Cancer Biopsy Market Synopsis:

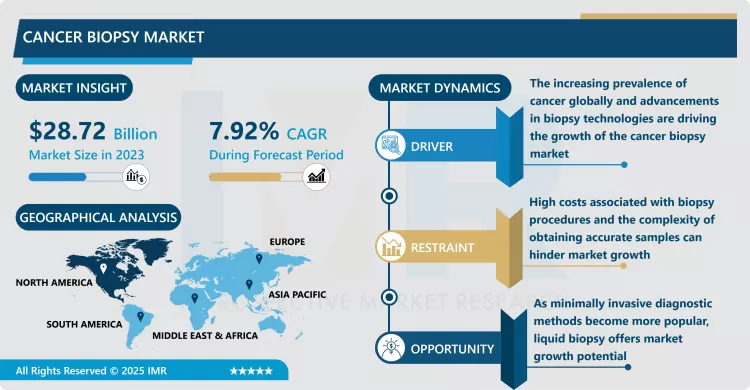

Cancer Biopsy Market Was Valued at USD 28.72 Billion in 2023 and is projected to reach USD 57.03 Billion by 2032, growing at a CAGR of 7.92% from 2024 to 2032.

The cancer biopsy market is a rapidly growing sector within the global healthcare industry, driven by the increasing prevalence of cancer cases worldwide. Biopsy procedures are crucial for diagnosing various types of cancer, helping to determine the stage and extent of the disease, as well as to guide treatment decisions. Traditional biopsy techniques, such as needle and surgical biopsies, are being complemented by more advanced techniques like liquid biopsy, which is a non-invasive method that analyzes cancer-related genetic material in blood samples. This shift toward minimally invasive and more accurate diagnostic tools is boosting the demand for innovative biopsy solutions.

Technological advancements, such as the development of molecular and genetic biomarkers, are enhancing the sensitivity and specificity of cancer biopsies, further accelerating the market's growth. The adoption of automated biopsy systems and AI-powered diagnostic tools is also making biopsy procedures more efficient, reducing human error and improving patient outcomes. Additionally, as the global cancer burden rises, the demand for accurate and timely diagnosis is becoming more critical, pushing healthcare providers to adopt the latest biopsy techniques. The increasing emphasis on personalized medicine is another factor driving the market, as precise molecular profiling through biopsy can guide targeted therapies.

Geographically, North America holds a dominant share of the cancer biopsy market, supported by a robust healthcare infrastructure, high adoption rates of advanced medical technologies, and favorable reimbursement policies. However, the Asia Pacific region is expected to see rapid growth due to improving healthcare access, rising cancer awareness, and growing healthcare investments in countries such as China and India. The market faces challenges related to the high cost of advanced biopsy procedures and the availability of skilled professionals. Despite these challenges, the cancer biopsy market is expected to expand significantly due to increasing cancer incidence, technological advancements, and growing demand for early-stage cancer detection.

Cancer Biopsy Market Trend Analysis:

Growth of Liquid Biopsy

- Liquid biopsy is emerging as a significant trend in the cancer biopsy market, offering a less invasive alternative to traditional tissue biopsies. This technique uses blood samples to detect cancer-related genetic material, such as circulating tumor DNA (ctDNA) or exosomes, making it an attractive option for early detection, monitoring treatment responses, and assessing minimal residual disease. Liquid biopsy's ability to provide real-time insights into tumor dynamics without the need for invasive surgical procedures is driving its adoption in clinical practice. As the technology advances, its accuracy and reliability are expected to improve, broadening its applications in cancer diagnostics and treatment monitoring.

Integration of AI and Automation in Biopsy Procedures

- The integration of artificial intelligence (AI) and automation in cancer biopsy procedures is transforming the market by enhancing the accuracy, efficiency, and consistency of biopsy diagnoses. AI algorithms are increasingly used to analyze biopsy samples, detect cancerous cells, and predict outcomes based on complex data sets, reducing human error and the time required for analysis. Additionally, automated biopsy systems are streamlining procedures, improving workflow, and making biopsies more accessible in resource-limited settings. This trend is expected to grow, as AI and automation continue to make cancer biopsies faster, more accurate, and more affordable for patients worldwide.

