Cardiac Implantable Electronic Device Market Synopsis:

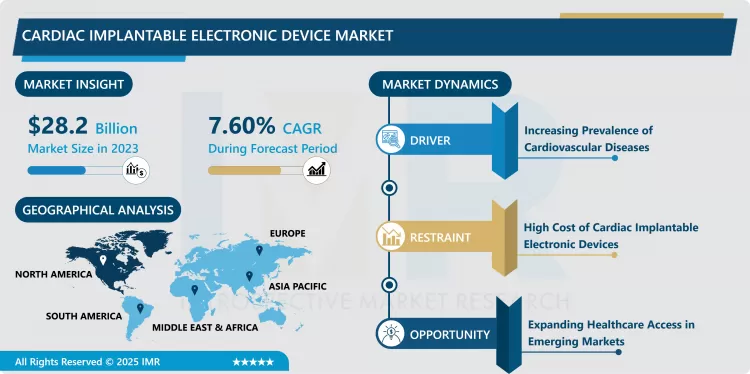

Cardiac Implantable Electronic Device Market Size Was Valued at USD 28.2 Billion in 2023, and is Projected to Reach USD 54.52 Billion by 2032, Growing at a CAGR of 7.60% From 2024-2032.

Heart devices also known as Cardiac Implantable Electronic Devices or CIEDs are devices that are surgically placed with the patient’s body to treat or monitor heart diseases and necessarily rhythm and failure. These implantable devices, such as pacemakers, ICDs, and CRT devices, generate electrical signals to the heart to maintain correct working of the heart muscles. CIEDs are used in patients who have arrhythmias, heart block or congestive heart failure to reduce sudden cardiac death rates and better heart condition.

The key factors are specifically the rising incidences of CVDs, including arrhythmia, heart failure, as well as other cardiac disorders that require Cardiac Implantable Electronic Devices. The increasing ageing rates in developed and even developing countries have continued to put pressure on the demands for such gadgets. Also the inactive life styles; unhealthy diets and high stress levels are some of the leading causes of heart diseases hence the need for enhanced cardiac health care.

Development of technology also has a great impact on the growth of the market as well as has a great influence on the market. Device evolution in miniaturization, battery back-up, remote monitoring, and better therapies has further raised the efficiency and acceptable comfort of CIEDs. These advances have led to the availabilities, affordability and efficiency of these devices in managing various cardiac diseases and therefore increased their popularity in all related health facilities.

Cardiac Implantable Electronic Device Market Trend Analysis:

Increasing adoption of remote monitoring and telemedicine solutions.

- One more direction in the CIED market development is the tendency toward the integration of telemonitoring and telemedicine systems. In the recent past, patients have been using Wireless Technologies in that they can send data from the implanted devices to the healthcare providers a way that they can be monitored without the patient going for several hospital checkups. This translates not only to better patient care outcomes but also enhances ways of controlling the costs of health care since through innovative tools, hospital readmissions can be prevented and further action taken is possible.

- Another large trend is the increase in minimally invasive therapies. There are trends toward even more endovascular implantations of the devices such as pacemakers or ICDs, which result in less invasiveness, faster recovery or potential complications. This trend is also supported by the increasingly popular trend to carry out surgeries that otherwise would require a hospital stay, as well as the need for minimizing the impact on the patient’s comfort.

The expanding healthcare infrastructure in emerging economies

- There is thus an immense opportunity for CIED manufacturing firms in emerging economies as the healthcare facilities develop continuously. The advances in care delivery systems and when health care access emerges strongly developed in countries like India, China and Brazil, the use of cardiac devices is likely to increase. Thirdly, the percent of population with awareness of cardiovascular health in these regions is also rising and hence it is expected that the CIEDs will be utilized more as preventive measures as well as treatment of various heart diseases.

- In addition, the increasing interest in patient-specific treatment offers a great potential for the creation of individualized CIEDs. Optimization of genetics and diagnostics offers an opportunity to develop the devices with a close fit to patients’ needs and enhance treatment effectiveness and patients’ satisfaction. The aspect of developing more customized solutions to patients’ needs in terms of the methods and treatments for heart disorders is expected to keep propelling the CIED market growth most especially in developed Nations.

