Blood Clot Retrieval Devices Market Synopsis

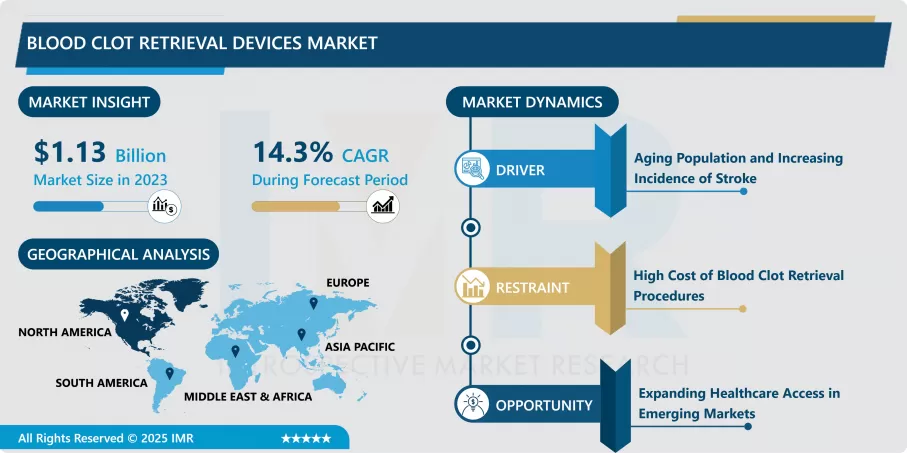

Blood Clot Retrieval Devices Market Size Was Valued at USD 1.13 Billion in 2023, and is Projected to Reach USD 3.76 Billion by 2032, Growing at a CAGR of 14.3% From 2024-2032.

The Blood Clot Retrieval Devices Market refers to the medical products designed to pull clot formations in blood vessels, particularly in cases of ischemic stroke and other severe vascular complications. These devices are mostly useful in recanalization, enhancing prognosis, and also minimizing the likelihood of serious consequences or deficits. This is through new developments in minimally invasive surgeries, the rising need for good solutions to any stroke cases, and enhanced perception of endovascular procedures.

- The Blood Clot Retrieval Devices Market is growing because of the increased incidence of strokes and other vascular conditions around the world that require quick diagnosis and effective treatment. It is for this reason that, despite being one of the leading causes of death and long-term disability globally, the field of stroke has received copious funding for advanced medical technologies that can enhance its results. MEs, aspiration devices, and stent retrievers are highly valuable instrumental tools in present-day endovascular therapies. Such devices are used instead of clot-dissolving drugs popular as they work in severe cases than the drugs at a faster rate in dissolving the blood clot.

- The market growth is due to the use of minimally invasive surgeries, global population aging because of increased vulnerability to vascular diseases. In addition, advances in health systems, especially in developing countries, are growing the adoption of such sophisticated healthcare technologies. The leading participants in the market are also aiming at offering enhanced products through enhancing aspect of a device and targeting the requirements of the specialized medical professionals and underlying challenges of cerebrovascular procedures.

Blood Clot Retrieval Devices Market Trend Analysis

Integration of Imaging Technology in Clot Retrieval Devices

- A current trend that is remains evident in the Blood Clot Retrieval Devices Market is the incorporation of Imaging Technologies in Clot Retrieval Systems. Incorporation of augmented reality optimizes appearance of actual images and experience, accuracy, and directional maneuvers of procedures, thereby minimizing hazardous incidences and increasing the probability of advantageous results. Fluoroscopy and intraoperative imaging help in accordance of retrieval devices, which are precise to treat complicated and sensitive areas, which include the brain’s vasculature.

- Also, emerging technology such as artificial intelligence and machine learning enhance the results of imaging supplemented clot retrieval systems. Another way that AI works to support health care is by alerting clinicians to blood clot locations and helping to plan optimal interventions — a necessity for time-sensitive conditions such as ischemic stroke. From this, it is expected that the integration of the imaging technology will enhance the tendencies of developing highly technological, less invasive approaches that will significantly enhance the efficiency, efficacy and safety of the treatments.

Expanding Healthcare Access in Emerging Markets

- The Blood Clot Retrieval Devices Market in emerging countries is also a big potential market because of better developments in healthcare infrastructure and the availability of sophisticated devices. There are number of countries in Asia-Pacific, Latin America and Middle East that are trying hard to improve the stock of health care facilities and coverage to ensure that more patients can reach for the life-saving procedures like clot retrieval devices.

- In addition, increased consciousness about stroke and improved usage of medical insurance in these area generate the need for blood clot retrieval solutions. It remains to add that the market segment associated with specialized hospitals is expanding continuously, and the availability of skilled professionals enhances this sector because more patients will be able to address these markets with valuable solutions.

