Calcium Gluconate Market Synopsis:

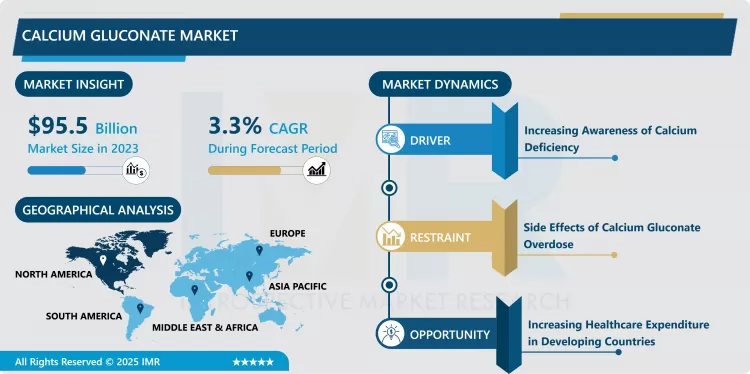

Calcium Gluconate Market Size Was Valued at USD 95.5 Billion in 2023, and is Projected to Reach USD 127.9 Billion by 2032, Growing at a CAGR of 3.3% From 2024-2032.

salt of gluconic acid having wide application in healthcare, food and pharmaceutical products. But it has a significant function in the correction of calcium deficiency and hypocalcmentation. Calcium gluconate is available in tablets and solution orally and intramuscularly for human and animals use. Catering a broad market segment the industries that the product serves includes; pharmaceuticals, food additives and personal care products. This market is driven by increasing knowledge of calcium’s health benefits among people who suffer from high calcium deficiency levels in certain regions.

Calcium gluconate market has been growing steadily in the past few years due to the upsurge in the health consciousness globally especially the developing nations. As this calcium malnutrition increases, there is increasing call for calcium supplements and enrichment in foods and drinks. Calcium gluconate is especially preferred due to its efficiency in the hypocalcemia treatment—a disease that affects millions of people. Agriculture and drug sector, especially the food market, has demonstrated the raised acceptance of calcium gluconate due to expanding health awareness and malnutrition. The need for injectable calcium gluconate for medical emergencies including, cardiopulmonary arrest due to hyperkalemia also aids the market’s growth.

Furthermore, there is growth in the market due to increasing incidence of diseases and changing consumer lifestyle prefer supplements in their diets. With shifting life patterns, low calcium obtainability from food, and more frequency of bone disorders such as osteoporosis, calcium gluconate has become an invaluable product for many people. Major players in the industry are concentrating on adding value to the delivery systems, to offer enhanced bioavailability. The ever enhancing research and development activities in the fields of the pharmaceutical as well as the nutraceutical industries are expected to considerably enhance the market prospect of calcium gluconate in the forthcoming years.

Calcium Gluconate Market Trend Analysis:

Rising Demand for Calcium Gluconate in Food Fortification

- Another area that has been noticed to have grown in the calcium gluconate market, is its application in food and beverage fortification. With the increase in consumer knowledge on nutrient gaps in the foods and beverages they consume more firms are shifting goals towards adding other nutrients into their foods and beverages such as calcium. Calcium gluconate, as one of the most easily absorbed forms of calcium is steadily gaining popularity among the manufacturers of food products.

- From milk products to flavoured and enriched drinks, its use is fast growing. An increased interest in healthier nutritional regimes that has become especially noticeable in North America and Europe has been the driving force for manufacturers to increase production of calcium gluconate enriched foods. In the same way, regulatory authorities have been encouraging the use of food rich in calcium, which is expected to boost the demand for the compound.

Increasing Healthcare Expenditure in Developing Countries

- The possibility for the calcium gluconate market is mainly seen in the countries of developing regions where the healthcare sector is still in the process of development and the share of knowledge about the necessity of the calcium consumption is still growing. In view of escalating healthcare costs in Asia-Pacific, Africa and Latin American countries, those societies are increasingly concerned with adequacy of calcium intakes. Increase awareness of the impact of minerals on health and increasing government programs and health awareness campaigns are two factors that are believed to provide opportunities for extended market development. Besides, the expansion in the number of the middle-income populace in these territories accompanied by growing average prosperity results in elevated consumption of dietary supplements. This expanding consumer base is a potential market for affordable, high quality calcium gluconate products for these manufacturers to penetrate into.

