Canned Tuna Market Synopsis

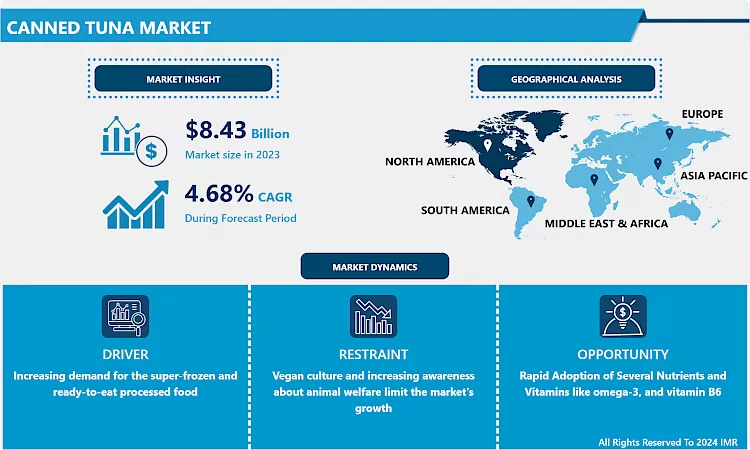

Canned Tuna Market Size Was Valued at USD 8.43 Billion in 2023, and is Projected to Reach USD 12.51 Billion by 2032, Growing at a CAGR of 4.48% From 2024-2032.

Canned tuna, a product involving the processing and preserving of tuna fish in airtight containers, is known for its long shelf life, typically ranging from 1 to 5 years.

- This product is rich in omega-3 fatty acids, proteins, and vitamins, and has a low acidity level, making it beneficial for heart health. Additionally, its nutrients support liver function and healthy brain development, making it a popular choice among health-conscious consumers.

- The canned tuna market is experiencing growth, driven by increasing health awareness. This market is expanding due to the rising demand from various sales channels, including wholesale dealers, and online, and offline stores. Contributing factors to this growth include rising disposable incomes and urbanization, which enhance the demand for canned tuna. However, the market faces potential challenges due to growing animal welfare concerns and the rising popularity of vegan lifestyles, which may impact market dynamics in the forecast period.

Canned Tuna Market Trend Analysis

Increasing demand for the super-frozen and ready-to-eat processed food.

- The increasing demand for super-frozen and ready-to-eat processed foods is a significant driver in the canned tuna market. This trend caters to the fast-paced lifestyle of modern consumers who seek quick and convenient meal options. Canned tuna, with its ready-to-eat nature, fits perfectly into this category. It requires no additional preparation or cooking, making it an ideal choice for those with limited time for meal preparation. The ease of use and convenience offered by canned tuna appeals to many consumers, from busy professionals to students and families seeking quick meal solutions.

- There is a growing awareness and preference for healthier food options among consumers. Canned tuna, being high in protein, omega-3 fatty acids, and other essential nutrients, aligns well with the health-conscious segment of the market. This health aspect is particularly appealing to those looking to maintain a balanced diet without compromising on the ease of meal preparation.

Rapid Adoption of Several Nutrients and Vitamins like omega-3, and vitamin B6.

- The growing consumer awareness about the benefits of omega-3 fatty acids and vitamin B6 present in canned tuna represents a significant opportunity in the market. Omega-3 fatty acids are known for their heart health benefits, reducing the risk of cardiovascular diseases, and improving mental health. Vitamin B6, on the other hand, plays a crucial role in metabolism, brain function, and immune health. The inclusion of these nutrients makes canned tuna an attractive option for health-conscious consumers, thus driving its demand.

- The presence of essential nutrients in canned tuna offers a competitive edge in the health food market. This aspect can be leveraged by brands to market their products as not only convenient and shelf-stable but also as a healthy choice rich in essential nutrients. As more consumers seek convenient yet nutritious meal options, canned tuna could see increased popularity, particularly among those looking to incorporate more seafood into their diets for its health benefits.

Canned Tuna Market Segment Analysis:

Canned Tuna Market Segmented on the basis of type and Distribution Channel.

By Type, Canned Light Tuna segment is expected to dominate the market during the forecast period

- Light tuna, typically sourced from species like skipjack or yellowfin, is highly prized for its lower mercury content compared to white tuna (albacore). This makes it a safer choice for frequent consumption, particularly for vulnerable groups such as pregnant women and children. Moreover, light tuna is rich in essential nutrients like omega-3 fatty acids, protein, and vitamins, making it a popular choice for health-conscious consumers. Its lower fat content compared to other types of tuna also appeals to those looking to maintain a healthy diet.

