Bioresorbable Implants Market Synopsis:

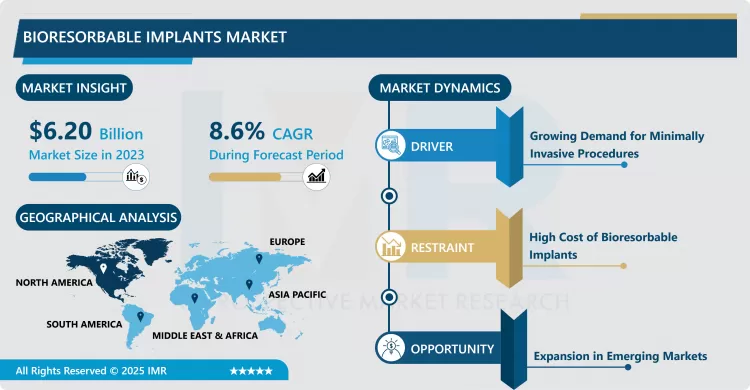

Bioresorbable Implants Market Size Was Valued at USD 6.20 Billion in 2023, and is Projected to Reach USD 13.03 Billion by 2032, Growing at a CAGR of 8.6% From 2024-2032.

Medical devices which are bioresorbable or which dissolve in the human body after delivering the intended performance are known as Bioresorbable Implants Market. These implants are intended to be used in operations where other forms of permanent implant would be useless because they would need other surgery to spare the implant. They are most applicable today in orthopedics cardiovascular and dental surgeries in that they provide opportunities for healing without the risks inherent with implants.

The use of bioserodegradable implants presents the following improvements in surgical management and patients’ security. These implants are normally of biodegradable substances which dissolve in the human body after performing their task of offering support to the tissues that need healing. The technology involved in its use is most suitable to clear up complications arising from implantable materials in the body, for example, infections, and inflammation. It thus has become a burgeoning segment over the last years, due to a rising trend toward minimally invasive therapies and improved patient benefits.

In this market, material advancements and manufacturing have expanded the uses of bioresorbable implants beyond the previous applications. These implants are now applied mostly in orthopedics, cardiovascular operations, and dental operations where there is no need for a second surgery to remove the implant. Recent advancements in biopolymers, new composite material, and manufacturing technologies are pushing forward biomechanical characteristics and degradation profiles of the implant that best suits specific medical applications. In addition, the conventional metallic and polymeric implants are being replaced by bioresorbable ones due to the fact that patients as well as healthcare providers prefer bioresorbable ones due to their cheaper prices and shorter time to heal than the normal implants.

Bioresorbable Implants Market Trend Analysis:

Increased Use of Polylactic Acid (PLA) in Bioresorbable Implants

- Among the factors which can be observed in the context of the Bioresorbable Implants Market, an important and currently growing tendency may be considered the usage of polylactic acid (PLA) as the key material. PLA is preferred for its characteristic of providing consistent biodegradation rate and excellent biocompatibility that is adaptable in a variety of bioresorbable uses. Co-extruded with polylactic acid from renewable resources, it contributes positively to sustainable healthcare while providing the hard structure needed during the healing process.

- PLA is widely used in mechanical ventures such as orthopedic and dental surgery since it gives power and sturdiness amid underlying recuperation while struggling to evaporate inside the body. The tendency of PLA usage corresponds to the general inclination toward environmentally friendly and biodegradable materials present in health care. Thus, as manufacturers move forward with experimenting with PLA and other high-end polymers, they will in all likelihood bring to medical field biodegradable implants featuring better biocompatibility and a more specific degradation cycle, which will only help in pushing the use of PLA based biodegradable implants forward at a faster space across the market.

Expansion in Emerging Markets

- The market for bioresorbable implants offers great potential for growth in the untapped markets of Asia-Pacific and Latin America. The healthcare expenditure has increased more in these regions with better access to sophisticated health care technologies and an increase in surgical procedures because of the incidence of orthopedic and cardiovascular diseases. There is also a growing healthcare industrial base for these regions, which in return means that they are ideal for manufacturing industries that want to venture into new markets.

- That is why, with the availability of the bioresorbable implant, the patients in the emerging regions are offered the treatment suitable to minimize the surgical risks and recovery time. With the increase in knowledge regarding use of bioresorbable implants in the treatment of patients, then the demand in those area of the world is expected to increase. Those companies that are willing to invest in growth of their markets in these countries will have an early bird advantage, governmental support and increasing patient population, meaning that the growth that these regions have should be capitalized on.

Bioresorbable Implants Market Segment Analysis:

The bioresorbable Implants Market is Segmented on the basis of Material Type, Application, End User, and Region

By Material Type, Polylactic Acid (PLA) segment is expected to dominate the market during the forecast period

- In the case of implant materials, Polylactic Acid (PLA) and Polyglycolic Acid (PGA) dominate the market primarily because of their biocompatibility and controlled degradation behaviour. PLA has been popular for use in orthopedic implants in recent years because besides giving mechanical support in the initial stages required for bone healing it degrades more slowly than other polymeric materials which make it suitable for applications which require slow degradation. PGA is on the other hand famous for its rapid resorption and therefore ideal for uses that need tissue healing support. Polycaprolactone (PCL) and Polydioxanone (PDO) are also widely used due to their high utility in application where controlled degradation rate is desirable.