Calcium Gluconate Market Segment Analysis:

Calcium Gluconate Market is Segmented on the basis of Form, Application, End User, and Region

By Form, Powder segment is expected to dominate the market during the forecast period

- Calcium gluconate in powder form is expected to emerge as the largest segment in the global calcium gluconate market during the given time period owing to the sheer number of applications that it can be put to use in. This form is more manageable and less compaction presenting costs savings in storage fitness for use and transportation as a more preferable form of delivery to leading industries in the chemical production industry such as the pharmaceutical, food, and nutraceutical industries. Calcium gluconate powder can be easily processed into oral tablets, capsules, and nutritional supplements, which create much space for producers.

- Additionally, the conditioned lasts slightly longer than other forms such as liquids and also it is more stable. Calcium gluconate powder is also used in intravenous purpose after dissolving in the water or any other fluid making its demand higher in medical sector. Hence getting extended uses along with the convenience, it presents will keep the powder segment Commands an important position in the market.

By Application, Oral Liquid segment expected to held the largest share

- Based on application, the largest calcium gluconate application is in oral liquid because it is widely used for treating calcium which deficiency. This dosage form is a liquid, calcium gluconate, which can be administered in the oral route, especially for patients who cannot ingest tablets or capsules such as the elderly and children. Further, liquid formulations are easily assimilated in the body since they are quickly absorbed, and this is helpful since it works faster than in the other cases where calcium deficiency is not severe. Orally administered liquid calcium gluconate prescription is common for patients who cannot easily digest normal calcium intake due to certain dietary limitations or gastrointestinal problems. Orally administered is another key driver that has made the calcium gluconate formulation type popular because of the formulation’s high bioavailability.

Calcium Gluconate Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- For instance, in 2023, North America has been projected to take the largest share in the global calcium gluconate market because of the high incidence of calcium deficiency in this area, well-developed health care sector and growing populace health consciousness towards supplementary calcium. Old people mostly in the United States segment use calcium supplements to counter bone related diseases as people age including osteoporosis.

- Meantime, the market estimations show that North America occupied more than 35% of the total market in 2023. The well-developed major pharmaceutical industry and the commercial use of dietary supplements for food and nutrition also contribute to driving the growth of calcium gluconate. However, the increase in governmental campaigns to popularise calcium fortified foods and calcium supplements also contributes to market growth.

Active Key Players in the Calcium Gluconate Market:

- Akzo Nobel (Netherlands)

- American Elements (USA)

- Anmol Chemicals (India)

- Ferro Corporation (USA)

- Global Calcium (India)

- Jost Chemical Co. (USA)

- Jungbunzlauer (Switzerland)

- Khalid Scientific Co. (Saudi Arabia)

- Liaoyang Fuqiang Food Chemical Co. Ltd. (China)

- Noah Technologies (USA)

- PMP Fermentation Products (USA)

- Roquette Frères (France)

- Shreeji Pharma (India)

- Spectrum Chemical Mfg. Corp. (USA)

- Xinhong Pharma (China)

- Other Active Players

|

Calcium Gluconate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 95.5 Billion |

|

Forecast Period 2024-32 CAGR: |

3.3 % |

Market Size in 2032: |

USD 127.9 Billion |

|

Segments Covered: |

By Form |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Calcium Gluconate Market by By Form (2018-2032)

4.1 Calcium Gluconate Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Powder

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Gum

4.5 Liquid

Chapter 5: Calcium Gluconate Market by By Application (2018-2032)

5.1 Calcium Gluconate Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Oral Liquid

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Pharmaceutical

5.5 Tablets

5.6 Food Additive Nutraceuticals

5.7 Food and Beverage

Chapter 6: Calcium Gluconate Market by By End User (2018-2032)

6.1 Calcium Gluconate Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Bulking Agent

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Emulsifier

6.5 Thickening Agent

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Calcium Gluconate Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AKZO NOBEL (NETHERLANDS)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AMERICAN ELEMENTS (USA)

7.4 ANMOL CHEMICALS (INDIA)

7.5 FERRO CORPORATION (USA)

7.6 GLOBAL CALCIUM (INDIA)

7.7 JOST CHEMICAL CO. (USA)

7.8 JUNGBUNZLAUER (SWITZERLAND)

7.9 KHALID SCIENTIFIC CO. (SAUDI ARABIA)

7.10 LIAOYANG FUQIANG FOOD CHEMICAL CO. LTD. (CHINA)

7.11 NOAH TECHNOLOGIES (USA)

7.12 PMP FERMENTATION PRODUCTS (USA)

7.13 ROQUETTE FRÈRES (FRANCE)

7.14 SHREEJI PHARMA (INDIA)

7.15 SPECTRUM CHEMICAL MFG. CORP. (USA)

7.16 XINHONG PHARMA (CHINA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Calcium Gluconate Market By Region

8.1 Overview

8.2. North America Calcium Gluconate Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Form

8.2.4.1 Powder

8.2.4.2 Gum

8.2.4.3 Liquid

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Oral Liquid

8.2.5.2 Pharmaceutical

8.2.5.3 Tablets

8.2.5.4 Food Additive Nutraceuticals

8.2.5.5 Food and Beverage

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Bulking Agent

8.2.6.2 Emulsifier

8.2.6.3 Thickening Agent

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Calcium Gluconate Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Form

