Blood Glucose Monitoring Market Synopsis:

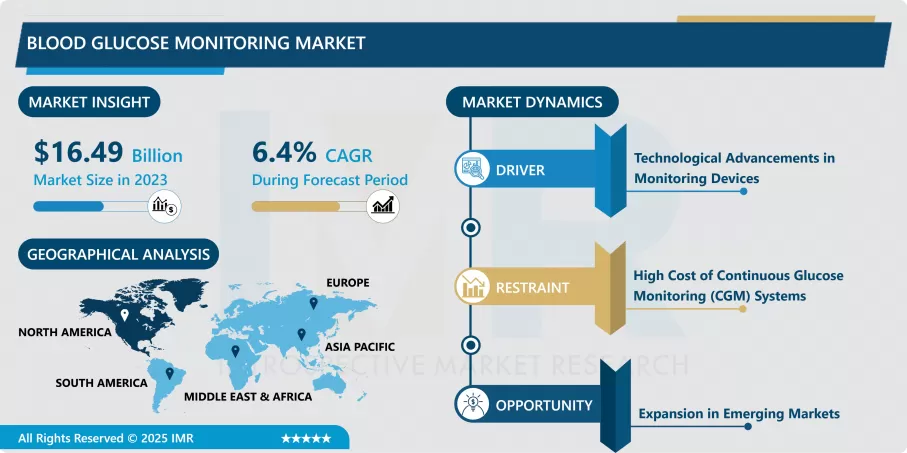

Blood Glucose Monitoring Market Size Was Valued at USD 16.49 Billion in 2023, and is Projected to Reach USD 28.82 Billion by 2032, Growing at a CAGR of 6.4% From 2024-2032.

The Blood Glucose Monitoring (BGM) market deals with the healthcare industry products and services related to the technologies and devices for measuring the glucose level particularly for diabetic patients. Also ranged from glucose meter, test strips, lancets, and continuous glucose monitor (CGM) which assist in real time monitoring of glucose levels in the body in order to prevent diabetes complications.

- The Blood Glucose Monitoring (BGM) market is an important niche that constitutes the diabetes care field because of the rising incidence of the disease and the increasing need for home-testing kits. Globally diabetes is now a menace, encompassing both Type 1 and Type 2 and it affects millions of people. Growth in the rate of diabetic patients is thereby creating a large demand for efficient blood glucose monitoring apparatus. These instruments help people to monitor their glucose level with great accuracy and offer crucial information to avoid hyperglycemia or hypoglycemia.

- Technological changes have been a dramatic influence to the specification of the BGM market. There exist several advancements in the CGM systems and enhancement of the blood glucose meters have better provided ways and means of monitoring blood sugar levels. The use of digital technologies especially mobile application of glucose tracking is also on the increase, this is because they make it possible for the health care providers to monitor data that is being sent in real time hence enabling the management of diabetes. In addition, the use of cloud-based systems as well as AI for data analysis and better interpretation is also gradually growing which is paving a way to personalized decision-making on diabetic patients.

- Presently, North America has the largest market share for BGM due to factors including high health care spending, availability of superior health care facility, and a burgeoning population of diabetic patients. That said, areas such as Asia-Pacific are also expected to grow faster owing to rising awareness of diabetes and greater percentage of gets middle-income population having significantly improved access to healthcare products. It’s also solving the trend toward homecare where patients prefer to test their blood glucose level on their own, and less often, visit healthcare facilities

- With the rise of the global diabetic population, which is complemented by a growing use of better monitoring systems, the BGM market is predicted to expand in the future. The firms in the market are always coming up with new products with not only higher accuracy but also more convenient for use such as wearable and non-intrusive devices. Further, the increasing healthcare consciousness, extended emphasis for the preventive healthcare services and products, all are fueling the global blood glucose monitoring solutions market.

Blood Glucose Monitoring Market Trend Analysis:

Rising Demand for Continuous Glucose Monitoring (CGM) Systems

- Also, the increasing demand for mobile and wirelessly connected devices is currently one of the most significant tendencies in the BGM market: the CGM systems. These systems offer constant, constant data about a client’s blood sugar level of glucose, which supplies better and more complete information regarding the state of a client’s blood sugar level at various points in time throughout the day and night. It is different from the conventional blood glucose meter for the self-monitoring of glucose level, which involves a fingerstick test in order to obtain a momentary value of glucose and the intermittent monitoring of glucose compared to a CGM, which monitors glucose levels continually and assists the patient to fine tune their insulin doses more appropriately. This constant data stream is inimical to better glucose control for patients with diabetes type 1, who must be vigilant in their monitoring of blood glucose.

