Bagster Bag Market Synopsis:

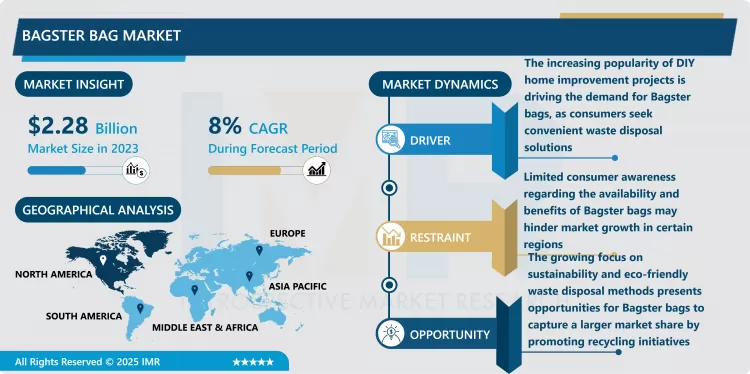

Bagster Bag Market Size Was Valued at USD 2.28 Billion in 2023, and is Projected to Reach USD 4.5 Billion by 2032, Growing at a CAGR of 8% From 2024-2032.

There is significant awareness of the Bagster bag market since the general public is looking for an easy way to dispose of their waste. The Bagster bag is a large heavy-duty bag for debris, construction material and yard waste pick up and disposal now provides customers with superb choice to the standard dumpster rental options. By just filling the bag and booking a pickup, homeowners and contractors who need a reliable way to dispose of debris without regular use have found it convenient.

The main drivers for the Bagster bag market include population willingness to do home improvements themselves, improved induction of waste disposal measures. That is why when consumers are performing home renovations, landscaping, and decluttering, flexible waste disposal solutions such as Bagster bags are popular among consumers. Further, the increasing popularity of sustainable and recycling products has made consumers look for suitable methods to dispose of waste, which created another filler to the market. Bagster bags meet this need by being an easy to handle product which can effectively handle different kinds of waste.

North America tops the regional section of the supply chain for Bagster bags because of large home improvement retail stores and increasing consumer awareness of the Bagster bags. However, other regions are also turning to this new product as word of mouth of the product spreads. The population of cities and towns and the resulting increase in the volume of garbage increases the demand for Bagster bag and can contribute to the further development of the market. Consumers are expected to pay more attention to the qualitative improvements of the products, for instance durability or environmental impact, to gain a better share in this growing market.

Bagster Bag Market Trend Analysis:

Growing Popularity of DIY Projects

- The increased interest of homeowners in do-it-yourself home remodeling activities is exerting pressure on the Bagster bag market. In other factors, DIY makes it easy for homeowners to take on multiple projects with the likelihood that they make lots of waste that needs easy disposal. Bagster bags serve the interest of these consumers because they offer a reasonable way through which one can dispose of debris without having to order a standard dumpster. The rising volume of home improvement and other related projects also resulted in the higher purchase of Bagster bags as those consumers who undergo renovation, having a clean out, and doing a landscaping project will need the bag.

Increased Focus on Sustainability

- The increase in awareness of sustainability, and the environmental-friendly ways of disposing wastes has also affected the Bagster bag market. Many customers are increasingly aware of their responsibility towards the environment and look for ways to manage waste more responsibly including recycling. Bagster bags are a little more convenient, and can be used for any number of items that can be recycled. With increased consciousness on the right methods to disposes the wastes, more people will use bags from Bagster hence putting pressure to the manufacturers to look for the eco-friendly raw materials and designing the bags.

Bagster Bag Market Segment Analysis:

Bagster Bag Market is Segmented on the basis of Material Type, End user Industry, Distribution Channel, Product Type, and Region

By Material Type, Paper segment is expected to dominate the market during the forecast period

- In the market segment of Bagster bags the materials that are used predominantly are the plastic, paper, metal, and glass, which serves particular purpose in waste disposal. Polyethylene types are the most common through out the world due to their strength and capacity to hold bulk debris during construction or renovation. Paper choices which are primarily employed for the collections of tender waste products such as yard waste are continuously preferred by the green consumer to recycle products. The metal substance is rare and is incorporated where required in the reserve bags for metals or glass such as bottles, etc. Availability of the materials makes it easier for the consumers to settle for the right Bagster bag that serves the purpose needed in the market thus making it diverse.