8.3.4.1 Powder

8.3.4.2 Gum

8.3.4.3 Liquid

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Oral Liquid

8.3.5.2 Pharmaceutical

8.3.5.3 Tablets

8.3.5.4 Food Additive Nutraceuticals

8.3.5.5 Food and Beverage

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Bulking Agent

8.3.6.2 Emulsifier

8.3.6.3 Thickening Agent

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Calcium Gluconate Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Form

8.4.4.1 Powder

8.4.4.2 Gum

8.4.4.3 Liquid

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Oral Liquid

8.4.5.2 Pharmaceutical

8.4.5.3 Tablets

8.4.5.4 Food Additive Nutraceuticals

8.4.5.5 Food and Beverage

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Bulking Agent

8.4.6.2 Emulsifier

8.4.6.3 Thickening Agent

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Calcium Gluconate Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Form

8.5.4.1 Powder

8.5.4.2 Gum

8.5.4.3 Liquid

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Oral Liquid

8.5.5.2 Pharmaceutical

8.5.5.3 Tablets

8.5.5.4 Food Additive Nutraceuticals

8.5.5.5 Food and Beverage

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Bulking Agent

8.5.6.2 Emulsifier

8.5.6.3 Thickening Agent

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Calcium Gluconate Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Form

8.6.4.1 Powder

8.6.4.2 Gum

8.6.4.3 Liquid

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Oral Liquid

8.6.5.2 Pharmaceutical

8.6.5.3 Tablets

8.6.5.4 Food Additive Nutraceuticals

8.6.5.5 Food and Beverage

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Bulking Agent

8.6.6.2 Emulsifier

8.6.6.3 Thickening Agent

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Calcium Gluconate Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Form

8.7.4.1 Powder

8.7.4.2 Gum

8.7.4.3 Liquid

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Oral Liquid

8.7.5.2 Pharmaceutical

8.7.5.3 Tablets

8.7.5.4 Food Additive Nutraceuticals

8.7.5.5 Food and Beverage

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Bulking Agent

8.7.6.2 Emulsifier

8.7.6.3 Thickening Agent

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Calcium Gluconate Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 95.5 Billion |

|

Forecast Period 2024-32 CAGR: |

3.3 % |

Market Size in 2032: |

USD 127.9 Billion |

|

Segments Covered: |

By Form |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Calcium Gluconate Market research report is 2024-2032.

Akzo Nobel (Netherlands), American Elements (USA), Anmol Chemicals (India), Ferro Corporation (USA), Global Calcium (India), Jost Chemical Co. (USA), Jungbunzlauer (Switzerland), Khalid Scientific Co. (Saudi Arabia), Liaoyang Fuqiang Food Chemical Co. Ltd. (China), Noah Technologies (USA), PMP Fermentation Products (USA), Roquette Frères (France), Shreeji Pharma (India), Spectrum Chemical Mfg. Corp. (USA), Xinhong Pharma (China), and Other Active Players.

The Calcium Gluconate Market is segmented into Form, Application, End User and region. By Form, the market is categorized into Powder, Gum, Liquid. By Application, the market is categorized into Oral Liquid, Pharmaceutical, Tablets, Food Additive Nutraceuticals, Food and Beverages. By End User, the market is categorized into Bulking Agent, Emulsifier, Thickening Agent. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

salt of gluconic acid has wide applications in healthcare, food, and pharmaceutical products. But it has a significant function in the correction of calcium deficiency and hyperalimentation. Calcium gluconate is available in tablets and solutions orally and intramuscularly for human and animal use. Catering a broad market segment the industries that the product serves include; pharmaceuticals, food additives and personal care products. This market is driven by increasing knowledge of calcium’s health benefits among people who suffer from high calcium deficiency levels in certain regions.

Calcium Gluconate Market Size Was Valued at USD 95.5 Billion in 2023, and is Projected to Reach USD 127.9 Billion by 2032, Growing at a CAGR of 3.3% From 2024-2032.