Capsule Endoscopy System Market Overview

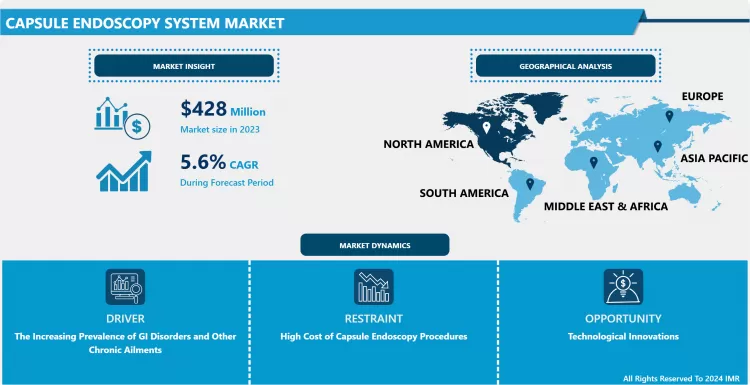

The Capsule Endoscopy System Market was valued at USD 428 million in 2023 and is projected to reach USD 698.91 million by 2032, growing at a CAGR of 5.6% from 2024 to 2032.

-

A capsule endoscopy system is a non-invasive diagnostic procedure that utilizes a tiny wireles camera, encapsulated within a pill-shaped capsule, to capture images of the digestive tract. This capsule, measuring approximately the size of a large vitamin, is equipped with a light source and a high-resolution camera capable of transmitting thousands of images per second to a data recorder worn around the waist.

-

Capsule endoscopy is a non-invasive procedure that doesn't require incisions or sedation, making it more comfortable and patient-friendly. It allows for a comprehensive examination of the small intestine, an often inaccessible area. Patients can move around during the procedure, reducing anxiety and enhancing comfort. Capsule endoscopy is generally considered safe with minimal risks.

-

The market for capsule endoscopy systems is growing due to their effectiveness and patient-friendly nature. Advancements like 360-degree imaging improve diagnostic precision, enabling timely detection of gastrointestinal disorders, early intervention, and improved patient outcomes. As medical professionals increasingly adopt this technology, it continues to transform the gastrointestinal diagnostics landscape.

Capsule Endoscopy System Market Trend Analysis:

The Increasing Prevalence of GI Disorders and Other Chronic Ailments

-

Gastrointestinal disorders, such as Crohn's, celiac, and obscure gastrointestinal bleeding, are on the rise globally. Capsule endoscopy, with its non-invasive imaging capabilities, is a valuable diagnostic tool due to its ability to visualize the small intestine, a challenging area with traditional endoscopic methods. This makes it a valuable diagnostic tool in the face of GI disorders.

-

The aging population worldwide is increasing the prevalence of chronic ailments, including gastrointestinal issues like colorectal cancer, diverticulitis, and bleeding. The capsule endoscopy system, with its patient-friendly approach and reduced discomfort, is particularly appealing for older individuals with multiple comorbidities. Its ability to detect abnormalities early, allowing for timely medical intervention, could improve patient outcomes and reduce the burden of chronic diseases on healthcare systems.

-

In addition to gastrointestinal disorders, the capsule endoscopy system has found utility in diagnosing and monitoring other chronic ailments, such as Crohn's disease. The technology's versatility in addressing a spectrum of medical conditions further propels its market growth. As healthcare providers increasingly recognize the benefits of capsule endoscopy in enhancing diagnostic capabilities and patient care, the market is poised for sustained expansion in response to the growing healthcare needs of an aging and ailing population.

Technological Innovations

-

Companies investing in innovation gain a competitive edge by meeting evolving consumer demands. Advances in artificial intelligence, IoT, and 5G connectivity enhance efficiency, streamline operations, and deliver personalized products and services. These innovations not only improve the customer experience but also open new revenue sources.

