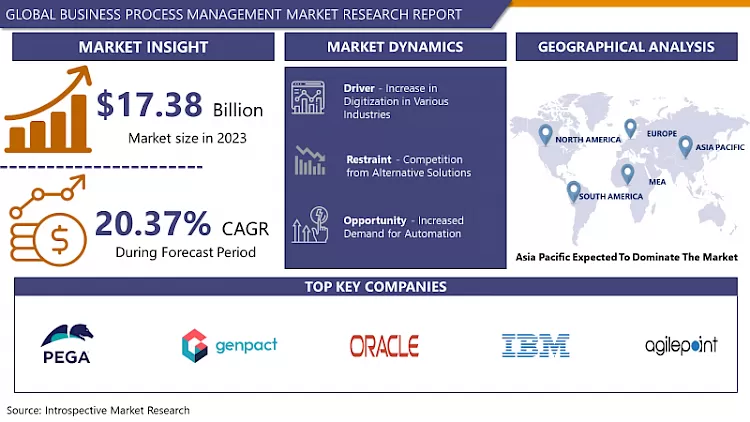

Business Process Management Market Size Was Valued at USD 17.38 Billion in 2023, and is Projected to Reach USD 92.2 Billion by 2032, Growing at a CAGR of 20.37 % From 2024-2032.

Business Process Management (BPM) is a systematic approach to optimize and manage an organization's business processes for enhanced efficiency, agility, and performance. It involves designing, modeling, executing, monitoring, and continually improving processes to achieve business objectives. BPM integrates technology, people, and processes to streamline workflows, reduce operational costs, and ensure compliance. BPM enables organizations to adapt to changing market dynamics, enhance customer satisfaction, and maintain a competitive edge.

Advantages of BPM include increased operational efficiency, reduced costs, enhanced agility, and improved customer satisfaction. By automating and optimizing workflows, organizations can streamline processes, minimize errors, and respond more effectively to changing business environments. BPM also facilitates better compliance with regulations and standards, fostering a culture of continuous improvement.

- A significant market trend in BPM is the increasing adoption of cloud-based BPM solutions. Cloud BPM offers scalability, flexibility, and accessibility, allowing organizations to deploy and manage processes more efficiently. Low-code and no-code BPM platforms are gaining popularity, enabling business users to participate in application development without extensive coding expertise. Another trend is the integration of artificial intelligence and machine learning into BPM systems, enabling advanced analytics, predictive modeling, and decision support.

- The demand for BPM solutions is driven by the need for organizations to digitize and transform their operations in the face of technological advancements and evolving customer expectations. The BPM market is experiencing growth across industries like finance, healthcare, manufacturing, and telecommunications, driven by businesses seeking agile, customer-centric strategies to improve efficiency and drive innovation.

Business Process Management Market Trend Analysis:

Increase in Digitization in Various Industries

- The increase in digitization across various industries has become a driving force in the Business Process Management (BPM) market due to its transformative impact on operational efficiency, data management, and overall business agility. As industries undergo digital transformation, organizations recognize the need to replace manual, paper-based processes with digital solutions to keep pace with rapidly evolving market dynamics.

- Digitization plays a crucial role in optimizing processes through automation, reducing manual errors, and enhancing overall productivity. Automated workflows streamline routine tasks, freeing up human resources for more strategic and value-added activities. Digitization facilitates better data management and analysis, empowering organizations to extract actionable insights from large datasets. The demand for Business Process Management (BPM) solutions is growing the strategic imperative of digitization in industries, enabling organizations to design, execute, and optimize their digital processes, efficient, and technologically advanced landscape across various sectors.

Growing Demand for Automation

- The Business Process Management (BPM) Software enhanced operational efficiency, reduced manual errors, and accelerated processes in the face of evolving business landscapes. Automation within BPM enables the streamlining of routine and complex workflows, eliminating time-consuming manual tasks and minimizing errors. Automation is widely recognized as a tool that enhances productivity, facilitates faster market response, and adapts to evolving customer expectations.