- The choice includes PLA and PCL as these materials are strong enough to sustain bone load during the healing period and let themselves be metabolized by the body later. PDO and other materials are thus applied in cardiovascular and dental applications where faster or controlled degradation rates are required. As discoveries are made in material science newer composites and bio-based materials are predicted to further improve the functional characteristics of bioresorbable implants expanding its application.

By Application, Orthopedic Implants segment expected to held the largest share

- The sports medicine, orthopedic sector has the largest share of the bioresorbable implants business due to the fact that bones are continually subjecting to injuries, fractures or other degenerative ailments that require support for healing. Bioresorbable implants are especially appreciated in this sector because they do not require implant removal surgery which boosts the risks of secondary surgeries. Another major segment that can be considered belongs to cardiovascular implants; they provide perfect short-term solution in cases of one operation such as in vascular grafts, when the implant has to support vessels as they grow and then is safely resorbed.

- The use of bioresorbable implants has gained increased demand in dental applications because their use has little or no effect on causing infections and uniquely fit in the body. Other potential uses that are also being realized include soft tissue repair and reconstruction as new classes of bioresorbable materials unbend to the specifications of other medical procedures. The innovations in everything from imaging application to molecular diagnostics means that the market has the potential to grow in its utility and application across a broad amount of medical specialties in order to improve the overall quality of patients’ care.

Bioresorbable Implants Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is dominating the Bioresorbable Implants Market owing to improved healthcare facilities, increased health care expenditure, and increased research activities. Besides, favourable regulatory conditions existing in the region, as well as the high level of recognition of bioresorbable products among both, healthcare practitioners and patients, have also played a role here. North America has also grown implanted usage of biomaterial based products in terms of orthopedics, cardiovascular and dental implants, most of which is bioresorbable.

- North America also has many key players in the medical device industry and continuous advancement in material science to support its market. Government policies regarding all kinds of medical equipment and reimbursement associated with implants of the United States and Canada also contribute to the expansion of bioresorbable implants market. That is why despite the rather slow growth of the section, North America remains underway of the industry leader due to the increasing demand for outpatient operations.

Active Key Players in the Bioresorbable Implants Market:

- DePuy Synthes (US)

- Stryker Corporation (US)

- Smith & Nephew (UK)

- Zimmer Biomet (US)

- CONMED Corporation (US)

- Medtronic (Ireland)

- Bioretec Ltd. (Finland)

- B. Braun Melsungen AG (Germany)

- Arthrex, Inc. (US)

- KLS Martin Group (Germany)

- DSM Biomedical (Netherlands)

- Integra LifeSciences (US)

- Other Active Players

Key Industry Developments in the Bioresorbable Implants Market:

- In March 2023, Bioretec Ltd, a medical device company, received FDA market authorization for its RemeOs trauma screw, marking a milestone as the first and only company offering bioresorbable metal implants in the U.S. This innovation aims to replace traditional titanium and steel implants used in healing bone fractures, eliminating the need for removal surgeries.

|

Bioresorbable Implants Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.20 Billion |

|

Forecast Period 2024-32 CAGR: |

8.6% |

Market Size in 2032: |

USD 13.03 Billion |

|

Segments Covered: |

By Material Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bioresorbable Implants Market by By Material Type (2018-2032)

4.1 Bioresorbable Implants Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Polylactic Acid (PLA)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Polyglycolic Acid (PGA)

4.5 Polycaprolactone (PCL)

4.6 Polydioxanone (PDO)

4.7 Others

Chapter 5: Bioresorbable Implants Market by By Application (2018-2032)

5.1 Bioresorbable Implants Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Orthopedic Implants

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cardiovascular Implants

5.5 Dental Implants

5.6 Other

Chapter 6: Bioresorbable Implants Market by By End User (2018-2032)

6.1 Bioresorbable Implants Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Specialty Clinics

6.5 Ambulatory Surgical Centers

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Bioresorbable Implants Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 DEPUY SYNTHES (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 STRYKER CORPORATION (US)

7.4 SMITH & NEPHEW (UK)

7.5 ZIMMER BIOMET (US)

7.6 CONMED CORPORATION (US)

7.7 MEDTRONIC (IRELAND)

7.8 BIORETEC LTD. (FINLAND)

7.9 B. BRAUN MELSUNGEN AG (GERMANY)

7.10 ARTHREX INC. (US)

7.11 KLS MARTIN GROUP (GERMANY)

7.12 DSM BIOMEDICAL (NETHERLANDS)

7.13 INTEGRA LIFESCIENCES (US)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Bioresorbable Implants Market By Region

