Cardiac Implants Market Synopsis:

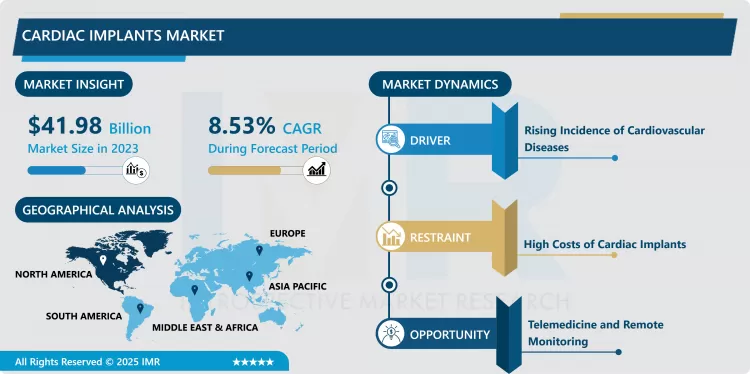

Cardiac Implants Market Size Was Valued at USD 41.98 Billion in 2023, and is Projected to Reach USD 74.45 Billion by 2032, Growing at a CAGR of 8.53% From 2024-2032.

The cardiac implants market covers healthcare products that are built to replace or supplement the function of various elements within the heart. These products include pacemakers implantable cardioverter defibrillators (ICDs) cardiac resynchronization therapy(CRT)devices(parts 3.4), and types of stents and heart valves(parts 3.5). These devices are used for the identification of the heart diseases as well as management of different rhythms, failure, and arterial disorders. The Cardiac Implants Market is especially growing due to factors like a growth in cases of CVD, increase in technological developments happening to the implants, and the geriatric population, which requires long-term care for their cardiac diseases.

The global cardiac implants market is advancing at a fast pace; this is due to increased incidences of cardiovascular diseases (CVDs) across the world, increased technological development, and the growth of the geriatric population. CVDs are one of the major causes of death globally and require efficient treatments; this has created increased demand in cardiac implants including pace makers, ICDs, and CRT systems etc. It is also observed improvements and developments in the material used along with the design of these devices which in turn post the efficiency and durability of such devices contributing to better patients’ health.

Besides that, Reimbursement and regulatory approvals of new and quasi advanced Cardiac Implant technologies have helped to boost the market growth. Moreover, an increasingly conscious approach towards keeping the heart unhealthy, and the enhanced existence of healthcare infrastructures in developed countries are helping to improve early diagnosis and treatment of related ailments, thus increasing take on of cardiac implants. Among all these regions, Asia-Pacific and Latin America collectively are expected to display the highest CAGR influences, owing to factors such as up surging healthcare expenditures, enhanced accessibility to hospitals, and enhanced awareness of heart diseases.

However, factors including high costs associated with cardiac implants, and fixed rules and regulations together with the complexities of the procedures of implantation may act as a constraint to the market. Further, the market experiences return issues and complications, which are related to implantable devices, that harms consumer confidence. However, the trend for the development of the landscape of the cardiac implants market seems overall optimistic due to the constant investments in the research and development of more effective and better tolerated implant solutions. With changing face of healthcare industry, use of telemedicine and remote monitoring solutions is anticipated to add greater value to the market and facilitate superior care management of heart illnesses.

Cardiac Implants Market Trend Analysis:

Innovations and Advancements

- A key characteristic seen within the cardiac implants market is innovation, where next generation products are created using improved materials and digital processes to benefit the patients. Techniques like temporary bioresorbable stents are also being adopted because they resolve the problem of growth of implants in the later years and related complications. Likewise, remote-controlled implantable cardioverter-defibrillators (ICDs) ensure greater mobility, contributing to the fact that patient data can be monitored by the healthcare providers in real time – which would not be possible without the use of such devices – increasing management approaches and decreasing the number of necessary hospital visits. All these technologies not only help improve patient experiences but also meet the dynamic needs of the healthcare organizations that seek to enhance the efficiency of service delivery in health care.