By End user Industry, Residential segment expected to held the largest share

- The Bagster bag market is divided by its application sector like residential, business enterprise, industrial, institutional and construction zones. In the residential sector, people often use Bagster bags for fixing houses, repairing, and rearranging their home, yard cleaning, among other things, for the simple reason that they do not require a fixed appointment or schedule when it comes to disposing of waste. Offices, schools, hospitals and other commercial and institutional establishments of any kind use the Bagster bags for waste disposal during events and/or during cleanouts. One of the biggest industries is the construction industry because contractors take advantage of Bagster bags to collect waste and other construction materials for transportation to disposal centers. The ability of Bagster bags to be useful across numerous industries as showcased above makes them popular across the market environment.

Bagster Bag Market Regional Insights:

North America is attributed to high consumer awareness regarding waste management and recycling, along with strict government regulations.

- North America is due to the increasing consumer awareness for waste management and recycling and stringed government rules that have a direct impact on the growth of the Bagster bag market. The consumers in the region have waken up to the realizing that improper disposal of wastes has detrimental effects to the environment. This awareness is matched with legislation that compels recycling and proper handling of wastes and has made people and companies look for efficient waste disposal means and methods. Therefore, the Bagster bags have proven to be useful and versatile in disposal of waste from construction, development, landscaping and repair projects. Thus, the simultaneous consumer education and pressure from the regulation provide the legal background that advances the use of Bagster bags among the population for private, as well as utilitarian, purposes.

Active Key Players in the Bagster Bag Market:

- Suez Environnement (France)

- Waste Management (United States)

- Sharps Compliance (United States)

- Veolia Environnement (France)

- MedPro Disposal (United States)

- Kimble Environmental Services (United States)

- Waste Industries USA (United States)

- Covanta Energy (United States)

- Stericycle (United States)

- Cleanaway (Australia)

- Republic Services (United States)

- BioMedical Waste Solutions (United States)

- Waste Connections (United States)

- Wheelabrator Technologies (United States)

- Daniels Sharpsmart (Australia)

- Other Active Players

|

Global Bagster Bag Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.28 Billion |

|

Forecast Period 2024-32 CAGR: |

8% |

Market Size in 2032: |

USD 4.5 Billion |

|

Segments Covered: |

By Material Type |

|

|

|

By End user Industry |

|

||

|

By Distribution Channel |

|

||

|

By Product Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bagster Bag Market by By Material Type (2018-2032)

4.1 Bagster Bag Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Plastic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Paper

4.5 Metal

4.6 Glass

4.7 Others

Chapter 5: Bagster Bag Market by By End user Industry (2018-2032)

5.1 Bagster Bag Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Residential

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial

5.5 Industrial

5.6 Institutional

5.7 Construction

5.8 Others

Chapter 6: Bagster Bag Market by By Distribution Channel (2018-2032)

6.1 Bagster Bag Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Online

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Offline

6.5 Retail Stores

6.6 Supermarkets/Hypermarkets

6.7 Distributors

6.8 Others

Chapter 7: Bagster Bag Market by By Product Type (2018-2032)

7.1 Bagster Bag Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Garbage Bags

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Trash Bags

7.5 Recycling Bags

7.6 Compostable Bags

7.7 Reusable Bags

7.8 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Bagster Bag Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 SUEZ ENVIRONNEMENT (FRANCE)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 WASTE MANAGEMENT (UNITED STATES)