- Light tuna is generally more affordable than other varieties, such as white tuna. This price advantage makes it accessible to a broader consumer base, boosting its market share. Additionally, its mild flavor and versatility in recipes enhance its appeal. Light tuna can be used in a wide range of dishes, from salads and sandwiches to more elaborate culinary creations, making it a staple in many households.

By Application, Supermarkets/Hypermarkets segment held the largest share of 49.3% in 2022

- Supermarkets and hypermarkets typically offer a diverse range of canned tuna brands and varieties, catering to different consumer preferences and dietary requirements. This variety includes different types of tuna (like albacore, and yellowfin), in various forms (chunk, flaked), and different mediums (oil, water, brine). These stores often serve as one-stop shops, providing customers with a convenient option to buy canned tuna along with their other grocery items. This convenience is a significant factor in attracting customers who prefer to do all their shopping in one location.

- Competitive Pricing and Promotions: Supermarkets and hypermarkets are known for their competitive pricing strategies. They often have the buying power to negotiate lower prices with suppliers, which they then pass on to customers. Additionally, these stores frequently run promotions, discounts, and deals on canned tuna, making it a more attractive option for budget-conscious consumers.

Canned Tuna Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North American consumers, especially in the United States, exhibit a strong preference for light tuna, which aligns with global trends. This preference is driven by factors such as affordability and familiarity. Light tuna, often found in species like skipjack, is generally less expensive than other varieties like albacore or bluefin, making it a popular choice among budget-conscious consumers.

- Growing awareness of sustainable fishing practices among North American consumers. This shift in consumer consciousness is leading to an increased demand for brands that promote eco-friendly fishing practices and responsible sourcing. Labels and certifications indicating sustainable practices are becoming influential factors in consumer purchasing decisions, with such brands gaining traction in the market.

Canned Tuna Market Top Key Players:

- Wild Planet Foods (U.S.)

- Safe Catch Foods (U.S.)

- Ocean Naturals (Canada)

- Bumble Bee Seafoods (U.S.)

- Wild Caught (U.S.)

- Anova Food (U.S.)

- Good Catch Foods (U.S.)

- Wm. Underwood Co. (U.S.)

- BJM Seafood (France)

- CF Grupo (Spain)

- Ortiz (Spain)

- Tonhay Bay (France)

- Ocean Hug (U.K.)

- Tonno Callipo(Italy)

- Ortiz El Consorcio (Spain)

- Bela Sirena (Portugal)

- Crown Prince (Denmark)

- Thai Union Group (Thailand)

- Century Tuna (Philippines)

- Matiz (South Korea)

- GeTuna (Thailand)

- Ng? Phúc (Vietnam)

Key Industry Developments in the Canned Tuna Market:

- In January 2023, Vgarden Ltd., a leading food tech developer, launched a groundbreaking vegan canned tuna, offering a 100% plant-based alternative. The product mimics the appearance, texture, and flavor of traditional canned tuna, catering to the increasing demand for sustainable food options. This innovative creation provides a solution to the global issue of overfishing and the declining populations of wild tuna. Designed to appeal to eco-conscious consumers, Vgarden's plant-based tuna marks a significant step toward a more sustainable future in the food industry, promoting both environmental and ethical responsibility.

- In March 2023, Seasogood, a Dutch brand, launched its plant-based canned tuna alternatives across Spain. The innovative product offers a sustainable and delicious option for tuna lovers, available in four flavors: natural, tomato, olive oil, and lemon & black pepper. With growing demand for plant-based foods, Seasogood’s tuna alternatives provide an environmentally-friendly and nutritious choice. The launch marks a significant step in the brand’s expansion, catering to the increasing preference for plant-based options in Spain.

|

Canned Tuna Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.43 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.48% |

Market Size in 2032: |

USD 12.51 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Canned Tuna Market by By Type (2018-2032)

4.1 Canned Tuna Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Canned White Tuna

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Canned Light Tuna

Chapter 5: Canned Tuna Market by By Distribution (2018-2032)

5.1 Canned Tuna Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Channel

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Supermarkets and Hypermarkets

5.5 Convenience Stores

5.6 Online Retailers

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Canned Tuna Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 MATHESON TRI-GAS INC. (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 PRAXAIR INC. (USA)

