Cancer Diagnostics Market Synopsis:

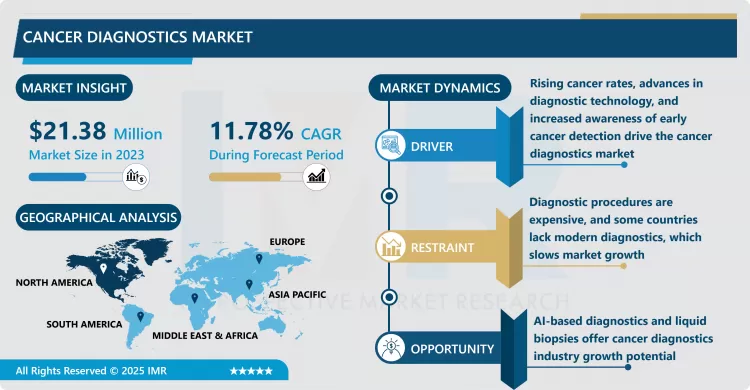

Cancer Diagnostics Market Was Valued at USD 21.38 Million in 2023 and is projected to reach USD 58.25 Billion by 2032, growing at a CAGR of 11.78 % from 2024 to 2032.

The cancer diagnostics market is a rapidly growing sector within the global healthcare industry, driven by the increasing incidence of cancer worldwide and advancements in diagnostic technologies. The demand for early detection and personalized cancer treatments has led to significant investments in cancer diagnostic solutions, such as imaging, biopsy, and molecular diagnostics. These tools enable healthcare professionals to detect cancer at its early stages, improving treatment outcomes and survival rates. The development of non-invasive diagnostic techniques, including liquid biopsy and genetic testing, is further fueling the market's expansion, offering more accurate and efficient ways to monitor and diagnose various types of cancer.

Key factors contributing to the growth of the cancer diagnostics market include the rising awareness of cancer prevention and early detection, an aging population, and improved healthcare infrastructure in emerging markets. In addition, the growing adoption of precision medicine, which tailors treatment plans based on individual genetic profiles, has increased the demand for more advanced diagnostic tools. Innovations in imaging technologies, such as MRI, PET, and CT scans, along with the integration of artificial intelligence (AI) and machine learning in diagnostics, are expected to enhance the accuracy and efficiency of cancer detection, further driving market growth.

While the market shows promising growth potential, challenges such as the high cost of advanced diagnostic procedures, regulatory hurdles, and a lack of access to cutting-edge technologies in low-resource settings could hinder market expansion. However, the increasing number of collaborations between diagnostic companies and research organizations, coupled with the development of new biomarkers, is likely to mitigate these challenges. The market is expected to experience continued growth as research and development efforts in cancer diagnostics continue to evolve, providing more accurate and cost-effective solutions for detecting and treating cancer.

Cancer Diagnostics Market Trend Analysis:

Advancements in Liquid Biopsy Technology in Cancer Diagnostics

- Liquid biopsy technology is revolutionizing cancer diagnostics by offering a non-invasive alternative to traditional tissue biopsies. This innovation allows for the detection of cancer-related genetic mutations and biomarkers in blood samples, enabling early detection and monitoring of cancer progression. Liquid biopsies are particularly valuable in detecting cancers that are hard to biopsy through conventional methods, such as lung or pancreatic cancer. The ongoing improvements in sensitivity and specificity, coupled with the ability to track real-time changes in a patient's cancer profile, are driving the increasing adoption of liquid biopsy technologies in clinical practice. This trend is expected to enhance personalized treatment plans and improve patient outcomes.

Integration of Artificial Intelligence (AI) in Cancer Diagnostics

- The integration of Artificial Intelligence (AI) and machine learning algorithms into cancer diagnostic tools is transforming the landscape of early detection and diagnosis. AI can analyze medical imaging scans, such as CT, MRI, and mammograms, with high accuracy, assisting radiologists in identifying subtle patterns that may be missed by the human eye. Additionally, AI algorithms are used to process vast amounts of patient data, from genetic profiles to histopathology slides, improving diagnostic precision and enabling personalized treatment approaches. As AI technology continues to advance, it is expected to reduce diagnostic errors, shorten diagnostic timelines, and contribute to more accurate cancer detection, driving the growth of the cancer diagnostics market.

