Bacterial Filters Market Synopsis:

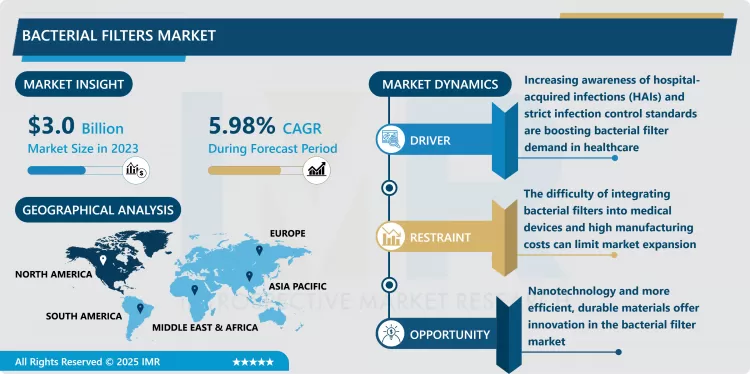

Bacterial Filters Market Was Valued at USD 3.0 Billion in 2023 and is Projected to Reach USD 5.07 Billion by 2032, Growing at a CAGR of 5.98 % from 2024 to 2032

The bacterial filters market is primarily driven by the increasing awareness of infection control, particularly in healthcare settings where the risk of airborne infections and microbial contamination is high. Bacterial filters are designed to prevent the transmission of harmful microorganisms, including bacteria, viruses, and fungi, by filtering air and fluids. These filters are widely used in medical devices, respiratory care equipment, and surgical applications, ensuring that patients and healthcare providers are protected from cross-contamination during procedures. The growing demand for these filters can be attributed to the rise in hospital-acquired infections (HAIs), the prevalence of respiratory diseases, and heightened safety standards in healthcare environments.

The increasing focus on improving air quality, particularly in environments such as hospitals, clinics, and research laboratories, has further fueled the demand for bacterial filters. Hospitals and healthcare facilities are required to maintain sterile conditions to protect patients undergoing surgeries or other medical treatments. As the need for patient safety continues to grow, there is a rise in the adoption of bacterial filters in various medical equipment, including ventilators, anesthesia machines, and breathing circuits. In addition, these filters are becoming more advanced with the integration of nanotechnology and antimicrobial materials, which enhance their effectiveness and lifespan, contributing to market growth.

Additionally, the expanding medical tourism industry and growing healthcare infrastructure in emerging economies are further driving the market. As these regions experience economic growth and improved healthcare facilities, the need for bacterial filters in hospitals, clinics, and diagnostic centers is increasing. The market is also witnessing technological advancements such as self-cleaning filters and disposable options, which are expected to boost the market’s growth trajectory in the coming years. Furthermore, stringent regulations for infection control and hygiene standards across the globe are expected to fuel the demand for high-quality bacterial filters.

Bacterial Filters Market Trend Analysis:

Growing Adoption of Advanced Materials and Nanotechnology

- One of the key trends driving the bacterial filters market is the increasing adoption of advanced materials and nanotechnology in filter designs. These technologies enhance the filtration efficiency, enabling filters to capture smaller pathogens, including bacteria and viruses that are not easily trapped by traditional filters. The incorporation of antimicrobial coatings and nanofiber materials is improving the effectiveness and longevity of bacterial filters, especially in high-risk environments such as operating rooms, intensive care units (ICUs), and laboratories. This trend is contributing to the development of next-generation filters that are more efficient, durable, and capable of providing enhanced protection against airborne infections.

Expansion in Emerging Markets Due to Healthcare Infrastructure Growth

- Another notable trend is the expansion of the bacterial filters market in emerging economies, driven by the rapid growth of healthcare infrastructure. As developing countries enhance their healthcare systems, there is a growing demand for infection control products, including bacterial filters, to improve patient safety and reduce the spread of hospital-acquired infections (HAIs). Governments and healthcare institutions are investing in state-of-the-art medical equipment and sterilization technologies, which include high-performance bacterial filters in ventilators, anesthesia machines, and other critical care devices. This trend is expected to continue as healthcare accessibility and quality improve across regions like Asia-Pacific, Latin America, and the Middle East.

Bacterial Filters Market Segment Analysis:

Bacterial Filters Market is Segmented on the basis of Device Type, Application, Technology, and End User.

By Device Type, Reusable segment is expected to dominate the market during the forecast period

- In the bacterial filters market, the device types are primarily segmented into reusable and disposable filters. Reusable bacterial filters are designed for long-term use, typically found in critical medical equipment such as ventilators, anesthesia machines, and respiratory care devices. These filters are durable, cost-effective over time, and often require periodic cleaning or replacement of filter elements. On the other hand, disposable bacterial filters are intended for single-use applications, particularly in settings where hygiene and infection control are of utmost importance, such as in surgeries, intensive care units (ICUs), and diagnostic environments. Disposable filters are typically favored in high-risk situations where contamination must be avoided, providing a safer and more convenient option for preventing cross-contamination and the spread of infections. Both segments are experiencing growth, driven by the increasing demand for infection control and improved healthcare standards across the globe.