Cardiac Implantable Electronic Device Market Segment Analysis:

Cardiac Implantable Electronic Device Market is Segmented on the basis of Type, Application, End User, and Region

By Type, Pacemakers segment is expected to dominate the market during the forecast period

- The cardiac implantable electronic devices (CIEDs) market is primarily segmented into three types: , heart failure and dual chamber pacemakers, implantable cardioverter defibrillators or ICDs and Cardiac Resynchronization Therapy or CRT devices. Pacemakers are implanted devices that help to run the heart if the heart rate is slow or bradycardia by sending electrical impulses to the heart tissues. ICDs are intended to detect and respond to dangerous arrhythmias while attempting to maintain a normal rhythm through electrical shocks when needed to prevent sudden cardiac death. CRT devices are pacemaker devices, which are employed to cure heart failure, since they help to coordinate left and right ventricular contractions to enhance the strength of heart pumping. Every type of equipment is used in treating different heart diseases thus playing forward the ailing patient’s lives.

By Application, Arrhythmia segment expected to held the largest share

- In terms of application the CIEDs market is also divided into products used for arrhythmia, heart rhythm monitoring, and heart block. Recognizing arrhythmia, which is also known as irregular heart beating or tachycardia or bradycardia, use of CIED includes pacemaker and implantable cardioverter defibrillators ICDs are used to create a control over electrical impulses of the heart and reestablish its standard pace. Cardiac event monitoring comprises an ongoing analysis of the patient’s heart rhythm and Holter monitors and CIEDs, especially when they are equipped with telemonitoring systems, assist persons with heart diseases in controlling the conditions. Heart block is the clinical casual term where the electrical conduction within the heart is impaired or interrupted and mostly the only remedy is to eventually implant pacemaker apparatus in order to properly regulate the heartbeat. Both applications focus on particular cardiovascular diseases, providing individual approaches towards patients’ treatment and complications prevention.

Cardiac Implantable Electronic Device Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is looked at as having the largest market share currently in CIED. It is also a suitable region due to the high rate of cardiovascular diseases mainly in the U.S where population aging and unhealthy living standards contribute to the ever-rising rate of illnesses. The North American region remains one of the most important drivers of the global CIED market, due to the robust healthcare system, the availability of sophisticated technologies, leading healthcare device manufacturers and technology providers.

- Besides healthcare, the accessibility of ceded government fiscal policies and reimbursement concerning the CIED processes in North America props up market supremacy. The legal framework in the region is friendly, as the US ‘FDA’, has given its nod to various CIED technologies that contribute to the growth in this market. North American market is also investing greatly in research and development which helps enhance and diversify cardiac devices steadily keeping this region on top in the worldwide market.

Active Key Players in the Cardiac Implantable Electronic Device Market:

- Abbott Laboratories (U.S.)

- Biotronik (Germany)

- Boston Scientific Corporation (U.S.)

- Lepu Medical Technology (China)

- Medtronic (Ireland)

- MicroPort Scientific Corporation (China)

- Philips Healthcare (Netherlands)

- St. Jude Medical (U.S.)

- Stryker Corporation (U.S.)

- Zoll Medical Corporation (U.S.)

- Other Active Players

|

Cardiac Implantable Electronic Device Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.2 Billion |

|

Forecast Period 2024-32 CAGR: |

7.60 % |

Market Size in 2032: |

USD 54.52 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cardiac Implantable Electronic Device Market by By Type (2018-2032)

4.1 Cardiac Implantable Electronic Device Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Pacemakers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Implantable Cardioverter Defibrillators (ICDs)

4.5 Cardiac Resynchronization Therapy (CRT) Devices

Chapter 5: Cardiac Implantable Electronic Device Market by By Application (2018-2032)

5.1 Cardiac Implantable Electronic Device Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Arrhythmia

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Heart Rhythm Monitoring

5.5 Heart Block

Chapter 6: Cardiac Implantable Electronic Device Market by By End User (2018-2032)

6.1 Cardiac Implantable Electronic Device Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Ambulatory Surgical Centers

6.5 Specialty Clinics

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cardiac Implantable Electronic Device Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT LABORATORIES (U.S.)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BIOTRONIK (GERMANY)

