Butylated Triphenyl Phosphate Market Synopsis

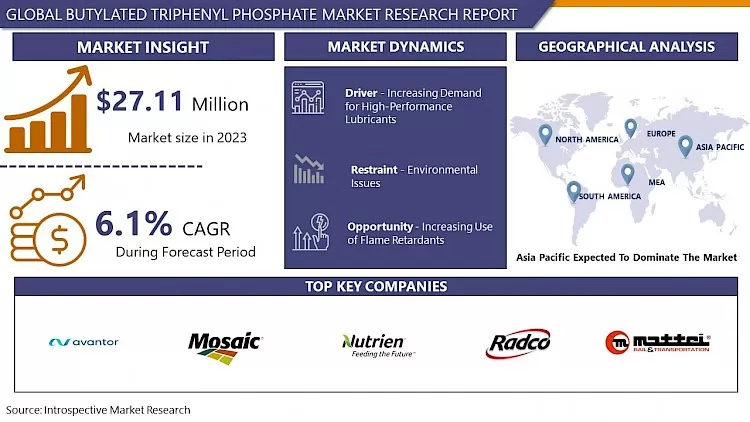

The butylated Triphenyl Phosphate Market Size Was Valued at USD 27.11 Million in 2023 and is Projected to Reach USD 46.19 Million by 2032, Growing at a CAGR of 6.1% From 2024-2032.

Butylated Triphenyl Phosphate (BTPF) is a chemical compound commonly used as a flame retardant and plasticizer. It serves as a crucial additive in various industries, including automotive, electronics, and construction. As a flame retardant, BTPF enhances the fire resistance of materials, making it valuable in manufacturing fire-safe products. The plasticizing properties contribute to improving the flexibility and durability of plastics.

- BTPF is known for its effectiveness in meeting safety standards and regulations related to fire protection. Flame retardant and plasticizer, BTPF offers effective fire protection for various materials used in industries such as automotive, electronics, and construction. Its versatile application extends to hydraulic fluids and lubricating oils, further enhancing its market significance. BTPF is known for its compliance with stringent safety and environmental regulations, positioning it as a preferred choice for industries emphasizing sustainability and regulatory adherence.

- The market is growing in technological advancements to improve the performance of flame-retardant materials. Research and development activities focus on developing advanced formulations of BTPF, catering to evolving industry needs. Moreover, there is an observable shift towards environmentally friendly formulations, aligning with the broader trend of sustainability in the chemical industry.

- As construction activities, automotive production, and the electronics sector continue to expand globally, the demand for flame retardants like BTPF is expected to rise, driven by the ongoing commitment to safety standards and regulations. The demand for Butylated Triphenyl Phosphate is stimulated by the increasing awareness of fire safety, stringent regulations, and expanding applications across diverse industries. The growth in construction, automotive production, and the electronics sector significantly contributes to the rising demand for flame retardants.

Butylated Triphenyl Phosphate Market Trend Analysis

Increasing Demand for High-Performance Lubricants

- BTPF is utilized as a plasticizer and antiwear additive in lubricating oils, contributing to enhanced performance and longevity of machinery and equipment. As industrial activities continue to grow globally, the demand for lubricants in sectors such as manufacturing, automotive, and aerospace has witnessed a parallel surge. BTPF, with its unique chemical properties, acts as a multifunctional additive, imparting not only antiwear and friction-reducing characteristics but also flame-retardant properties. This dual functionality makes BTPF a preferred choice in the formulation of lubricants, addressing both the performance requirements and safety standards essential in various industries

- The demand for high-performance lubricants is increasing due to the increasing demand for advanced machinery operating under demanding conditions. BTPF enhances thermal stability and antiwear properties and aligns with modern industrial applications, boosting its market demand.

Increasing Use of Flame Retardants

- The Butylated Triphenyl Phosphate (BTPP) market is growing due to the rising demand for flame retardant solutions in sectors like electronics, automotive, and construction, driven by the increasing importance of safety standards and regulations. Manufacturers are increasingly seeking reliable flame-retardant additives to enhance their products' safety features due to growing awareness of fire safety and regulatory requirements.

