Carbon Black Market Synopsis

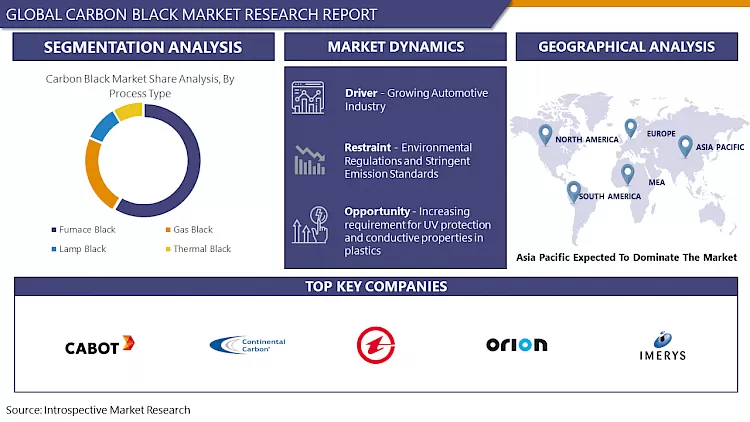

Carbon Black Market Size Was Valued at USD 27.44 Billion In 2023 And Is Projected To Reach USD 41.49 Billion By 2032, Growing At A CAGR Of 4.7% From 2024-2032.

Carbon Black, produced by incomplete combustion of hydrocarbons, is a finely divided carbonaceous particle with a high surface area. It is used in rubber fillers, inks, coatings, plastics, and water purification processes. Carbon Black is also essential in batteries, and electronics, and as a catalyst in chemical reactions due to its unique properties.

- Carbon Black, a material derived from incomplete combustion of hydrocarbons, is widely used in various industries due to its high surface area-to-volume ratio. It enhances mechanical strength, abrasion resistance, and durability in rubber manufacturing, making it a preferred pigment in inks, coatings, and plastics. The demand for Carbon Black is increasing globally due to the automotive, construction, and electronics industries. It is used for high-performance tires and water purification systems in the automotive sector.

- Carbon Black also enhances electrical conductivity in lithium-ion batteries, contributing to energy storage solutions. In the electronics industry, it is used in conductive plastics, cables, and electronic devices. In the pharmaceutical and cosmetics industries, it is used in drug formulations, cosmetics, and personal care products due to its coloring properties and adsorption capabilities. Carbon Black also serves as a catalyst support in chemical processes, facilitating reactions. Carbon Black is a versatile additive with economic and environmental benefits. Its widespread availability and low production cost make it a cost-effective choice for industries seeking high-performance additives. Its use in enhancing product longevity and performance reduces maintenance and replacement frequency.

- Carbon Black also offers sustainability and resource efficiency by extending the lifespan of rubber products and reducing raw material consumption. Its role in water purification helps mitigate environmental pollution by removing harmful contaminants from wastewater streams. As industries prioritize sustainability, Carbon Black's versatility makes it a preferred choice for achieving performance goals while minimizing environmental impact. Research and development efforts are ongoing to optimize production processes and ensure Carbon Black remains a valuable resource for diverse industries.

Carbon Black Market Trend Analysis

Growing Automotive Industry

- The automotive industry is experiencing a surge in demand for Carbon Black due to its role in enhancing vehicle performance, durability, and safety. Carbon Black is primarily used in tire manufacturing, where it improves tire mechanical properties like abrasion resistance, tread wear, and traction. With urbanization and disposable income driving the demand for tires, Carbon Black's use extends to other automotive components like belts, hoses, seals, and gaskets. It also finds application in automotive coatings and plastics, providing UV protection, coloration, and reinforcement to exterior and interior components.

- The trend towards electric vehicles (EVs) also contributes to the growing demand for Carbon Black, as they still require tires and rubber components. The automotive industry's focus on sustainability and fuel efficiency drives innovations in tire technology, leading to the development of high-performance tires relying heavily on Carbon Black additives.

- Carbon Black is crucial in the development of lightweight materials and energy-efficient tires for automotive manufacturers to meet emissions and fuel efficiency regulations. These advancements reduce vehicle environmental footprints and enhance performance and sustainability. As the automotive industry evolves, demand for Carbon Black is expected to remain robust, solidifying its position as a vital component in vehicle production and advancement.

Increasing requirement for UV protection and conductive properties in plastics

- The demand for UV protection and conductive properties in plastics is on the rise due to concerns over UV radiation damage. Carbon Black, with its excellent UV absorption properties, is an ideal additive in plastic formulations, offering enhanced durability and prolonging the lifespan of products exposed to sunlight. Conductive plastics are also in high demand in industries like electronics, automotive, and packaging, playing a crucial role in electromagnetic interference shielding, static dissipation, and electrical conductivity.