Cancer Biopsy Market Segment Analysis:

Cancer Biopsy Market is Segmented on the basis of Product, Biopsy Type, Application, and Region

By Product, Kits and Consumables segment is expected to dominate the market during the forecast period

- The cancer biopsy market is segmented by product into instruments, kits and consumables, and services. Instruments include devices used for the extraction and analysis of biopsy samples, such as biopsy needles, forceps, and endoscopic equipment, which are crucial for performing both traditional and advanced biopsy procedures. Kits and consumables encompass the reagents, collection kits, and materials required for the preparation, transportation, and processing of biopsy samples, enabling accurate diagnosis and analysis. Services cover the professional offerings, including laboratory analysis, diagnostic services, and consultation, provided by hospitals, diagnostic centers, and research institutions. Each segment plays a pivotal role in enhancing the efficiency and precision of cancer biopsy procedures, contributing to the overall growth and advancement of the market.

By Application, Breast Cancer segment expected to held the largest share

- The cancer biopsy market is broadly segmented by application, with key areas including breast cancer, colorectal cancer, cervical cancer, lung cancer, prostate cancer, skin cancer, blood cancer, kidney cancer, liver cancer, pancreatic cancer, ovarian cancer, and others. Among these, breast cancer and lung cancer are the most prominent due to their high incidence rates and the growing demand for early detection and personalized treatment. Additionally, rising awareness and advancements in diagnostic techniques are driving the growth in markets for colorectal, prostate, and blood cancers. As precision medicine continues to evolve, cancer biopsies are becoming increasingly essential for identifying genetic mutations and tailoring treatment strategies across various cancer types, thereby expanding the market across different cancer applications.

Cancer Biopsy Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to dominate the cancer biopsy market over the forecast period due to the region's advanced healthcare infrastructure, high adoption of cutting-edge diagnostic technologies, and significant investment in research and development. The presence of major players, such as Abbott Laboratories and Thermo Fisher Scientific, along with strong regulatory support for medical innovations, has contributed to the widespread availability of innovative biopsy techniques, including liquid biopsy and molecular diagnostics. Furthermore, the growing prevalence of cancer, particularly in the U.S., coupled with rising awareness of early cancer detection, is driving the demand for advanced biopsy procedures. These factors are expected to solidify North America's leadership in the global cancer biopsy market.

Active Key Players in the Cancer Biopsy Market:

- QIAGEN (Germany)

- Illumina, Inc. (USA)

- Angle PLC (UK)

- Myriad Genetics (USA)

- COUNSYL, Inc. (USA)

- Hologic, Inc. (USA)

- Biocept, Inc. (USA)

- Thermo Fisher Scientific, Inc. (USA)

- Danaher (USA)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Epigenomics AG (Germany)

- BD (Becton, Dickinson and Company) (USA)

- Helio Health (Laboratory for Advanced Medicine) (USA)

- Other Active Players

|

Cancer Biopsy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.72 Billion |

|

Forecast Period 2024-32 CAGR: |

7.92% |

Market Size in 2032: |

USD 57.03 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Biopsy Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cancer Biopsy Market by By Product (2018-2032)

4.1 Cancer Biopsy Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Instruments

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Kits and Consumables

4.5 Services

Chapter 5: Cancer Biopsy Market by By Biopsy Type (2018-2032)

5.1 Cancer Biopsy Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Tissue Biopsy (Needle Biopsy (Fine Needle Aspiration (FNA)

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Core Needle Biopsy (CNB))

5.5 Liquid Biopsy

5.6 Others

Chapter 6: Cancer Biopsy Market by By Application (2018-2032)

6.1 Cancer Biopsy Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Breast Cancer

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Colorectal Cancer

6.5 Cervical Cancer

6.6 Lung Cancer

6.7 Prostate Cancer

6.8 Skin Cancer

6.9 Blood Cancer

6.10 Kidney Cancer

6.11 Liver Cancer

6.12 Pancreatic Cancer

6.13 Ovarian Cancer

6.14 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cancer Biopsy Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 QIAGEN (GERMANY)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ILLUMINA INC. (USA)

