Butyl Lactate Market Synopsis

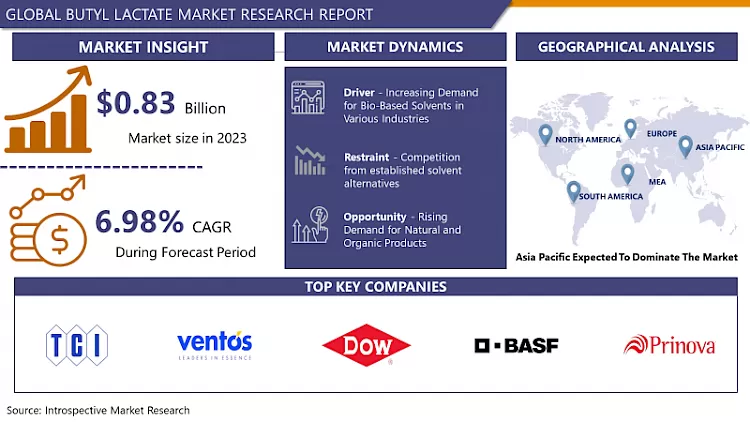

Butyl Lactate Market Size Was Valued at USD 0.83 Billion in 2023 and is Projected to Reach USD 1.52 Billion by 2032, Growing at a CAGR of 6.98% From 2024-2032.

Butyl lactate is a chemical compound composed of butanol and lactic acid, commonly used as a solvent and ingredient in various industries. It exhibits low toxicity and volatility, making it suitable for applications such as coatings, paints, and ink formulations. With its ability to dissolve a wide range of substances, butyl lactate serves as a versatile ingredient, contributing to product stability and performance in numerous industrial processes.

Butyl lactate, a chemical derived from lactic acid and butanol, finds extensive usage in sectors like cosmetics, pharmaceuticals, and industrial applications. Its versatility stems from its properties, including its solvency, low toxicity, and biodegradability. The butyl lactate serves as a solvent for various formulations such as nail polish removers, hair care products, and skincare solutions in the cosmetics industry. Its mild nature makes it suitable for sensitive skin formulations, enhancing its attractiveness to cosmetic manufacturers seeking safer alternatives. Additionally, its biodegradability aligns with the growing demand for eco-friendly ingredients in cosmetic products.

- Moreover, butyl lactate's application extends to the pharmaceutical sector, where it serves as a solvent in drug formulations. Its low toxicity profile makes it a preferred choice for pharmaceutical companies striving to meet stringent safety standards. Furthermore, its compatibility with a wide range of active pharmaceutical ingredients (APIs) enhances its utility in drug delivery systems.

- The Butyl Lactate market is poised for continued growth fueled by increasing demand from end-user industries. Factors such as growing environmental concerns, with the shift towards sustainable products, are expected to drive further adoption of butyl lactate across various applications. Additionally, ongoing research and development activities aimed at enhancing its properties and exploring new applications will likely contribute to the market's expansion in the coming years.

Butyl Lactate Market Trend Analysis

Increasing Demand for Bio-Based Solvents in Various Industries

- Industries are increasingly recognizing the benefits of bio-based solvents, fueled by a growing emphasis on sustainability and environmental consciousness. Bio-based solvents, such as butyl lactate, offer a renewable and eco-friendly alternative to traditional petroleum-based solvents. This shift in preference aligns with broader industry trends towards greener practices, thereby fostering the expansion of the butyl lactate market.

- Governments worldwide are implementing stricter regulations aimed at curbing environmental pollution and promoting sustainable practices. This regulatory environment incentivizes industries to adopt bio-based solvents, driving the uptake of butyl lactate and contributing to market growth. Additionally, consumers are becoming more conscious of the environmental impact of the products they use, prompting companies to integrate sustainable solutions like butyl lactate into their processes.

- The versatility and effectiveness of butyl lactate across various applications further strengthen its market demand. Butyl lactate demonstrates excellent solvency properties, making it suitable for a wide range of industrial applications, including paints and coatings, pharmaceuticals, and cosmetics. Its ability to dissolve various substances efficiently while being derived from renewable sources enhances its appeal to industries seeking both performance and sustainability.

Rising Demand for Natural and Organic Products

- Consumers are becoming health-conscious and environmentally aware shifting towards products that are perceived as safer and more eco-friendly. This trend is particularly prominent in industries such as cosmetics, personal care, and food, where butyl lactate finds wide-ranging applications. As a natural ester derived from lactic acid, butyl lactate aligns well with this consumer preference for clean-label ingredients, making it an attractive choice for manufacturers seeking to meet evolving market demands.

