CAD or CAM Milling Machine Market Synopsis

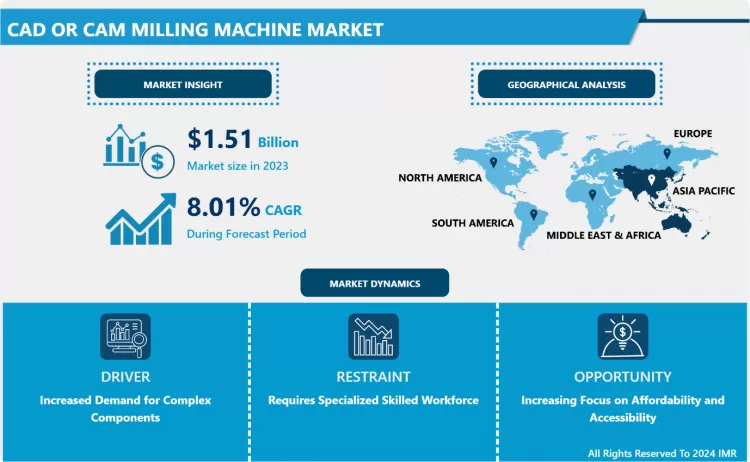

CAD or CAM Milling Machine Market Size Was Valued at USD 1.51 Billion in 2023, and is Projected to Reach USD 3.03 Billion by 2032, Growing at a CAGR of 8.01% From 2024-2032

CAD/CAM milling machines are automated tools used in manufacturing to precisely sculpt or carve solid materials based on digital designs created using Computer-Aided Design (CAD) software. CAM (Computer-Aided Manufacturing) translates these designs into machine-readable instructions for precise cutting, shaping, and milling operations. These machines find extensive applications in various industries, including dentistry, aerospace, automotive, and medical, for creating complex components with high accuracy.

- The CAD/CAM milling machines are essential for automating fabrication processes, allowing complex component manufacturing and specific machining based on digital design models. These applications are widely used across industries like dentistry, aerospace, automotive, and many other industries. Prototyping, and CAD/CAM milling machines are essential for creating dental prostheses, crowns, bridges, and various other components with exceptional accuracy.

- The CAD/CAM milling machines, manufacturers, and dental labs efficiently translate digital design data into physical products, reducing manufacturing times while enhancing overall accuracy. Advanced software interfaces facilitate continuous communication between design and manufacturing phases, revolutionizing dental prosthetics production and streamlining workflows across diverse industries. Continuous market evolution focuses on enhancing machine capabilities, including multi-axis milling, faster processing speeds, and the integration of various materials, from metals to ceramics.

- The market's influence is evident in dental practices, laboratories, and industrial production facilities, where CAD/CAM milling machines optimize workflow efficiency and uplift product quality standards. Leading the charge in innovation, the market drives the transformation of conventional manufacturing processes into digitized, basic, and highly productive operations.

CAD or CAM Milling Machine Market Trend Analysis

Increased Demand for Complex Components

- There is a growing need for complex and precise parts across various sectors such as aerospace, automotive, healthcare, and electronics. CAD/CAM milling machines offer unparalleled capabilities to manufacture these complex components with high precision and efficiency.

- In industries like aerospace and automotive, lightweight structures and intricate designs are essential for performance and fuel efficiency, CAD/CAM milling machines enable the production of complex geometries, such as turbine blades, engine components, and vehicle chassis, with tight tolerances and repeatability.

- Similarly, in the healthcare sector, the demand for personalized medical devices, implants, and prosthetics is increasing, driving the need for CAD/CAM milling machines capable of manufacturing patient-specific products with highest accuracy and customization.

- Furthermore, as consumer electronics become more advanced and compact, manufacturers rely on CAD/CAM milling machines to produce intricate electronic components and printed circuit boards (PCBs) with fine features and precise dimensions.

Increasing Focus on Affordability and Accessibility

- Technological advancement and competition have forced manufacturers to increase focus on making products more affordable and accessible to a broader range of customers.

