Barge Transportation Market Synopsis

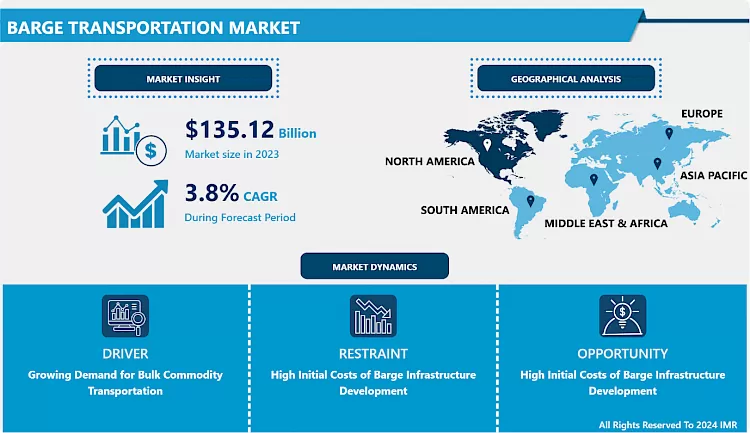

Barge Transportation Market Size Was Valued at USD 135.12 Billion in 2023, and is Projected to Reach USD 189.01 Billion by 2032, Growing at a CAGR of 3.8% From 2024-2032.

The Barge Transportation Market is defined as the transportation of goods and other merchandise through barge and it is a flat-bottomed boat to transportation of huge and massive materials. More precisely, they are chiefly employed in the inland navigation, the coasting, the off-shore operations, barge transport has turned into the cheap and effective way of delivering the great volume of through such cargoes as the coals, the petroleum products, the grains and the chemicals.

The Market of Barge Transportation has grown slowly because of this because it is another faster and cheaper means of transport than rail or road. Use of the inland transport technicians is instrumental in boosting regional as well as international business chiefly across market segments that cut across volumes of products. Some of drivers that have been attributed to overall market growth includes; increase demand for bulk commodities, enhancement of barges design to cover more capacity and increase in the general demand for environmentally friendly transport.

The regions whish mainly uses the barge transportation is North America and Europe since these regions possess the favourable networks of river, canal and ports. However, other developing countries such as China and India that want to be included in barge transportation business as indication of increasing industrialization and infrastructural expansion. Through the employment of GPS-transmitting barges and other aspects of the automated managing of barge traffic, bfs the utilization of barge transport increases significantly in the recent trends of logistics carriers.

Barge Transportation Market Trend Analysis:

Rising Adoption of Green Shipping Practices

- At the present, the barge transportation industry has adopted environment friendly method known as Green Shipping in the process of -meeting international environmental legislation among other sustainable measures. Many companies are on the verge of adopting the technology concerning sustainability and energy saving touching on the barge design. The move to cleaner fuels is in progress and efficiency is also being sought by the introduction of innovations such as hull optimization. Moreover, the governments and other regulatory authorities have provided a continuous push towards the adoption of sustainable green transport mode and green investment towards the associated projects. This trend not only makes the environmental effect minimum, but also the credibility and attractiveness of the options will increase greatly.

Expansion in Emerging Economies

- The market prospects of the barge transportation market are changed by new entrant economy countries. Due to increase in industrializations, urbanization and infrastructural growth there is need for cheap and efficient transport in Asian-Pacific, Latin American and African area. These regional governments are directing considerable funds to inland waterways and ports as means of transport and commerce. There is also the availability of multiple natural water sources that brings the feasibility of the barge transportation into these market areas. Such opportunities may be tapped through venturing into joint partnership or forming alliances with local business people as well as companies playing service to the region.

Barge Transportation Market Segment Analysis:

Barge Transportation Market is segmented on the basis of type, application, bridge fleet, and Region.

