Blood Gas Analyzers Market Synopsis:

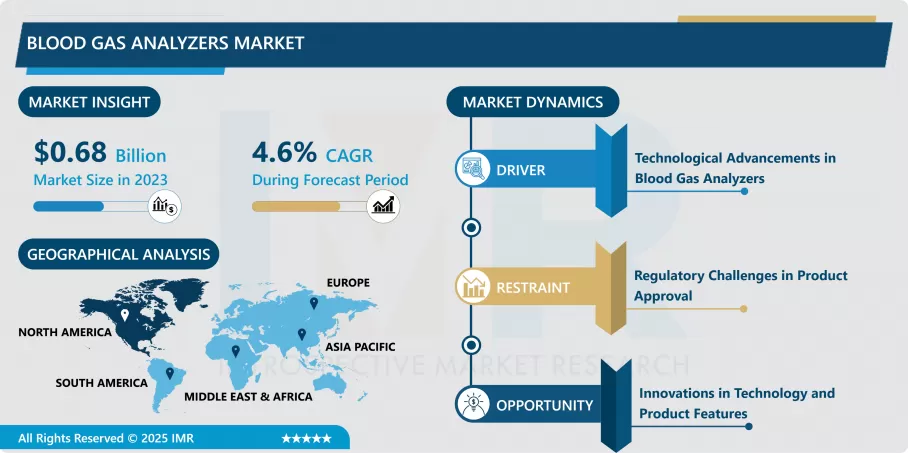

Blood Gas Analyzers Market Size Was Valued at USD 0.68 Billion in 2023, and is Projected to Reach USD 1.03 Billion by 2032, Growing at a CAGR of 4.6% From 2024-2032.

Blood gas analyzers in the scope of this report are defined as devices for determination of pH and concentration of carbon dioxide (CO?) and oxy-gent (O?) in arterial blood. These analyzers remain very vital in managing several illnesses including those that have rapid features such as in emergency or intense care medicine. The worldwide incidence of chronic diseases has risen, and the need for point-of-care testing has accelerated the development of blood gas analysis technology and improved result timeliness and accuracy.

The increasing cases of respiratory disorders are seen to be a major factor of the Blood Gas Analyzers Market coupled with the escalating cases of chronicle diseases including asthma, COPD, and heart diseases. These diseases require frequent evaluation of the blood gas value to assess the patient status and treatments being offered. Due to aging, a large population of individuals is at a higher risk of developing these health problems and the elderly form a large chunk of the population meaning that the demand for efficient and effective blood gas analysis in the health care system is created.

The second factor is the continually enhancing use of point of care testing (POCT) across numerous healthcare centres. Based on the principles of POCT, diagnosis can be done more quickly and appropriate treatments recommended especially in a crisis. The portable and more friendly equipment that have resulted from technological enhancement makes it easier to conduct blood gases even in the ward or remote areas. These factors are putting the market wheels in motion and making the whole affair convenient and efficient.

Blood Gas Analyzers Market Trend Analysis:

The integration of advanced technologies such as artificial intelligence (AI) and machine learning

- A key pattern found in the Blood Gas Analyzers Market is the utilization of AI and machine learning in the market. These technologies provide more precise concentration values for the blood gas analyzers and prediction analytics with auto analysis results. Forehatches, providers continue to look for ways to enhance patient experiences and operational efficiencies, the adoption of these technologies into blood gas analyzers is on the rise.

- Furthermore, there is shift to realize multiparameter monitoring devices which are capable of analyzing in addition to blood gases, electrolytes, and metabolites. This is the case because of the necessity of diagnostic solutions that give an integrative analysis of the patient’s state of health. Multiple tests from a single sample saves time and quickens the flow of important test results – an aspect that augurs well for patient care.

Technological Advancements

- Future marketing development and the existing competition in the Blood Gas Analyzers Market also represents the potential for growth in the developing economies. Growing health system sophistication and a greater number of people having access to medical services will also lead to the need for improved diagnostic equipment. For manufacturers, these markets present a chance to diversify depend on local distributors and healthcare providers to generate increased business. Adaptation of products to needs and prices of these regions as well as designing products to the specific requirements of such areas also help in market entry and growth.

- As a result, the current and future development in blood gas analyzer is one of the areas that can offer several opportunities for improvement. New directions are wireless connectivity, ability to use the cloud for limited purposes and increased portability to address the emerging needs of healthcare.? In terms of strategic development, an enhancement of the existing blood gas analyzers, as well as the launch of new products that demonstrate higher efficacy and simplified operation as the result of expanded R&D investment can contribute to market leadership.

Blood Gas Analyzers Market Segment Analysis:

Blood Gas Analyzers Market is Segmented on the basis of Product type, application, end user, and region.