Blood Clot Retrieval Devices Market Segment Analysis:

Blood Clot Retrieval Devices Market Segmented on the basis of product type, application, end user, and region

By Product Type, Aspiration Devices segment is expected to dominate the market during the forecast period

- Blood clot retrieval devices can be classified based on the product type as mechanical embolic removal devices, aspiration devices and stent retrievers depending on individual requisites of vascular operations. It is preferred to use mechanical embolic removal devices because they physically remove clots from bigger vessels efficiently. These devices are more helpful in the treatment of ischemic stroke in which early evacuation of the clot makes a lot of difference. The other category of devices is the aspiration devices that use certain suction to eliminate and remove blood clots. The use of aspiration devices has been considered because of the success recorded with regard to some vascular areas and because aspiration has lesser probability of traumatizing the blood vessels.

- Stent retrievers are another important product type which is popular because of the possibilities and efficacy in the treatment of acute ischemic stroke. They are intended to envelop and pull-out clots using a Stent mounted inside the vessel, enclosing the clot and then pulling it out. Stent retrievers are standard tools for the treatment of ischemic strokes and are used when it is necessary to restore blood flow.

By End User, Hospitals segment expected to held the largest share

- There are three major segments within the end-users: hospitals, ambulatory surgical centers, and specialty clinics. The largest end-user group is hospitals due to their ability to deal with crisis cases and complicated surgery plans. Hospitals have the structural facilities, human capital, and technology that makes them the most appropriate environments for the blood clot retrievals. Besides, hospitals can provide patients with round-the-clock monitoring after the procedure – which is particularly important for stroke treatment.

- ASCs and specialty clinics appear to be significant factors that growers are becoming cost effective and faster for patients requiring clot retrieval devices. In this regard, specialty clinics essentially address specific needs mainly through housing specialists in neurology and vascular services. Such relative availability of ASCs and specialty clinics also suggests that the trend toward outpatient care is well under way, especially in urban environment.

Blood Clot Retrieval Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is the largest market in the blood clot retrieval devices market primarily due to its higher healthcare standards, greater incidence of stroke, and large investment in the medical sector. The area has good and easily available infrastructure of health care centres and certainly highly skilled staff, which make it possible for most patients to undergo operations using clot retrieval devices. Moreover, the healthcare system of North America research and development areas as research for innovative devices and better patient care outcomes.

Furthermore, government policies and reimbursements for the U.S and Canada motivate the use of sophisticated medical equipment such as blood clotting retrieval systems. North American market is a major market for those devices as the population of that region is aging and there is growing demand for the minimally invasive treatment option

Active Key Players in the Blood Clot Retrieval Devices Market

- Medtronic (Ireland)

- Stryker Corporation (United States)

- Terumo Corporation (Japan)

- Penumbra, Inc. (United States)

- Johnson & Johnson (United States)

- Boston Scientific Corporation (United States)

- Teleflex Incorporated (United States)

- Edwards Lifesciences (United States)

- Merit Medical Systems (United States)

- Acandis GmbH (Germany)

- Balt USA (United States)

- Rapid Medical (Israel), Other Active Players

Key Industry Developments in the Blood Clot Retrieval Devices Market:

- In April 2024, Penumbra, Inc, a global healthcare company, announced FDA clearance and the launch of Lightning Flash 2.0, an advanced computer-assisted vacuum thrombectomy (CAVT) system. This system is designed to remove venous thrombus and treat pulmonary emboli (PE) with enhanced speed and sensitivity, utilizing Lightning Flash algorithms and novel catheter technology to navigate complex anatomy and potentially minimize blood loss.

- In February 2024, CERENOVUS, Inc., part of Johnson & Johnson MedTech, launched the CEREGLIDE 71 Intermediate Catheter, a next- generation device designed for the revascularization of acute ischemic stroke patients. This catheter, featuring TruCourse technology, is optimized for effective direct aspiration and delivery of compatible stent Retrievers Like The Embotrap Iii Revascularization Device, Enhancing The Cerenovus Stroke Solutions Portfolio.

Blood Clot Retrieval Devices Market Scope:

|

Global Blood Clot Retrieval Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.13 Billion |

|

Forecast Period 2024-32 CAGR: |

14.3% |

Market Size in 2032: |

USD 3.76 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Blood Clot Retrieval Devices Market by By Product Type (2018-2032)

4.1 Blood Clot Retrieval Devices Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Mechanical Embolic Removal Devices

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Aspiration Devices

4.5 Stent Retrievers

Chapter 5: Blood Clot Retrieval Devices Market by By Application (2018-2032)

5.1 Blood Clot Retrieval Devices Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Coronary Artery Disease

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Peripheral Artery Disease

5.5 Ischemic Stroke

Chapter 6: Blood Clot Retrieval Devices Market by By End User (2018-2032)

6.1 Blood Clot Retrieval Devices Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centers (ASCs)

6.5 Specialty Clinics

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Blood Clot Retrieval Devices Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MEDTRONIC (IRELAND)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 STRYKER CORPORATION (UNITED STATES)