- Carbon Black is widely used as a conductive filler in plastic composites, achieving desired conductivity levels while maintaining mechanical integrity and processing efficiency. The emergence of electric vehicles (EVs) and electronic devices further drives the demand for conductive plastics, as lightweight, durable materials with excellent electrical properties are needed. Carbon Black offers economic advantages as a conductive additive, enabling the production of cost-effective, lightweight plastics with tailored electrical properties, meeting the evolving demands of modern industries.

Carbon Black Market Segment Analysis:

The Carbon Black Market is Segmented on the basis of Process Type, Application, and Grade.

By Process Type, Furnace Black segment is expected to dominate the market during the forecast period

- The Furnace Black segment dominates the Carbon Black industry due to its superior properties, widespread applications, and established manufacturing processes. Furnace Black offers excellent reinforcement and durability, making it ideal for the automotive and tire industries. Its high abrasion resistance, tensile strength, and resilience make it ideal for enhancing rubber product performance and longevity. The demand for high-quality tires with superior traction, wear resistance, and fuel efficiency further drives its prominence in the market.

- The furnace method, which involves the combustion of hydrocarbons in a controlled environment, allows for large-scale manufacturing with consistent product quality. This process allows for customization to meet specific customer requirements, ensuring widespread adoption across various industries. The Furnace Black segment also benefits from economies of scale, with major manufacturers operating large production facilities to meet global demand.

- They leverage advanced technologies and economies of scale to optimize efficiency, reduce costs, and maintain competitive pricing. The Furnace Black segment has a long history of use and established supply chains, providing stability and reliability to customers. Manufacturers have invested in research and development to enhance Furnace Black products, ensuring their relevance and competitiveness in evolving markets.

By Application, Tire Manufacturing segment is expected to dominate the market during the forecast period

- The tire manufacturing segment is expected to dominate the demand for Carbon Black due to its crucial role in tire rubber formulations. Carbon Black enhances tire mechanical properties, such as abrasion resistance, tread wear, and traction, making them more durable, safer, and longer-lasting. The automotive industry is experiencing continuous growth globally, driven by factors like population expansion, urbanization, and increasing disposable incomes. Emerging markets are particularly affected by rapid industrialization and urban development.

- Automotive manufacturers are focusing on improving fuel efficiency, reducing emissions, and enhancing vehicle safety. Carbon Black plays a pivotal role in developing high-performance tires that meet these requirements, ensuring optimal fuel economy, reduced carbon emissions, and enhanced driving stability. The tire industry's research and development efforts continuously explore new tire designs, materials, and technologies to address evolving consumer preferences and industry trends. Carbon Black remains at the forefront of tire innovation, with manufacturers constantly seeking ways to optimize its usage for improved performance and sustainability.

Carbon Black Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is expected to dominate the Carbon Black market due to its thriving manufacturing sector, particularly in countries like China, India, Japan, and South Korea, which are major producers of automobiles, rubber products, plastics, and electronics. The region's rapid urbanization and infrastructure development are driving the production and consumption of goods requiring Carbon Black as a key additive.

- Carbon Black finds extensive application in construction materials like coatings, sealants, and concrete, further driving its demand. The shift towards electric vehicles (EVs) and the growing demand for lightweight materials in automotive manufacturing present significant opportunities for Carbon Black usage. Asia Pacific is at the forefront of the EV revolution, contributing to the increased demand for Carbon Black in battery casings, tires, and other automotive components. The region's favorable regulatory environment and government initiatives promoting manufacturing and industrial growth further bolster the demand for Carbon Black in the region.

Carbon Black Market Top Key Players:

- Cabot Corporation (US)

- Continental Carbon Company (US)

- Sid Richardson Carbon & Energy Co. (US)

- Orion Engineered Carbons S.A. (Luxembourg)

- Imerys Carbonates (France)

- Omsk Carbon Group (Russia)

- Mitsubishi Chemical Corporation (Japan)

- Nippon Steel Chemical & Material Co., Ltd. (Japan)

- Tokai Carbon Co., Ltd. (Japan)

- Asahi Carbon Co., Ltd. (Japan)

- OCI Company Ltd. (South Korea)

- Himadri Specialty Chemicals Ltd. (India)

- Ralson Goodluck Carbon Pvt. Ltd. (India)

- Birla Carbon (India)

- Phillips Carbon Black Limited (India)

- Jiangxi Yongtai Energy Co., Ltd. (China)

- Cabot (China) Ltd. (China)

- Suzhou Baohua Carbon Black Co., Ltd. (China)

- Shijiazhuang Xinyuanhua Rubber Chemical Co., Ltd. (China)

- Jinneng Science & Technology Co., Ltd. (China)

- Jiangxi Black Cat Carbon Black Inc. (China)

- Longxing Chemical Industry Co., Ltd. (China)

- Shandong Huadong Rubber Materials Co., Ltd. (China)

- China Synthetic Rubber Corporation (Taiwan), and Other Major Players.

