Blood and Blood Components Market Synopsis:

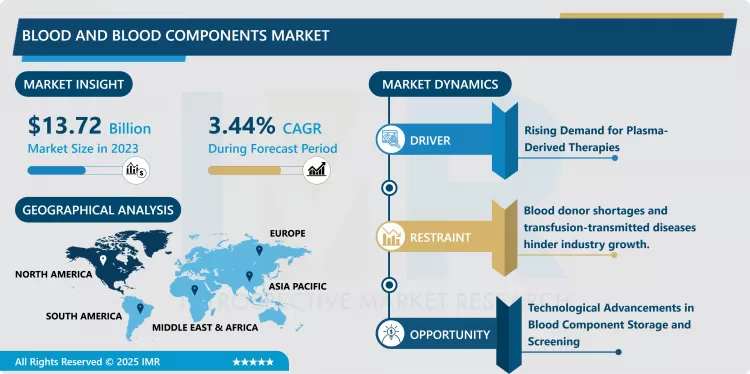

Blood and Blood Components Market Size Was Valued at USD 13.72 Billion in 2023, and is Projected to Reach USD 18.60 Billion by 2032, Growing at a CAGR of 3.44% From 2024-2032.

The Blood and Blood Components Market is one of the vital segments of the healthcare industry because of the requirements of blood providing, transfusion, and surgeries and treatments of diseases. It is a blood component made up of red blood cells, plasma, platelets and cryoprecipitate that is useful in patients with hematological disorders, trauma, cancer treatment and surgery. There is steady progress of demand in this market due to the evolution of blood processing techniques, and enhanced knowledge of blood donation across the world.

There is also an added demand due to increase rates of chronic diseases such as cardiovascular and cancers which require blood components and or certain element of the blood. Blood component therapy through which it becomes possible to deliver the affected part of the blood instead of the entire blood has enhanced the patient’s clinical results and the utilization of resources. Not only that, but the elderly population is on the rise, and they are more vulnerable to chronic diseases, which drive the market further. Improvement in food supply chain safety measures has prompted the development of even better ways of packing, transporting and conducting tests on them so as to make them safe for use, Additionally, the rising elderly population, who are more prone to chronic diseases, is also contributing to the market's expansion. Efforts to enhance the safety and accessibility of blood supply chains have led to innovations in storage, transportation, and screening processes, ensuring that blood products remain safe and effective for use.

However, the market faces challenges such as blood shortages, particularly in developing regions, where the availability of donated blood is limited. Another challenge arising from regulatory requirements is that the costs involved in blood collection and blood storage also remain high, thus can be prohibitive for small scale of blood banks. Still, continual campaigns by governments and other organizations that encourage blood donation coupled with improvements in blood storage and testing technologies are rich opportunities that the market can capitalise on. Moreover, collaborations both internally within the industry as well as externally are proactively solving the supply chain problem and increasing the demand of components in the blood globally.

Blood and Blood Components Market Trend Analysis:

Rising Demand for Plasma-Derived Therapies

- Plasma derived products are seeing incredible demand because of developments in autoimmune diseases, immunological deficiencies and other chronic illnesses treatments.. Clotting factors and immunoglobulins that are harvested from plasma are useful to hemophiliacs, patients with autoimmune diseases or other immune deficiencies. As the diagnosis rates of diseases rise and awareness of such therapies grow, there is a burgeoning market for plasma-derived products. Thirdly, technical advancements in plasma fractionation are enhancing effectiveness of these treatments to address increasing growth worldwide.

Technological Advancements in Blood Component Storage and Screening

- Advances made in storage and screening technologies of blood components are greatly improving the quality and stability of blood products.. Better and efficient refrigerator technologies and pathogen inactivation techniques have made it possible to preserve blood components for longer periods and at the same time minimize chances of transmitting diseases when trans.fusing blood products. As for the blood typing, screening, and component separation there are also the signs of growing the automation level in blood banks which will allow to provide better distribution of human resources and respond faster to the emergencies. Some of these technologies are very important to practice steady and secure blood supply especially in the areas or countries where there is shortage of the donors or high need of the blood products.

Blood and Blood Components Market Segment Analysis:

Blood and Blood Components Market is Segmented on the basis of Product Type, Application, End Use, and Region.

By Product Type, Whole Blood and Blood Components segment is expected to dominate the market during the forecast period

- The Blood and Blood Components Market share is classified based on the product type as whole blood, packed red blood cells, leukocytes, platelets, and plasma.. While whole blood is sometimes used for emergency situations where the component is required for transfusion, whole, individual components are more typically used in targeted therapies that treat disorders ranging from anemia to clotting disorders to immune deficiencies. For example red blood cells play a very important role in tackling blood loss and anemia and likewise platelets play a noble role in treating patients with bleeding disorders. Plasma is the protein and antibodies solution, which makes plasma particularly useful for the production of the plasma derived products such as factors essential to patients suffering from immune and coagulation disorders. The above segmentation makes it easier for health care providers to define the transfusion therapy to fit different diseases, thereby improving the effectiveness of treatment plans for several disorders.