By Product Type, Portable Blood Gas Analyzers segment is expected to dominate the market during the forecast period

- The classification of the blood gas analyzers market mainly includes portable and stationary blood gas analyzers, which is offered to serve differentiated functions with regards to the health care industry. Transportable blood gas analyzers are therefore used to perform tests at patient’s bedside, in emergencies or other locations that are not … These are portable devices that are user friendly, offer instant results and therefore vital in situations that require the attention of a critical care unit. However, the portable blood gas analyzers are commonly used incurring mini-computers while the stationary blood gas analyzers are normally placed in the laboratory centres or big hospitals. It has better features and higher capacity, which is ideal for the rigorous screening of several samples. For portable analyzers, the emphasis is made on their transportability and rapid performance while the perspective stationary devices aimed at providing an accurate and profound examination of a patient’s condition meet various requirements of the healthcare system.

By Application, Emergency Medicine segment expected to held the largest share

- The Blood Gas Analyzers Market classified on the basis of application are emergency medicine, critical care, anesthesia, metabolism, and others. In emergency medical department, blood gas analysers are indispensable tools used for determination of patient’s respiratory and metabolic state in about twenty minutes, which will help in decision making when faced with life threatening conditions. These analyzers are especially important in critical care areas because they help clinicians to track the status of seriously ill patients and respond rapidly to modifications in their chemical balance.

- In terms of anesthesia, blood gas analyzers are used for various patients in determining oxygenation and ventilation status in patients during surgical procedures so as to facilitate decisions on ventilation by anesthesia logists. Besides, it is helpful in diagnosis and confirmation of metabolic disorders from the blood gas levels pointing to such complications as acidosis and alkalosis. Other is a rather broad classification which refers to different applications where the blood gas analysis is handy with research laboratories, diagnostics etc., which prove that such devices are quite helpful in different types of healthcare scenarios.

Blood Gas Analyzers Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America holds the largest share in the Blood Gas Analyzers Market because of increased healthcare infrastructure and the rising incidence of chronic illnesses. The region has strong local healthcare, which concentrate on early identification and immediate tracking of health changes. Also, growing popularity of the point-of-care testing in the hospital and clinics is driving the demand of the blood gas analyzer, which again is a positive sign for North American region to dominate the global market.

- It is also reliability on the increased spending on healthcare technology and research going in North America. Some segments that are boosted the market are Government and private association, healthcare enhancement objectives, and rising new age medical products. The fact that there are significant manufacturers of Blood Gas Analyzers have their headquarters in the region means that there is constant development of these instruments by key players meaning that the health care organization will always have access to the latest models.

Active Key Players in the Blood Gas Analyzers Market

- Abbott Laboratories (United States)

- Roche Diagnostics (Switzerland)

- Siemens Healthineers (Germany)

- Thermo Fisher Scientific (United States)

- Medtronic (Ireland)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Baxter International (United States)

- Nova Biomedical (United States)

- A. Menarini Diagnostics (Italy)

- Point of Care Testing, Inc. (United States), Other Active Players

Key Industry Development:

In July 2024: Werfen announced the introduction of the GEM Premier 7000 with Intelligent Quality Management 3 (iQM3) at the Association for Laboratory Medicine (ADLM) Annual Meeting (formerly the American Association for Clinical Chemistry), which received 510(k) clearance by the US Food and Drug Administration. The GEM Premier 7000 with iQM3 represents a breakthrough in blood gas testing, offering hemolysis detection for the first time at the point-of-care (POC).

Blood Gas Analyzers Market Scope:

|

Global Blood Gas Analyzers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.68 Billion |

|

Forecast Period 2024-32 CAGR: |

4.6 % |

Market Size in 2032: |

USD 1.03 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Blood Gas Analyzers Market by By Product Type (2018-2032)

4.1 Blood Gas Analyzers Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Portable Blood Gas Analyzers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Stationary Blood Gas Analyzers

Chapter 5: Blood Gas Analyzers Market by By Application (2018-2032)

5.1 Blood Gas Analyzers Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Emergency Medicine

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Critical Care

5.5 Anesthesia

5.6 Metabolic Disorders

5.7 Others

Chapter 6: Blood Gas Analyzers Market by By End User (2018-2032)

6.1 Blood Gas Analyzers Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Diagnostic Laboratories

6.5 Research Laboratories

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Blood Gas Analyzers Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT LABORATORIES (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ROCHE DIAGNOSTICS (SWITZERLAND)

