Body Fat Reduction Market Synopsis:

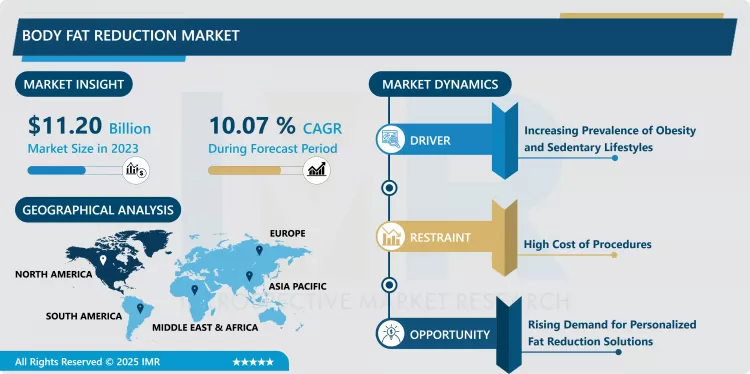

Body Fat Reduction Market Size Was Valued at USD 11.20 Billion in 2023, and is Projected to Reach USD 36.15 Billion by 2032, Growing at a CAGR of 10.07 % From 2024-2032.

The body fat reduction market is a worldwide industry that intends to offer products, services, and procedures to help people reduce excess body fats. This industry encompasses both surgical and nonsurgical approaches, fueled by growing health awareness and aesthetic concerns, as well as mounting demand for effective methods of reducing body fat. It caters to diverse customers, starting from those seeking cosmetic improvements to those who seek health-related weight concerns.

Market Overview Market for Body Fat Reduction is developing at a healthy pace as the global prevalence of obesity and associated health conditions is continuing. Health-related worries among people and a global demand for body weight management are pushing up the demand, which helps the growth of the market. The market includes liposuction, fat freezing, laser-assisted, and various noninvasive treatments using more advanced technologies, such as ultrasound and radiofrequency.

Surgical procedures still account for a large proportion of the market, but liposuction is still the most in-demand of them all. However, of late, non-surgical methods to reduce fats have attracted a large share since they are less invasive, and their recovery times and risk profiles are correspondingly shorter. Advances in this type, including cryolipolysis and radiofrequency treatments, have made it possible for the market to attract those looking for safer alternatives to these traditional surgery procedures.

Advances in medical technology are also fueling the market as fat reduction treatments and procedures get more accessible and productive. An increase in services offered by hospitals, clinics, and medical spas has also played a significant factor in augmenting the market size. North America and Europe regions have dominated the market due to the high concentration of advanced healthcare facilities. Emerging markets in Asia-Pacific are gadding up due to rising disposable incomes and awareness of healthcare.

Body Fat Reduction Market Trend Analysis:

Growing Popularity of Non-Surgical Procedures

- Growing demand can be seen in the body fat reduction market, increasingly shifting towards non-surgical methods. Such techniques are preferred more by patients since they avoid the inconvenience of staying in the hospital and, possibly, enduring complications, more threatening with the more invasive types of surgical interventions. Such areas as cryolipolysis (fat freezing), ultrasound, and radiofrequency are very popular because individuals can resume usual activity within a relatively short period following the procedure.

- This trend is mainly motivated by advances in medical technology, which effectively produce results that do not require long periods of recovery. Non-invasive treatments are more attractive to businesspersons since the treatments can be received in a lunch break with immediate return to work following a treatment. Technological advancement will continue, and the effectiveness of non-invasive fat reduction treatments is going to improve, and this will make non-invasive fat reduction treatments stand out more as the most sought-after trend in this market.

Rising Demand for Personalized Fat Reduction Solutions

- One of the emerging opportunities in the body fat reduction market is the increasing demand for tailormade fat reduction solutions. With an increasing awareness of the different reasons for weight gain and how and where fat is deposited, more patients are requiring treatment plans tailored to their needs. This opens up service providers' windows to provide individualized approaches, including targeting body areas, combinations of multiple procedures, and individual metabolic factors.

- Personalized fat reduction also includes offering services wherein the patient has an inclination toward either a non-invasive or an invasive treatment, body-type category, and health status. These are consumers who will be on a lookout for more natural-looking and perhaps better outcomes. Providers with sophisticated diagnostic equipment to measure the body and customize the treatment taking into account this diagnostic capability will be in good position to latch onto this rising wave of demand.

