities exceeding 100 g. This change is due to the fact that these containers are portable and user-friendly.

- The issue of infant health and cleanliness is becoming more serious, the preference for convenience-oriented lifestyles is on the rise, and there are more working women which all will lead to a substantial growth of baby food packaging market in future. The market is expected to keep on growing because of the rising demand for organic and natural infant food products, the growth of e-commerce platforms, and the use of sustainable packaging alternatives. Nevertheless, the issue of security and accessibility to counterfeit and cheaper products is expected to be the main factor that will dampen the growth of this market.

Baby Food Packaging Market Segment Analysis:

Baby Food Packaging Market is segmented based on Material type, Sealing & Handle, and application.

By material type, paper segment is expected to dominate the market during the forecast period

- The materials like paper, metal, glass, polymer and paper are just a few of the many that make up the material segmentation of the infant food packaging market. As a result of the paper category taking up 35% (3.37 billion dollars) of market revenue, it was the leading category in the market. The main factor that makes the category in developing economies increase is the demand for environmentally friendly and sustainable packaging solutions for baby food. Because of the growing demand for user-friendly and convenient packaging solutions, metal becomes the category with the fastest increasing.

By Sealing & Handle, zipper top segment held the largest share in 2023

- In terms of sealing and handles, the market for infant food packaging is segmented into the following categories: zipper tops, spout tops, heat seals, patch handles and finally…heat gen. The zipper closures turned to be the most profitable category as a consequence of the increased demand for flexible and secure packaging materials. Spout tops are on the contrary expected to show the fastest growth during the forecast period because of the increasing number of working mothers and hence, demand for alternatives to breastfeeding. Spout-top containers are the best solution for housing formula and breast milk.

Baby Food Packaging Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The baby food packaging in North America will be the main factor that will dominate this market because of the rising demand for eco-friendly packaging materials. The high standard of living in the region is making parents more and more worried about the environmental protection and conservation of the products they buy for their children. This is the reason for the growth of green packaging materials market and consequently, these are now made available in this region.

Active Key Players in the Baby Food Packaging Market

- Gerber Packaging (USA)

- Heinz Baby Food (USA)

- Nestle S.A. (Switzerland)

- Piramal Glass (Mumbai)

- Amcor (Australia)

- AptarGroup (USA)

- Ball Corporation (Colorado)

- Owens-Illinois, Inc. (Ohio)

- Tetra Pak International S.A. (Switzerland)

- Berlin Packaging (USA), and Other Key Players

Key Industry Developments in the Baby Food Packaging Market:

- Gerber, the biggest baby food company in the US, announced in July 2023 that it would use recycled material packaging for its products. This results in Gerber's continuous commitment to sustainability.

- Plum Organics, the leading company in organic baby food industry, announced in August 2023 a new line of infant food that is packed in recyclable pouches. The consumer's demand for more eco-friendly packaging has fueled this innovation.

|

Global Baby Food Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.5 % |

Market Size in 2032: |

USD 13.1 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Sealing & Handle |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Baby Food Packaging Market by By Material Type (2018-2032)

4.1 Baby Food Packaging Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Polymer

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Paper

4.5 Metal

4.6 Glass

Chapter 5: Baby Food Packaging Market by By Sealing & Handle (2018-2032)

5.1 Baby Food Packaging Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Spout Top

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Heat Seal

5.5 Patch Handle

5.6 Zipper Top

Chapter 6: Baby Food Packaging Market by By Application (2018-2032)

6.1 Baby Food Packaging Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Liquid Milk

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Dried Ba

Chapter 7: Baby Food Packaging Market by by Food (2018-2032)

7.1 Baby Food Packaging Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Powder Milk

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Baby Food Packaging Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 WHIRLPOOL CORPORATION (U.S.)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 SAMSUNG ELECTRONICS CO. LTD. (SOUTH KOREA)

8.4 HAIER INC. (CHINA)

8.5 BAJAJ ELECTRICALS LTD (INDIA)

8.6 KONINKLIJKE PHILIPS N.V. (SOUTH KOREA)

8.7 IFB APPLIANCES (INDIA)

8.8 KENT (INDIA)

8.9 EUREKA FORBES LTD. (INDIA)

8.10 PANASONIC HOLDINGS CORPORATION (JAPAN)

8.11 ORIENT ELECTRIC (INDIA)

8.12 LG ELECTRONICS INC. (SOUTH KOREA)

8.13 ELECTROLUX AB (SWEDEN)

8.14 MIDEA GROUP COLTD. (CHINA)

8.15 WHIRLPOOL CORPORATION (UNITED STATES)

8.16 SIEMENS HOME APPLIANCES (GERMANY)

8.17 OTHER KEY PLAYERS

Chapter 9: Global Baby Food Packaging Market By Region

9.1 Overview

9.2. North America Baby Food Packaging Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Material Type

9.2.4.1 Polymer

9.2.4.2 Paper

9.2.4.3 Metal

9.2.4.4 Glass

9.2.5 Historic and Forecasted Market Size By By Sealing & Handle

9.2.5.1 Spout Top

9.2.5.2 Heat Seal

9.2.5.3 Patch Handle

9.2.5.4 Zipper Top

9.2.6 Historic and Forecasted Market Size By By Application

9.2.6.1 Liquid Milk

9.2.6.2 Dried Ba

9.2.7 Historic and Forecasted Market Size By by Food

9.2.7.1 Powder Milk

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Baby Food Packaging Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Material Type