- BTPP, a versatile flame retardant, is well-positioned to meet these demands. Advancements in technology and public safety concerns have driven the demand for flame-resistant materials, making BTPP a valuable component in flame-retardant solutions. The widespread adoption of flame retardants like BTPP presents substantial market growth opportunities.

Butylated Triphenyl Phosphate Market Segment Analysis:

Butylated Triphenyl Phosphate Market Segmented based on Product Type, Application, End-User, and Distribution Channel

By Application, Lubricants segment is expected to dominate the market during the forecast period

- BTP offers superior thermal stability and anti-oxidation properties, making it an ideal choice for enhancing the lubrication efficiency of various machinery and automotive applications. Its ability to mitigate wear and reduce friction in moving parts ensures prolonged equipment life, improved operational reliability, and increased energy efficiency. The Lubricants industry is experiencing a surge in demand owing to the expansion of automotive and industrial sectors globally.

- As these sectors continue to grow, the need for high-performance lubricants that can withstand harsh operating conditions becomes paramount. BTP's versatility in addressing these challenges positions it as a preferred choice in lubricant formulations, contributing significantly to its anticipated dominance in the market over the forecast period.

By End-User, the Automotive segment held the largest share of xx% in 2022

- Automotive manufacturers increasingly prioritize safety features, and flame retardants like BTP play a crucial role in enhancing the fire resistance of various components within vehicles. With the rising demand for lightweight materials in automotive construction, BTP finds extensive use in plastics and polymers, providing both fire safety and structural integrity. Furthermore, stringent global regulations mandating enhanced fire safety standards in the automotive industry further drive the adoption of flame-retardant additives.

- As electric vehicles (EVs) gain growth, the demand for flame retardants in battery components, where BTP is commonly employed, is anticipated to surge. The expanding automotive market in emerging economies and the continuous development of advanced materials emphasize BTP's significance in ensuring the safety and compliance of automotive components, standing as a dominant force in the market within the automotive sector.

Butylated Triphenyl Phosphate Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is a hub for various industries, including automotive, electronics, and construction, which are significant consumers of flame-retardant materials like BTP. The rapid industrialization and urbanization in countries such as China and India contribute to increased demand for fire safety solutions in construction and manufacturing applications.

- Stringent regulations in the region regarding fire safety standards and environmental protection drive the adoption of flame retardants to meet compliance requirements. As Asia Pacific experiences sustained economic growth, the automotive sector, in particular, continues to expand, further fueling the demand for flame retardants in materials used in vehicle manufacturing.

- The growth of the electronics industry, especially in countries like China, South Korea, and Japan, contributes to the rising need for flame retardants in electronic components. These factors collectively position Asia Pacific as a dominant player in the Butylated Triphenyl Phosphate market, with a strong position for market direction over the forecast period.

Butylated Triphenyl Phosphate Market Top Key Players:

- Avantor (USA)

- The Mosaic Company (USA)

- Nutrien Ltd (Canada)

- Radco Industries Inc. (USA)

- MATTEI COMPRESSORS INC. (USA)

- The Good Scents Company (USA)

- LANXESS (Germany)

- PCC Rokita Spólka Akcyjna (Poland)

- PCC SE (Germany)

- EuroChem Group (Switzerland)

- PINFA (Belgium)

- ICL (Israel)

- ZHANGJIAGANG FORTUNE CHEMICAL CO. LTD. (China)

- Imperial Chemical Corporation (Japan), and Other Major Players.

Key Industry Developments in the Butylated Triphenyl Phosphate Market:

In February 2024, Avantor, Inc. acknowledged supplier excellence in various categories and products. The event convened Avantor's European sales organization and supplier partners to enhance collaboration for an outstanding customer experience. The Avantor Supplier Award recipients were commended for their exceptional performance, encompassing product quality, collaboration, operational excellence, marketing, and overall contribution to the company's objectives.

|

Global Butylated Triphenyl Phosphate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 27.11 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.1 % |

Market Size in 2032: |

USD 46.19 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Butylated Triphenyl Phosphate Market by By Type (2018-2032)

4.1 Butylated Triphenyl Phosphate Market Snapshot and Growth Engine

4.2 Market Overview

4.3 BTPF Flame Retardant

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 BTPF Plasticizer

Chapter 5: Butylated Triphenyl Phosphate Market by By Application (2018-2032)