By Type, Dry Cargo segment is expected to dominate the market during the forecast period

- Dry cargo will have higher market potential compared with the wet cargo market for the duration of the forecast period as the demand for moving large volumes of necessities such as grains, coals, ores and construction materials grows higher. Barges are therefore in terms of sensitivity, size and cost suitable for transport of bulky and low value material and equipment over a vast network of Inland waterways. The segment is boosted by increasing number of agricultural exports, new towns and cities as well as need for powering up of coal, biomass among others. The emergence of this segment also entails other and better design for barge contract has become available for holds on different categories of dry cargo. With the continuing trend of globalization also the dry cargo segment must maintain its dominance in the global market place.

By Application, Coke and Refine petroleum products segment expected to hold the largest share

- The coke and refined petroleum products segment is expected to continue to be in the largest place of Barge Transportation Market thanks to inland waterways have a large role in energy & chemical industry. Barges are the most preferred means of transporting the liquid bulk products due to capacity, safety and cost of using the facility in demand of its products like gasoline, diesel, jet fuel and industrial usage coke all of which fall under the petroleum products. Additionally, increased environmental standards that force company to safely transport hazardous cargo through barges is also enhancing the use of barge specifically for petroleum and chemicals. This is also supported by upgrade technologies on tanker barges which improve compliance to safety standards on the segment.

Barge Transportation Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America in the Barge Transportation Market size is expected to grow most significantly in the near future because of the extensive inland waterways connected with this region along with convenient infrastructures. Many of the water system such as the Mississippi River, The Great Lakes and other water body is very Import e for transportation and movement of goods in the region. The United States of America being one of the largest exporters in the North American region enjoys the returns from their agricultural products export, energy sector and industries whereby majority of their shipment heavily depend on barge.

- Alombo also improved coupled with high transportation of crude oil and related products through barges due to the discovery of shale gas in the U.S. Another area important to the region’s emission reduction has also moved towards the enhancement of eco-friendly barge solutions such as LNG-powered vessels. This aspect of using barge transportation for the natural resources exports also contributes to general market control by North America especially Canada. Due to innovation and government support the barge transportation industry in North America will remain privileged to be among the leading barge transportation industry globally.

Active Key Players in the Barge Transportation Market:

- American Commercial Barge Line (USA)

- Campbell Transportation Company (USA)

- Canal Barge Company, Inc. (USA)

- CGB Enterprises, Inc. (USA)

- Danser Group (Netherlands)

- Ingram Marine Group (USA)

- Kirby Corporation (USA)

- McAllister Towing and Transportation Company (USA)

- Mitsui O.S.K. Lines, Ltd. (Japan)

- PACC Offshore Services Holdings Ltd. (Singapore)

- SEACOR Holdings Inc. (USA)

- Stolt-Nielsen Limited (UK)

- Tidewater Holdings, Inc. (USA)

- Vane Brothers Company (USA)

- Viking Supply Ships AB (Sweden), Other Active Players.

Key Industry Development in the Barge Transportation Market:

- In February 2024, Future Proof Shipping launched the H2 Barge 2, a hydrogen-powered vessel designed to operate without carbon emissions along the Rhine River between Duisburg (DE) and Rotterdam (NL). The development and launch were supported by the EU-funded Flagships project and the Interreg-funded ZEM Ports NS project, marking a significant milestone in sustainable shipping.

- In October 2023, Seacor Holdings announced the sale of its inland water division to Ingram Barge Co., a division of Ingram Marine Group. The transaction included over 1,000 covered dry cargo hopper barges, eight towboats with more than 6,000 horsepower, and terminal and fleeting infrastructure along the Mississippi River, which became operational under Ingram Marine Group.

|

Global Barge Transportation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 135.12 Billion |

|

Forecast Period 2024-32 CAGR: |

3.8% |

Market Size in 2032: |

USD 189.01 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Barge Fleet |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Barge Transportation Market by By Type (2018-2032)