8.1 Overview

8.2. North America Bioresorbable Implants Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Material Type

8.2.4.1 Polylactic Acid (PLA)

8.2.4.2 Polyglycolic Acid (PGA)

8.2.4.3 Polycaprolactone (PCL)

8.2.4.4 Polydioxanone (PDO)

8.2.4.5 Others

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Orthopedic Implants

8.2.5.2 Cardiovascular Implants

8.2.5.3 Dental Implants

8.2.5.4 Other

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Hospitals

8.2.6.2 Specialty Clinics

8.2.6.3 Ambulatory Surgical Centers

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Bioresorbable Implants Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Material Type

8.3.4.1 Polylactic Acid (PLA)

8.3.4.2 Polyglycolic Acid (PGA)

8.3.4.3 Polycaprolactone (PCL)

8.3.4.4 Polydioxanone (PDO)

8.3.4.5 Others

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Orthopedic Implants

8.3.5.2 Cardiovascular Implants

8.3.5.3 Dental Implants

8.3.5.4 Other

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Hospitals

8.3.6.2 Specialty Clinics

8.3.6.3 Ambulatory Surgical Centers

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Bioresorbable Implants Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Material Type

8.4.4.1 Polylactic Acid (PLA)

8.4.4.2 Polyglycolic Acid (PGA)

8.4.4.3 Polycaprolactone (PCL)

8.4.4.4 Polydioxanone (PDO)

8.4.4.5 Others

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Orthopedic Implants

8.4.5.2 Cardiovascular Implants

8.4.5.3 Dental Implants

8.4.5.4 Other

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Hospitals

8.4.6.2 Specialty Clinics

8.4.6.3 Ambulatory Surgical Centers

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Bioresorbable Implants Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Material Type

8.5.4.1 Polylactic Acid (PLA)

8.5.4.2 Polyglycolic Acid (PGA)

8.5.4.3 Polycaprolactone (PCL)

8.5.4.4 Polydioxanone (PDO)

8.5.4.5 Others

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Orthopedic Implants

8.5.5.2 Cardiovascular Implants

8.5.5.3 Dental Implants

8.5.5.4 Other

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Hospitals

8.5.6.2 Specialty Clinics

8.5.6.3 Ambulatory Surgical Centers

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Bioresorbable Implants Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Material Type

8.6.4.1 Polylactic Acid (PLA)

8.6.4.2 Polyglycolic Acid (PGA)

8.6.4.3 Polycaprolactone (PCL)

8.6.4.4 Polydioxanone (PDO)

8.6.4.5 Others

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Orthopedic Implants

8.6.5.2 Cardiovascular Implants

8.6.5.3 Dental Implants

8.6.5.4 Other

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Hospitals

8.6.6.2 Specialty Clinics

8.6.6.3 Ambulatory Surgical Centers

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Bioresorbable Implants Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Material Type

8.7.4.1 Polylactic Acid (PLA)

8.7.4.2 Polyglycolic Acid (PGA)

8.7.4.3 Polycaprolactone (PCL)

8.7.4.4 Polydioxanone (PDO)

8.7.4.5 Others

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Orthopedic Implants

8.7.5.2 Cardiovascular Implants

8.7.5.3 Dental Implants

8.7.5.4 Other

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Hospitals

8.7.6.2 Specialty Clinics

8.7.6.3 Ambulatory Surgical Centers

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Bioresorbable Implants Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.20 Billion |

|

Forecast Period 2024-32 CAGR: |

8.6% |

Market Size in 2032: |

USD 13.03 Billion |

|

Segments Covered: |

By Material Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Bioresorbable Implants Market research report is 2024-2032.

DePuy Synthes (US), Stryker Corporation (US), Smith & Nephew (UK), Zimmer Biomet (US), CONMED Corporation (US), Medtronic (Ireland), Bioretec Ltd. (Finland), B. Braun Melsungen AG (Germany), Arthrex, Inc. (US), KLS Martin Group (Germany), DSM Biomedical (Netherlands), Integra LifeSciences (US), and Other Active Players.

The Bioresorbable Implants Market is segmented into Material Type, Application, End User and region. By Material Type, the market is categorized into Polylactic Acid (PLA), Polyglycolic Acid (PGA), Polycaprolactone (PCL), Polydioxanone (PDO), Others. By Application, the market is categorized into Orthopedic Implants, Cardiovascular Implants, Dental Implants, Other. By End-User, the market is categorized into Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Bioresorbable Implants Market encompasses medical devices that are bioresorbable and thus, become a part of the body after they have delivered their function. These implants are used in surgeries that would require permanent implants to be inapplicable since they would require other surgeries to remove the implant. They are most applicable today in orthopedics cardiovascular and dental surgeries in that they provide opportunities for healing without the risks inherent with implants.

Bioresorbable Implants Market Size Was Valued at USD 6.20 Billion in 2023, and is Projected to Reach USD 13.03 Billion by 2032, Growing at a CAGR of 8.6% From 2024-2032.