Bolts Market Synopsis

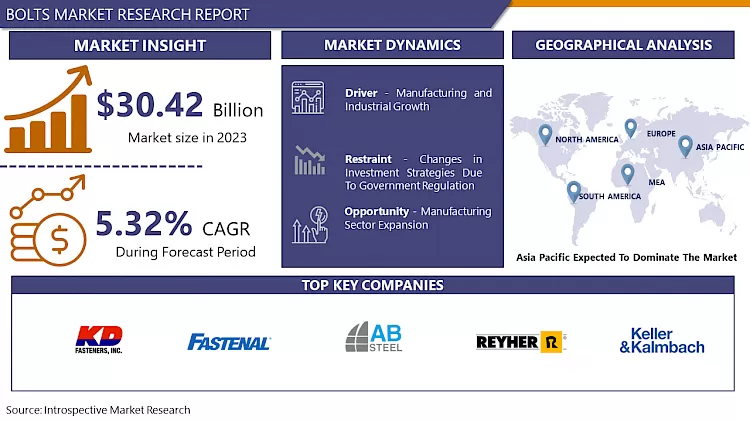

Bolts Market Size Was Valued at USD 30.42 billion in 2023 and is Projected to Reach USD 48.51 billion by 2032, Growing at a CAGR of 5.32% From 2024-2032.

A bolt is a form of threaded fastener with an external male thread requiring a matching pre-formed female thread such as a nut. Bolts are very closely related to screws. Bolts are also required for securing gates or doors because they act as a solid framework for padlocks or deadbolts to latch onto.

- Both screws and bolts have a wide range of head designs. These are made to fit the tool that will be used to tighten them. Instead of allowing the bolt to move, some bolt heads lock the bolt into place, requiring a tool only for the nut end. Common bolt heads include hex, slotted hex washer, and socket cap.

- The same task is carried out by all fasteners: joining and securing two or more components mechanically. The performance and service life of the fastener, however, are significantly impacted by variations in type, quality, shape, and material

- A bolted joint is frequently created using bolts. Combining the nut's axial clamping force with the bolt's shank acting as a dowel to pin the joint against sideways shear forces results in this situation. To create a better, stronger dowel, many bolts have a plain, unthreaded shank.

- A screwdriver head fitting is frequently used on bolts in place of an external wrench. Instead of using them from the side, screwdrivers are used directly in front of the fastener. These cannot typically apply the same amount of torque due to their smaller size compared to most wrench heads. Although it is incorrect, it is frequently believed that screwdriver heads indicate a screw and wrenches indicate a bolt.

Bolts Market Trend Analysis

Manufacturing and Industrial Growth

- The growth of manufacturing and industrial sectors serves as a pivotal force propelling the demand for bolts in the market. Bolts play a crucial role in securing structural components, machinery, and equipment within these sectors, ensuring the integrity and safety of various applications. As manufacturing and industrial activities expand, there is a parallel surge in the need for reliable fastening solutions, thereby driving the bolt market.

- In manufacturing processes, bolts are indispensable for assembling and connecting diverse components, ranging from heavy machinery to intricate electronic devices. The construction of robust and stable structures relies heavily on the use of bolts, reinforcing the importance of this fastening element in industrial applications.

- Additionally, the development of innovative technologies and materials in manufacturing has led to the demand for specialized bolts tailored to specific industrial requirements. As industries continue to evolve and expand globally, the bolt market is expected to witness sustained growth, driven by the ongoing advancements and investments in manufacturing and industrial sectors. The symbiotic relationship between manufacturing and bolts underscores their status as interconnected elements crucial for the continued progress of various industries.

Manufacturing Sector Expansion create an Opportunity for Bolts Market

- The expanding manufacturing sector presents significant opportunities for the bolt market. As industrial production and infrastructure development continue to surge, the demand for fasteners, including bolts, is on the rise. Bolts are essential components in the construction of machinery, vehicles, and structures, making them indispensable in manufacturing processes.

- One key opportunity lies in the increasing complexity and specialization of manufacturing machinery, where bolts play a crucial role in ensuring structural integrity. As industries adopt advanced technologies and automation, the demand for high-quality and specialized bolts with specific characteristics, such as durability, corrosion resistance, and precision, is escalating.

- Moreover, the global push towards sustainable and green manufacturing practices has opened avenues for innovative bolt solutions. Eco-friendly materials, energy-efficient manufacturing processes, and recyclable bolts are gaining traction in the market.