4.1 Barge Transportation Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cargo

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Liquid Cargo

4.5 Gaseous Cargo

Chapter 5: Barge Transportation Market by By Application (2018-2032)

5.1 Barge Transportation Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Agricultural Products

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Coal & Crude Petroleum

5.5 Metal Ores

5.6 Coke & Refined Petroleum Products

5.7 Food Products

5.8 Secondary Raw Materials & Wastes

5.9 Beverages & Tobacco

5.10 Rubber & Plastic

5.11 Chemicals

5.12 Nuclear

5.13 Fuel

Chapter 6: Barge Transportation Market by By Barge Fleet (2018-2032)

6.1 Barge Transportation Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Covered

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Open

6.5 Tank

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Barge Transportation Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMERICAN COMMERCIAL BARGE LINE (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CAMPBELL TRANSPORTATION COMPANY (USA)

7.4 CANAL BARGE COMPANY INC. (USA)

7.5 CGB ENTERPRISES INC. (USA)

7.6 DANSER GROUP (NETHERLANDS)

7.7 INGRAM MARINE GROUP (USA)

7.8 KIRBY CORPORATION (USA)

7.9 MCALLISTER TOWING AND TRANSPORTATION COMPANY (USA)

7.10 MITSUI O.S.K. LINES LTD. (JAPAN)

7.11 PACC OFFSHORE SERVICES HOLDINGS LTD. (SINGAPORE)

7.12 SEACOR HOLDINGS INC. (USA)

7.13 STOLT-NIELSEN LIMITED (UK)

7.14 TIDEWATER HOLDINGS INC. (USA)

7.15 VANE BROTHERS COMPANY (USA)

7.16 VIKING SUPPLY SHIPS AB (SWEDEN)

7.17

Chapter 8: Global Barge Transportation Market By Region

8.1 Overview

8.2. North America Barge Transportation Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Cargo

8.2.4.2 Liquid Cargo

8.2.4.3 Gaseous Cargo

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Agricultural Products

8.2.5.2 Coal & Crude Petroleum

8.2.5.3 Metal Ores

8.2.5.4 Coke & Refined Petroleum Products

8.2.5.5 Food Products

8.2.5.6 Secondary Raw Materials & Wastes

8.2.5.7 Beverages & Tobacco

8.2.5.8 Rubber & Plastic

8.2.5.9 Chemicals

8.2.5.10 Nuclear

8.2.5.11 Fuel

8.2.6 Historic and Forecasted Market Size By By Barge Fleet

8.2.6.1 Covered

8.2.6.2 Open

8.2.6.3 Tank

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Barge Transportation Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Cargo

8.3.4.2 Liquid Cargo

8.3.4.3 Gaseous Cargo

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Agricultural Products

8.3.5.2 Coal & Crude Petroleum

8.3.5.3 Metal Ores

8.3.5.4 Coke & Refined Petroleum Products

8.3.5.5 Food Products

8.3.5.6 Secondary Raw Materials & Wastes

8.3.5.7 Beverages & Tobacco

8.3.5.8 Rubber & Plastic

8.3.5.9 Chemicals

8.3.5.10 Nuclear

8.3.5.11 Fuel

8.3.6 Historic and Forecasted Market Size By By Barge Fleet

8.3.6.1 Covered

8.3.6.2 Open

8.3.6.3 Tank

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Barge Transportation Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Cargo

8.4.4.2 Liquid Cargo

8.4.4.3 Gaseous Cargo

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Agricultural Products

8.4.5.2 Coal & Crude Petroleum

8.4.5.3 Metal Ores

8.4.5.4 Coke & Refined Petroleum Products

8.4.5.5 Food Products

8.4.5.6 Secondary Raw Materials & Wastes

8.4.5.7 Beverages & Tobacco

8.4.5.8 Rubber & Plastic

8.4.5.9 Chemicals

8.4.5.10 Nuclear

8.4.5.11 Fuel

8.4.6 Historic and Forecasted Market Size By By Barge Fleet

8.4.6.1 Covered

8.4.6.2 Open

8.4.6.3 Tank

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Barge Transportation Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Cargo