-

Emerging technologies in various industries drive a cycle of continuous improvement, promoting economic expansion. Businesses adopting these solutions contribute to innovation ecosystems, boosting individual companies and broader economic growth. Governments and policymakers recognize the transformative power of technology, often incentivizing research and development initiatives. This collaborative effort between the public and private sectors fosters an environment conducive to innovation, driving economic prosperity.

-

Technological innovations drive market growth by addressing societal challenges and promoting sustainability. Solutions focusing on renewable energy, resource efficiency, and environmental conservation meet the growing demand for sustainable practices and position businesses as responsible global citizens. Companies that leverage technology to meet eco-friendly demands are at the forefront of a burgeoning market.

Capsule Endoscopy System Market Segment Analysis:

Capsule Endoscopy System Market Segmented on the basis of type, Product, Application and End-users.

By End-User, Hospitals segment is expected to dominate the market during the forecast Period

-

Hospitals are the most dominant segment in the healthcare market due to their critical role and continuous integration of innovative technologies. They demand advanced medical equipment, electronic health records, telemedicine solutions, and diagnostic tools. The focus on patient-centric care, efficiency improvements, and accurate diagnostics drives hospitals to invest in technological innovations. The ongoing digital transformation, including artificial intelligence in diagnostics and robotics in surgeries, solidifies hospitals as the primary beneficiaries of technological advancements. As the healthcare industry evolves, hospitals continue to embrace innovative solutions.

Capsule Endoscopy System Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

North America is the most dominant market region due to its robust technological infrastructure, extensive research and development capabilities, and high adoption across industries. The region is home to numerous technology hubs, fostering innovation and attracting top talent. Major tech giants and start-ups contribute to North America's dominance by pushing boundaries. The well-established healthcare, finance, and information technology sectors also play pivotal roles in sustaining its market dominance.

-

North America's market dominance is attributed to government support, favourable regulatory frameworks, and a culture that values technological innovation. The region's investment in emerging technologies like artificial intelligence, biotechnology, and renewable energy solidifies its position as a driving force in shaping various industries' futures. This dominance is largely due to its forward-thinking approach, resource abundance, and conducive ecosystem.

Key Players Covered in Capsule Endoscopy System Market:

- CapsoVision (U.S)

- Boston Scientific Corporation (U.S)

- Northside Gastroenterology Endoscopy Center, LLC (U.S.)

- Interscope, Inc. (U.S.)

- AnX Robotica (U.S.)

- Medtronic plc (Ireland)

- IntroMedic Co., Ltd. (South Korea)

- Chongqing Jinshan Science & Technology (Group) Co., Ltd. (China)

- Shangxian Minimal Invasive Inc. (China)

- Fujifilm Holdings Corporation (Japan)

- Olympus Corporation (Japan)

- RF System Lab Co., Ltd. (Japan)

- Check Cap (Israel) and Other Major Players

Key Industry Developments in the Capsule Endoscopy System Market:

-

In November 2024, UAM Regional Medical City (GRMC) proudly announced the launch of an advanced capsule endoscopy service, enhancing digestive health diagnostics with a minimally invasive solution. This significant advancement in gastrointestinal healthcare for Guam and the surrounding region prioritizes innovative technology and patient comfort. Supported by a USDA Rural Development Program grant, this initiative reflects GRMC's commitment to improving healthcare access and quality for the residents of Guam.

In January 2024, ANX Robotica announced the FDA approval of Proscan, a different AI-enabled rationale For Small-Bowl Video Capsule Endoscopy. AnX Robotica, a pioneer in advanced gastrointestinal imaging technologies, is excited to announce the FDA approval of the NaviCam ProScan. Through a rigorous De Novo submission process, the FDA approved ProScan, making it the first AI-assisted reading tool designed to assist small bowel capsule endoscopy examinations in adult patients with capsule endoscopy images obtained for suspected small bowel bleeding.

|

Global Capsule Endoscopy System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 428 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.6% |