8.4 SHARPS COMPLIANCE (UNITED STATES)

8.5 VEOLIA ENVIRONNEMENT (FRANCE)

8.6 MEDPRO DISPOSAL (UNITED STATES)

8.7 KIMBLE ENVIRONMENTAL SERVICES (UNITED STATES)

8.8 WASTE INDUSTRIES USA (UNITED STATES)

8.9 COVANTA ENERGY (UNITED STATES)

8.10 STERICYCLE (UNITED STATES)

8.11 CLEANAWAY (AUSTRALIA)

8.12 REPUBLIC SERVICES (UNITED STATES)

8.13 BIOMEDICAL WASTE SOLUTIONS (UNITED STATES)

8.14 WASTE CONNECTIONS (UNITED STATES)

8.15 WHEELABRATOR TECHNOLOGIES (UNITED STATES)

8.16 DANIELS SHARPSMART (AUSTRALIA)

8.17 OTHER ACTIVE PLAYERS

Chapter 9: Global Bagster Bag Market By Region

9.1 Overview

9.2. North America Bagster Bag Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Material Type

9.2.4.1 Plastic

9.2.4.2 Paper

9.2.4.3 Metal

9.2.4.4 Glass

9.2.4.5 Others

9.2.5 Historic and Forecasted Market Size By By End user Industry

9.2.5.1 Residential

9.2.5.2 Commercial

9.2.5.3 Industrial

9.2.5.4 Institutional

9.2.5.5 Construction

9.2.5.6 Others

9.2.6 Historic and Forecasted Market Size By By Distribution Channel

9.2.6.1 Online

9.2.6.2 Offline

9.2.6.3 Retail Stores

9.2.6.4 Supermarkets/Hypermarkets

9.2.6.5 Distributors

9.2.6.6 Others

9.2.7 Historic and Forecasted Market Size By By Product Type

9.2.7.1 Garbage Bags

9.2.7.2 Trash Bags

9.2.7.3 Recycling Bags

9.2.7.4 Compostable Bags

9.2.7.5 Reusable Bags

9.2.7.6 Others

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Bagster Bag Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Material Type

9.3.4.1 Plastic

9.3.4.2 Paper

9.3.4.3 Metal

9.3.4.4 Glass

9.3.4.5 Others

9.3.5 Historic and Forecasted Market Size By By End user Industry

9.3.5.1 Residential

9.3.5.2 Commercial

9.3.5.3 Industrial

9.3.5.4 Institutional

9.3.5.5 Construction

9.3.5.6 Others

9.3.6 Historic and Forecasted Market Size By By Distribution Channel

9.3.6.1 Online

9.3.6.2 Offline

9.3.6.3 Retail Stores

9.3.6.4 Supermarkets/Hypermarkets

9.3.6.5 Distributors

9.3.6.6 Others

9.3.7 Historic and Forecasted Market Size By By Product Type

9.3.7.1 Garbage Bags

9.3.7.2 Trash Bags

9.3.7.3 Recycling Bags

9.3.7.4 Compostable Bags

9.3.7.5 Reusable Bags

9.3.7.6 Others

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Bagster Bag Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Material Type

9.4.4.1 Plastic

9.4.4.2 Paper

9.4.4.3 Metal

9.4.4.4 Glass

9.4.4.5 Others

9.4.5 Historic and Forecasted Market Size By By End user Industry

9.4.5.1 Residential

9.4.5.2 Commercial

9.4.5.3 Industrial

9.4.5.4 Institutional

9.4.5.5 Construction

9.4.5.6 Others

9.4.6 Historic and Forecasted Market Size By By Distribution Channel

9.4.6.1 Online

9.4.6.2 Offline

9.4.6.3 Retail Stores

9.4.6.4 Supermarkets/Hypermarkets

9.4.6.5 Distributors

9.4.6.6 Others

9.4.7 Historic and Forecasted Market Size By By Product Type

9.4.7.1 Garbage Bags

9.4.7.2 Trash Bags

9.4.7.3 Recycling Bags

9.4.7.4 Compostable Bags

9.4.7.5 Reusable Bags

9.4.7.6 Others

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Bagster Bag Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Material Type

9.5.4.1 Plastic

9.5.4.2 Paper

9.5.4.3 Metal

9.5.4.4 Glass

9.5.4.5 Others

9.5.5 Historic and Forecasted Market Size By By End user Industry

9.5.5.1 Residential

9.5.5.2 Commercial

9.5.5.3 Industrial

9.5.5.4 Institutional

9.5.5.5 Construction

9.5.5.6 Others

9.5.6 Historic and Forecasted Market Size By By Distribution Channel

9.5.6.1 Online

9.5.6.2 Offline

9.5.6.3 Retail Stores

9.5.6.4 Supermarkets/Hypermarkets

9.5.6.5 Distributors

9.5.6.6 Others

9.5.7 Historic and Forecasted Market Size By By Product Type

9.5.7.1 Garbage Bags

9.5.7.2 Trash Bags

9.5.7.3 Recycling Bags

9.5.7.4 Compostable Bags

9.5.7.5 Reusable Bags

9.5.7.6 Others

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Bagster Bag Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Material Type