By Application, Trauma and Surgery segment expected to held the largest share

- The Blood and Blood Components Market, based on the segments by application, caters to the essential medical requirement such as anaemia, trauma/surgery, cancer treatment, bleeding disorder and other rare blood disorder.. For example, in anemia management and treatment, there is need to transfuse packed red blood cells for those clients who have very low level of red blood cells, in trauma and surgery, there is need to administer blood components to treat patients whose status is alarming due to bleeding. Another treatment commonly accompanied with cancer is one that includes use of blood transfusions to patients who are receiving chemotherapy or radiation therapy that results in low blood cell counts. Medical conditions like hemophilia depend on a particular blood products for instance clotting factors to prevent or manage bleeding incidents. Moreover, diseases such as some rare blood disorders also require particular type of transfusion, which shows that blood and blood product is relevant in many therapeutic contexts.

Blood and Blood Components Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- According to the analysis, the market is expected to witness growth in North America during the forecasts period due to factors such as: well-developed health system, enhanced awareness, and sound facilities for blood procurement and distribution.. The region has had access to well organized blood bank networks and has invested heavily towards research on new blood products and transfusion technologies. Further, increasing usage of plasma derived therapeutics and well established regulatory environment for blood assortment is key driver. A special emphasis is made upon the United States where constant innovations in blood technology, particularly, in the area of storing, screening, and applying pathogen reduction to blood components guarantee an unhampered access to safe blood products.

Active Key Players in the Blood and Blood Components Market:

- Becton, Dickinson & Co. (US)

- Kidde-Fenwal Inc. (US)

- Bio-Rad Laboratories, Inc. (US)

- Cerus Corporation (US)

- Immucor (US)

- Beckman Coulter, Inc. (US)

- bioMérieux SA (France)

- Octapharma AG (Switzerland)

- Abbott (US)

- CSL Behring LLC (Australia)

- MacoPharma (France)

- Shanghai RAAS (China)

- China Biologic Products Holdings, Inc. (China)

- Takeda Pharmaceutical Company Limited (Japan)

- Grifols S.A. (Spain)

- Bharat Serums and Vaccines Ltd. (India), and Other Active Players.

|

Global Blood and Blood Components Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.72 Billion |

|

Forecast Period 2024-32 CAGR: |

3.44% |

Market Size in 2032: |

USD 18.60 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Blood and Blood Components Market by By Product Type (2018-2032)

4.1 Blood and Blood Components Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Whole Blood and Blood Components

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Red Blood Cells

4.5 White Blood Cells

4.6 Platelets

4.7 Plasma

Chapter 5: Blood and Blood Components Market by By Application (2018-2032)

5.1 Blood and Blood Components Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Anemia

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Trauma and Surgery

5.5 Cancer Treatment

5.6 Bleeding Disorders

5.7 Others (Others include rare blood diseases)

Chapter 6: Blood and Blood Components Market by By End User (2018-2032)

6.1 Blood and Blood Components Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centers

6.5 Blood and Blood Component Bank

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Blood and Blood Components Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 BECTON

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DICKINSON & CO. (US)

7.4 KIDDE-FENWAL INC. (US)

7.5 BIO-RAD LABORATORIES INC. (US)

7.6 CERUS CORPORATION (US)

7.7 IMMUCOR (US)

7.8 BECKMAN COULTER INC. (US)

7.9 BIOMÉRIEUX SA (FRANCE)

7.10 OCTAPHARMA AG (SWITZERLAND)

7.11 ABBOTT (US)

7.12 CSL BEHRING LLC (AUSTRALIA)

7.13 MACOPHARMA (FRANCE)

7.14 SHANGHAI RAAS (CHINA)

7.15 CHINA BIOLOGIC PRODUCTS HOLDINGS INC. (CHINA)

7.16 TAKEDA PHARMACEUTICAL COMPANY LIMITED (JAPAN)

7.17 GRIFOLS S.A. (SPAIN)

7.18 BHARAT SERUMS AND VACCINES LTD. (INDIA)

7.19 OTHER ACTIVE PLAYERS

Chapter 8: Global Blood and Blood Components Market By Region

8.1 Overview

8.2. North America Blood and Blood Components Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product Type

8.2.4.1 Whole Blood and Blood Components

8.2.4.2 Red Blood Cells

8.2.4.3 White Blood Cells

8.2.4.4 Platelets

8.2.4.5 Plasma

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Anemia

8.2.5.2 Trauma and Surgery

8.2.5.3 Cancer Treatment

8.2.5.4 Bleeding Disorders

8.2.5.5 Others (Others include rare blood diseases)

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Hospitals

8.2.6.2 Ambulatory Surgical Centers

8.2.6.3 Blood and Blood Component Bank

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Blood and Blood Components Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product Type