Body Fat Reduction Market Segment Analysis:

Body Fat Reduction Market is Segmented on the basis of Procedure, Gender, Service Provider, and Region

By Procedure, Surgical segment is expected to dominate the market during the forecast period

- The market for the reduction of body fat can further be subdivided into surgical and non-surgical procedures. Surgical procedures like liposuction and tummy tucks have long been regarded as the most effective methods for a huge amount of body fat reduction. These procedures yield more instant and visible effects, which is what many individuals seek from as dramatic a change in body contour as possible. These procedures, however, take longer periods of recovery and come with more risks because the treatments involved are considered more invasive.

- Minimal downtime and more minimal invasive procedures have boosted the popularity of cryolipolysis, laser therapy, and ultrasound-based treatments. Patients prefer these because they are less painful and cause fewer side effects. Innovations in non-invasive technologies will continue to make these treatments more effective and will attract a wider age group that is looking for fat loss treatments.

By Service Provider, Hospitals segment expected to held the largest share

- The market is served by various types of service providers, including hospitals, clinics, medical spas, and other specialty centers. Hospitals tend to dominate the market in terms of advanced surgical fat reduction procedures. Equipped with cutting-edge technology and highly skilled surgeons, hospitals are often the go-to destination for patients seeking invasive treatments like liposuction and body contouring surgeries.

- On the other hand, clinics and medical spas are gaining popularity as preferred service providers for non-surgical fat reduction treatments. Medical spas, in particular, offer a blend of medical expertise and a spa-like experience, making them attractive to individuals seeking cosmetic improvements without the clinical setting of a hospital. These service providers cater to a growing demand for personalized, non-invasive treatments, contributing to the overall growth of the market.

- Currently, North America leads this market for body fat reduction. Such a position is attributed to a few factors, including high disposable incomes, the advanced healthcare infrastructure, as well as widespread knowledge about body aesthetics. Demand for both surgical and non-surgical fat reduction procedures is heavy, especially in the United States, where established markets for cosmetic surgeries exist, and most recently, new non-invasive technologies are being marketed.

- This region also boasts of the presence of some key market players who are always investing in research and development to come up with ways of producing more efficient and less invasive ways of reducing fats. Cultural pressure to enhance body image and fitness boosts consumer demand for fat reduction services in North America. Technological advancement, quality of health care, and demand of consumers place North America at a competitive advantage in the global arena.

Active Key Players in the Body Fat Reduction Market

- AbbVie Inc. (USA)

- Allergan (Ireland)

- Bausch Health Companies Inc. (Canada)

- Cynosure, LLC (USA)

- Alma Lasers (Israel)

- Sciton, Inc. (USA)

- Lumenis Ltd. (Israel)

- Cutera, Inc. (USA)

- Candela Corporation (USA)

- Fotona (Slovenia)

- Venus Concept (Canada)

- BTL Industries (Czech Republic)

- Other Active Players

Key Industry Developments in the Body Fat Reduction Market:

- In March 2024, Amgen differentiated itself in the competitive weight loss market with its injectable treatment, MariTide, which not only aids in weight loss but also helps maintain weight loss after discontinuation

- In April 2023, Eli Lilly and Company announced that tirzepatide (10 mg and 15 mg) demonstrated superior weight loss as compared to placebo over 72 weeks in the SURMOUNT-2 study. Participants using tirzepatide lost up to 15.7% of their body weight. This phase 3 trial, involving 938 adults with obesity or overweight and type 2 diabetes, met all primary and secondary objectives for efficacy and safety.

- In February 2022, Givaudan introduced PrimeLock+, a patent-pending, natural, vegan-friendly solution designed to enhance plant-based products. It mimics animal fat cells to improve the taste, texture, and juiciness of plant-based foods, addressing common issues like oil loss during cooking. This innovation helps food manufacturers elevate consumer satisfaction by better preserving flavor and texture.

|

Body Fat Reduction Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 11.20 Billion |

|

Forecast Period 2024-32 CAGR: |

10.07% |

Market Size in 2032: |

USD 36.15 Billion |

|

Segments Covered: |

By Procedure |

|

|

|

By Gender |

|

||

|

By Service Provider |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Body Fat Reduction Market by By Procedure (2018-2032)

4.1 Body Fat Reduction Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Surgical

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Non- Surgical

Chapter 5: Body Fat Reduction Market by By Gender (2018-2032)

5.1 Body Fat Reduction Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Female

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Male

Chapter 6: Body Fat Reduction Market by By Service Provider (2018-2032)

6.1 Body Fat Reduction Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Clinics

6.5 Medical Spas

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Body Fat Reduction Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBVIE INC. (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALLERGAN (IRELAND)