7.4 ANGLE PLC (UK)

7.5 MYRIAD GENETICS (USA)

7.6 COUNSYL INC. (USA)

7.7 HOLOGIC INC. (USA)

7.8 BIOCEPT INC. (USA)

7.9 THERMO FISHER SCIENTIFIC INC. (USA)

7.10 DANAHER (USA)

7.11 F. HOFFMANN-LA ROCHE LTD. (SWITZERLAND)

7.12 EPIGENOMICS AG (GERMANY)

7.13 BD (BECTON

7.14 DICKINSON AND COMPANY) (USA)

7.15 HELIO HEALTH (LABORATORY FOR ADVANCED MEDICINE) (USA)

7.16 OTHER ACTIVE PLAYERS

Chapter 8: Global Cancer Biopsy Market By Region

8.1 Overview

8.2. North America Cancer Biopsy Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product

8.2.4.1 Instruments

8.2.4.2 Kits and Consumables

8.2.4.3 Services

8.2.5 Historic and Forecasted Market Size By By Biopsy Type

8.2.5.1 Tissue Biopsy (Needle Biopsy (Fine Needle Aspiration (FNA)

8.2.5.2 Core Needle Biopsy (CNB))

8.2.5.3 Liquid Biopsy

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size By By Application

8.2.6.1 Breast Cancer

8.2.6.2 Colorectal Cancer

8.2.6.3 Cervical Cancer

8.2.6.4 Lung Cancer

8.2.6.5 Prostate Cancer

8.2.6.6 Skin Cancer

8.2.6.7 Blood Cancer

8.2.6.8 Kidney Cancer

8.2.6.9 Liver Cancer

8.2.6.10 Pancreatic Cancer

8.2.6.11 Ovarian Cancer

8.2.6.12 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cancer Biopsy Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product

8.3.4.1 Instruments

8.3.4.2 Kits and Consumables

8.3.4.3 Services

8.3.5 Historic and Forecasted Market Size By By Biopsy Type

8.3.5.1 Tissue Biopsy (Needle Biopsy (Fine Needle Aspiration (FNA)

8.3.5.2 Core Needle Biopsy (CNB))

8.3.5.3 Liquid Biopsy

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size By By Application

8.3.6.1 Breast Cancer

8.3.6.2 Colorectal Cancer

8.3.6.3 Cervical Cancer

8.3.6.4 Lung Cancer

8.3.6.5 Prostate Cancer

8.3.6.6 Skin Cancer

8.3.6.7 Blood Cancer

8.3.6.8 Kidney Cancer

8.3.6.9 Liver Cancer

8.3.6.10 Pancreatic Cancer

8.3.6.11 Ovarian Cancer

8.3.6.12 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cancer Biopsy Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product

8.4.4.1 Instruments

8.4.4.2 Kits and Consumables

8.4.4.3 Services

8.4.5 Historic and Forecasted Market Size By By Biopsy Type

8.4.5.1 Tissue Biopsy (Needle Biopsy (Fine Needle Aspiration (FNA)

8.4.5.2 Core Needle Biopsy (CNB))

8.4.5.3 Liquid Biopsy

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size By By Application

8.4.6.1 Breast Cancer

8.4.6.2 Colorectal Cancer

8.4.6.3 Cervical Cancer

8.4.6.4 Lung Cancer

8.4.6.5 Prostate Cancer

8.4.6.6 Skin Cancer

8.4.6.7 Blood Cancer

8.4.6.8 Kidney Cancer

8.4.6.9 Liver Cancer

8.4.6.10 Pancreatic Cancer

8.4.6.11 Ovarian Cancer

8.4.6.12 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cancer Biopsy Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product

8.5.4.1 Instruments

8.5.4.2 Kits and Consumables

8.5.4.3 Services

8.5.5 Historic and Forecasted Market Size By By Biopsy Type

8.5.5.1 Tissue Biopsy (Needle Biopsy (Fine Needle Aspiration (FNA)

8.5.5.2 Core Needle Biopsy (CNB))

8.5.5.3 Liquid Biopsy

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size By By Application

8.5.6.1 Breast Cancer

8.5.6.2 Colorectal Cancer

8.5.6.3 Cervical Cancer

8.5.6.4 Lung Cancer

8.5.6.5 Prostate Cancer

8.5.6.6 Skin Cancer

8.5.6.7 Blood Cancer

8.5.6.8 Kidney Cancer

8.5.6.9 Liver Cancer

8.5.6.10 Pancreatic Cancer

8.5.6.11 Ovarian Cancer

8.5.6.12 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cancer Biopsy Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product