- In addition, the enhanced biocompatibility and function in the improved cardiac devices are revolutionizing the cardiovascular industry. Several implant manufacturers are striving not only to maintain compliance with regulatory requirements and offer implants that will have a long service life for patients with chronic diseases. This focus on innovation is due to the following complications that may be witnessed with conventional cardiac devices; infection and device failure. Therefore, the market is experiencing a shift toward increasing innovation in implants, with chemical analysis devoted to optimizing properties and designs of cardiac implants. , all of these developments are going to be designed for enhancing the quality of life in patients and equally harnessing the available healthcare resources and results.

Transformative Opportunities in the Cardiac Implants Market

- The cardiac implants market is on the process of revolution with implantable devices such as pacemakers, defibrillators and stents developing with new features constantly. Held presents various innovations that have improved the performance of these devices and in turn, patient and health care status. This is one of the recent developments which include remote monitoring and wireless gadgetry, for health check on people. This will enable the health-care professionals monitor patient’s condition you know through the virtual space and come in to correct whenever something is wrong. This kind of management also raises the level of care and effectively transfers the responsibility of the patient and their processes to the brand.

- In addition, these technologies are proving to be popular with health-care firms that can see room for expansion of the cardiac implant market. Demand for higher level and better solutions from the patients and health care providers will help this product market to grow rapidly. Also, more people are getting knowledgeable of various heart diseases and therefore, more and more are going for checkups using these better technologies, which is an added advantage. New technologies, growing investment, and a larger pool of potential customers will present the market for cardiac implants with a swell of opportunities for its stakeholders, and helping to steadily shape the future of an important area of healthcare.

Cardiac Implants Market Segment Analysis:

Cardiac Implants Market is Segmented on the basis of Product, Application, End Users, and Region

By Product, Implantable Cardioverter-defibrillators (ICDs) segment is expected to dominate the market during the forecast period

- ICD is a complex piece of medical equipment designed to closely monitor the heart rhythms and deliver electrical impulses if it finds forms of dangerous arrhythmia, for instance ventricular tachycardia or ventricular fibrillation. These devices are particularly useful in patients who have experienced a heart attack, moderate or severe arrhythmia, since they decrease the likelihood of suffering a sudden cardiac death and help return the heart to normal. The incidence of heart diseases has been on the rise, and the addition of various factors including obesity, hypertension, and diabetes means that there are many ICD candidates. This means that as people come to understand that early interventional and preventive measures can save their lives in cardiology, the demand for such crucial devices increases.

- Recent development of ICD implies that the devices’ efficacy and functionality has increased hence enhancing the patients’ welfare. For instance, leadless ICDs do not require the traditional leads and thus reduces on the patient’s complications, and discomfort. Also, mobile applications permit the continuous tracking of patients’ heart rhythms with a view of offering prompt treatment when needed. It also benefits both, patients and healthcare providers, by improving the ease of gaining access to an array of treatment options while also helping providers in the provision of highly individualized treatments. Day by day, the technology is also advancing and therefore it has been assumed that the using of this ICDs will also increase gradually due to technological advancement and increase consciousness among the patient regarding cardiac issues.

By End Users, Hospitals segment expected to held the largest share

- Hospitals are the largest consumer groups of cardiac devices taking care of patients with cardiac diseases ranging from neuroable intakes to surgical and extended follow-ups. These institutions are able to tackle complicated heart related diseases most of the times involving a number of specialists as a team in order to cater for the patient fully. The occurrence of heart diseases is increasing all over the world, and as a result, more hospitals are performing cardiovascular operations, defining the need for better cardiac technologies. This increased demand is not only due to the rising population of human beings that need medical attention but also due to the development in technology in the medical department that enable doctors to perform their operations anyhow they desire but in a less destructive manner.

