Biomass Briquettes Market Synopsis:

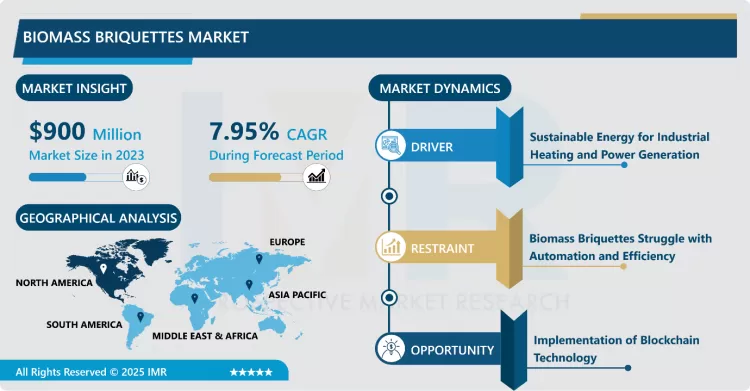

The Biomass Briquettes Market Size Was Valued at USD 900 Million in 2023 and is Projected to Reach USD 1,791.62 Million by 2032, Growing at a CAGR of 7.95% From 2024-2032.

Biomass briquettes are a biofuel substitute made of biodegradable green waste with lower emissions of greenhouse gases and carbon dioxide than traditional fuel sources. This fuel source is used as an alternative to harmful biofuels. Briquettes are used for heating, cooking fuel, and electricity generation usually in developing countries that do not have access to more traditional fuel sources. Biomass briquettes have become popular in developed countries due to their accessibility, and eco-friendly impact. The briquettes can be used in developed countries for producing electricity from steam power by heating water in boilers.

Coal is the largest carbon dioxide emitter per unit area when it comes to electricity generation. Carbon is also the most common ingredient in charcoal. There has been a recent push to replace the burning of fossil fuels with biomass. The replacement of this non-renewable resource with biological waste would lower the carbon footprint and lower the overall pollution of the world.

The briquettes have a high potential to generate energy, they also help in reducing land, soil, and air pollution. Moreover, this process of recycling biowaste and converting it into fuel is very economical and also has low maintenance costs. Briquettes are rapidly gaining popularity and are becoming the first choice of industries as a primary source of energy.

Biomass Briquettes Market Growth and Trend Analysis:

Sustainable Energy for Industrial Heating and Power Generation

- Briquettes have a great potential to be used to replace or supplement the current energy sources being used for household energy, especially for cooking, They can also be replaced with coal. The bio-mass briquettes are the best project to create a substitute for fossil fuels without harming the environment Briquette production can be considered as one of the essential waste management practices. Most developing countries have agricultural waste as crop residue or industrial waste as sludge or sewage. The most applicable energy generation in those countries is based on biomass and fossil fuels.

- However, waste disposal practices are in a deplorable situation in developing countries. As a result, reusing waste to make fire briquettes will improve environmental quality and sustainability while lowering energy generation costs by providing employment opportunities for those living in rural areas.

- Biomass briquettes are widely used as a fuel source for industrial heating applications. They can be used in boilers, furnaces, and kilns to generate heat for various industrial processes. Biomass briquettes provide a consistent and reliable source of heat, making them ideal for industries that require a steady supply of energy.

- Biomass briquettes can also be used to generate electricity in biomass power plants. These plants utilize biomass briquettes as a fuel source to produce steam, which is then used to drive turbines and generate electricity. Biomass briquettes offer a renewable and sustainable energy source for power generation, reducing the reliance on fossil fuels.

Biomass Briquettes Struggle with Automation and Efficiency

- While biomass briquetting has its merits, it also comes with several challenges. Briquettes are only sometimes suitable for automatic fuel feeding and may lead to suboptimal combustion compared to other fuels. As industries increasingly shift towards automation, biomass briquettes could need to help maintain relevance. Other fuels, such as pellets, Astillas, and certain types of loose biomass, offer better efficiency and cost-effectiveness, making them more suitable for modern industrial applications.