8.5.4.2 Liquid Cargo

8.5.4.3 Gaseous Cargo

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Agricultural Products

8.5.5.2 Coal & Crude Petroleum

8.5.5.3 Metal Ores

8.5.5.4 Coke & Refined Petroleum Products

8.5.5.5 Food Products

8.5.5.6 Secondary Raw Materials & Wastes

8.5.5.7 Beverages & Tobacco

8.5.5.8 Rubber & Plastic

8.5.5.9 Chemicals

8.5.5.10 Nuclear

8.5.5.11 Fuel

8.5.6 Historic and Forecasted Market Size By By Barge Fleet

8.5.6.1 Covered

8.5.6.2 Open

8.5.6.3 Tank

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Barge Transportation Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Cargo

8.6.4.2 Liquid Cargo

8.6.4.3 Gaseous Cargo

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Agricultural Products

8.6.5.2 Coal & Crude Petroleum

8.6.5.3 Metal Ores

8.6.5.4 Coke & Refined Petroleum Products

8.6.5.5 Food Products

8.6.5.6 Secondary Raw Materials & Wastes

8.6.5.7 Beverages & Tobacco

8.6.5.8 Rubber & Plastic

8.6.5.9 Chemicals

8.6.5.10 Nuclear

8.6.5.11 Fuel

8.6.6 Historic and Forecasted Market Size By By Barge Fleet

8.6.6.1 Covered

8.6.6.2 Open

8.6.6.3 Tank

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Barge Transportation Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Cargo

8.7.4.2 Liquid Cargo

8.7.4.3 Gaseous Cargo

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Agricultural Products

8.7.5.2 Coal & Crude Petroleum

8.7.5.3 Metal Ores

8.7.5.4 Coke & Refined Petroleum Products

8.7.5.5 Food Products

8.7.5.6 Secondary Raw Materials & Wastes

8.7.5.7 Beverages & Tobacco

8.7.5.8 Rubber & Plastic

8.7.5.9 Chemicals

8.7.5.10 Nuclear

8.7.5.11 Fuel

8.7.6 Historic and Forecasted Market Size By By Barge Fleet

8.7.6.1 Covered

8.7.6.2 Open

8.7.6.3 Tank

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Barge Transportation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 135.12 Billion |

|

Forecast Period 2024-32 CAGR: |

3.8% |

Market Size in 2032: |

USD 189.01 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Barge Fleet |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Barge Transportation Market research report is 2024-2032.

American Commercial Barge Line, Ingram Marine Group, Kirby Corporation, SEACOR Holdings Inc., Tidewater Holdings, Inc., and Other Active players.

The Barge Transportation Market is segmented into Type, Application, Barge Fleet, and region. By Type, the market is categorized into Cargo, Liquid Cargo, and Gaseous Cargo. By Application, the market is categorized into Agricultural Products, Coal & Crude Petroleum, Metal Ores, Coke & Refined Petroleum Products, Food Products, Secondary Raw Materials & Wastes, Beverages & Tobacco, Rubber & Plastic, Chemicals, Nuclear, and Fuel. By Barge Fleet, the market is categorized into Covered, Open, and Tank. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Barge Transportation Market is defined as the transportation of goods and other merchandise through barge and it is a flat-bottomed boat for transportation of massive materials. More precisely, they are chiefly employed in the inland navigation, coasting, and off-shore operations, barge transport has turned into a cheap and effective way of delivering the great volume of cargoes such as coals, petroleum products, grains, and chemicals.

Barge Transportation Market Size Was Valued at USD 135.12 Billion in 2023, and is Projected to Reach USD 189.01 Billion by 2032, Growing at a CAGR of 3.8% From 2024-2032.