9.3.4.1 Polymer

9.3.4.2 Paper

9.3.4.3 Metal

9.3.4.4 Glass

9.3.5 Historic and Forecasted Market Size By By Sealing & Handle

9.3.5.1 Spout Top

9.3.5.2 Heat Seal

9.3.5.3 Patch Handle

9.3.5.4 Zipper Top

9.3.6 Historic and Forecasted Market Size By By Application

9.3.6.1 Liquid Milk

9.3.6.2 Dried Ba

9.3.7 Historic and Forecasted Market Size By by Food

9.3.7.1 Powder Milk

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Baby Food Packaging Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Material Type

9.4.4.1 Polymer

9.4.4.2 Paper

9.4.4.3 Metal

9.4.4.4 Glass

9.4.5 Historic and Forecasted Market Size By By Sealing & Handle

9.4.5.1 Spout Top

9.4.5.2 Heat Seal

9.4.5.3 Patch Handle

9.4.5.4 Zipper Top

9.4.6 Historic and Forecasted Market Size By By Application

9.4.6.1 Liquid Milk

9.4.6.2 Dried Ba

9.4.7 Historic and Forecasted Market Size By by Food

9.4.7.1 Powder Milk

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Baby Food Packaging Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Material Type

9.5.4.1 Polymer

9.5.4.2 Paper

9.5.4.3 Metal

9.5.4.4 Glass

9.5.5 Historic and Forecasted Market Size By By Sealing & Handle

9.5.5.1 Spout Top

9.5.5.2 Heat Seal

9.5.5.3 Patch Handle

9.5.5.4 Zipper Top

9.5.6 Historic and Forecasted Market Size By By Application

9.5.6.1 Liquid Milk

9.5.6.2 Dried Ba

9.5.7 Historic and Forecasted Market Size By by Food

9.5.7.1 Powder Milk

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Baby Food Packaging Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Material Type

9.6.4.1 Polymer

9.6.4.2 Paper

9.6.4.3 Metal

9.6.4.4 Glass

9.6.5 Historic and Forecasted Market Size By By Sealing & Handle

9.6.5.1 Spout Top

9.6.5.2 Heat Seal

9.6.5.3 Patch Handle

9.6.5.4 Zipper Top

9.6.6 Historic and Forecasted Market Size By By Application

9.6.6.1 Liquid Milk

9.6.6.2 Dried Ba

9.6.7 Historic and Forecasted Market Size By by Food

9.6.7.1 Powder Milk

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Baby Food Packaging Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Material Type

9.7.4.1 Polymer

9.7.4.2 Paper

9.7.4.3 Metal

9.7.4.4 Glass

9.7.5 Historic and Forecasted Market Size By By Sealing & Handle

9.7.5.1 Spout Top

9.7.5.2 Heat Seal

9.7.5.3 Patch Handle

9.7.5.4 Zipper Top

9.7.6 Historic and Forecasted Market Size By By Application

9.7.6.1 Liquid Milk

9.7.6.2 Dried Ba

9.7.7 Historic and Forecasted Market Size By by Food

9.7.7.1 Powder Milk

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Baby Food Packaging Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.6 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.5 % |

Market Size in 2032: |

USD 13.1 Bn. |

|

Segments Covered: |

By Material Type |

|

|

|

By Sealing & Handle |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Baby Food Packaging Market research report is 2024-2032.

Bericap India Pvt. Ltd., Essel Propack Limited, Hindustan National Glass & Industries Ltd, ITC Ltd Paperboards, MeadWestvaco Corporation, Tata Tinplate Company of India (TCIL), Tetra Pak India Pvt Ltd, Cascades Inc, FPC Flexible Packaging Corp, and Other Major Players..

The Baby Food Packaging Market is segmented into type, Sealing & Handle, application, and region. By type, the market is categorized into Polymer, Paper, Metal, Glass, and Others. By Sealing & Handle, the market is categorized into Spout Top, Heat Seal, Patch Handle, Zipper Top, and Other. By application, the market is categorized into Liquid Milk, Dried Baby Food, Powder Milk, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Baby food packaging comprises containers and materials that are manufactured and designed specifically for the purpose of storing, preserving, and dispensing baby food products. Strict attention to hygiene, safety, and convenience during the construction of these containers guarantees the nutritional integrity and freshness of the contents. Typical baby food packaging consists of pouches, jars, cans, and trays, and frequently includes portion control, easy-to-read labeling, resealable closures, and portion control to accommodate the specific requirements of infants and toddlers and to provide parents and caregivers with peace of mind.

Baby Food Packaging Market Size Was Valued at USD 9.6 Billion in 2023, and is Projected to Reach USD 13.1 Billion by 2032, Growing at a CAGR of 3.5% From 2024-2032.