5.1 Butylated Triphenyl Phosphate Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Lubricants

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Hydraulic Fluids

5.5 Flame Retardants

Chapter 6: Butylated Triphenyl Phosphate Market by By End-User (2018-2032)

6.1 Butylated Triphenyl Phosphate Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Electrical

6.5 Construction

6.6 Textile

6.7 Aerospace

Chapter 7: Butylated Triphenyl Phosphate Market by By Distribution Channel (2018-2032)

7.1 Butylated Triphenyl Phosphate Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Direct Sales

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Distributors

7.5 Online Retailers

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Butylated Triphenyl Phosphate Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 FRAM (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 WIX FILTERS (USA)

8.4 CUMMINS (USA)

8.5 DONALDSON (USA)

8.6 CLARCOR (USA)

8.7 ACDELCO (USA)

8.8 SOGEFI (ITALY)

8.9 UFI GROUP (ITALY)

8.10 MANN+HUMMEL (GERMANY)

8.11 MAHLE (GERMANY)

8.12 FREUDENBERG (GERMANY)

8.13 BOSCH (GERMANY)

8.14 APEC KOREA (SOUTH KOREA)

8.15 BENGBU JINWEI (CHINA)

8.16 ZHEJIANG UNIVERSE FILTER (CHINA)

8.17 YONGHUA GROUP (CHINA)

8.18 OKYIA AUTO TECHNOLOGY (CHINA)

8.19 GUANGZHOU YIFENG (CHINA)

8.20 TORA GROUP (CHINA)

8.21 BENGBU PHOENIX (CHINA)

8.22 DONGGUAN SHENGLIAN FILTER (CHINA)

8.23 FOSHAN DONG FAN (CHINA)

8.24 KENLEE (SOUTH KOREA)

8.25 YBM (SOUTH KOREA)

8.26 DENSO (JAPAN)

8.27 AND MAJOR PLAYERS.

Chapter 9: Global Butylated Triphenyl Phosphate Market By Region

9.1 Overview

9.2. North America Butylated Triphenyl Phosphate Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Type

9.2.4.1 BTPF Flame Retardant

9.2.4.2 BTPF Plasticizer

9.2.5 Historic and Forecasted Market Size By By Application

9.2.5.1 Lubricants

9.2.5.2 Hydraulic Fluids

9.2.5.3 Flame Retardants

9.2.6 Historic and Forecasted Market Size By By End-User

9.2.6.1 Automotive

9.2.6.2 Electrical

9.2.6.3 Construction

9.2.6.4 Textile

9.2.6.5 Aerospace

9.2.7 Historic and Forecasted Market Size By By Distribution Channel

9.2.7.1 Direct Sales

9.2.7.2 Distributors

9.2.7.3 Online Retailers

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Butylated Triphenyl Phosphate Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Type

9.3.4.1 BTPF Flame Retardant

9.3.4.2 BTPF Plasticizer

9.3.5 Historic and Forecasted Market Size By By Application

9.3.5.1 Lubricants

9.3.5.2 Hydraulic Fluids

9.3.5.3 Flame Retardants

9.3.6 Historic and Forecasted Market Size By By End-User

9.3.6.1 Automotive

9.3.6.2 Electrical

9.3.6.3 Construction

9.3.6.4 Textile

9.3.6.5 Aerospace

9.3.7 Historic and Forecasted Market Size By By Distribution Channel

9.3.7.1 Direct Sales

9.3.7.2 Distributors

9.3.7.3 Online Retailers

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Butylated Triphenyl Phosphate Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Type

9.4.4.1 BTPF Flame Retardant

9.4.4.2 BTPF Plasticizer

9.4.5 Historic and Forecasted Market Size By By Application

9.4.5.1 Lubricants

9.4.5.2 Hydraulic Fluids

9.4.5.3 Flame Retardants

9.4.6 Historic and Forecasted Market Size By By End-User

9.4.6.1 Automotive

9.4.6.2 Electrical

9.4.6.3 Construction

9.4.6.4 Textile

9.4.6.5 Aerospace

9.4.7 Historic and Forecasted Market Size By By Distribution Channel

9.4.7.1 Direct Sales

9.4.7.2 Distributors

9.4.7.3 Online Retailers

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Butylated Triphenyl Phosphate Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Type