7.4 BAUSCH HEALTH COMPANIES INC. (CANADA)

7.5 CYNOSURE LLC (USA)

7.6 ALMA LASERS (ISRAEL)

7.7 SCITON INC. (USA)

7.8 LUMENIS LTD. (ISRAEL)

7.9 CUTERA INC. (USA)

7.10 CANDELA CORPORATION (USA)

7.11 FOTONA (SLOVENIA)

7.12 VENUS CONCEPT (CANADA)

7.13 BTL INDUSTRIES (CZECH REPUBLIC)

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Body Fat Reduction Market By Region

8.1 Overview

8.2. North America Body Fat Reduction Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Procedure

8.2.4.1 Surgical

8.2.4.2 Non- Surgical

8.2.5 Historic and Forecasted Market Size By By Gender

8.2.5.1 Female

8.2.5.2 Male

8.2.6 Historic and Forecasted Market Size By By Service Provider

8.2.6.1 Hospitals

8.2.6.2 Clinics

8.2.6.3 Medical Spas

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Body Fat Reduction Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Procedure

8.3.4.1 Surgical

8.3.4.2 Non- Surgical

8.3.5 Historic and Forecasted Market Size By By Gender

8.3.5.1 Female

8.3.5.2 Male

8.3.6 Historic and Forecasted Market Size By By Service Provider

8.3.6.1 Hospitals

8.3.6.2 Clinics

8.3.6.3 Medical Spas

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Body Fat Reduction Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Procedure

8.4.4.1 Surgical

8.4.4.2 Non- Surgical

8.4.5 Historic and Forecasted Market Size By By Gender

8.4.5.1 Female

8.4.5.2 Male

8.4.6 Historic and Forecasted Market Size By By Service Provider

8.4.6.1 Hospitals

8.4.6.2 Clinics

8.4.6.3 Medical Spas

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Body Fat Reduction Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Procedure

8.5.4.1 Surgical

8.5.4.2 Non- Surgical

8.5.5 Historic and Forecasted Market Size By By Gender

8.5.5.1 Female

8.5.5.2 Male

8.5.6 Historic and Forecasted Market Size By By Service Provider

8.5.6.1 Hospitals

8.5.6.2 Clinics

8.5.6.3 Medical Spas

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Body Fat Reduction Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Procedure

8.6.4.1 Surgical

8.6.4.2 Non- Surgical

8.6.5 Historic and Forecasted Market Size By By Gender

8.6.5.1 Female

8.6.5.2 Male

8.6.6 Historic and Forecasted Market Size By By Service Provider

8.6.6.1 Hospitals

8.6.6.2 Clinics

8.6.6.3 Medical Spas

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Body Fat Reduction Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Procedure

8.7.4.1 Surgical

8.7.4.2 Non- Surgical

8.7.5 Historic and Forecasted Market Size By By Gender

8.7.5.1 Female

8.7.5.2 Male

8.7.6 Historic and Forecasted Market Size By By Service Provider

8.7.6.1 Hospitals

8.7.6.2 Clinics

8.7.6.3 Medical Spas

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Body Fat Reduction Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 11.20 Billion |

|

Forecast Period 2024-32 CAGR: |

10.07% |

Market Size in 2032: |

USD 36.15 Billion |

|

Segments Covered: |

By Procedure |

|

|

|

By Gender |

|

||

|

By Service Provider |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Body Fat Reduction Market research report is 2024-2032.

AbbVie Inc. (USA), Allergan (Ireland), Bausch Health Companies Inc. (Canada), Cynosure, LLC (USA), Alma Lasers (Israel), Sciton, Inc. (USA), Lumenis Ltd. (Israel), Cutera, Inc. (USA), Candela Corporation (USA), Fotona (Slovenia), Venus Concept (Canada), BTL Industries (Czech Republic), and Other Active Players.

The Body Fat Reduction Market is segmented into Procedure, Gender, Service Provider and region.By Procedure, the market is categorized into Surgical, Non-surgical. By Gender, the market is categorized into Female, Male. By Service Provider, the market is categorized into Hospitals, Clinics, Medical Spas, Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The body fat reduction market is a worldwide industry that intends to offer products, services, and procedures to help people reduce excess body fats. This industry encompasses both surgical and nonsurgical approaches, fueled by growing health awareness and aesthetic concerns, as well as mounting demand for effective methods of reducing body fat. It caters to diverse customers, starting from those seeking cosmetic improvements to those who seek health-related weight concerns.

Body Fat Reduction Market Size Was Valued at USD 11.20 Billion in 2023, and is Projected to Reach USD 36.15 Billion by 2032, Growing at a CAGR of 10.07% From 2024-2032.