- Advancements in the implantable electromechanics and imaging procedures as well as, less invasive surgical approaches, are a new wave of change in how cardiovascular services are delivered in hospitals. As a result of the advancement is state-of-the-art devices, technical workers in the healthcare facilities can provide new levels of treatment that enhances recovery time of the patients. As well, role of specific cardiac care teams emerges as hospitals give efforts to offer targeted treatments for patients with distinct cardiac characteristics. This trend towards specialization Sterling Heights ensures that patients are offered the best servicce hence promoting the market for advance cardiac machines in the hospital. The threats to the hospitals include absorbing costs for the new technologies cardiac devices hence as the healthcare needs change over time there will be increased sales due to innovation and quality improvement.

Cardiac Implants Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America specifically USA has emerged as a highly growth potential market for cardiac implants due to high acceptance of advanced cardiac devices and strong health care infrastructure and high health care spending. This area has one of the highest rates of cardiovascular diseases across the globe and requires appropriate treatment plans now. The Players in the industry include Medtronic, Abbott Laboratories, Boston Scientific and other players are investing heavily in development of technology to enhance the efficiency of devices and bring positive change in patient care. Thus, the emphasis on creating minimal impact operations and progressively improved devices have promoted enhanced patient safety and reduced time of rehabilitation, which in its turn contributes to the elevated implantation rates.

- Furthermore, there exist good reimbursement policies in the United States contributing to the availability of cardiac implants out to patents. Availability of insurance for such items as advanced cardiac devices ensures that the providers put forward such solutions, which in turn ensures that such individuals get the necessary attention in good time. This kind of cooperation between the authorities and industry participants contributes to the stable development of the cardiac implants market. Cardiovascular health has become gradually well understood among the population which has put significant growth and development in the technologies used in Cardiovascular Care Devices and further, it has brought long-term turn improvement in patient care and outcomes over the region.

Active Key Players in the Cardiac Implants Market:

- Medtronic

- Boston Scientific Corporation

- Stryker (Physio-Control Inc.)

- Biotronik

- Asahi Kasei Corporation (ZOLL Medical Corporation)

- Pacetronix.com

- Schiller AG

- Koninklijke Philips N.V.

- LivaNova PLC

- Abbott.

- Impulse Dynamics

- Angel Medical Systems, Inc.

- Other Active Players

|

Cardiac Implants Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 41.98 Billion |

|

Forecast Period 2024-32 CAGR: |

8.53% |

Market Size in 2032: |

USD 74.45 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cardiac Implants Market by By Product (2018-2032)

4.1 Cardiac Implants Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Implantable Cardioverter-defibrillators (ICDs)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Pacemakers

4.5 Coronary Stents

4.6 Implantable Heart Rhythm Monitors

4.7 Implantable Hemodynamic Monitors

4.8 Other Products

Chapter 5: Cardiac Implants Market by By Application (2018-2032)

5.1 Cardiac Implants Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Arrhythmias

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Acute Myocardial Infarction

5.5 Myocardial Ischemia

5.6 Other Applications

Chapter 6: Cardiac Implants Market by By End Users (2018-2032)

6.1 Cardiac Implants Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Cardiology Centers

6.5 Other End Users

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cardiac Implants Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 MEDTRONIC

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BOSTON SCIENTIFIC CORPORATION

7.4 STRYKER (PHYSIO-CONTROL INC.)

7.5 BIOTRONIK

7.6 ASAHI KASEI CORPORATION (ZOLL MEDICAL CORPORATION)

7.7 PACETRONIX.COM

7.8 SCHILLER AG

7.9 KONINKLIJKE PHILIPS N.V.

7.10 LIVANOVA PLC

7.11 ABBOTT

7.12 IMPULSE DYNAMICS

7.13 ANGEL MEDICAL SYSTEMS INC

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Cardiac Implants Market By Region