7.4 SIEMENS HEALTHINEERS (GERMANY)

7.5 THERMO FISHER SCIENTIFIC (UNITED STATES)

7.6 MEDTRONIC (IRELAND)

7.7 F. HOFFMANN-LA ROCHE LTD (SWITZERLAND)

7.8 BAXTER INTERNATIONAL (UNITED STATES)

7.9 NOVA BIOMEDICAL (UNITED STATES)

7.10 A. MENARINI DIAGNOSTICS (ITALY)

7.11 POINT OF CARE TESTING INC. (UNITED STATES)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Blood Gas Analyzers Market By Region

8.1 Overview

8.2. North America Blood Gas Analyzers Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product Type

8.2.4.1 Portable Blood Gas Analyzers

8.2.4.2 Stationary Blood Gas Analyzers

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Emergency Medicine

8.2.5.2 Critical Care

8.2.5.3 Anesthesia

8.2.5.4 Metabolic Disorders

8.2.5.5 Others

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Hospitals

8.2.6.2 Diagnostic Laboratories

8.2.6.3 Research Laboratories

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Blood Gas Analyzers Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product Type

8.3.4.1 Portable Blood Gas Analyzers

8.3.4.2 Stationary Blood Gas Analyzers

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Emergency Medicine

8.3.5.2 Critical Care

8.3.5.3 Anesthesia

8.3.5.4 Metabolic Disorders

8.3.5.5 Others

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Hospitals

8.3.6.2 Diagnostic Laboratories

8.3.6.3 Research Laboratories

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Blood Gas Analyzers Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product Type

8.4.4.1 Portable Blood Gas Analyzers

8.4.4.2 Stationary Blood Gas Analyzers

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Emergency Medicine

8.4.5.2 Critical Care

8.4.5.3 Anesthesia

8.4.5.4 Metabolic Disorders

8.4.5.5 Others

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Hospitals

8.4.6.2 Diagnostic Laboratories

8.4.6.3 Research Laboratories

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Blood Gas Analyzers Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product Type

8.5.4.1 Portable Blood Gas Analyzers

8.5.4.2 Stationary Blood Gas Analyzers

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Emergency Medicine

8.5.5.2 Critical Care

8.5.5.3 Anesthesia

8.5.5.4 Metabolic Disorders

8.5.5.5 Others

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Hospitals

8.5.6.2 Diagnostic Laboratories

8.5.6.3 Research Laboratories

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Blood Gas Analyzers Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product Type

8.6.4.1 Portable Blood Gas Analyzers

8.6.4.2 Stationary Blood Gas Analyzers

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Emergency Medicine

8.6.5.2 Critical Care

8.6.5.3 Anesthesia

8.6.5.4 Metabolic Disorders

8.6.5.5 Others

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Hospitals

8.6.6.2 Diagnostic Laboratories

8.6.6.3 Research Laboratories

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Blood Gas Analyzers Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product Type

8.7.4.1 Portable Blood Gas Analyzers

8.7.4.2 Stationary Blood Gas Analyzers

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Emergency Medicine

8.7.5.2 Critical Care

8.7.5.3 Anesthesia

8.7.5.4 Metabolic Disorders

8.7.5.5 Others

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Hospitals

8.7.6.2 Diagnostic Laboratories

8.7.6.3 Research Laboratories

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Blood Gas Analyzers Market Scope:

|

Global Blood Gas Analyzers Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.68 Billion |

|

Forecast Period 2024-32 CAGR: |

4.6 % |

Market Size in 2032: |

USD 1.03 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Blood Gas Analyzers Market research report is 2024-2032.

Abbott Laboratories (United States), Roche Diagnostics (Switzerland), Siemens Healthineers (Germany), Thermo Fisher Scientific (United States), Medtronic (Ireland), F. Hoffmann-La Roche Ltd (Switzerland), Baxter International (United States), Nova Biomedical (United States), A. Menarini Diagnostics (Italy), Point of Care Testing, Inc. (United States).

The Blood Gas Analyzers Market is segmented into by Product Type (Portable Blood Gas Analyzers, Stationary Blood Gas Analyzers), Application (Emergency Medicine, Critical Care, Anesthesia, Metabolic Disorders, Others), End User (Hospitals, Diagnostic Laboratories, Research Laboratories, Others). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Blood gas analyzers in the scope of this report are defined as devices for determination of pH and concentration of carbon dioxide (CO?) and oxy-gent (O?) in arterial blood. These analyzers remain very vital in managing several illnesses including those that have rapid features such as in emergency or intense care medicine. The worldwide incidence of chronic diseases has risen, and the need for point-of-care testing has accelerated the development of blood gas analysis technology and improved result timeliness and accuracy.

Blood Gas Analyzers Market Size Was Valued at USD 0.68 Billion in 2023, and is Projected to Reach USD 1.03 Billion by 2032, Growing at a CAGR of 4.6% From 2024-2032.