Battery-as-a Service Market Synopsis

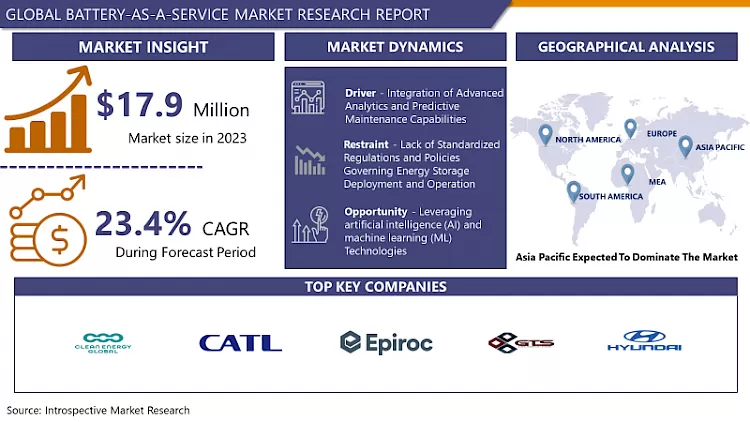

Battery-as-a Service Market Size Was Valued at USD 17.9 Million in 2023, and is Projected to Reach USD 118.8 Million by 2032, Growing at a CAGR of 23.4% From 2024-2032.

Battery-as-a-Service (BaaS) is a business model where the end consumers pay per kilowatt-hour of energy storage capacity instead of having direct access to the batteries. In this case, the provision of batteries, their maintenance, monitoring and the replacement is the responsibility of the service provider. There are several benefits of BaaS, which are explained as follows: The initial cost of setting up battery storage is relatively low; second, battery storage management is not complicated and does not require a lot of resources; third, adopting the latest battery technology does not require a great deal of investment since it is managed by BaaS operators. This model is finding application across different sectors, especially in renewable energy solutions, electric vehicles, and balancing of the power grid where modular and scalable energy storage systems are required.

- The Battery-as-a-Service (BaaS) market is emerging at a progressive pace because of the growing concern for scalable and eco-friendly energy storage solution across multiple industries. BaaS creates value proposition to businesses and consumers by providing energy storage capacity akin to owning batteries without having to invest in battery infrastructure or bear the cost of battery maintenance. The above model is especially engaging in fields like integration of renewable energy systems where reliable energy storage is crucial to maintaining the stability of the grid and efficiently utilizing renewable energy like solar and wind.

- Furthermore, with the advent of electric vehicles (EVs), BaaS has gained more attention as it solves problems associated with battery durability, limited driving distance, and the initial cost of owning an EV. As a subscription model allows for utilizing battery capacity and avoiding associated expenses, BaaS contributes to the growth of EV manufacturing and charging infrastructure companies, thus driving demand for electric vehicles. In conclusion, there are high opportunities for BaaS in the coming years as more organisations and governments are aiming to improve sustainability and energy security of their operations and investments in infrastructure.

Battery-as-a Service Market Trend Analysis

Integration of Advanced Analytics and Predictive Maintenance Capabilities

- As more and more consumers turn to battery storage solutions, service providers are implementing data analytics and machine learning to enhance battery effectiveness and durability while reducing downtime. The metrics like state of charge, temperature, amount of usage, etc. , when regularly checked by the BaaS providers, they can predict the problems beforehand and reach for an appropriate maintenance and replacement schedule. This trend not only improves the dependability and effectiveness of energy storage systems but also helps in cutting down on operational costs and thus making customers happier.

Leveraging artificial intelligence (AI) and machine learning (ML) technologies

- Another clear and promising development for the Battery-as-a-Service (BaaS) market may also cover the usage of artificial intelligence (AI) and machine learning (ML) to enhance battery efficiency and provide the greatest benefits to consumers. When implemented in BaaS platforms smart monitoring and predictive analytics can improve battery’s efficiency, longevity and facilitate the identification of maintenance requirements. Cognitive self-learning systems can receive signals in real-time from batteries, weather conditions, patterns of energy demand, and other related parameters to charge and discharge cycles, maximize the life of batteries, and predict when they are most likely to fail.

- Additionally, with the aid of the advanced AI technology, predictive maintenance can be achieved, and as such, any problem that may occur to the energy storage devices can be rectified before it becomes worse. It not only benefits the customers by improving their satisfaction level, but also helps the providers in cutting down operational expenses by identifying an ideal network configuration and avoiding redundant maintenance tasks. Furthermore, by using AI, BaaS providers can improve their service offerings and even add new value-added services such as energy management recommendations, demand response management, and grid balancing services to their portfolios which will allow them to gain more market share and diversify their revenue streams. In sum, it can be seen that the utilisation of AI and ML technologies holds a great promise for BaaS providers to deliver improved effectiveness and added value for energy storage solutions, thus contributing to the growth of the market and the increase of customer take-up.