Cancer Diagnostics Market Segment Analysis:

Cancer Diagnostics Market is Segmented on the basis of Application, End User, Product, Technology, and Region

By Application, Breast Cancer segment is expected to dominate the market during the forecast period

- The cancer diagnostics market is segmented based on applications and end users. In terms of applications, the market covers various cancer types such as lung cancer, colorectal cancer, breast cancer, and melanoma, with each requiring specialized diagnostic tools for early detection and accurate diagnosis. Lung and colorectal cancers hold significant market shares due to their high prevalence, while breast cancer diagnostics continue to dominate in terms of screening due to widespread awareness and screening programs. Melanoma, a skin cancer, has seen an increase in diagnostic demand with growing awareness of skin health. On the end-user front, hospitals and diagnostic laboratories are the primary users of cancer diagnostic services, with hospitals leading in advanced diagnostic procedures and treatment integration. Diagnostic laboratories also play a critical role in providing specialized testing and supporting oncologists with detailed diagnostic insights. Other end users include research institutions and healthcare facilities involved in cancer research and clinical trials.

By Technology, IVD Testing segment expected to held the largest share

- The cancer diagnostics market is driven by a variety of technologies that play a pivotal role in early detection and monitoring. In-vitro diagnostic (IVD) testing, including blood tests and molecular diagnostics, enables the detection of cancer biomarkers, allowing for non-invasive and accurate diagnosis. Imaging technologies, such as CT scans, MRI, and PET scans, provide detailed images that help in detecting tumors, staging cancer, and planning treatment. Additionally, biopsies, both traditional and minimally invasive, are essential for confirming cancer diagnosis by analyzing tissue samples. These technologies, often used in conjunction, are advancing the precision and speed of cancer diagnostics, offering better outcomes through early detection and personalized treatment strategies.

Cancer Diagnostics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is expected to dominate the cancer diagnostics market over the forecast period due to the region's advanced healthcare infrastructure, high healthcare expenditure, and rapid adoption of cutting-edge diagnostic technologies. The presence of leading players in the field, coupled with strong governmental and private sector investments in cancer research, has significantly contributed to the growth of the market. Additionally, North America benefits from high awareness about cancer screenings, early detection programs, and a growing number of healthcare professionals trained in advanced diagnostic techniques. The increasing prevalence of cancer, alongside the development of innovative diagnostic tools such as liquid biopsy and AI-based systems, further solidifies the region's leadership in the global cancer diagnostics market.

Active Key Players in the Cancer Diagnostics Market:

- Abbott Laboratories (US)

- Agilent Technologies (US)

- Becton, Dickinson and Company (BD) (US)

- bioMérieux SA (France)

- Danaher Corporation (US)

- Hoffmann-La Roche Ltd. (Switzerland)

- GE Healthcare (US)

- Hologic, Inc. (US)

- Illumina, Inc. (US)

- Koninklijke Philips N.V. (Netherlands)

- Merck KGaA (Germany)

- Myriad Genetics, Inc. (US)

- QIAGEN N.V. (Netherlands)

- Siemens Healthineers AG (Germany)

- Sysmex Corporation (Japan)

- Thermo Fisher Scientific Inc. (US)

- Exact Sciences Corporation (US)

- Guardant Health, Inc. (US)

- Caris Life Sciences (US)

- Foundation Medicine, Inc. (US)

- Other Active Players

|

Cancer Diagnostics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 21.38 Million |

|

Forecast Period 2024-32 CAGR: |

11.78% |

Market Size in 2032: |

USD 58.25 Million |

|

Segments Covered: |

By Application |

|

|

|

By End User |

|

||

|

By Product |

|

||

|

By Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cancer Diagnostics Market by By Application (2018-2032)

4.1 Cancer Diagnostics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Lung Cancer

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Colorectal Cancer

4.5 Breast Cancer

4.6 Melanoma

Chapter 5: Cancer Diagnostics Market by By End User (2018-2032)