- For a long time, CGM market has been expanding with; this being supported by advancing technology that has enhanced the production of more accurate & affordable CGM devices. Technology was installed early with the CGM working initially with Type 1 diabetics and later on with the Type 2 diabetics. Moreover, improved compatibility with portable devices such as mobiles and other features supported by cloud technology are providing increase mobility to CGM systems so that patient could easily track his medical condition. This trend is expected to continue as more people look for progression, ease and effectiveness in their style of managing diabetes.

Expansion in Emerging Markets

- The Blood Glucose Monitoring (BGM) market continues to expand and there is more opportunity within emerging markets. This is because with increasing disposable incomes, improved health care systems, and enhanced awareness of diabetes in developing nations such as India, China and Brazil and numerous other emerging states, the demand for glucose monitoring devices is rapidly growing. The diabetes rate in these areas is rising rapidly, and it has become a main factor enabling the application of blood glucose monitoring solutions. Also, the expansion of programmes that focus on diabetic care services and better access to health care product boost the market.

- Another factor for covering the opportunity for growth of sales in emerging markets is the gradual increase observed in the number of inexpensive blood glucose meters and test strips. Manufacturers are therefore keen, on bringing to market cheap and easy-to-use provided the markets in these regions are price sensitive. When healthcare providers and individuals in growing number of emerging economies use more sophisticated forms of diabetes management, there is also increasing need for more sophisticated solutions such as CGM systems. These factors make the BGM market in emerging markets the major growth area in the coming years.

Blood Glucose Monitoring Market Segment Analysis:

Blood Glucose Monitoring Market Segmented on the basis of product type, technology, end user, and region.

By Product Type, Blood Glucose Meters segment is expected to dominate the market during the forecast period

- The product types segment of Blood Glucose Monitoring market comprises of various products which are used by diabetics in a variety of ways. The two most popular types of products are blood glucose meters, these are portable, handheld lancets that enable patients to check their blood glucose levels by pricking a finger to obtain a droplet of blood. The test strip bowls used by glucose meters incorporate test strips as disposable elements of the glucose meters for tests requiring them. Lancets for drawing blood are also among the products offered in the market Other products include:

- CGM systems are a relatively new and significant portion of the market that provides the benefit of constant, real-time glucose information. Current technological devices that are preferred by patients requiring continuous checking of their glucose level include CGMs particularly for patients with type 1 diabetes. The growth of the CGM market is anticipated to be fast-growing because of the expert’s increased technological capabilities, such as connectivity with smartphones and other devices that support overall health management. And the innovations make CGMs more appealing to a wider set of patients, thereby fuelling growth for the entire market.

By End User, Homecare segment expected to held the largest share

- Based on the end user configuration, the Blood Glucose Monitoring market can be divide into homecare, hospitals & clinics, and diagnostic centers. The largest market segment is the homecare one because more and more patients with diabetes want to check their blood glucose level at home. This segment is expanding because more people are using self-testing devices such as blood glucose meters and systems of CGM in order to monitor their diabetes.

- Other major patient end users being the hospital & clinics and diagnostic center that uses the blood glucose monitoring products especially for the patients and diagnostics. Such healthcare facilities need appropriate and dependable glucose trackers for clients with diabetes and to identify the presence of hypoglycemia or hyperglycemia. As diabetes become more of an issue, the market for these monitoring devices in these locations will continue to rise especially for the CGM systems that provides ambulatory monitoring and significantly conducive data for use in clinical diagnosis.

Blood Glucose Monitoring Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is the most prominent region in the Blood Glucose Monitoring (BGM) market as it has more healthcare spending, better health facilities and a greater number of patient population with diabetes disease. Type 1 and Type 2 diabetes are more common in this area than in many other countries, ensuring the great popularity of glucose monitoring instruments. Large insurance reimbursement policies invested in the area also assist in the utilization of high-tech devices such as CGM systems.