By End User, Water Purification Industry segment expected to held the largest share

- The bacterial filters market is segmented by end-user industries, including hospitals, the water purification industry, and others. Hospitals are the largest end-user segment, driven by the increasing demand for infection control in critical care units, operating rooms, and respiratory devices. Bacterial filters are crucial in preventing the spread of infections in healthcare settings by filtering out harmful microorganisms from the air and fluids. The water purification industry also significantly contributes to the market, where bacterial filters are used to ensure clean and safe drinking water by removing harmful bacteria and pathogens. Other end users include industries like pharmaceuticals, biotechnology, and food and beverages, where bacterial filters are essential for maintaining sterile environments and ensuring product safety. These diverse applications highlight the growing need for high-quality bacterial filters across various sectors to ensure health and safety standards.

Bacterial Filters Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to dominate the bacterial filters market over the forecast period due to the region's well-established healthcare infrastructure, high healthcare spending, and strict infection control regulations. The United States, in particular, is a major driver of market growth as healthcare institutions continue to adopt advanced filtration technologies to prevent hospital-acquired infections (HAIs) and improve patient safety. The increasing prevalence of respiratory diseases, coupled with the rising adoption of medical devices such as ventilators and anesthesia machines, further supports the demand for bacterial filters. Additionally, the presence of key market players in the region, ongoing research and development activities, and significant investments in healthcare technologies are expected to bolster North America's leadership in the bacterial filters market.

Active Key Players in the Bacterial Filters Market:

- Philips (Netherlands)

- Medtronic (Ireland)

- Danaher (USA)

- Sibelmed (Spain)

- Vitalograph (UK)

- GE (USA)

- Drägerwerk (Germany)

- Teleflex (USA)

- SunMed (USA)

- Dadsun Corporation (China)

- Armstrong Medical (Ireland)

- General Electric Company (USA)

- A-M Systems, LLC. (USA)

- Aqua Free GmbH (Germany), and Other Active Players.

|

Global Bacterial Filters Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.0 Billion |

|

Forecast Period 2024-32 CAGR: |

5.98% |

Market Size in 2032: |

USD 5.07 Billion |

|

Segments Covered: |

By Device Type |

|

|

|

By Application |

|

||

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bacterial Filters Market by By Device Type (2018-2032)

4.1 Bacterial Filters Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Reusable

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Disposable

Chapter 5: Bacterial Filters Market by By Application (2018-2032)

5.1 Bacterial Filters Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Water Purification

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Air Purification

Chapter 6: Bacterial Filters Market by By Technology (2018-2032)

6.1 Bacterial Filters Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Microfiltration

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ultrafiltration

6.5 Nanofiltration

6.6 Others

Chapter 7: Bacterial Filters Market by By End User (2018-2032)

7.1 Bacterial Filters Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Water Purification Industry

7.5 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Bacterial Filters Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 PHILIPS (NETHERLANDS)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MEDTRONIC (IRELAND)

8.4 DANAHER (USA)

8.5 SIBELMED (SPAIN)

8.6 VITALOGRAPH (UK)

8.7 GE (USA)

8.8 DRÄGERWERK (GERMANY)

8.9 TELEFLEX (USA)

8.10 SUNMED (USA)

8.11 DADSUN CORPORATION (CHINA)

8.12 ARMSTRONG MEDICAL (IRELAND)

8.13 GENERAL ELECTRIC COMPANY (USA)

8.14 A-M SYSTEMS LLC. (USA)

8.15 AQUA FREE GMBH (GERMANY)

8.16 OTHER ACTIVE PLAYERS

Chapter 9: Global Bacterial Filters Market By Region

9.1 Overview

9.2. North America Bacterial Filters Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Device Type

9.2.4.1 Reusable

9.2.4.2 Disposable

9.2.5 Historic and Forecasted Market Size By By Application

9.2.5.1 Water Purification

9.2.5.2 Air Purification

9.2.6 Historic and Forecasted Market Size By By Technology

9.2.6.1 Microfiltration

9.2.6.2 Ultrafiltration

9.2.6.3 Nanofiltration

9.2.6.4 Others

9.2.7 Historic and Forecasted Market Size By By End User

9.2.7.1 Hospitals

9.2.7.2 Water Purification Industry

9.2.7.3 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Bacterial Filters Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Device Type