5.1 Cancer Diagnostics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Diagnostic Laboratories

5.5 Others

Chapter 6: Cancer Diagnostics Market by By Product (2018-2032)

6.1 Cancer Diagnostics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Instruments

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Consumables

Chapter 7: Cancer Diagnostics Market by By Technology (2018-2032)

7.1 Cancer Diagnostics Market Snapshot and Growth Engine

7.2 Market Overview

7.3 IVD Testing

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Imaging Technologies

7.5 Biopsies

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Cancer Diagnostics Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ABBOTT LABORATORIES (US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 AGILENT TECHNOLOGIES (US)

8.4 BECTON

8.5 DICKINSON AND COMPANY (BD) (US)

8.6 BIOMÉRIEUX SA (FRANCE)

8.7 DANAHER CORPORATION (US)

8.8 HOFFMANN-LA ROCHE LTD. (SWITZERLAND)

8.9 GE HEALTHCARE (US)

8.10 HOLOGIC INC. (US)

8.11 ILLUMINA INC. (US)

8.12 KONINKLIJKE PHILIPS N.V. (NETHERLANDS)

8.13 MERCK KGAA (GERMANY)

8.14 MYRIAD GENETICS INC. (US)

8.15 QIAGEN N.V. (NETHERLANDS)

8.16 SIEMENS HEALTHINEERS AG (GERMANY)

8.17 SYSMEX CORPORATION (JAPAN)

8.18 THERMO FISHER SCIENTIFIC INC. (US)

8.19 EXACT SCIENCES CORPORATION (US)

8.20 GUARDANT HEALTH INC. (US)

8.21 CARIS LIFE SCIENCES (US)

8.22 FOUNDATION MEDICINE INC. (US)

8.23 OTHER ACTIVE PLAYERS

Chapter 9: Global Cancer Diagnostics Market By Region

9.1 Overview

9.2. North America Cancer Diagnostics Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Application

9.2.4.1 Lung Cancer

9.2.4.2 Colorectal Cancer

9.2.4.3 Breast Cancer

9.2.4.4 Melanoma

9.2.5 Historic and Forecasted Market Size By By End User

9.2.5.1 Hospitals

9.2.5.2 Diagnostic Laboratories

9.2.5.3 Others

9.2.6 Historic and Forecasted Market Size By By Product

9.2.6.1 Instruments

9.2.6.2 Consumables

9.2.7 Historic and Forecasted Market Size By By Technology

9.2.7.1 IVD Testing

9.2.7.2 Imaging Technologies

9.2.7.3 Biopsies

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Cancer Diagnostics Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Application

9.3.4.1 Lung Cancer

9.3.4.2 Colorectal Cancer

9.3.4.3 Breast Cancer

9.3.4.4 Melanoma

9.3.5 Historic and Forecasted Market Size By By End User

9.3.5.1 Hospitals

9.3.5.2 Diagnostic Laboratories

9.3.5.3 Others

9.3.6 Historic and Forecasted Market Size By By Product

9.3.6.1 Instruments

9.3.6.2 Consumables

9.3.7 Historic and Forecasted Market Size By By Technology

9.3.7.1 IVD Testing

9.3.7.2 Imaging Technologies

9.3.7.3 Biopsies

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Cancer Diagnostics Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Application

9.4.4.1 Lung Cancer

9.4.4.2 Colorectal Cancer

9.4.4.3 Breast Cancer

9.4.4.4 Melanoma

9.4.5 Historic and Forecasted Market Size By By End User

9.4.5.1 Hospitals

9.4.5.2 Diagnostic Laboratories

9.4.5.3 Others

9.4.6 Historic and Forecasted Market Size By By Product

9.4.6.1 Instruments

9.4.6.2 Consumables

9.4.7 Historic and Forecasted Market Size By By Technology

9.4.7.1 IVD Testing

9.4.7.2 Imaging Technologies

9.4.7.3 Biopsies

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Cancer Diagnostics Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Application