Battery-as-a Service Market Segment Analysis:

Battery-as-a Service Market is segmented on the basis of type, Service, and application.

By Type, Stationary Equipment segment is expected to dominate the market during the forecast period

- The global Battery-as-a-Service (BaaS) market is set to expand at a relatively high CAGR in the near future, while the Stationary Equipment segment will lead the way during the forecast period. This dominance is because energy storage solutions are increasingly being applied in stationary uses including grid balancing services, backup power and the integration of renewable energy systems. As industries and utilities across the globe pay attention to sustainability and reliability, it calls for progressive energy storage systems to address a variety of issues concerning inconsistent power generation and demand. The BaaS model used for stationary batteries offers a cost-efficient and agile way for businesses and utilities to tap into the benefits of storage while avoiding the capital and maintenance costs.

- In addition, the improvement of battery technology, and supportive government policies for energy storage systems deployment are contributing to the development of the Stationary Equipment segment as the BaaS market growth stimuli in the future years.

By Service, Vehicle-Battery Separation segment is expected to held the largest share

- The Vehicle-Battery Separation segment will also see the highest growth rate in the Battery-as-a-Service (BaaS) market in terms of service offering. This segment refers to the removal of battery on the vehicle and offering it as a service which is common in the EV segment.

- One of the primary factors driving this segment’s dominance is the increasing popularity of electric cars. Ever increasing numbers of people and companies switch to electric cars or other electric equipment to decrease the use of fossil fuels and CO2 emissions, the need for effective and cheap batteries increases. Vehicle-Battery Separation also allows EV manufacturers and fleet owners and managers to introduce a variety of ownership schemes, avoid high initial costs, and consider challenges associated with the battery degradation and replacement. Also, integrating the battery to the car simplifies the battery’s performance, remote monitoring, maintenance, and optimization. The providers of such services can also use the sophisticated technologies like predictive analytics and remote diagnosing to guarantee that batteries and their related devices operate at their full capacity and have long expected life spans, which should be valuable for the customers.

- In addition, the Vehicle-Battery Separation segment enables creation of new revenue streams for electric vehicles like battery swapping and leasing which in turn catalyze market growth and demand. Through this approach, BaaS providers can fine-tune the offerings of the battery to the needs of different customers depending on the application; personal use, businesses, and public transport.

Battery-as-a Service Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The BaaS market will remain dominated by the Asia Pacific region in the forecast period for several reasons that have boosted the energy storage solutions market in the region.

- Furthermore, the growth in the GDP of the world economy and increasing population density in the Asian countries such as China and India and South-East Asia has boosted the requirements of a robust and efficient energy supply system. As these economies grow, the regulators and policymakers are under pressure to manage energy security challenges, grid infrastructure flexibility, and environmental responsibilities; therefore, investments in energy storage solutions like BaaS are increasing.

- Also, the rise of renewable energy resources such as solar and wind power in the Asia Pacific region to address fluctuating demand patterns; there is an opportunity for energy storage. The integration of renewable energy through BaaS is efficient and less costly, making it effective in improving energy reliability and the shift to a cleaner energy system.

Active Key Players in the Battery-as-a Service Market

- Clean Energy Global GmbH (Germany)

- Contemporary Amperex Technology Co. Ltd. (China)

- Epiroc AB (Sweden)

- Global Technology Systems Inc. (United States)

- Hyundai Motor Company (South Korea)

- Octillion Power Systems Inc. (United States)

- Other key Players

|

Global Battery-as-a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.9 Mn. |

|

Forecast Period 2024-32 CAGR: |

23.4 % |

Market Size in 2032: |

USD 118.8 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Service |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Battery-As-A-Service Market by By Type (2018-2032)

4.1 Battery-As-A-Service Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Stationary Equipment

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Mobile Equipment

Chapter 5: Battery-As-A-Service Market by By Service (2018-2032)

5.1 Battery-As-A-Service Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Vehicle-Battery Separation

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Battery Subscription

5.5 Chargeable

5.6 Swappable and Upgradable Batteries

Chapter 6: Battery-As-A-Service Market by By Application (2018-2032)

6.1 Battery-As-A-Service Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Automotive and Transport

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Energy

6.5 Industrial

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Battery-As-A-Service Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABB (SWITZERLAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ADVANCED ENERGY INDUSTRIES INC. (U.S.)