Bolts Market Segment Analysis:

Bolts Market Segmented on the basis of Type, Material Type, and Application.

By Material Type, Metal segment is expected to dominate the market during the forecast period

- The inherent strength and durability of metal bolts make them indispensable for heavy-duty applications. Steel bolts, in particular, are renowned for their robustness, making them the preferred choice in construction projects and machinery assembly. Additionally, the versatility of metal alloys allows for the production of bolts tailored to specific requirements, further enhancing their appeal across diverse industries.

- Furthermore, the metal segment benefits from ongoing innovations in metallurgy and manufacturing processes, resulting in bolts with improved performance characteristics. Advances in corrosion-resistant coatings also contribute to the longevity of metal bolts, a crucial factor in their widespread adoption.

- As industries continue to demand reliable and sturdy fastening solutions, the metal segment is expected to maintain its dominance in the bolt market, solidifying its position as the material of choice for applications requiring strength, durability, and precision.

By Application, Automotive segment held the largest share of 43% in 2022

- The automotive segment is poised to dominate the bolt market due to a confluence of factors driving demand within the automotive industry. Bolts play a critical role in the assembly and structural integrity of vehicles, serving as essential components in various applications such as engine assembly, chassis construction, and body fabrication. The automotive sector's continuous evolution and technological advancements, including the growing demand for electric vehicles (EVs) and lightweight materials, further contribute to the prominence of bolts in this market.

- In the automotive manufacturing process, bolts are utilized for joining components, ensuring safety, and enhancing overall performance. With the increasing emphasis on fuel efficiency, safety standards, and innovative automotive designs, the demand for high-quality and specialized bolts continues to rise. Additionally, the surge in electric vehicle production, characterized by distinct engineering requirements, augments the need for specialized bolts adapted to these unique applications.

Bolts Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region has been a powerhouse in various industries, and it's plausible that it continues to dominate the bolt market. The region's robust economic growth, burgeoning industrialization, and infrastructure development have likely increased the demand for bolts across sectors such as construction, manufacturing, and automotive. China and India, in particular, have been major contributors to the growth of industrial activities, creating a substantial market for fasteners like bolts.

- Moreover, the automotive and construction sectors in the Asia Pacific are continuously expanding, driven by urbanization and population growth. These industries heavily rely on bolts for assembling and construction purposes. The increasing investments in renewable energy projects and the overall push for sustainable development in the region may also contribute to the demand for specialized bolts.

Bolts Market Top Key Players:

- Kd Fasteners Inc. (U.S.)

- Fastenal Company (U.S.)

- Brunner Manufacturing Co. Inc. (U.S.)

- Rockford Fastener Inc. (U.S.)

- AB Steel Inc. (Canada)

- Würth Industries Service GmbH & Co. KG (Germany)

- REYHER (Germany)

- Keller & Kalmbach GmbH (Germany)

- Fabory (Netherlands)

- Big Bolt Nut (India)

- Viha Steel & Forging (India)

- Jignesh Steel (India)

Key Industry Developments in the Bolts Market:

- In May 2024, Jindal Stainless, India’s leading stainless-steel manufacturer, announced major expansion and acquisition plans to augment its melting and downstream capacities, to become one of the largest stainless-steel producers in the world. The company announced a three-pronged investment strategy worth nearly INR 5,400 crores to achieve global leadership in stainless steel.

- In June 2023, Lubrinox introduced bolts, nuts, and fasteners with a high-end lubricating coating. The fasteners help prevent the inner and outer threads of a stainless-steel connection from sticking together.

- In March 2022, Fastto Nederland BV's founder and owner Guido Voskamp signed a contract transferring ownership to Fabory. Fastto is a well-known fastener expert with a pertinent product line and committed patrons. The Fabory-Fastto partnership demonstrates a strong strategic fit between two experts in fasteners.