9.5.4.1 Lung Cancer

9.5.4.2 Colorectal Cancer

9.5.4.3 Breast Cancer

9.5.4.4 Melanoma

9.5.5 Historic and Forecasted Market Size By By End User

9.5.5.1 Hospitals

9.5.5.2 Diagnostic Laboratories

9.5.5.3 Others

9.5.6 Historic and Forecasted Market Size By By Product

9.5.6.1 Instruments

9.5.6.2 Consumables

9.5.7 Historic and Forecasted Market Size By By Technology

9.5.7.1 IVD Testing

9.5.7.2 Imaging Technologies

9.5.7.3 Biopsies

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Cancer Diagnostics Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Application

9.6.4.1 Lung Cancer

9.6.4.2 Colorectal Cancer

9.6.4.3 Breast Cancer

9.6.4.4 Melanoma

9.6.5 Historic and Forecasted Market Size By By End User

9.6.5.1 Hospitals

9.6.5.2 Diagnostic Laboratories

9.6.5.3 Others

9.6.6 Historic and Forecasted Market Size By By Product

9.6.6.1 Instruments

9.6.6.2 Consumables

9.6.7 Historic and Forecasted Market Size By By Technology

9.6.7.1 IVD Testing

9.6.7.2 Imaging Technologies

9.6.7.3 Biopsies

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Cancer Diagnostics Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Application

9.7.4.1 Lung Cancer

9.7.4.2 Colorectal Cancer

9.7.4.3 Breast Cancer

9.7.4.4 Melanoma

9.7.5 Historic and Forecasted Market Size By By End User

9.7.5.1 Hospitals

9.7.5.2 Diagnostic Laboratories

9.7.5.3 Others

9.7.6 Historic and Forecasted Market Size By By Product

9.7.6.1 Instruments

9.7.6.2 Consumables

9.7.7 Historic and Forecasted Market Size By By Technology

9.7.7.1 IVD Testing

9.7.7.2 Imaging Technologies

9.7.7.3 Biopsies

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Cancer Diagnostics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 21.38 Million |

|

Forecast Period 2024-32 CAGR: |

11.78% |

Market Size in 2032: |

USD 58.25 Million |

|

Segments Covered: |

By Application |

|

|

|

By End User |

|

||

|

By Product |

|

||

|

By Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Cancer Diagnostics Market research report is 2024-2032.

Abbott Laboratories (US), Agilent Technologies (US), Becton, Dickinson and Company (BD) (US), bioMérieux SA (France), Danaher Corporation (US), Hoffmann-La Roche Ltd. (Switzerland), GE Healthcare (US), Hologic, Inc. (US), Illumina, Inc. (US), Koninklijke Philips N.V. (Netherlands), Merck KGaA (Germany), Myriad Genetics, Inc. (US), QIAGEN N.V. (Netherlands), Siemens Healthineers AG (Germany), Sysmex Corporation (Japan), Thermo Fisher Scientific Inc. (US), Exact Sciences Corporation (US), Guardant Health, Inc. (US), Caris Life Sciences (US), Foundation Medicine, Inc. (US), and Other Active Players.

The Cancer Diagnostics Market is segmented into Application, End User, By Product, By Technology and region. Application(Lung Cancer, Colorectal Cancer, Breast Cancer, Melanoma), By End User(Hospitals, Diagnostic Laboratories, Others), By Product(Instruments, Consumables), By Technology(IVD Testing, Imaging Technologies, Biopsies). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Cancer diagnostics is the process of identifying cancer presence, type, and stage in patients through a range of diagnostic tools and methods. This includes imaging techniques such as CT scans, MRI, and X-rays, molecular diagnostics like biomarker analysis and genetic testing, and laboratory tests such as blood panels and biopsy examinations. Effective cancer diagnostics enable early detection, which is crucial for determining the most suitable treatment plan and improving patient outcomes. These diagnostics also play a vital role in monitoring cancer progression, assessing treatment efficacy, and enhancing personalized medicine approaches.

Cancer Diagnostics Market Was Valued at USD 21.38 Million in 2023 and is projected to reach USD 58.25 Billion by 2032, growing at a CAGR of 11.78 % from 2024 to 2032