7.4 ANALOG DEVICES INC. (U.S.)

7.5 CRANE HOLDINGS

7.6 CO. (U.S.)

7.7 DELTA ELECTRONICS INC. (TAIWAN)

7.8 FLEX LTD (SINGAPORE)

7.9 INFINEON TECHNOLOGIES AG (GERMANY)

7.10 MURATA MANUFACTURING COLTD. (JAPAN)

7.11 NXP SEMICONDUCTOR (NETHERLANDS)

7.12 RENESAS ELECTRONICS CORPORATION (JAPAN)

7.13 SKYWORKS SOLUTIONS INC. (U.S.)

7.14 STMICROELECTRONICS (SWITZERLAND)

7.15 TDK CORPORATION (JAPAN)

7.16 TEXAS INSTRUMENTS INCORPORATED (U.S.)

7.17 VICOR CORPORATION (U.S.)

7.18 OTHER KEY PLAYERS

Chapter 8: Global Battery-As-A-Service Market By Region

8.1 Overview

8.2. North America Battery-As-A-Service Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Stationary Equipment

8.2.4.2 Mobile Equipment

8.2.5 Historic and Forecasted Market Size By By Service

8.2.5.1 Vehicle-Battery Separation

8.2.5.2 Battery Subscription

8.2.5.3 Chargeable

8.2.5.4 Swappable and Upgradable Batteries

8.2.6 Historic and Forecasted Market Size By By Application

8.2.6.1 Automotive and Transport

8.2.6.2 Energy

8.2.6.3 Industrial

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Battery-As-A-Service Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Stationary Equipment

8.3.4.2 Mobile Equipment

8.3.5 Historic and Forecasted Market Size By By Service

8.3.5.1 Vehicle-Battery Separation

8.3.5.2 Battery Subscription

8.3.5.3 Chargeable

8.3.5.4 Swappable and Upgradable Batteries

8.3.6 Historic and Forecasted Market Size By By Application

8.3.6.1 Automotive and Transport

8.3.6.2 Energy

8.3.6.3 Industrial

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Battery-As-A-Service Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Stationary Equipment

8.4.4.2 Mobile Equipment

8.4.5 Historic and Forecasted Market Size By By Service

8.4.5.1 Vehicle-Battery Separation

8.4.5.2 Battery Subscription

8.4.5.3 Chargeable

8.4.5.4 Swappable and Upgradable Batteries

8.4.6 Historic and Forecasted Market Size By By Application

8.4.6.1 Automotive and Transport

8.4.6.2 Energy

8.4.6.3 Industrial

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Battery-As-A-Service Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Stationary Equipment

8.5.4.2 Mobile Equipment

8.5.5 Historic and Forecasted Market Size By By Service

8.5.5.1 Vehicle-Battery Separation

8.5.5.2 Battery Subscription

8.5.5.3 Chargeable

8.5.5.4 Swappable and Upgradable Batteries

8.5.6 Historic and Forecasted Market Size By By Application

8.5.6.1 Automotive and Transport

8.5.6.2 Energy

8.5.6.3 Industrial

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Battery-As-A-Service Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Stationary Equipment

8.6.4.2 Mobile Equipment

8.6.5 Historic and Forecasted Market Size By By Service

8.6.5.1 Vehicle-Battery Separation

8.6.5.2 Battery Subscription

8.6.5.3 Chargeable

8.6.5.4 Swappable and Upgradable Batteries

8.6.6 Historic and Forecasted Market Size By By Application

8.6.6.1 Automotive and Transport

8.6.6.2 Energy

8.6.6.3 Industrial

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Battery-As-A-Service Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Stationary Equipment

8.7.4.2 Mobile Equipment

8.7.5 Historic and Forecasted Market Size By By Service

8.7.5.1 Vehicle-Battery Separation

8.7.5.2 Battery Subscription

8.7.5.3 Chargeable

8.7.5.4 Swappable and Upgradable Batteries

8.7.6 Historic and Forecasted Market Size By By Application

8.7.6.1 Automotive and Transport

8.7.6.2 Energy

8.7.6.3 Industrial

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Battery-as-a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.9 Mn. |

|

Forecast Period 2024-32 CAGR: |

23.4 % |

Market Size in 2032: |

USD 118.8 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Service |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Battery-as-a Service Market research report is 2024-2032.

Clean Energy Global GmbH, Contemporary Amperex Technology Co. Ltd., Epiroc AB, Global Technology Systems Inc. and Other Major Players.

The Battery-as-a Service Market is segmented into Type, Service, Application, and region. By Type, the market is categorized into Stationary Equipment, Mobile Equipment. By Service, the market is categorized into Vehicle-Battery Separation, Battery Subscription, Chargeable, Swappable and Upgradable Batteries. By Application, the market is categorized into Automotive and Transport, Energy, Industrial, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Battery-as-a-Service (BaaS) is a business model where the end consumers pay per kilowatt-hour of energy storage capacity instead of having direct access to the batteries. In this case, the provision of batteries, their maintenance, monitoring and the replacement is the responsibility of the service provider. There are several benefits of BaaS, which are explained as follows: The initial cost of setting up battery storage is relatively low; second, battery storage management is not complicated and does not require a lot of resources; third, adopting the latest battery technology does not require a great deal of investment since it is managed by BaaS operators. This model is finding application across different sectors, especially in renewable energy solutions, electric vehicles, and balancing of the power grid where modular and scalable energy storage systems are required.

Battery-as-a Service Market Size Was Valued at USD 17.9 Million in 2023, and is Projected to Reach USD 118.8 Million by 2032, Growing at a CAGR of 23.4% From 2024-2032.