- Cost optimization and resource utilization drive the adoption of automation in BPM. Automated processes contribute to significant time and cost savings, enabling organizations to allocate human resources to more strategic and value-added tasks. The demand for BPM solutions with robust automation capabilities continues to grow, reflecting the broader industry trend towards efficiency, agility, and the integration of advanced technologies in business operations.

Business Process Management Market Segment Analysis:

Business Process Management Market Segmented based on Solution, Deployment, Organization Size, and Application.

By Solution, Automation segment is expected to dominate the market during the forecast Period

Organizations across industries are increasingly recognizing the transformative impact of automation in streamlining workflows, minimizing errors, and accelerating processes. The demand for BPM solutions with robust automation capabilities is driven by the need for cost optimization, resource utilization, and the ability to respond swiftly to dynamic market conditions. Automation has improved productivity and allows businesses to allocate human resources strategically, focusing on value-added tasks. The Automation segment is going to emerge as a key player in the digital transformation of industries, providing businesses with agility, scalability, and a competitive edge.

Business Process Management Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is anticipated to dominate the Business Process Management (BPM) market over the forecast period due to economic growth, digital transformation, and increased adoption of BPM solutions. As several countries in the region experience rapid industrialization and economic development, organizations are keen on optimizing their business processes to enhance efficiency and remain competitive. The demand for BPM solutions is particularly pronounced in sectors such as manufacturing, finance, and healthcare, where streamlined processes are crucial for sustained growth.

- Businesses in countries like China, India, Japan, and South Korea are increasingly recognizing the transformative potential of BPM in enabling digital transformation, improving customer experiences, and meeting evolving regulatory requirements. The rise of cloud-based solutions, with a proactive approach to adopting emerging technologies, positions the Asia Pacific as a key player in the global BPM market. The region's dynamic business environment offers opportunities for BPM vendors to provide solutions that address the specific needs of varied industries and enterprises, further fueling the anticipated dominance of the Asia Pacific in the BPM market over the forecast period.

Key Players Covered in Business Process Management Market:

- Genpact (US)

- TIBCO (US)

- Pegasystems (US)

- ProcessMaker (US)

- Creatio (US)

- AgilePoint (US)

- BP Logix (US)

- Kofax (US)

- AuraPortal (US)

- K2 (US)

- Appian (US)

- Nintex (US)

- OpenText (Canada)

- IBM (US)

- Oracle (US)

- Software AG (Germany)

- Bizagi (UK)

- Bonitasoft (France)

- Kissflow (India)

- Newgen Software (India), and Other Major Players

Key Industry Developments in the Business Process Management Market:

- In May 2023 Pegasystems Inc. introduced Pega Process Mining, an intuitive solution embedded within Pega Platform™, aimed at enhancing operational efficiency for enterprises. By seamlessly integrating process mining capabilities and generative AI-ready APIs, Pega empowers users of all proficiency levels to identify and rectify inefficiencies within their workflows. This innovation addresses the challenges posed by complex customer and employee experiences, providing organizations with a unified approach to streamline operations.

- In August 2023, Genpact and Heubach Group announced a strategic partnership to streamline finance, accounting, and supply chain processes post the acquisition of Clariant's global pigments business. Genpact established Heubach Group Business Services (GBS) centers with optimized operating models to enhance customer experiences and drive sustainable growth. This collaboration underscores Genpact's commitment to delivering transformative business outcomes.

- In December 2023, IBM finalized a deal with Software AG majority owned by Silver Lake, to acquire StreamSets and webMethods, their flagship Super iPaaS platforms, for €2.13 billion in cash. This move underscores IBM's commitment to advancing AI and hybrid cloud solutions. StreamSets will enhance watsonx, IBM's AI and data platform, while webMethods will provide crucial integration and API management tools for hybrid multi-cloud environments.

|

Global Business Process Management Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 17.38 Bn. |

|

Forecast Period 2023-30 CAGR: |

20.37 % |

Market Size in 2032 : |

USD 92.02 Bn. |

|

Segments Covered: |

By Solution |

|

|

|

By Deployment |

|

||

|

By Organization Size |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Business Process Management Market by By Solution (2018-2032)