9.3.4.1 Reusable

9.3.4.2 Disposable

9.3.5 Historic and Forecasted Market Size By By Application

9.3.5.1 Water Purification

9.3.5.2 Air Purification

9.3.6 Historic and Forecasted Market Size By By Technology

9.3.6.1 Microfiltration

9.3.6.2 Ultrafiltration

9.3.6.3 Nanofiltration

9.3.6.4 Others

9.3.7 Historic and Forecasted Market Size By By End User

9.3.7.1 Hospitals

9.3.7.2 Water Purification Industry

9.3.7.3 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Bacterial Filters Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Device Type

9.4.4.1 Reusable

9.4.4.2 Disposable

9.4.5 Historic and Forecasted Market Size By By Application

9.4.5.1 Water Purification

9.4.5.2 Air Purification

9.4.6 Historic and Forecasted Market Size By By Technology

9.4.6.1 Microfiltration

9.4.6.2 Ultrafiltration

9.4.6.3 Nanofiltration

9.4.6.4 Others

9.4.7 Historic and Forecasted Market Size By By End User

9.4.7.1 Hospitals

9.4.7.2 Water Purification Industry

9.4.7.3 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Bacterial Filters Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Device Type

9.5.4.1 Reusable

9.5.4.2 Disposable

9.5.5 Historic and Forecasted Market Size By By Application

9.5.5.1 Water Purification

9.5.5.2 Air Purification

9.5.6 Historic and Forecasted Market Size By By Technology

9.5.6.1 Microfiltration

9.5.6.2 Ultrafiltration

9.5.6.3 Nanofiltration

9.5.6.4 Others

9.5.7 Historic and Forecasted Market Size By By End User

9.5.7.1 Hospitals

9.5.7.2 Water Purification Industry

9.5.7.3 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Bacterial Filters Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Device Type

9.6.4.1 Reusable

9.6.4.2 Disposable

9.6.5 Historic and Forecasted Market Size By By Application

9.6.5.1 Water Purification

9.6.5.2 Air Purification

9.6.6 Historic and Forecasted Market Size By By Technology

9.6.6.1 Microfiltration

9.6.6.2 Ultrafiltration

9.6.6.3 Nanofiltration

9.6.6.4 Others

9.6.7 Historic and Forecasted Market Size By By End User

9.6.7.1 Hospitals

9.6.7.2 Water Purification Industry

9.6.7.3 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Bacterial Filters Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Device Type

9.7.4.1 Reusable

9.7.4.2 Disposable

9.7.5 Historic and Forecasted Market Size By By Application

9.7.5.1 Water Purification

9.7.5.2 Air Purification

9.7.6 Historic and Forecasted Market Size By By Technology

9.7.6.1 Microfiltration

9.7.6.2 Ultrafiltration

9.7.6.3 Nanofiltration

9.7.6.4 Others

9.7.7 Historic and Forecasted Market Size By By End User

9.7.7.1 Hospitals

9.7.7.2 Water Purification Industry

9.7.7.3 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Bacterial Filters Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 3.0 Billion |

|

Forecast Period 2024-32 CAGR: |

5.98% |

Market Size in 2032: |

USD 5.07 Billion |

|

Segments Covered: |

By Device Type |

|

|

|

By Application |

|

||

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Bacterial Filters Market research report is 2024-2032.

Philips (Netherlands), Medtronic (Ireland), Danaher (USA), Sibelmed (Spain), Vitalograph (UK), GE (USA), Drägerwerk (Germany), Teleflex (USA), SunMed (USA), Dadsun Corporation (China), Armstrong Medical (Ireland), General Electric Company (USA), A-M Systems, LLC. (USA), Aqua Free GmbH (Germany), Other Active Players.

The Bacterial Filters Market is segmented into by Device Typ, Application, by Technology, End User and region. by Device Type (Reusable and Disposable), by Application (Water Purification and Air Purification), by Technology (Microfiltration, Ultrafiltration, Nanofiltration, and Others), by End User (Hospitals, Water Purification Industry, and Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Bacterial filters are specialized devices designed to prevent the transmission of harmful microorganisms, such as bacteria, viruses, and fungi, by filtering air, gases, or fluids in various healthcare and industrial applications. These filters are commonly used in medical equipment, including ventilators, anesthesia machines, and respiratory circuits, to ensure that the air or fluids being delivered to patients are free from pathogens that could cause infections or complications. Bacterial filters are typically made from materials like polypropylene, glass fibers, or specialized membranes that trap microorganisms while allowing airflow or fluid passage. They are crucial in maintaining sterile conditions in healthcare settings, especially in operating rooms, intensive care units, and laboratories, where the risk of infection is high.

Bacterial Filters Market Was Valued at USD 3.0 Billion in 2023 and is Projected to Reach USD 5.07 Billion by 2032, Growing at a CAGR of 5.98 % from 2024 to 2032