Key Industry Developments in the Carbon Black Market:

- In June 2023, PCBL Limited commenced two growth initiatives: establishing a new plant expansion in Chennai, Tamil Nadu, and enhancing an existing plant project in Mundra, Gujarat. These expansions are being executed in two phases, with the first phase focusing on the specialty chemical line expected to commence operations by the first quarter of the fiscal year 2023-24. This strategic move is projected to elevate the company's overall manufacturing capacity to 790,000 metric tonnes per annum (MTPA) and facilitate the generation of 122 megawatts (MW) of renewable energy.

- In February 2023, Balkrishna Industries Ltd (BKT) escalated its carbon black production efforts, aiming to augment its capacity by nearly 20% within the year. The company is set to enlarge its Bhuj facility located in the eastern Indian state of Gujarat to yield 198 kilotons per annum (ktpa) of carbon black. Notably, the Bhuj plant, operational since 2017, is equipped to manufacture 65 ktpa of carbon black grades tailored for tire tread applications.

|

Global Carbon Black Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 27.44 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.7 % |

Market Size in 2032: |

USD 41.49 Bn. |

|

Segments Covered: |

By Process Type |

|

|

|

By Application |

|

||

|

By Grade |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Carbon Black Market by By Process Type (2018-2032)

4.1 Carbon Black Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Furnace Black

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Gas Black

4.5 Lamp Black

4.6 Thermal Black

Chapter 5: Carbon Black Market by By Application (2018-2032)

5.1 Carbon Black Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Tire Manufacturing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Plastics

5.5 Inks and Coatings

5.6 Rubber Goods

Chapter 6: Carbon Black Market by By Grade (2018-2032)

6.1 Carbon Black Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Standard Grade

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Specialty Grade

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Carbon Black Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CABOT CORPORATION (US)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 CONTINENTAL CARBON COMPANY (US)

7.4 SID RICHARDSON CARBON & ENERGY CO. (US)

7.5 ORION ENGINEERED CARBONS S.A. (LUXEMBOURG)

7.6 IMERYS CARBONATES (FRANCE)

7.7 OMSK CARBON GROUP (RUSSIA)

7.8 MITSUBISHI CHEMICAL CORPORATION (JAPAN)

7.9 NIPPON STEEL CHEMICAL & MATERIAL COLTD. (JAPAN)

7.10 TOKAI CARBON COLTD. (JAPAN)

7.11 ASAHI CARBON COLTD. (JAPAN)

7.12 OCI COMPANY LTD. (SOUTH KOREA)

7.13 HIMADRI SPECIALTY CHEMICALS LTD. (INDIA)

7.14 RALSON GOODLUCK CARBON PVT. LTD. (INDIA)

7.15 BIRLA CARBON (INDIA)

7.16 PHILLIPS CARBON BLACK LIMITED (INDIA)

7.17 JIANGXI YONGTAI ENERGY COLTD. (CHINA)

7.18 CABOT (CHINA) LTD. (CHINA)

7.19 SUZHOU BAOHUA CARBON BLACK COLTD. (CHINA)

7.20 SHIJIAZHUANG XINYUANHUA RUBBER CHEMICAL COLTD. (CHINA)

7.21 JINNENG SCIENCE & TECHNOLOGY COLTD. (CHINA)

7.22 JIANGXI BLACK CAT CARBON BLACK INC. (CHINA)

7.23 LONGXING CHEMICAL INDUSTRY COLTD. (CHINA)

7.24 SHANDONG HUADONG RUBBER MATERIALS COLTD. (CHINA)

7.25 CHINA SYNTHETIC RUBBER CORPORATION (TAIWAN)

7.26

Chapter 8: Global Carbon Black Market By Region

8.1 Overview

8.2. North America Carbon Black Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Process Type

8.2.4.1 Furnace Black

8.2.4.2 Gas Black

8.2.4.3 Lamp Black

8.2.4.4 Thermal Black

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Tire Manufacturing

8.2.5.2 Plastics

8.2.5.3 Inks and Coatings

8.2.5.4 Rubber Goods

8.2.6 Historic and Forecasted Market Size By By Grade

8.2.6.1 Standard Grade

8.2.6.2 Specialty Grade

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Carbon Black Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Process Type