4.1 Business Process Management Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Automation

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Process Modeling

4.5 Content & Document Management

4.6 Monitoring & Optimization

4.7 Integration

Chapter 5: Business Process Management Market by By Deployment (2018-2032)

5.1 Business Process Management Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Cloud-based

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 On-premise

Chapter 6: Business Process Management Market by By Organization Size (2018-2032)

6.1 Business Process Management Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Small & Medium Enterprises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Large Enterprises

Chapter 7: Business Process Management Market by By Application (2018-2032)

7.1 Business Process Management Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Manufacturing

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Healthcare

7.5 Banking Financial Services and Insurance (BFSI)

7.6 IT

7.7 Retail

7.8 Government & Defense

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Business Process Management Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 CISCO SYSTEMS INC. (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 DELL TECHNOLOGIES INC. (USA)

8.4 BLOOMBERG L.P. (USA)

8.5 FTI TECHNOLOGY LLC (USA)

8.6 GROUND LABS (SINGAPORE)

8.7 INTERNATIONAL BUSINESS MACHINES CORPORATION (USA)

8.8 ACTIVENAV (USA)

8.9 FORMPIPE SOFTWARE AB (SWEDEN)

8.10 EGNYTE INC. (USA)

8.11 DRUVA INC. (USA)

8.12 OTHER KEY PLAYERS

8.13

Chapter 9: Global Business Process Management Market By Region

9.1 Overview

9.2. North America Business Process Management Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Solution

9.2.4.1 Automation

9.2.4.2 Process Modeling

9.2.4.3 Content & Document Management

9.2.4.4 Monitoring & Optimization

9.2.4.5 Integration

9.2.5 Historic and Forecasted Market Size By By Deployment

9.2.5.1 Cloud-based

9.2.5.2 On-premise

9.2.6 Historic and Forecasted Market Size By By Organization Size

9.2.6.1 Small & Medium Enterprises

9.2.6.2 Large Enterprises

9.2.7 Historic and Forecasted Market Size By By Application

9.2.7.1 Manufacturing

9.2.7.2 Healthcare

9.2.7.3 Banking Financial Services and Insurance (BFSI)

9.2.7.4 IT

9.2.7.5 Retail

9.2.7.6 Government & Defense

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Business Process Management Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Solution

9.3.4.1 Automation

9.3.4.2 Process Modeling

9.3.4.3 Content & Document Management

9.3.4.4 Monitoring & Optimization

9.3.4.5 Integration

9.3.5 Historic and Forecasted Market Size By By Deployment

9.3.5.1 Cloud-based

9.3.5.2 On-premise

9.3.6 Historic and Forecasted Market Size By By Organization Size

9.3.6.1 Small & Medium Enterprises

9.3.6.2 Large Enterprises

9.3.7 Historic and Forecasted Market Size By By Application

9.3.7.1 Manufacturing

9.3.7.2 Healthcare

9.3.7.3 Banking Financial Services and Insurance (BFSI)

9.3.7.4 IT

9.3.7.5 Retail

9.3.7.6 Government & Defense

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Business Process Management Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Solution

9.4.4.1 Automation

9.4.4.2 Process Modeling

9.4.4.3 Content & Document Management

9.4.4.4 Monitoring & Optimization

9.4.4.5 Integration

9.4.5 Historic and Forecasted Market Size By By Deployment

9.4.5.1 Cloud-based

9.4.5.2 On-premise

9.4.6 Historic and Forecasted Market Size By By Organization Size

9.4.6.1 Small & Medium Enterprises

9.4.6.2 Large Enterprises

9.4.7 Historic and Forecasted Market Size By By Application

9.4.7.1 Manufacturing

9.4.7.2 Healthcare

9.4.7.3 Banking Financial Services and Insurance (BFSI)

9.4.7.4 IT

9.4.7.5 Retail

9.4.7.6 Government & Defense

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Business Process Management Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Solution