8.3.4.1 Whole Blood and Blood Components

8.3.4.2 Red Blood Cells

8.3.4.3 White Blood Cells

8.3.4.4 Platelets

8.3.4.5 Plasma

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Anemia

8.3.5.2 Trauma and Surgery

8.3.5.3 Cancer Treatment

8.3.5.4 Bleeding Disorders

8.3.5.5 Others (Others include rare blood diseases)

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Hospitals

8.3.6.2 Ambulatory Surgical Centers

8.3.6.3 Blood and Blood Component Bank

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Blood and Blood Components Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product Type

8.4.4.1 Whole Blood and Blood Components

8.4.4.2 Red Blood Cells

8.4.4.3 White Blood Cells

8.4.4.4 Platelets

8.4.4.5 Plasma

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Anemia

8.4.5.2 Trauma and Surgery

8.4.5.3 Cancer Treatment

8.4.5.4 Bleeding Disorders

8.4.5.5 Others (Others include rare blood diseases)

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Hospitals

8.4.6.2 Ambulatory Surgical Centers

8.4.6.3 Blood and Blood Component Bank

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Blood and Blood Components Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product Type

8.5.4.1 Whole Blood and Blood Components

8.5.4.2 Red Blood Cells

8.5.4.3 White Blood Cells

8.5.4.4 Platelets

8.5.4.5 Plasma

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Anemia

8.5.5.2 Trauma and Surgery

8.5.5.3 Cancer Treatment

8.5.5.4 Bleeding Disorders

8.5.5.5 Others (Others include rare blood diseases)

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Hospitals

8.5.6.2 Ambulatory Surgical Centers

8.5.6.3 Blood and Blood Component Bank

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Blood and Blood Components Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product Type

8.6.4.1 Whole Blood and Blood Components

8.6.4.2 Red Blood Cells

8.6.4.3 White Blood Cells

8.6.4.4 Platelets

8.6.4.5 Plasma

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Anemia

8.6.5.2 Trauma and Surgery

8.6.5.3 Cancer Treatment

8.6.5.4 Bleeding Disorders

8.6.5.5 Others (Others include rare blood diseases)

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Hospitals

8.6.6.2 Ambulatory Surgical Centers

8.6.6.3 Blood and Blood Component Bank

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Blood and Blood Components Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product Type

8.7.4.1 Whole Blood and Blood Components

8.7.4.2 Red Blood Cells

8.7.4.3 White Blood Cells

8.7.4.4 Platelets

8.7.4.5 Plasma

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Anemia

8.7.5.2 Trauma and Surgery

8.7.5.3 Cancer Treatment

8.7.5.4 Bleeding Disorders

8.7.5.5 Others (Others include rare blood diseases)

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Hospitals

8.7.6.2 Ambulatory Surgical Centers

8.7.6.3 Blood and Blood Component Bank

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Blood and Blood Components Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.72 Billion |

|

Forecast Period 2024-32 CAGR: |

3.44% |

Market Size in 2032: |

USD 18.60 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Blood and Blood Components Market research report is 2024-2032.

Becton, Dickinson & Co. (US), Kidde-Fenwal Inc. (US), Bio-Rad Laboratories, Inc. (US), Cerus Corporation (US), Immucor (US), Beckman Coulter, Inc. (US), bioMérieux SA (France), Octapharma AG (Switzerland), Abbott (US), CSL Behring LLC (Australia), MacoPharma (France), Shanghai RAAS (China), China Biologic Products Holdings, Inc. (China), Takeda Pharmaceutical Company Limited (Japan), Grifols S.A. (Spain), Bharat Serums and Vaccines Ltd. (India), and Other Active Players.

The Blood and Blood Components Market is segmented into by Product Type, by Application, End User and region. by Product Type (Whole Blood and Blood Components (Red Blood Cells, White Blood Cells, Platelets, and Plasma)), by Application (Anemia, Trauma and Surgery, Cancer Treatment, Bleeding Disorders, and Others (Others include rare blood diseases)), by End User (Hospitals, Ambulatory Surgical Centers, Blood and Blood Component Bank, and Others). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The Blood and Blood Components Market is one of the vital segments of the healthcare industry because of the requirements of blood providing, transfusion, and surgeries and treatments of diseases. It is a blood component made up of red blood cells, plasma, platelets and cryoprecipitate that is useful in patients with haemological disorders, trauma, cancer treatment and surgery. There is steady progress of demand in this market due to the evolution of blood processing techniques, and enhanced knowledge of blood donation across the world.

Blood and Blood Components Market Size Was Valued at USD 13.72 Billion in 2023, and is Projected to Reach USD 18.60 Billion by 2032, Growing at a CAGR of 3.44% From 2024-2032.