7.4 BOSTON SCIENTIFIC CORPORATION (U.S.)

7.5 LEPU MEDICAL TECHNOLOGY (CHINA)

7.6 MEDTRONIC (IRELAND)

7.7 MICROPORT SCIENTIFIC CORPORATION (CHINA)

7.8 PHILIPS HEALTHCARE (NETHERLANDS)

7.9 ST. JUDE MEDICAL (U.S.)

7.10 STRYKER CORPORATION (U.S.)

7.11 ZOLL MEDICAL CORPORATION (U.S.)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Cardiac Implantable Electronic Device Market By Region

8.1 Overview

8.2. North America Cardiac Implantable Electronic Device Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 Pacemakers

8.2.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.2.4.3 Cardiac Resynchronization Therapy (CRT) Devices

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Arrhythmia

8.2.5.2 Heart Rhythm Monitoring

8.2.5.3 Heart Block

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Hospitals

8.2.6.2 Ambulatory Surgical Centers

8.2.6.3 Specialty Clinics

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cardiac Implantable Electronic Device Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 Pacemakers

8.3.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.3.4.3 Cardiac Resynchronization Therapy (CRT) Devices

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Arrhythmia

8.3.5.2 Heart Rhythm Monitoring

8.3.5.3 Heart Block

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Hospitals

8.3.6.2 Ambulatory Surgical Centers

8.3.6.3 Specialty Clinics

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cardiac Implantable Electronic Device Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 Pacemakers

8.4.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.4.4.3 Cardiac Resynchronization Therapy (CRT) Devices

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Arrhythmia

8.4.5.2 Heart Rhythm Monitoring

8.4.5.3 Heart Block

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Hospitals

8.4.6.2 Ambulatory Surgical Centers

8.4.6.3 Specialty Clinics

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cardiac Implantable Electronic Device Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 Pacemakers

8.5.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.5.4.3 Cardiac Resynchronization Therapy (CRT) Devices

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Arrhythmia

8.5.5.2 Heart Rhythm Monitoring

8.5.5.3 Heart Block

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Hospitals

8.5.6.2 Ambulatory Surgical Centers

8.5.6.3 Specialty Clinics

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cardiac Implantable Electronic Device Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 Pacemakers

8.6.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.6.4.3 Cardiac Resynchronization Therapy (CRT) Devices

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Arrhythmia

8.6.5.2 Heart Rhythm Monitoring

8.6.5.3 Heart Block

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Hospitals

8.6.6.2 Ambulatory Surgical Centers

8.6.6.3 Specialty Clinics

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cardiac Implantable Electronic Device Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 Pacemakers

8.7.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.7.4.3 Cardiac Resynchronization Therapy (CRT) Devices

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Arrhythmia

8.7.5.2 Heart Rhythm Monitoring

8.7.5.3 Heart Block

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Hospitals

8.7.6.2 Ambulatory Surgical Centers

8.7.6.3 Specialty Clinics

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Cardiac Implantable Electronic Device Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.2 Billion |

|

Forecast Period 2024-32 CAGR: |

7.60 % |

Market Size in 2032: |

USD 54.52 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Cardiac Implantable Electronic Device Market research report is 2024-2032.

•Medtronic (Ireland), Abbott Laboratories (U.S.), Boston Scientific Corporation (U.S.), Biotronik (Germany), Philips Healthcare (Netherlands), St. Jude Medical (U.S.), Stryker Corporation (U.S.), Zoll Medical Corporation (U.S.), MicroPort Scientific Corporation (China), Lepu Medical Technology (China) and Other Active Players.

The Cardiac Implantable Electronic Device Market is segmented into by Product Type (Pacemakers, Implantable Cardioverter Defibrillators (ICDs), Cardiac Resynchronization Therapy (CRT) Devices), Application (Arrhythmia, Heart Rhythm Monitoring, Heart Block), End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics). By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA)

Heart devices also known as Cardiac Implantable Electronic Devices or CIEDs are devices that are surgically placed with the patient’s body to treat or monitor heart diseases and necessarily rhythm and failure. These implantable devices, such as pacemakers, ICDs, and CRT devices, generate electrical signals to the heart to maintain correct working of the heart muscles. CIEDs are used in patients who have arrhythmias, heart block or congestive heart failure to reduce sudden cardiac death rates and better heart condition.

Cardiac Implantable Electronic Device Market Size Was Valued at USD 28.2 Billion in 2023, and is Projected to Reach USD 54.52 Billion by 2032, Growing at a CAGR of 7.60% From 2024-2032.