9.5.4.1 Automation

9.5.4.2 Process Modeling

9.5.4.3 Content & Document Management

9.5.4.4 Monitoring & Optimization

9.5.4.5 Integration

9.5.5 Historic and Forecasted Market Size By By Deployment

9.5.5.1 Cloud-based

9.5.5.2 On-premise

9.5.6 Historic and Forecasted Market Size By By Organization Size

9.5.6.1 Small & Medium Enterprises

9.5.6.2 Large Enterprises

9.5.7 Historic and Forecasted Market Size By By Application

9.5.7.1 Manufacturing

9.5.7.2 Healthcare

9.5.7.3 Banking Financial Services and Insurance (BFSI)

9.5.7.4 IT

9.5.7.5 Retail

9.5.7.6 Government & Defense

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Business Process Management Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Solution

9.6.4.1 Automation

9.6.4.2 Process Modeling

9.6.4.3 Content & Document Management

9.6.4.4 Monitoring & Optimization

9.6.4.5 Integration

9.6.5 Historic and Forecasted Market Size By By Deployment

9.6.5.1 Cloud-based

9.6.5.2 On-premise

9.6.6 Historic and Forecasted Market Size By By Organization Size

9.6.6.1 Small & Medium Enterprises

9.6.6.2 Large Enterprises

9.6.7 Historic and Forecasted Market Size By By Application

9.6.7.1 Manufacturing

9.6.7.2 Healthcare

9.6.7.3 Banking Financial Services and Insurance (BFSI)

9.6.7.4 IT

9.6.7.5 Retail

9.6.7.6 Government & Defense

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Business Process Management Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Solution

9.7.4.1 Automation

9.7.4.2 Process Modeling

9.7.4.3 Content & Document Management

9.7.4.4 Monitoring & Optimization

9.7.4.5 Integration

9.7.5 Historic and Forecasted Market Size By By Deployment

9.7.5.1 Cloud-based

9.7.5.2 On-premise

9.7.6 Historic and Forecasted Market Size By By Organization Size

9.7.6.1 Small & Medium Enterprises

9.7.6.2 Large Enterprises

9.7.7 Historic and Forecasted Market Size By By Application

9.7.7.1 Manufacturing

9.7.7.2 Healthcare

9.7.7.3 Banking Financial Services and Insurance (BFSI)

9.7.7.4 IT

9.7.7.5 Retail

9.7.7.6 Government & Defense

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Business Process Management Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 17.38 Bn. |

|

Forecast Period 2023-30 CAGR: |

20.37 % |

Market Size in 2032 : |

USD 92.02 Bn. |

|

Segments Covered: |

By Solution |

|

|

|

By Deployment |

|

||

|

By Organization Size |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Business Process Management Market research report is 2024-2032.

Genpact (US), TIBCO (US), Pegasystems (US), ProcessMaker (US), Creatio (US), AgilePoint (US), BP Logix (US), Kofax (US), AuraPortal (US), K2 (US), Appian (US), Nintex (US), OpenText (Canada), IBM (US), Oracle (US), Software AG (Germany), Bizagi (UK), Bonitasoft (France), Kissflow (India), Newgen Software (India), and Other Major Players.

The Business Process Management Market is segmented into Solution, Deployment, Organization Size, and Application, and region. By Solution, the market is categorized into Automation, Process Modeling, Content and Document Management, and Monitoring & Optimization, Integration. By Deployment, the market is categorized into Cloud-based, and On-premise. By Organization Size, the market is categorized into Small and medium Enterprises and Large Enterprises. By Application, the market is categorized into Manufacturing, Healthcare, Banking, Financial Services and Insurance (BFSI), IT, Retail, and Government & Defense. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Business Process Management (BPM) is a systematic approach to optimize and manage an organization's business processes for enhanced efficiency, agility, and performance. It involves designing, modeling, executing, monitoring, and continually improving processes to achieve business objectives. BPM integrates technology, people, and processes to streamline workflows, reduce operational costs, and ensure compliance. BPM enables organizations to adapt to changing market dynamics, enhance customer satisfaction, and maintain a competitive edge.

Business Process Management Market Size Was Valued at USD 17.38 Billion in 2023, and is Projected to Reach USD 92.2 Billion by 2032, Growing at a CAGR of 20.37 % From 2024-2032.