Implementation of Blockchain Technology

- Blockchain technology serves actively as a tool for sustainable acquisition methods. The implementation of blockchain enables companies to verify sustainable harvest operations of biomass materials starting from wood and agricultural waste. Blockchain controls operations by blocking the entry of wood from illegal harvests and provides transparency across all supply chain stages.

- For instance, A partnership develops between Enviva and GoChain to help achieve higher tracking standards for their biomass products through Seattle-based blockchain platform solutions. The application of blockchain technology allows Enviva to monitor essential information starting from forest tract locations up to production plant details and raw material weights along with fiber types during each production stage.

- The digital ledger system enables better management of biomass sourcing by improving both material transparency and accuracy in addition to ensuring sustainable sourcing alongside regulatory compliance.

Biomass Briquettes Market Segment Analysis:

Biomass Briquettes Market is segmented based on type, feedstock, application, and region

By Type, the Sawdust Biomass Briquette segment is expected to dominate the market during the forecast period

- Briquettes produced from agro-residues are fairly good substitutes for coal, lignite, and firewood. Briquettes from sawdust have a high specific density of 1400 kg/m3 compared to the bulk density of 210 kg/m3 (approx.) of loose sawdust. Loading/unloading, transportation, and storage costs of agro-residues are drastically reduced if they are converted in the form of briquettes. The formation of briquettes at the very site of its production stops air pollution to a large extent.

- Hence briquetting of sawdust produces a renewable and environment-friendly source of energy. The demand for sawdust briquettes is increasing due to their cost-effectiveness, high energy output, and positive environmental impact, further driving the market's growth. With their ability to replace traditional fossil fuels and offer substantial benefits in terms of storage and transportation, sawdust briquettes are positioned as a leading solution in the renewable energy market.

By Application, Power Generation segment held the largest share in 2023

- Biomass energy remains a stable contributor to the renewable energy landscape. It primarily derives from two key sources wood biomass and waste biomass. Over the years, wood biomass has consistently provided 5.4 quadrillion Btu of energy, while waste biomass contributes approximately 1.4 quadrillion Btu.

- In the electric power sector, biomass plays a steady role, supplying energy to large utility-scale power plants and maintaining its share in the overall renewable energy mix. Biomass is expected to remain relatively constant in its contribution to the renewable sector.

Biomass Briquettes Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- In North America, countries such as the U.S. and Canada have seen increasing adoption of biomass briquettes in response to growing environmental concerns and the need for renewable energy sources.

- The renewable energy source biomass made from organic plant and animal materials serves as a substantial resource to power different sectors around the world and in the United States. Total U.S. energy consumption for biomass during 2023 represented 5% which resulted in 4,978 trillion British thermal units (TBtu). The use of biomass extends to heating functions electricity production and transportation fuel needs. Biomass serves critically important purposes for developing nations due to they deploy its extensive use for both cooking and heating requirements.

- The largest consumer of biomass energy, accounting for 45% of biomass energy use. Industries such as wood products and paper mills use biomass in combined heat and power (CHP) plants.

- In recent years, biomass energy exports have been rising, with wood pellets becoming a key export commodity. In 2023, the U.S. exported approximately 8.6 million tons of wood fuel pellets, further solidifying its position as a leading player in the global biomass energy market.

Biomass Briquettes Market Active Players:

- Agro Energy (India)

- Biomass Power Solutions (USA)

- Biomass Secure Power (Canada)

- Biomass UK (United Kingdom)

- BMC (Biomass Energy Corporation) (USA)

- Briquettes Europe (France)

- Drax Group (UK)

- Enviva (USA)

- FutureMetrics LLC (USA)

- German Pellets (Germany)

- Granule Group (China)

- Greenwood Resources (USA)

- Kraton Polymers (USA)

- Other Active Players

- Pacific BioEnergy (Canada)

- Rentech, Inc. (USA)

- Samson Energy (Brazil)

- Simec Group (Australia)

- Växjö Energy (Sweden)

- Westervelt Renewable Energy (USA)

- Wood Pellet Group (Denmark)

- Other Active Key Players

Key Industry Developments in the Biomass Briquettes Market:

- In September 2024, Brazilian mining company Vale and Midrex Technologies agreed to cooperate in promoting a technical solution for the use of iron ore briquettes in direct reduction plants. This is stated in a press release from Midrex. The companies signed a technical cooperation agreement. The agreement expands the cooperation between the parties and the testing work started over the past year.