7.4 TERUMO CORPORATION (JAPAN)

7.5 PENUMBRA INC. (UNITED STATES)

7.6 JOHNSON & JOHNSON (UNITED STATES)

7.7 BOSTON SCIENTIFIC CORPORATION (UNITED STATES)

7.8 TELEFLEX INCORPORATED (UNITED STATES)

7.9 EDWARDS LIFESCIENCES (UNITED STATES)

7.10 MERIT MEDICAL SYSTEMS (UNITED STATES)

7.11 ACANDIS GMBH (GERMANY)

7.12 BALT USA (UNITED STATES)

7.13 RAPID MEDICAL (ISRAEL)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Blood Clot Retrieval Devices Market By Region

8.1 Overview

8.2. North America Blood Clot Retrieval Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product Type

8.2.4.1 Mechanical Embolic Removal Devices

8.2.4.2 Aspiration Devices

8.2.4.3 Stent Retrievers

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Coronary Artery Disease

8.2.5.2 Peripheral Artery Disease

8.2.5.3 Ischemic Stroke

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Hospitals

8.2.6.2 Ambulatory Surgical Centers (ASCs)

8.2.6.3 Specialty Clinics

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Blood Clot Retrieval Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product Type

8.3.4.1 Mechanical Embolic Removal Devices

8.3.4.2 Aspiration Devices

8.3.4.3 Stent Retrievers

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Coronary Artery Disease

8.3.5.2 Peripheral Artery Disease

8.3.5.3 Ischemic Stroke

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Hospitals

8.3.6.2 Ambulatory Surgical Centers (ASCs)

8.3.6.3 Specialty Clinics

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Blood Clot Retrieval Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product Type

8.4.4.1 Mechanical Embolic Removal Devices

8.4.4.2 Aspiration Devices

8.4.4.3 Stent Retrievers

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Coronary Artery Disease

8.4.5.2 Peripheral Artery Disease

8.4.5.3 Ischemic Stroke

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Hospitals

8.4.6.2 Ambulatory Surgical Centers (ASCs)

8.4.6.3 Specialty Clinics

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Blood Clot Retrieval Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product Type

8.5.4.1 Mechanical Embolic Removal Devices

8.5.4.2 Aspiration Devices

8.5.4.3 Stent Retrievers

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Coronary Artery Disease

8.5.5.2 Peripheral Artery Disease

8.5.5.3 Ischemic Stroke

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Hospitals

8.5.6.2 Ambulatory Surgical Centers (ASCs)

8.5.6.3 Specialty Clinics

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Blood Clot Retrieval Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product Type

8.6.4.1 Mechanical Embolic Removal Devices

8.6.4.2 Aspiration Devices

8.6.4.3 Stent Retrievers

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Coronary Artery Disease

8.6.5.2 Peripheral Artery Disease

8.6.5.3 Ischemic Stroke

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Hospitals

8.6.6.2 Ambulatory Surgical Centers (ASCs)

8.6.6.3 Specialty Clinics

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Blood Clot Retrieval Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product Type

8.7.4.1 Mechanical Embolic Removal Devices

8.7.4.2 Aspiration Devices

8.7.4.3 Stent Retrievers

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Coronary Artery Disease

8.7.5.2 Peripheral Artery Disease

8.7.5.3 Ischemic Stroke

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Hospitals

8.7.6.2 Ambulatory Surgical Centers (ASCs)

8.7.6.3 Specialty Clinics

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Blood Clot Retrieval Devices Market Scope:

|

Global Blood Clot Retrieval Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.13 Billion |

|

Forecast Period 2024-32 CAGR: |

14.3% |

Market Size in 2032: |

USD 3.76 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Blood Clot Retrieval Devices Market research report is 2024-2032.

Medtronic (Ireland), Stryker Corporation (United States), Terumo Corporation (Japan), Penumbra, Inc. (United States), Johnson & Johnson (United States), Boston Scientific Corporation (United States), Teleflex Incorporated (United States), and Other Active Players.

The Blood Clot Retrieval Devices Market is segmented into Product Type, Application, End User and region. By product Type, the market is categorized into Mechanical Embolic Removal Devices, Aspiration Devices, Stent Retrievers. By Application, the market is categorized into Coronary Artery Disease, Peripheral Artery Disease, Ischemic Stroke. By End User, the market is categorized into Hospitals, Ambulatory Surgical Centers (ASCs), Specialty Clinics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Blood Clot Retrieval Devices Market refers to the medical products designed to pull clot formations in blood vessels particularly in cases of ischemic stroke and other severe vascular complications. These devices are mostly useful in recanalization, enhancing prognosis, and also minimizing the likelihood of serious consequences or deficit. This is through new developments in the minimally invasive surgeries, rising need for good solutions to any stroke cases, enhanced perception of the endovascular procedures.

Blood Clot Retrieval Devices Market Size Was Valued at USD 1.13 Billion in 2023, and is Projected to Reach USD 3.76 Billion by 2032, Growing at a CAGR of 14.3% From 2024-2032.