9.5.4.1 BTPF Flame Retardant

9.5.4.2 BTPF Plasticizer

9.5.5 Historic and Forecasted Market Size By By Application

9.5.5.1 Lubricants

9.5.5.2 Hydraulic Fluids

9.5.5.3 Flame Retardants

9.5.6 Historic and Forecasted Market Size By By End-User

9.5.6.1 Automotive

9.5.6.2 Electrical

9.5.6.3 Construction

9.5.6.4 Textile

9.5.6.5 Aerospace

9.5.7 Historic and Forecasted Market Size By By Distribution Channel

9.5.7.1 Direct Sales

9.5.7.2 Distributors

9.5.7.3 Online Retailers

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Butylated Triphenyl Phosphate Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Type

9.6.4.1 BTPF Flame Retardant

9.6.4.2 BTPF Plasticizer

9.6.5 Historic and Forecasted Market Size By By Application

9.6.5.1 Lubricants

9.6.5.2 Hydraulic Fluids

9.6.5.3 Flame Retardants

9.6.6 Historic and Forecasted Market Size By By End-User

9.6.6.1 Automotive

9.6.6.2 Electrical

9.6.6.3 Construction

9.6.6.4 Textile

9.6.6.5 Aerospace

9.6.7 Historic and Forecasted Market Size By By Distribution Channel

9.6.7.1 Direct Sales

9.6.7.2 Distributors

9.6.7.3 Online Retailers

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Butylated Triphenyl Phosphate Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Type

9.7.4.1 BTPF Flame Retardant

9.7.4.2 BTPF Plasticizer

9.7.5 Historic and Forecasted Market Size By By Application

9.7.5.1 Lubricants

9.7.5.2 Hydraulic Fluids

9.7.5.3 Flame Retardants

9.7.6 Historic and Forecasted Market Size By By End-User

9.7.6.1 Automotive

9.7.6.2 Electrical

9.7.6.3 Construction

9.7.6.4 Textile

9.7.6.5 Aerospace

9.7.7 Historic and Forecasted Market Size By By Distribution Channel

9.7.7.1 Direct Sales

9.7.7.2 Distributors

9.7.7.3 Online Retailers

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Butylated Triphenyl Phosphate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 27.11 Mn. |

|

Forecast Period 2024-32 CAGR: |

6.1 % |

Market Size in 2032: |

USD 46.19 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Frequently Asked Questions :

The forecast period in the Butylated Triphenyl Phosphate Market research report is 2024-2032.

Avantor (USA), The Mosaic Company (USA), Nutrien Ltd (Canada), Radco Industries Inc. (USA), MATTEI COMPRESSORS INC. (USA), The Good Scents Company (USA), LANXESS (Germany), PCC Rokita Spólka Akcyjna (Poland), PCC SE (Germany), EuroChem Group (Switzerland), PINFA (Belgium), ICL (Israel), ZHANGJIAGANG FORTUNE CHEMICAL CO. LTD. (China), Imperial Chemical Corporation (Japan)and Other Major Players.

The Butylated Triphenyl Phosphate Market is segmented into Product Type, Application, End-User, Distribution Channel, and region. By Product Type, the market is categorized into BTPF Flame Retardant and BTPF Plasticizer. By Application, the market is categorized into Lubricants, Hydraulic Fluids, and Flame Retardants. By End-User, the market is categorized into Automotive, Electrical, Construction, Textile, and Aerospace. By Distribution Channel, the market is categorized into Direct Sales, Distributors, and Online Retailers. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Butylated Triphenyl Phosphate (BTPF) is a chemical compound commonly used as a flame retardant and plasticizer. It serves as a crucial additive in various industries, including automotive, electronics, and construction. As a flame retardant, BTPF enhances the fire resistance of materials, making it valuable in manufacturing fire-safe products. The plasticizing properties contribute to improving the flexibility and durability of plastics.

The butylated Triphenyl Phosphate Market Size Was Valued at USD 27.11 Million in 2023 and is Projected to Reach USD 46.19 Million by 2032, Growing at a CAGR of 6.1% From 2024-2032.