- In February 2021, Würth Industry announced the acquisition of Atlantic Fasteners Inc., a mainstay in the structural industry with 36 years of history manufacturing structural bolts and distributing standard and specialty fasteners.

|

Global Bolts Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 30.42 Bn. |

|

Forecast Period 2023-32 CAGR: |

5.32% |

Market Size in 2032: |

USD 48.51 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Bolts Market by By Type (2018-2032)

4.1 Bolts Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Half Screw Bolt

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Full Screw Bolt

Chapter 5: Bolts Market by By Material (2018-2032)

5.1 Bolts Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Metal

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Plastic

Chapter 6: Bolts Market by By Applications (2018-2032)

6.1 Bolts Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Construction

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Automotive

6.5 Aerospace

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Bolts Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 DEERE & COMPANY(US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 IBM CORPORATION (US)

7.4 MICROSOFT CORPORATION (US)

7.5 THE CLIMATE CORPORATION (US)

7.6 FARMERS EDGE INC. (CANADA)

7.7 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP (US)

7.8 CISCO SYSTEMS INC. (US)

7.9 GOOGLE LLC (US)

7.10 AMAZON WEB SERVICES INC (US)

7.11 CORTEVA INC (US)

7.12 AGEAGLE AERIAL SYSTEMS INC. (US)

7.13 DESCARTES LABS INC. (US)

Chapter 8: Global Bolts Market By Region

8.1 Overview

8.2. North America Bolts Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Half Screw Bolt

8.2.4.2 Full Screw Bolt

8.2.5 Historic and Forecasted Market Size By By Material

8.2.5.1 Metal

8.2.5.2 Plastic

8.2.6 Historic and Forecasted Market Size By By Applications

8.2.6.1 Construction

8.2.6.2 Automotive

8.2.6.3 Aerospace

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Bolts Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Half Screw Bolt

8.3.4.2 Full Screw Bolt

8.3.5 Historic and Forecasted Market Size By By Material

8.3.5.1 Metal

8.3.5.2 Plastic

8.3.6 Historic and Forecasted Market Size By By Applications

8.3.6.1 Construction

8.3.6.2 Automotive

8.3.6.3 Aerospace

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Bolts Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Half Screw Bolt

8.4.4.2 Full Screw Bolt

8.4.5 Historic and Forecasted Market Size By By Material

8.4.5.1 Metal

8.4.5.2 Plastic

8.4.6 Historic and Forecasted Market Size By By Applications

8.4.6.1 Construction

8.4.6.2 Automotive

8.4.6.3 Aerospace

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Bolts Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Half Screw Bolt

8.5.4.2 Full Screw Bolt

8.5.5 Historic and Forecasted Market Size By By Material

8.5.5.1 Metal

8.5.5.2 Plastic

8.5.6 Historic and Forecasted Market Size By By Applications

8.5.6.1 Construction

8.5.6.2 Automotive

8.5.6.3 Aerospace

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Bolts Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Half Screw Bolt

8.6.4.2 Full Screw Bolt

8.6.5 Historic and Forecasted Market Size By By Material

8.6.5.1 Metal

8.6.5.2 Plastic

8.6.6 Historic and Forecasted Market Size By By Applications

8.6.6.1 Construction

8.6.6.2 Automotive

8.6.6.3 Aerospace

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Bolts Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Half Screw Bolt

8.7.4.2 Full Screw Bolt

8.7.5 Historic and Forecasted Market Size By By Material

8.7.5.1 Metal

8.7.5.2 Plastic

8.7.6 Historic and Forecasted Market Size By By Applications

8.7.6.1 Construction

8.7.6.2 Automotive

8.7.6.3 Aerospace

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Bolts Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 30.42 Bn. |

|

Forecast Period 2023-32 CAGR: |

5.32% |

Market Size in 2032: |

USD 48.51 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Bolts Market research report is 2024-2032.

Würth Industries Service GmbH & Co. KG (Germany), REYHER (Germany), AB Steel Inc. (Canada), Keller & Kalmbach GmbH (Germany), Rockford Fastener Inc. (U.S.), Viha Steel & Forging (India), Brunner Manufacturing Co. Inc. (U.S.), Kd Fasteners Inc. (U.S.), Big Bolt Nut (India), Fabory (Netherlands), Fastenal Company (U.S.), B&G Manufacturing (U.S.), Jignesh Steel (India), and Other Major Players.

The Bolts Market is segmented into Type, Material Type, Application, and region. By Type, the market is categorized into Half Screw Bolt, Full Screw Bolt, and Non-Threaded. By Nature, the market is categorized into Metal and Plastic. By Application, the market is categorized into Construction, Automotive, Aerospace. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A bolt is a form of threaded fastener with an external male thread requiring a matching pre-formed female thread such as a nut. Bolts are very closely related to screws. Bolts are also required for securing gates or doors because they act as a solid framework for padlocks or deadbolts to latch onto.

Bolts Market Size Was Valued at USD 30.42 billion in 2023 and is Projected to Reach USD 48.51 billion by 2032, Growing at a CAGR of 5.32% From 2024-2032.