- Affordability plays a crucial role in expanding the market reach of CAD/CAM milling machines. Manufacturers are Lowering the cost barrier enabling small to medium-sized enterprises (SMEs), independent practitioners, and educational institutions to invest in these technologies.

- Manufacturers are integrating in-built interfaces for easy workflows, and comprehensive training and support programs to make these machines accessible to users with varying levels of expertise. Additionally, advancements in remote monitoring and maintenance enhance accessibility by providing timely assistance and reducing downtime.

- The importance of affordability and accessibility stimulates market expansion and raises technological innovation. Manufacturers are forced to streamline production processes, optimize resource utilization, and explore cost-effective materials without compromising quality. This drive towards efficiency and affordability pushed towards research and development for efforts more advanced CAD/CAM milling solutions.

CAD or CAM Milling Machine Market Segment Analysis:

CAD or CAM Milling Machine Market Segmented based on Machine Type, Technology, and End-User.

By Machine Type, CAD/CAM Milling Machines segment is expected to dominate the market during the forecast period

- The CAD/CAM milling machines segment is integrated into both Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) functionalities, offering a comprehensive solution for digital design and direct fabrication of prototypes or end-use parts. Their versatility allows users to create complex geometries and intricate designs with precision and efficiency.

- CAD/CAM milling machines streamline the manufacturing process by eliminating the need for manual intervention and reducing human errors. They help improve production efficiency, reduce lead times, and lower production costs across various industries.

- Furthermore, advancements in CAD/CAM software and hardware technologies have enhanced the capabilities of these machines, enabling higher levels of automation, faster processing speeds, and improved surface finishes. As a result, manufacturers can achieve greater productivity and competitiveness in the market. These machines enable manufacturers to meet the evolving needs of customers by delivering with superior quality and accuracy.

By Technology, 4-axis Milling Machines segment held the largest share of 55% in 2022

- The 4-axis milling machines segment offers a balance between versatility and cost-effectiveness, making them highly sought after across a wide range of industries. 4-axis milling machines enable machining operations along four axes and one rotational axis. This configuration provides manufacturers with the capability to produce complex components with relatively simpler setups compared to 5-axis machines, resulting in cost savings and enhanced productivity.

- Industries such as automotive, aerospace, healthcare, and electronics, require precise machining of intricate components. The 4-axis milling machines are mostly suitable for their needs. These machines excel in producing parts with complex geometries, such as turbine blades, engine components, medical implants, and electronic enclosures.

- The versatility of 4-axis milling machines allows for the efficient machining of a wide range of materials, from metals and alloys to plastics and composites, further contributing to their dominance in the market.

CAD or CAM Milling Machine Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- There is a rapidly growing importance on automation and digitalization in manufacturing processes is driving the demand for CAD/CAM milling machines in the Asia Pacific region. Manufacturers are increasingly adopting these technologies to improve efficiency, precision, and productivity in their production processes.

- The Asia Pacific region is experiencing rapid industrialization and urbanization, leading to increased demand for advanced manufacturing technologies like CAD/CAM milling machines. Countries such as China, Japan, South Korea, and India are at the forefront of this industrial revolution, fueling the adoption of CAD/CAM technologies in various industries including automotive, aerospace, healthcare, and consumer electronics.

- Furthermore, government initiatives and investments in research and development are promoting the adoption of advanced manufacturing technologies in the region. For example, China's Made in China 2025 initiative aims to upgrade the country's manufacturing capabilities through the integration of technologies like CAD/CAM.

- The presence of leading CAD/CAM milling machine manufacturers in the Asia Pacific region further contributes to its dominance in the market. Companies such as DMG Mori, Mazak Corporation, and Amann Girrbach have a strong presence in the region and are continuously innovating to meet the evolving needs of customers over the forecast period.