- In February 2024, GHG Reduction Technologies Pvt. Ltd., a subsidiary of EKI Energy Services Ltd., announced the inauguration of its state-of-the-art Biomass Briquettes (Biocoal) manufacturing plant in India. The inauguration ceremony marked a significant milestone in GHG Reduction Technology's ongoing commitment towards clean energy transitions and mitigating global warming.

|

Biomass Briquettes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 900 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.95 % |

Market Size in 2032: |

USD 1,791.62 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Feedstock |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Biomass Briquettes Market by By Type (2018-2032)

4.1 Biomass Briquettes Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Sawdust Biomass Briquettes

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Agromass Biomass Briquettes

4.5 Wood Biomass Briquettes.

Chapter 5: Biomass Briquettes Market by By Feedstock (2018-2032)

5.1 Biomass Briquettes Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Agriculture Waste

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Wood and Woody Residue

5.5 Solid Municipal Waste

5.6 Other Feedstocks

Chapter 6: Biomass Briquettes Market by By Application (2018-2032)

6.1 Biomass Briquettes Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Power Generation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Thermal Energy

6.5 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Biomass Briquettes Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AGRO ENERGY (INDIA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BIOMASS POWER SOLUTIONS (USA)

7.4 BIOMASS SECURE POWER (CANADA)

7.5 BIOMASS UK (UNITED KINGDOM)

7.6 BMC (BIOMASS ENERGY CORPORATION) (USA)

7.7 BRIQUETTES EUROPE (FRANCE)

7.8 DRAX GROUP (UK)

7.9 ENVIVA (USA)

7.10 FUTUREMETRICS LLC (USA)

7.11 GERMAN PELLETS (GERMANY)

7.12 GRANULE GROUP (CHINA)

7.13 GREENWOOD RESOURCES (USA)

7.14 KRATON POLYMERS (USA)

7.15 PACIFIC BIOENERGY (CANADA)

7.16 RENTECH INC. (USA)

7.17 SAMSON ENERGY (BRAZIL)

7.18 SIMEC GROUP (AUSTRALIA)

7.19 VÄXJÖ ENERGY (SWEDEN)

7.20 WESTERVELT RENEWABLE ENERGY (USA)

7.21 WOOD PELLET GROUP (DENMARK)

7.22 OTHER ACTIVE PLAYERS.

Chapter 8: Global Biomass Briquettes Market By Region

8.1 Overview

8.2. North America Biomass Briquettes Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Sawdust Biomass Briquettes

8.2.4.2 Agromass Biomass Briquettes

8.2.4.3 Wood Biomass Briquettes.

8.2.5 Historic and Forecasted Market Size By By Feedstock

8.2.5.1 Agriculture Waste

8.2.5.2 Wood and Woody Residue

8.2.5.3 Solid Municipal Waste

8.2.5.4 Other Feedstocks

8.2.6 Historic and Forecasted Market Size By By Application

8.2.6.1 Power Generation

8.2.6.2 Thermal Energy

8.2.6.3 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Biomass Briquettes Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Sawdust Biomass Briquettes

8.3.4.2 Agromass Biomass Briquettes

8.3.4.3 Wood Biomass Briquettes.

8.3.5 Historic and Forecasted Market Size By By Feedstock

8.3.5.1 Agriculture Waste

8.3.5.2 Wood and Woody Residue

8.3.5.3 Solid Municipal Waste

8.3.5.4 Other Feedstocks

8.3.6 Historic and Forecasted Market Size By By Application

8.3.6.1 Power Generation

8.3.6.2 Thermal Energy

8.3.6.3 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Biomass Briquettes Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Sawdust Biomass Briquettes