- In addition, advanced digital health platforms have been established in North America, which in turn have driven demand for BGM devices. The integration of glucose monitoring devices with mobile apps and cloud based platforms is especially done so in this region to help every patient monitor the glucose levels more effectively. Thus, North America remains the dominating region on the BGM market, and there is no reason to expect that the leadership of this region will change in the near future.

Active Key Players in the Blood Glucose Monitoring Market

- Abbott Laboratories (USA)

- Medtronic (Ireland)

- Roche Diagnostics (Switzerland)

- Johnson & Johnson (USA)

- Dexcom, Inc. (USA)

- Ascensia Diabetes Care (Switzerland)

- Novo Nordisk (Denmark)

- Sanofi (France)

- Bayer AG (Germany)

- Lifescan, Inc. (USA)

- ARKRAY, Inc. (Japan)

- Ypsomed (Switzerland)

- Other Active Players

Key Industry Developments in the Blood Glucose Monitoring Market:

- In February 2024 – Dexcom, Inc. launched Dexcom ONE+, the latest Continuous Glucose Monitoring (CGM), with an aim to bring powerful, new diabetes management technology to patients in Belgium, Spain, and Poland.

- In January 2024 – Abbott with Tandem Diabetes Care, Inc., one of the players focusing on insulin delivery and diabetes technology, launched the t:slim X2 insulin pump with Control-IQ technology, the first automated insulin delivery system to integrate with FreeStyle Libre 2 Plus sensor in the U.S. This helped the company to strengthen its product portfolio.

- In January 2024 – Medtronic received CE approval for the MiniMed 780G system with Simplera Sync, a disposable, all-in-one Continuous Glucose Monitor (CGM) requiring no fingersticks or overtape with an aim to strengthen its product portfolio.

- In October 2023 – Dexcom, Inc. launched the Dexcom G7 Continuous Glucose Monitoring (CGM) System in Canada. This helped the company strengthen its product portfolio.

- In January 2022 – F. Hoffmann-La Roche Ltd. launched the Cobas pulse system, a blood glucose management solution with mobile digital health capabilities, with the aim of improving patient care globally.

Global Blood Glucose Monitoring Market Scope:

|

Global Blood Glucose Monitoring Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16.49 Billion |

|

Forecast Period 2024-32 CAGR: |

6.4% |

Market Size in 2032: |

USD 28.82 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Blood Glucose Monitoring Market by By Product Type (2018-2032)

4.1 Blood Glucose Monitoring Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Blood Glucose Meters

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Test Strips

4.5 Lancets

4.6 Continuous Glucose Monitoring (CGM) Systems

Chapter 5: Blood Glucose Monitoring Market by By Technology (2018-2032)

5.1 Blood Glucose Monitoring Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Self-Monitoring Blood Glucose (SMBG)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Continuous Glucose Monitoring (CGM)

Chapter 6: Blood Glucose Monitoring Market by By End User (2018-2032)

6.1 Blood Glucose Monitoring Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Homecare

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Hospitals & Clinics

6.5 Diagnostic Centers

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Blood Glucose Monitoring Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT LABORATORIES (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 MEDTRONIC (IRELAND)

7.4 ROCHE DIAGNOSTICS (SWITZERLAND)

7.5 JOHNSON & JOHNSON (USA)

7.6 DEXCOM INC. (USA)

7.7 ASCENSIA DIABETES CARE (SWITZERLAND)

7.8 NOVO NORDISK (DENMARK)

7.9 SANOFI (FRANCE)

7.10 OTHER ACTIVE PLAYERS

Chapter 8: Global Blood Glucose Monitoring Market By Region

8.1 Overview

8.2. North America Blood Glucose Monitoring Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product Type

8.2.4.1 Blood Glucose Meters

8.2.4.2 Test Strips

8.2.4.3 Lancets

8.2.4.4 Continuous Glucose Monitoring (CGM) Systems

8.2.5 Historic and Forecasted Market Size By By Technology

8.2.5.1 Self-Monitoring Blood Glucose (SMBG)

8.2.5.2 Continuous Glucose Monitoring (CGM)

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Homecare

8.2.6.2 Hospitals & Clinics

8.2.6.3 Diagnostic Centers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Blood Glucose Monitoring Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product Type