- Moreover, the rising demand for natural and organic products reflects a broader societal shift towards sustainability and wellness. Consumers are looking for products that are free from harmful chemicals and those that support ethical and sustainable practices throughout the supply chain. Butyl lactate, with its biodegradable properties and eco-friendly production process, fits into this narrative seamlessly. As a result, manufacturers can capitalize on this trend by incorporating butyl lactate into their formulations, thereby enhancing the market potential for this versatile compound.

- The growing awareness of the potential health risks associated with synthetic chemicals has fueled the demand for natural alternatives across various industries. Butyl lactate, being a naturally derived ingredient, offers a safer alternative to conventional additives without compromising performance. This presents a unique opportunity for players in the butyl lactate market to position their products as premium, high-quality solutions that cater to the evolving needs of discerning consumers.

Butyl Lactate Market Segment Analysis:

Butyl Lactate Market Segmented Based on Grade and Application.

By Grade, Food Grade Butyl Lactate segment is expected to dominate the market during the forecast period

Food Grade Butyl Lactate segment is primarily driven by the increasing demand for food additives and flavoring agents in the food and beverage industry. Food Grade Butyl Lactate offers several advantages, including its ability to act as a solvent, flavor enhancer, and preservative in food products. Its usage is prevalent in bakery, confectionery, dairy, and beverage applications, where it contributes to improving taste profiles and extending shelf life. Additionally, stringent regulatory standards and consumer preferences for natural and safe ingredients further bolster the demand for Food Grade Butyl Lactate. This segment holds a dominant position in the Butyl Lactate Market, with continued growth expected in the future.

Butyl Lactate Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is dignified to dominate the butyl lactate market due to several key factors. The region's growing population and rising disposable income levels are driving the demand for various consumer products, including cosmetics, personal care items, and pharmaceuticals, which extensively use butyl lactate as a solvent and fragrance ingredient. The region's robust manufacturing sector, particularly in countries like China, Japan, and India, fuels the demand for butyl lactate in industrial applications such as coatings, adhesives, and printing inks.

- The increasing emphasis on eco-friendly and sustainable products is boosting the adoption of butyl lactate, given its biodegradability and low toxicity compared to traditional solvents. Furthermore, favorable government policies promoting the use of bio-based chemicals and investments in research and development further bolster the market growth in the Asia Pacific region. Overall, the convergence of these factors positions the Asia Pacific region as a dominant player in the butyl lactate market, with significant growth prospects in the foreseeable future.

Butyl Lactate Market Top Key Players:

- Dow Chemical Company (USA)

- Eastman Chemical Company (USA)

- Vertellus Holdings LLC (USA)

- Vertellus Specialties Inc. (USA)

- IFF (USA)

- Advanced Biotech (USA)

- Prinova (USA)

- BOC Sciences (USA)

- BASF SE (Germany)

- Ventós (Spain)

- Inoue Perfumery (Japan)

- Shaanxi Dideu Medichem (China)

- Tokyo Chemical Industry Co., Ltd. (Japan), and other major key players.

|

Global Butyl Lactate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 0.83 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.98 % |

Market Size in 2032 : |

USD 1.52 Bn. |

|

Segments Covered: |

By Grade |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Butyl Lactate Market by By Grade (2018-2032)

4.1 Butyl Lactate Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Food Grade Butyl Lactate

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Industrial Grade Butyl Lactate

Chapter 5: Butyl Lactate Market by By Application (2018-2032)

5.1 Butyl Lactate Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Agrochemicals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cosmetics & Personal Care

5.5 Electronics

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Butyl Lactate Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ADVANCED ENVIRONMENTAL RECYCLING TECHNOLOGIES INC. (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ANHUI GUOFENG WOOD-PLASTIC COMPOSITE CO. LTD. (CHINA)

6.4 B. COMPOSITES PVT.LTD. (INDIA)

6.5 BCOMP (SWITZERLAND)

6.6 COLAN AUSTRALIA (AUSTRALIA)

6.7 COMPOSITES PVT.LTD. (INDIA)

6.8 DEVOLD AMT (NORWAY)

6.9 FIBERON (U.S.)

6.10 FLEXFORM SPA (U.S.)

6.11 G. ANGELONI S.R.L (ITALY)

6.12 GREEN DOT CORPORATION (U.S.)

6.13 HUALONG NEW MATERIAL LUMBER CO. LTD. (CHINA)

6.14 KUDOTI PTY LTD (SOUTH AFRICA)

6.15 LINGROVE INC

6.16 (U.S.)