9.6.4.1 Plastic

9.6.4.2 Paper

9.6.4.3 Metal

9.6.4.4 Glass

9.6.4.5 Others

9.6.5 Historic and Forecasted Market Size By By End user Industry

9.6.5.1 Residential

9.6.5.2 Commercial

9.6.5.3 Industrial

9.6.5.4 Institutional

9.6.5.5 Construction

9.6.5.6 Others

9.6.6 Historic and Forecasted Market Size By By Distribution Channel

9.6.6.1 Online

9.6.6.2 Offline

9.6.6.3 Retail Stores

9.6.6.4 Supermarkets/Hypermarkets

9.6.6.5 Distributors

9.6.6.6 Others

9.6.7 Historic and Forecasted Market Size By By Product Type

9.6.7.1 Garbage Bags

9.6.7.2 Trash Bags

9.6.7.3 Recycling Bags

9.6.7.4 Compostable Bags

9.6.7.5 Reusable Bags

9.6.7.6 Others

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Bagster Bag Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Material Type

9.7.4.1 Plastic

9.7.4.2 Paper

9.7.4.3 Metal

9.7.4.4 Glass

9.7.4.5 Others

9.7.5 Historic and Forecasted Market Size By By End user Industry

9.7.5.1 Residential

9.7.5.2 Commercial

9.7.5.3 Industrial

9.7.5.4 Institutional

9.7.5.5 Construction

9.7.5.6 Others

9.7.6 Historic and Forecasted Market Size By By Distribution Channel

9.7.6.1 Online

9.7.6.2 Offline

9.7.6.3 Retail Stores

9.7.6.4 Supermarkets/Hypermarkets

9.7.6.5 Distributors

9.7.6.6 Others

9.7.7 Historic and Forecasted Market Size By By Product Type

9.7.7.1 Garbage Bags

9.7.7.2 Trash Bags

9.7.7.3 Recycling Bags

9.7.7.4 Compostable Bags

9.7.7.5 Reusable Bags

9.7.7.6 Others

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Bagster Bag Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.28 Billion |

|

Forecast Period 2024-32 CAGR: |

8% |

Market Size in 2032: |

USD 4.5 Billion |

|

Segments Covered: |

By Material Type |

|

|

|

By End user Industry |

|

||

|

By Distribution Channel |

|

||

|

By Product Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Bagster Bag Market research report is 2024-2032.

Suez Environnement (France), Waste Management (United States), Sharps Compliance (United States), Veolia Environnement (France), MedPro Disposal (United States), Kimble Environmental Services (United States), Waste Industries USA (United States), Covanta Energy (United States), Stericycle (United States), Cleanaway (Australia), Republic Services (United States), BioMedical Waste Solutions (United States), Waste Connections (United States), Wheelabrator Technologies (United States), Daniels Sharpsmart (Australia), and Other Active Players.

The Bagster Bag Market is segmented into By Material Type, By End user Industry, By Distribution Channel, By Product Type and region. By Material Type (Plastic, Paper, Metal, Glass, Others), By End user Industry (Residential, Commercial, Industrial, Institutional, Construction, Others), By Distribution Channel (Online, Offline, Retail Stores, Supermarkets/Hypermarkets, Distributors, Others), By Product Type (Garbage Bags, Trash Bags, Recycling Bags, Compostable Bags, Reusable Bags, Others). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

A Bagster bag is a large, durable, and flexible waste collection bag designed for easy disposal of various types of debris, including construction materials, yard waste, and household clutter. Typically made from heavy-duty materials, Bagster bags can hold up to 3 cubic yards of waste, making them an ideal solution for home renovation projects, cleanouts, and landscaping tasks. Users can fill the bag at their convenience and schedule a pickup through their waste management service provider, allowing for hassle-free disposal without the need for a traditional dumpster rental. This innovative waste management option caters to both residential and commercial needs, providing a practical and efficient way to manage waste while promoting responsible disposal practices.

Bagster Bag Market Size Was Valued at USD 2.28 Billion in 2023, and is Projected to Reach USD 4.5 Billion by 2032, Growing at a CAGR of 8% From 2024-2032.