CAD or CAM Milling Machine Market Top Key Players:

- Dentsply (United States)

- Renishaw (United Kingdom)

- Sirona (Germany)

- Wieland (Germany)

- KaVo (Germany)

- Imes-icore (Germany)

- Röders (Germany)

- Datron (Germany)

- BienAir (Switzerland)

- Zirkonzahn (Italy)

- AmannGirrbach (Austria)

- Yenadent (Turkey)

- DMG Mori (Japan)

- Mazak Corporation (Japan), and Other Major Players.

Key Industry Developments in the CAD or CAM Milling Machine Market:

- In January 2024, Amann Girrbach AG launched Ceramill Matron, the first fifth generation milling machine. It outperforms older machines in terms of precision and milling results, as well as intuitive handling and user friendliness.

- In May 2023, Roland DGA Corporation launched next-generation milling machines named DWX-52D Plus dry mill and the DWX-42W Plus wet mill.

|

CAD or CAM Milling Machine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.51 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.01% |

Market Size in 2032: |

USD 3.03 Bn. |

|

Segments Covered: |

By Machine Type |

|

|

|

By Technology |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: CAD or CAM Milling Machine Market by By Machine Type (2018-2032)

4.1 CAD or CAM Milling Machine Market Snapshot and Growth Engine

4.2 Market Overview

4.3 CAD/CAM Milling Machines

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Dental CAD/CAM Milling Machines

Chapter 5: CAD or CAM Milling Machine Market by By Technology (2018-2032)

5.1 CAD or CAM Milling Machine Market Snapshot and Growth Engine

5.2 Market Overview

5.3 4-axis Milling Machines

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 5-axis Milling Machines

5.5 High-Speed Milling Machines

Chapter 6: CAD or CAM Milling Machine Market by By End-User (2018-2032)

6.1 CAD or CAM Milling Machine Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Automotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Aerospace

6.5 Electronics

6.6 Healthcare

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 CAD or CAM Milling Machine Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 OPTOMA CORPORATION (TAIWAN)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 PANASONIC CORPORATION (JAPAN)

7.4 SONY CORPORATION (JAPAN)

7.5 BARCO (BELGIUM)

7.6 NEC DISPLAY SOLUTIONS (JAPAN)

7.7 HITACHI DIGITAL MEDIA GROUP (JAPAN)

7.8 ACER INC. (TAIWAN)

7.9 SEIKO EPSON CORPORATION (JAPAN)

7.10 VIEWSONIC CORPORATION (UNITED STATES)

7.11 DELTA ELECTRONICS INC. (TAIWAN)

7.12 BENQ (QISDA CORPORATION) (TAIWAN)

7.13

Chapter 8: Global CAD or CAM Milling Machine Market By Region

8.1 Overview

8.2. North America CAD or CAM Milling Machine Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Machine Type

8.2.4.1 CAD/CAM Milling Machines

8.2.4.2 Dental CAD/CAM Milling Machines

8.2.5 Historic and Forecasted Market Size By By Technology

8.2.5.1 4-axis Milling Machines

8.2.5.2 5-axis Milling Machines

8.2.5.3 High-Speed Milling Machines

8.2.6 Historic and Forecasted Market Size By By End-User

8.2.6.1 Automotive

8.2.6.2 Aerospace

8.2.6.3 Electronics

8.2.6.4 Healthcare

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe CAD or CAM Milling Machine Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Machine Type

8.3.4.1 CAD/CAM Milling Machines

8.3.4.2 Dental CAD/CAM Milling Machines

8.3.5 Historic and Forecasted Market Size By By Technology

8.3.5.1 4-axis Milling Machines

8.3.5.2 5-axis Milling Machines

8.3.5.3 High-Speed Milling Machines

8.3.6 Historic and Forecasted Market Size By By End-User

8.3.6.1 Automotive

8.3.6.2 Aerospace

8.3.6.3 Electronics

8.3.6.4 Healthcare

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe CAD or CAM Milling Machine Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Machine Type