8.3.4.1 Furnace Black

8.3.4.2 Gas Black

8.3.4.3 Lamp Black

8.3.4.4 Thermal Black

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Tire Manufacturing

8.3.5.2 Plastics

8.3.5.3 Inks and Coatings

8.3.5.4 Rubber Goods

8.3.6 Historic and Forecasted Market Size By By Grade

8.3.6.1 Standard Grade

8.3.6.2 Specialty Grade

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Carbon Black Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Process Type

8.4.4.1 Furnace Black

8.4.4.2 Gas Black

8.4.4.3 Lamp Black

8.4.4.4 Thermal Black

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Tire Manufacturing

8.4.5.2 Plastics

8.4.5.3 Inks and Coatings

8.4.5.4 Rubber Goods

8.4.6 Historic and Forecasted Market Size By By Grade

8.4.6.1 Standard Grade

8.4.6.2 Specialty Grade

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Carbon Black Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Process Type

8.5.4.1 Furnace Black

8.5.4.2 Gas Black

8.5.4.3 Lamp Black

8.5.4.4 Thermal Black

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Tire Manufacturing

8.5.5.2 Plastics

8.5.5.3 Inks and Coatings

8.5.5.4 Rubber Goods

8.5.6 Historic and Forecasted Market Size By By Grade

8.5.6.1 Standard Grade

8.5.6.2 Specialty Grade

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Carbon Black Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Process Type

8.6.4.1 Furnace Black

8.6.4.2 Gas Black

8.6.4.3 Lamp Black

8.6.4.4 Thermal Black

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Tire Manufacturing

8.6.5.2 Plastics

8.6.5.3 Inks and Coatings

8.6.5.4 Rubber Goods

8.6.6 Historic and Forecasted Market Size By By Grade

8.6.6.1 Standard Grade

8.6.6.2 Specialty Grade

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Carbon Black Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Process Type

8.7.4.1 Furnace Black

8.7.4.2 Gas Black

8.7.4.3 Lamp Black

8.7.4.4 Thermal Black

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Tire Manufacturing

8.7.5.2 Plastics

8.7.5.3 Inks and Coatings

8.7.5.4 Rubber Goods

8.7.6 Historic and Forecasted Market Size By By Grade

8.7.6.1 Standard Grade

8.7.6.2 Specialty Grade

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Carbon Black Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 27.44 Bn. |

|

Forecast Period 2023-30 CAGR: |

4.7 % |

Market Size in 2032: |

USD 41.49 Bn. |

|

Segments Covered: |

By Process Type |

|

|

|

By Application |

|

||

|

By Grade |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

Frequently Asked Questions :

The forecast period in the Carbon Black Market research report is 2024-2032.

Cabot Corporation (US), Continental Carbon Company (US), Sid Richardson Carbon & Energy Co. (US), Orion Engineered Carbons S.A. (Luxembourg), Imerys Carbonates (France), Omsk Carbon Group (Russia), Mitsubishi Chemical Corporation (Japan), Nippon Steel Chemical & Material Co., Ltd. (Japan), Tokai Carbon Co., Ltd. (Japan), Asahi Carbon Co., Ltd. (Japan), OCI Company Ltd. (South Korea), Himadri Specialty Chemicals Ltd. (India), Ralson Goodluck Carbon Pvt. Ltd. (India), Birla Carbon (India), Phillips Carbon Black Limited (India), Jiangxi Yongtai Energy Co., Ltd. (China), Cabot (China) Ltd. (China), Suzhou Baohua Carbon Black Co., Ltd. (China), Shijiazhuang Xinyuanhua Rubber Chemical Co., Ltd. (China), Jinneng Science & Technology Co., Ltd. (China), Jiangxi Black Cat Carbon Black Inc. (China), Longxing Chemical Industry Co., Ltd. (China), Shandong Huadong Rubber Materials Co., Ltd. (China), China Synthetic Rubber Corporation (Taiwan), and Other Major Players.

The Carbon Black Market is segmented into Process Type, Application, Grade, and region. By Process Type, the market is categorized into Furnace Black, Gas Black, Lamp Black, and Thermal Black. By Application, the market is categorized into Tire Manufacturing, Plastics, Inks and Coatings, and Rubber Goods. By Grade, the market is categorized into Standard Grade, Specialty Grade. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Carbon Black, produced by incomplete combustion of hydrocarbons, is a finely divided carbonaceous particle with a high surface area. It is used in rubber fillers, inks, coatings, plastics, and water purification processes. Carbon Black is also essential in batteries, and electronics, and as a catalyst in chemical reactions due to its unique properties.

Carbon Black Market Size Was Valued at USD 27.44 Billion In 2023 And Is Projected To Reach USD 41.49 Billion By 2032, Growing At A CAGR Of 4.7% From 2024-2032.