6.17 MCG BIOCOMPOSITES LLC (U.S.)

6.18 MESHLIN COMPOSITES ZRT (HUNGARY)

6.19 NANJING XUHA SUNDI NEW BUILDING MATERIALS LTD. (CHINA)

6.20 ROCK WEST COMPOSITES INC (U.S.)

6.21 RTP COMPANY (U.S.)

6.22 STRUCTEAM (U.K.)

6.23 TAIYUAN HEAVY INDUSTRY COLTD (CHINA)

6.24 TALON TECHNOLOGY COLTD (U.S.)

6.25 TECNARO GMBH (GERMANY)

6.26 TREX COMPANY INC. (U.S.)

6.27 UFP INDUSTRIES INC(U.S.)

6.28 UPM (FINLAND)

6.29 YIXING HUALONG NEW MATERIAL LUMBER CO. LTD. (CHINA)

Chapter 7: Global Butyl Lactate Market By Region

7.1 Overview

7.2. North America Butyl Lactate Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Grade

7.2.4.1 Food Grade Butyl Lactate

7.2.4.2 Industrial Grade Butyl Lactate

7.2.5 Historic and Forecasted Market Size By By Application

7.2.5.1 Agrochemicals

7.2.5.2 Cosmetics & Personal Care

7.2.5.3 Electronics

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Butyl Lactate Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Grade

7.3.4.1 Food Grade Butyl Lactate

7.3.4.2 Industrial Grade Butyl Lactate

7.3.5 Historic and Forecasted Market Size By By Application

7.3.5.1 Agrochemicals

7.3.5.2 Cosmetics & Personal Care

7.3.5.3 Electronics

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Butyl Lactate Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Grade

7.4.4.1 Food Grade Butyl Lactate

7.4.4.2 Industrial Grade Butyl Lactate

7.4.5 Historic and Forecasted Market Size By By Application

7.4.5.1 Agrochemicals

7.4.5.2 Cosmetics & Personal Care

7.4.5.3 Electronics

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Butyl Lactate Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Grade

7.5.4.1 Food Grade Butyl Lactate

7.5.4.2 Industrial Grade Butyl Lactate

7.5.5 Historic and Forecasted Market Size By By Application

7.5.5.1 Agrochemicals

7.5.5.2 Cosmetics & Personal Care

7.5.5.3 Electronics

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Butyl Lactate Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Grade

7.6.4.1 Food Grade Butyl Lactate

7.6.4.2 Industrial Grade Butyl Lactate

7.6.5 Historic and Forecasted Market Size By By Application

7.6.5.1 Agrochemicals

7.6.5.2 Cosmetics & Personal Care

7.6.5.3 Electronics

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Butyl Lactate Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Grade

7.7.4.1 Food Grade Butyl Lactate

7.7.4.2 Industrial Grade Butyl Lactate

7.7.5 Historic and Forecasted Market Size By By Application

7.7.5.1 Agrochemicals

7.7.5.2 Cosmetics & Personal Care

7.7.5.3 Electronics

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Butyl Lactate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023 : |

USD 0.83 Bn. |

|

Forecast Period 2023-30 CAGR: |

6.98 % |

Market Size in 2032 : |

USD 1.52 Bn. |

|

Segments Covered: |

By Grade |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Butyl Lactate Market research report is 2024-2032.

Dow Chemical Company (USA), Eastman Chemical Company (USA), Vertellus Holdings LLC (USA), Vertellus Specialties Inc. (USA), IFF (USA), Advanced Biotech (USA), Prinova (USA), BOC Sciences (USA), BASF SE (Germany), Ventós (Spain), Inoue Perfumery (Japan), Shaanxi Dideu Medichem (China), Tokyo Chemical Industry Co., Ltd. (Japan), and Other Major Players.

The Butyl Lactate Market is segmented into Grade, Application, and region. By Type, the market is categorized into Food Grade Butyl Lactate, and Industrial Grade Butyl Lactate. Application, the market is categorized into Agrochemicals, and Cosmetics & Personal Care, Electronics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Butyl lactate is a chemical compound composed of butanol and lactic acid, commonly used as a solvent and ingredient in various industries. It exhibits low toxicity and volatility, making it suitable for applications such as coatings, paints, and ink formulations. With its ability to dissolve a wide range of substances, butyl lactate serves as a versatile ingredient, contributing to product stability and performance in numerous industrial processes.

Butyl Lactate Market Size Was Valued at USD 0.83 Billion in 2023 and is Projected to Reach USD 1.52 Billion by 2032, Growing at a CAGR of 6.98% From 2024-2032.