8.3.4.1 Blood Glucose Meters

8.3.4.2 Test Strips

8.3.4.3 Lancets

8.3.4.4 Continuous Glucose Monitoring (CGM) Systems

8.3.5 Historic and Forecasted Market Size By By Technology

8.3.5.1 Self-Monitoring Blood Glucose (SMBG)

8.3.5.2 Continuous Glucose Monitoring (CGM)

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Homecare

8.3.6.2 Hospitals & Clinics

8.3.6.3 Diagnostic Centers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Blood Glucose Monitoring Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product Type

8.4.4.1 Blood Glucose Meters

8.4.4.2 Test Strips

8.4.4.3 Lancets

8.4.4.4 Continuous Glucose Monitoring (CGM) Systems

8.4.5 Historic and Forecasted Market Size By By Technology

8.4.5.1 Self-Monitoring Blood Glucose (SMBG)

8.4.5.2 Continuous Glucose Monitoring (CGM)

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Homecare

8.4.6.2 Hospitals & Clinics

8.4.6.3 Diagnostic Centers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Blood Glucose Monitoring Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product Type

8.5.4.1 Blood Glucose Meters

8.5.4.2 Test Strips

8.5.4.3 Lancets

8.5.4.4 Continuous Glucose Monitoring (CGM) Systems

8.5.5 Historic and Forecasted Market Size By By Technology

8.5.5.1 Self-Monitoring Blood Glucose (SMBG)

8.5.5.2 Continuous Glucose Monitoring (CGM)

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Homecare

8.5.6.2 Hospitals & Clinics

8.5.6.3 Diagnostic Centers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Blood Glucose Monitoring Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product Type

8.6.4.1 Blood Glucose Meters

8.6.4.2 Test Strips

8.6.4.3 Lancets

8.6.4.4 Continuous Glucose Monitoring (CGM) Systems

8.6.5 Historic and Forecasted Market Size By By Technology

8.6.5.1 Self-Monitoring Blood Glucose (SMBG)

8.6.5.2 Continuous Glucose Monitoring (CGM)

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Homecare

8.6.6.2 Hospitals & Clinics

8.6.6.3 Diagnostic Centers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Blood Glucose Monitoring Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product Type

8.7.4.1 Blood Glucose Meters

8.7.4.2 Test Strips

8.7.4.3 Lancets

8.7.4.4 Continuous Glucose Monitoring (CGM) Systems

8.7.5 Historic and Forecasted Market Size By By Technology

8.7.5.1 Self-Monitoring Blood Glucose (SMBG)

8.7.5.2 Continuous Glucose Monitoring (CGM)

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Homecare

8.7.6.2 Hospitals & Clinics

8.7.6.3 Diagnostic Centers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Global Blood Glucose Monitoring Market Scope:

|

Global Blood Glucose Monitoring Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16.49 Billion |

|

Forecast Period 2024-32 CAGR: |

6.4% |

Market Size in 2032: |

USD 28.82 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Technology |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Blood Glucose Monitoring Market research report is 2024-2032.

Abbott Laboratories (USA), Medtronic (Ireland), Roche Diagnostics (Switzerland), Johnson & Johnson (USA), Dexcom, Inc. (USA), Ascensia Diabetes Care (Switzerland), Novo Nordisk (Denmark), Sanofi (France), and Other Active Players.

The Blood Glucose Monitoring Market is segmented into Product Type, Technology, End User and region. By Product Type, the market is categorized into Blood Glucose Meters, Test Strips, Lancets, Continuous Glucose Monitoring (CGM) Systems. By End User, the market is categorized into Homecare, Hospitals & Clinics, Diagnostic Centers. By Technology, the market is categorized into Self-Monitoring Blood Glucose (SMBG), Continuous Glucose Monitoring (CGM). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Russia; Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; The Netherlands; Italy; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The Blood Glucose Monitoring (BGM) market deals with the healthcare industry products and services related to the technologies and devices for measuring the glucose level particularly for diabetic patients. Also ranged from glucose meter, test strips, lancets, and continuous glucose monitor (CGM) which assist in real time monitoring of glucose levels in the body in order to prevent diabetes complications.

Blood Glucose Monitoring Market Size Was Valued at USD 16.49 Billion in 2023, and is Projected to Reach USD 28.82 Billion by 2032, Growing at a CAGR of 6.4% From 2024-2032.