Market Size in 2032: |

USD 698.91 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Capsule Endoscopy System Market by By Type (2018-2032)

4.1 Capsule Endoscopy System Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Capsule Endoscope

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Workstations and Recorders

Chapter 5: Capsule Endoscopy System Market by By Product (2018-2032)

5.1 Capsule Endoscopy System Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Oesophageal Capsule

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Small Bowel Capsule

5.5 Colon Capsule

Chapter 6: Capsule Endoscopy System Market by By Application (2018-2032)

6.1 Capsule Endoscopy System Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Obscure Gastrointestinal Bleeding

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Crohn’s Disease

6.5 Small Intestine Tumor

Chapter 7: Capsule Endoscopy System Market by By End User (2018-2032)

7.1 Capsule Endoscopy System Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Diagnostic Laboratories

7.5 Specialty Clinics

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Capsule Endoscopy System Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 THALES GROUP

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 CONDUENT INC

8.4 CUBIC CORPORATION

8.5 ADDCO

8.6 AGERO INC

8.7 DENSO CORPORATION

8.8 EFKON GMBH

8.9 HITACHI LTD

8.10 GARMIN LTD

8.11 THALES GROUP

8.12 XEROX CORPORATION

8.13 RECARDO

8.14 SENSYS NETWORKS INC

8.15 TELENAV INC

8.16 ITERIS INC

8.17 KAPSCH TRAFFICCOM

8.18 LANNER

8.19 NUANCE COMMUNICATIONS INC

8.20 Q-FREE ASA

8.21 SIEMENS AG

8.22 TOMTOM INTERNATIONAL BV

8.23 TRANSCORE

Chapter 9: Global Capsule Endoscopy System Market By Region

9.1 Overview

9.2. North America Capsule Endoscopy System Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Type

9.2.4.1 Capsule Endoscope

9.2.4.2 Workstations and Recorders

9.2.5 Historic and Forecasted Market Size By By Product

9.2.5.1 Oesophageal Capsule

9.2.5.2 Small Bowel Capsule

9.2.5.3 Colon Capsule

9.2.6 Historic and Forecasted Market Size By By Application

9.2.6.1 Obscure Gastrointestinal Bleeding

9.2.6.2 Crohn’s Disease

9.2.6.3 Small Intestine Tumor

9.2.7 Historic and Forecasted Market Size By By End User

9.2.7.1 Hospitals

9.2.7.2 Diagnostic Laboratories

9.2.7.3 Specialty Clinics

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Capsule Endoscopy System Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Type

9.3.4.1 Capsule Endoscope

9.3.4.2 Workstations and Recorders

9.3.5 Historic and Forecasted Market Size By By Product

9.3.5.1 Oesophageal Capsule

9.3.5.2 Small Bowel Capsule

9.3.5.3 Colon Capsule

9.3.6 Historic and Forecasted Market Size By By Application

9.3.6.1 Obscure Gastrointestinal Bleeding

9.3.6.2 Crohn’s Disease

9.3.6.3 Small Intestine Tumor

9.3.7 Historic and Forecasted Market Size By By End User

9.3.7.1 Hospitals

9.3.7.2 Diagnostic Laboratories

9.3.7.3 Specialty Clinics

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Capsule Endoscopy System Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Type

9.4.4.1 Capsule Endoscope

9.4.4.2 Workstations and Recorders

9.4.5 Historic and Forecasted Market Size By By Product

9.4.5.1 Oesophageal Capsule

9.4.5.2 Small Bowel Capsule

9.4.5.3 Colon Capsule

9.4.6 Historic and Forecasted Market Size By By Application

9.4.6.1 Obscure Gastrointestinal Bleeding

9.4.6.2 Crohn’s Disease

9.4.6.3 Small Intestine Tumor

9.4.7 Historic and Forecasted Market Size By By End User

9.4.7.1 Hospitals

9.4.7.2 Diagnostic Laboratories

9.4.7.3 Specialty Clinics

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Capsule Endoscopy System Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Type