6.4 AIR PRODUCTS AND CHEMICALS INC. (USA)

6.5 AIR LIQUIDE (FRANCE)

6.6 LINDE PLC (UK)

6.7 MESSER GROUP GMBH (GERMANY)

6.8 GULF CRYO (KUWAIT)

6.9 INOX AIR PRODUCTS LTD. (INDIA)

6.10 BASF SE (GERMANY)

6.11 IWATANI CORPORATION (JAPAN)

6.12 NIPPON SANSO HOLDINGS CORPORATION (JAPAN)

6.13 AIR WATER INC. (JAPAN)

6.14 TAIYO NIPPON SANSO CORPORATION (JAPAN)

6.15 SOUTHERN INDUSTRIAL GAS BERHAD (MALAYSIA)

6.16 ELLENBARRIE INDUSTRIAL GASES LTD. (INDIA)

6.17 LINDE ENGINEERING (INDIA)

6.18 AIR LIQUIDE (FRANCE)

6.19 QUANTUM DESIGN (U.S.)

6.20 CSIC (CHINA)

6.21 ADVANCED RESEARCH SYSTEMS (U.S.)

6.22 CRYO INDUSTRIES OF AMERICA (U.S.)

6.23 CRYOMECH (U.S.)

6.24 OTHERS KEY PLAYERS

Chapter 7: Global Canned Tuna Market By Region

7.1 Overview

7.2. North America Canned Tuna Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Type

7.2.4.1 Canned White Tuna

7.2.4.2 Canned Light Tuna

7.2.5 Historic and Forecasted Market Size By By Distribution

7.2.5.1 Channel

7.2.5.2 Supermarkets and Hypermarkets

7.2.5.3 Convenience Stores

7.2.5.4 Online Retailers

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Canned Tuna Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Type

7.3.4.1 Canned White Tuna

7.3.4.2 Canned Light Tuna

7.3.5 Historic and Forecasted Market Size By By Distribution

7.3.5.1 Channel

7.3.5.2 Supermarkets and Hypermarkets

7.3.5.3 Convenience Stores

7.3.5.4 Online Retailers

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Canned Tuna Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Type

7.4.4.1 Canned White Tuna

7.4.4.2 Canned Light Tuna

7.4.5 Historic and Forecasted Market Size By By Distribution

7.4.5.1 Channel

7.4.5.2 Supermarkets and Hypermarkets

7.4.5.3 Convenience Stores

7.4.5.4 Online Retailers

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Canned Tuna Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Type

7.5.4.1 Canned White Tuna

7.5.4.2 Canned Light Tuna

7.5.5 Historic and Forecasted Market Size By By Distribution

7.5.5.1 Channel

7.5.5.2 Supermarkets and Hypermarkets

7.5.5.3 Convenience Stores

7.5.5.4 Online Retailers

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Canned Tuna Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Type

7.6.4.1 Canned White Tuna

7.6.4.2 Canned Light Tuna

7.6.5 Historic and Forecasted Market Size By By Distribution

7.6.5.1 Channel

7.6.5.2 Supermarkets and Hypermarkets

7.6.5.3 Convenience Stores

7.6.5.4 Online Retailers

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Canned Tuna Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Type

7.7.4.1 Canned White Tuna

7.7.4.2 Canned Light Tuna

7.7.5 Historic and Forecasted Market Size By By Distribution

7.7.5.1 Channel

7.7.5.2 Supermarkets and Hypermarkets

7.7.5.3 Convenience Stores

7.7.5.4 Online Retailers

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Canned Tuna Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 8.43 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.48% |

Market Size in 2032: |

USD 12.51 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Canned Tuna Market research report is 2024-2032.

Wild Planet Foods (U.S.), Safe Catch Foods (U.S.), Ocean Naturals (Canada), Bumble Bee Seafoods (U.S.), Wild Caught (U.S.), Anova Food (U.S.), Good Catch Foods (U.S.), Wm. Underwood Co. (U.S.), BJM Seafood (France), CF Grupo (Spain), Ortiz (Spain), Tonhay Bay (France), Ocean Hug (U.K.), Tonno Callipo (Italy), Ortiz El Consorcio (Spain), Bela Sirena (Portugal), Crown Prince (Denmark), Thai Union Group (Thailand), Century Tuna (Philippines), Matiz (South Korea), GeTuna (Thailand), Ng? Phúc (Vietnam), and Other Major Players.

The Canned Tuna Market is segmented into Type, Distribution Channel, and region. By Type, the market is categorized into Canned White Tuna and Canned Light Tuna. By Distribution Channel, the market is categorized into Supermarkets and Hypermarkets, Convenience Stores, and Online Retailers. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Canned tuna, a product involving the processing and preservation of tuna fish in airtight containers, is known for its long shelf life, typically ranging from 1 to 5 years. This product is rich in omega-3 fatty acids, proteins, and vitamins, and has a low acidity level, making it beneficial for heart health. Additionally, its nutrients support liver function and healthy brain development, making it a popular choice among health-conscious consumers.

Canned Tuna Market Size Was Valued at USD 8.43 Billion in 2023, and is Projected to Reach USD 12.51 Billion by 2032, Growing at a CAGR of 4.48% From 2024-2032.