8.4.4.2 Agromass Biomass Briquettes

8.4.4.3 Wood Biomass Briquettes.

8.4.5 Historic and Forecasted Market Size By By Feedstock

8.4.5.1 Agriculture Waste

8.4.5.2 Wood and Woody Residue

8.4.5.3 Solid Municipal Waste

8.4.5.4 Other Feedstocks

8.4.6 Historic and Forecasted Market Size By By Application

8.4.6.1 Power Generation

8.4.6.2 Thermal Energy

8.4.6.3 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Biomass Briquettes Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Sawdust Biomass Briquettes

8.5.4.2 Agromass Biomass Briquettes

8.5.4.3 Wood Biomass Briquettes.

8.5.5 Historic and Forecasted Market Size By By Feedstock

8.5.5.1 Agriculture Waste

8.5.5.2 Wood and Woody Residue

8.5.5.3 Solid Municipal Waste

8.5.5.4 Other Feedstocks

8.5.6 Historic and Forecasted Market Size By By Application

8.5.6.1 Power Generation

8.5.6.2 Thermal Energy

8.5.6.3 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Biomass Briquettes Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Sawdust Biomass Briquettes

8.6.4.2 Agromass Biomass Briquettes

8.6.4.3 Wood Biomass Briquettes.

8.6.5 Historic and Forecasted Market Size By By Feedstock

8.6.5.1 Agriculture Waste

8.6.5.2 Wood and Woody Residue

8.6.5.3 Solid Municipal Waste

8.6.5.4 Other Feedstocks

8.6.6 Historic and Forecasted Market Size By By Application

8.6.6.1 Power Generation

8.6.6.2 Thermal Energy

8.6.6.3 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Biomass Briquettes Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Sawdust Biomass Briquettes

8.7.4.2 Agromass Biomass Briquettes

8.7.4.3 Wood Biomass Briquettes.

8.7.5 Historic and Forecasted Market Size By By Feedstock

8.7.5.1 Agriculture Waste

8.7.5.2 Wood and Woody Residue

8.7.5.3 Solid Municipal Waste

8.7.5.4 Other Feedstocks

8.7.6 Historic and Forecasted Market Size By By Application

8.7.6.1 Power Generation

8.7.6.2 Thermal Energy

8.7.6.3 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Biomass Briquettes Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 900 Mn. |

|

Forecast Period 2024-32 CAGR: |

7.95 % |

Market Size in 2032: |

USD 1,791.62 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Feedstock |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Biomass Briquettes Market research report is 2024-2032.

Agro Energy (India), Biomass Power Solutions (USA), Biomass Secure Power (Canada), Biomass UK (United Kingdom), BMC (Biomass Energy Corporation) (USA), Briquettes Europe (France), Drax Group (UK), Enviva (USA), FutureMetrics LLC (USA), German Pellets (Germany), Granule Group (China), Greenwood Resources (USA), Kraton Polymers (USA), Pacific BioEnergy (Canada), Rentech, Inc. (USA), Samson Energy (Brazil), Simec Group (Australia), Växjö Energy (Sweden), Westervelt Renewable Energy (USA), Wood Pellet Group (Denmark), and Other Active Players.

The Biomass Briquettes Market is segmented into Type, Nature, Application, and Region. By Type, it is categorized into Sawdust Biomass Briquettes, Agromass Biomass Briquettes, and Wood Biomass Briquettes. By Feedstock, it is categorized into Agriculture Waste, Wood and Woody Residue, Solid Municipal Waste, and Other Feedstocks. By Application, it is categorized into Power Generation, Thermal Energy, and Others. By Region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Biomass briquettes are a biofuel substitute made of biodegradable green waste with lower emissions of greenhouse gases and carbon dioxide than traditional fuel sources. This fuel source is used as an alternative to harmful biofuels. Briquettes are used for heating, cooking fuel, and electricity generation

The Biomass Briquettes Market Size Was Valued at USD 900 Million in 2023 and is Projected to Reach USD 1,791.62 Million by 2032, Growing at a CAGR of 7.95% From 2024-2032.