9.5.4.1 Capsule Endoscope

9.5.4.2 Workstations and Recorders

9.5.5 Historic and Forecasted Market Size By By Product

9.5.5.1 Oesophageal Capsule

9.5.5.2 Small Bowel Capsule

9.5.5.3 Colon Capsule

9.5.6 Historic and Forecasted Market Size By By Application

9.5.6.1 Obscure Gastrointestinal Bleeding

9.5.6.2 Crohn’s Disease

9.5.6.3 Small Intestine Tumor

9.5.7 Historic and Forecasted Market Size By By End User

9.5.7.1 Hospitals

9.5.7.2 Diagnostic Laboratories

9.5.7.3 Specialty Clinics

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Capsule Endoscopy System Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Type

9.6.4.1 Capsule Endoscope

9.6.4.2 Workstations and Recorders

9.6.5 Historic and Forecasted Market Size By By Product

9.6.5.1 Oesophageal Capsule

9.6.5.2 Small Bowel Capsule

9.6.5.3 Colon Capsule

9.6.6 Historic and Forecasted Market Size By By Application

9.6.6.1 Obscure Gastrointestinal Bleeding

9.6.6.2 Crohn’s Disease

9.6.6.3 Small Intestine Tumor

9.6.7 Historic and Forecasted Market Size By By End User

9.6.7.1 Hospitals

9.6.7.2 Diagnostic Laboratories

9.6.7.3 Specialty Clinics

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Capsule Endoscopy System Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Type

9.7.4.1 Capsule Endoscope

9.7.4.2 Workstations and Recorders

9.7.5 Historic and Forecasted Market Size By By Product

9.7.5.1 Oesophageal Capsule

9.7.5.2 Small Bowel Capsule

9.7.5.3 Colon Capsule

9.7.6 Historic and Forecasted Market Size By By Application

9.7.6.1 Obscure Gastrointestinal Bleeding

9.7.6.2 Crohn’s Disease

9.7.6.3 Small Intestine Tumor

9.7.7 Historic and Forecasted Market Size By By End User

9.7.7.1 Hospitals

9.7.7.2 Diagnostic Laboratories

9.7.7.3 Specialty Clinics

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Capsule Endoscopy System Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 428 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.6% |

Market Size in 2032: |

USD 698.91 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Product |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the market research report is 2024-2032.

CapsoVision (U.S), Boston Scientific Corporation (U.S), Northside Gastroenterology Endoscopy Center, LLC (U.S.), Interscope Inc. (U.S.), AnX Robotica (U.S.), Medtronic plc (Ireland), IntroMedic Co., Ltd. (South Korea), Chongqing Jinshan Science & Technology (Group) Co., Ltd. (China), Shangxian Minimal Invasive Inc. (China), Fujifilm Holdings Corporation (Japan), Olympus Corporation (Japan), RF System Lab Co., Ltd. (Japan), Check Cap (Israel)

The Capsule Endoscopy System Market is segmented into Type, Product, Application, End-User and region. By Type, the market is categorized into Capsule Endoscope and Workstations and Recorders. By Product, the market is categorized into Oesophageal Capsule, Small Bowel Capsule, and Colon Capsule. By Application, the market is categorized into Obscure Gastrointestinal Bleeding, Crohn’s Disease, and Small Intestine Tumor. By End-User, the market is categorized into Hospitals, Diagnostic Laboratories, and Specialty Clinics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.)

A capsule endoscopy system is a non-invasive diagnostic procedure that utilizes a tiny wireless camera, encapsulated within a pill-shaped capsule, to capture images of the digestive tract. This capsule, measuring approximately the size of a large vitamin, is equipped with a light source and a high-resolution camera capable of transmitting thousands of images per second to a data recorder worn around the waist.

The Capsule Endoscopy System Market was valued at USD 428 million in 2023 and is projected to reach USD 698.91 million by 2032, growing at a CAGR of 5.6% from 2024 to 2032.