8.6.4.1 Instruments

8.6.4.2 Kits and Consumables

8.6.4.3 Services

8.6.5 Historic and Forecasted Market Size By By Biopsy Type

8.6.5.1 Tissue Biopsy (Needle Biopsy (Fine Needle Aspiration (FNA)

8.6.5.2 Core Needle Biopsy (CNB))

8.6.5.3 Liquid Biopsy

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size By By Application

8.6.6.1 Breast Cancer

8.6.6.2 Colorectal Cancer

8.6.6.3 Cervical Cancer

8.6.6.4 Lung Cancer

8.6.6.5 Prostate Cancer

8.6.6.6 Skin Cancer

8.6.6.7 Blood Cancer

8.6.6.8 Kidney Cancer

8.6.6.9 Liver Cancer

8.6.6.10 Pancreatic Cancer

8.6.6.11 Ovarian Cancer

8.6.6.12 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cancer Biopsy Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product

8.7.4.1 Instruments

8.7.4.2 Kits and Consumables

8.7.4.3 Services

8.7.5 Historic and Forecasted Market Size By By Biopsy Type

8.7.5.1 Tissue Biopsy (Needle Biopsy (Fine Needle Aspiration (FNA)

8.7.5.2 Core Needle Biopsy (CNB))

8.7.5.3 Liquid Biopsy

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size By By Application

8.7.6.1 Breast Cancer

8.7.6.2 Colorectal Cancer

8.7.6.3 Cervical Cancer

8.7.6.4 Lung Cancer

8.7.6.5 Prostate Cancer

8.7.6.6 Skin Cancer

8.7.6.7 Blood Cancer

8.7.6.8 Kidney Cancer

8.7.6.9 Liver Cancer

8.7.6.10 Pancreatic Cancer

8.7.6.11 Ovarian Cancer

8.7.6.12 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Cancer Biopsy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.72 Billion |

|

Forecast Period 2024-32 CAGR: |

7.92% |

Market Size in 2032: |

USD 57.03 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Biopsy Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Cancer Biopsy Market research report is 2024-2032.

QIAGEN (Germany), Illumina, Inc. (USA), Angle PLC (UK), Myriad Genetics (USA), COUNSYL, Inc. (USA), Hologic, Inc. (USA), Biocept, Inc. (USA), Thermo Fisher Scientific, Inc. (USA), Danaher (USA), F. Hoffmann-La Roche Ltd. (Switzerland), Epigenomics AG (Germany), BD (Becton, Dickinson and Company) (USA), Helio Health (Laboratory for Advanced Medicine) (USA), and Other Active Players.

The Cancer Biopsy Market is segmented into By Product, By Product, Application and region. By Product (Instruments, Kits and Consumables, and Services), Biopsy Type (((Tissue Biopsy (Needle Biopsy (Fine Needle Aspiration (FNA) and Core Needle Biopsy (CNB)), Liquid Biopsy, and Others))), and By Application (Breast Cancer, Colorectal Cancer, Cervical Cancer, Lung Cancer, Prostate Cancer, Skin Cancer, Blood Cancer, Kidney Cancer, Liver Cancer, Pancreatic Cancer, Ovarian Cancer, and Others). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Cancer biopsy is a medical procedure in which a small sample of tissue is taken from a suspicious area in the body to be examined for signs of cancer. The sample can be obtained using various methods, including needle biopsies, surgical biopsies, or endoscopic procedures. The collected tissue is then analyzed in a laboratory to determine whether cancer cells are present and, if so, to identify the type and characteristics of the cancer. This diagnostic tool is crucial for confirming cancer diagnoses, determining the stage of the disease, and guiding treatment decisions.

Cancer Biopsy Market Was Valued at USD 28.72 Billion in 2023 and is projected to reach USD 57.03 Billion by 2032, growing at a CAGR of 7.92% from 2024 to 2032.