8.4.4.1 CAD/CAM Milling Machines

8.4.4.2 Dental CAD/CAM Milling Machines

8.4.5 Historic and Forecasted Market Size By By Technology

8.4.5.1 4-axis Milling Machines

8.4.5.2 5-axis Milling Machines

8.4.5.3 High-Speed Milling Machines

8.4.6 Historic and Forecasted Market Size By By End-User

8.4.6.1 Automotive

8.4.6.2 Aerospace

8.4.6.3 Electronics

8.4.6.4 Healthcare

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific CAD or CAM Milling Machine Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Machine Type

8.5.4.1 CAD/CAM Milling Machines

8.5.4.2 Dental CAD/CAM Milling Machines

8.5.5 Historic and Forecasted Market Size By By Technology

8.5.5.1 4-axis Milling Machines

8.5.5.2 5-axis Milling Machines

8.5.5.3 High-Speed Milling Machines

8.5.6 Historic and Forecasted Market Size By By End-User

8.5.6.1 Automotive

8.5.6.2 Aerospace

8.5.6.3 Electronics

8.5.6.4 Healthcare

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa CAD or CAM Milling Machine Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Machine Type

8.6.4.1 CAD/CAM Milling Machines

8.6.4.2 Dental CAD/CAM Milling Machines

8.6.5 Historic and Forecasted Market Size By By Technology

8.6.5.1 4-axis Milling Machines

8.6.5.2 5-axis Milling Machines

8.6.5.3 High-Speed Milling Machines

8.6.6 Historic and Forecasted Market Size By By End-User

8.6.6.1 Automotive

8.6.6.2 Aerospace

8.6.6.3 Electronics

8.6.6.4 Healthcare

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America CAD or CAM Milling Machine Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Machine Type

8.7.4.1 CAD/CAM Milling Machines

8.7.4.2 Dental CAD/CAM Milling Machines

8.7.5 Historic and Forecasted Market Size By By Technology

8.7.5.1 4-axis Milling Machines

8.7.5.2 5-axis Milling Machines

8.7.5.3 High-Speed Milling Machines

8.7.6 Historic and Forecasted Market Size By By End-User

8.7.6.1 Automotive

8.7.6.2 Aerospace

8.7.6.3 Electronics

8.7.6.4 Healthcare

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

CAD or CAM Milling Machine Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.51 Bn. |

|

Forecast Period 2024-32 CAGR: |

8.01% |

Market Size in 2032: |

USD 3.03 Bn. |

|

Segments Covered: |

By Machine Type |

|

|

|

By Technology |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the CAD or CAM Milling Machine Market research report is 2024-2032.

Dentsply (United States), Renishaw (United Kingdom), Sirona (Germany), Wieland (Germany), KaVo (Germany), Imes-icore (Germany), Röders (Germany), Datron (Germany), BienAir (Switzerland), Zirkonzahn (Italy), AmannGirrbach (Austria), Yenadent (Turkey), DMG Mori (Japan), Mazak Corporation (Japan), and Other Major Players.

The CAD or CAM Milling Machine Market is segmented into Machine Type, Technology, End-User, and region. By Machine Type, the market is categorized into CAD/CAM Milling Machines, and Dental CAD/CAM Milling Machines. By Technology, the market is categorized into 4-axis Milling Machines, 5-axis Milling Machines, and High-Speed Milling Machines. By, End-User, the market is categorized into Automotive, Aerospace, Electronics, and Healthcare. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

CAD/CAM milling machines are automated tools used in manufacturing to precisely sculpt or carve solid materials based on digital designs created using Computer-Aided Design (CAD) software. CAM (Computer-Aided Manufacturing) translates these designs into machine-readable instructions for precise cutting, shaping, and milling operations. These machines find extensive applications in various industries, including dentistry, aerospace, automotive, and medical, for creating complex components with high accuracy.

CAD or CAM Milling Machine Market Size Was Valued at USD 1.51 Billion in 2023, and is Projected to Reach USD 3.03 Billion by 2032, Growing at a CAGR of 8.01% From 2024-2032