8.1 Overview

8.2. North America Cardiac Implants Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Product

8.2.4.1 Implantable Cardioverter-defibrillators (ICDs)

8.2.4.2 Pacemakers

8.2.4.3 Coronary Stents

8.2.4.4 Implantable Heart Rhythm Monitors

8.2.4.5 Implantable Hemodynamic Monitors

8.2.4.6 Other Products

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Arrhythmias

8.2.5.2 Acute Myocardial Infarction

8.2.5.3 Myocardial Ischemia

8.2.5.4 Other Applications

8.2.6 Historic and Forecasted Market Size By By End Users

8.2.6.1 Hospitals

8.2.6.2 Cardiology Centers

8.2.6.3 Other End Users

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cardiac Implants Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Product

8.3.4.1 Implantable Cardioverter-defibrillators (ICDs)

8.3.4.2 Pacemakers

8.3.4.3 Coronary Stents

8.3.4.4 Implantable Heart Rhythm Monitors

8.3.4.5 Implantable Hemodynamic Monitors

8.3.4.6 Other Products

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Arrhythmias

8.3.5.2 Acute Myocardial Infarction

8.3.5.3 Myocardial Ischemia

8.3.5.4 Other Applications

8.3.6 Historic and Forecasted Market Size By By End Users

8.3.6.1 Hospitals

8.3.6.2 Cardiology Centers

8.3.6.3 Other End Users

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cardiac Implants Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Product

8.4.4.1 Implantable Cardioverter-defibrillators (ICDs)

8.4.4.2 Pacemakers

8.4.4.3 Coronary Stents

8.4.4.4 Implantable Heart Rhythm Monitors

8.4.4.5 Implantable Hemodynamic Monitors

8.4.4.6 Other Products

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Arrhythmias

8.4.5.2 Acute Myocardial Infarction

8.4.5.3 Myocardial Ischemia

8.4.5.4 Other Applications

8.4.6 Historic and Forecasted Market Size By By End Users

8.4.6.1 Hospitals

8.4.6.2 Cardiology Centers

8.4.6.3 Other End Users

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cardiac Implants Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Product

8.5.4.1 Implantable Cardioverter-defibrillators (ICDs)

8.5.4.2 Pacemakers

8.5.4.3 Coronary Stents

8.5.4.4 Implantable Heart Rhythm Monitors

8.5.4.5 Implantable Hemodynamic Monitors

8.5.4.6 Other Products

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Arrhythmias

8.5.5.2 Acute Myocardial Infarction

8.5.5.3 Myocardial Ischemia

8.5.5.4 Other Applications

8.5.6 Historic and Forecasted Market Size By By End Users

8.5.6.1 Hospitals

8.5.6.2 Cardiology Centers

8.5.6.3 Other End Users

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cardiac Implants Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Product

8.6.4.1 Implantable Cardioverter-defibrillators (ICDs)

8.6.4.2 Pacemakers

8.6.4.3 Coronary Stents

8.6.4.4 Implantable Heart Rhythm Monitors

8.6.4.5 Implantable Hemodynamic Monitors

8.6.4.6 Other Products

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Arrhythmias

8.6.5.2 Acute Myocardial Infarction

8.6.5.3 Myocardial Ischemia

8.6.5.4 Other Applications

8.6.6 Historic and Forecasted Market Size By By End Users

8.6.6.1 Hospitals

8.6.6.2 Cardiology Centers

8.6.6.3 Other End Users

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cardiac Implants Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Product

8.7.4.1 Implantable Cardioverter-defibrillators (ICDs)

8.7.4.2 Pacemakers

8.7.4.3 Coronary Stents

8.7.4.4 Implantable Heart Rhythm Monitors

8.7.4.5 Implantable Hemodynamic Monitors

8.7.4.6 Other Products

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Arrhythmias

8.7.5.2 Acute Myocardial Infarction

8.7.5.3 Myocardial Ischemia

8.7.5.4 Other Applications

8.7.6 Historic and Forecasted Market Size By By End Users

8.7.6.1 Hospitals

8.7.6.2 Cardiology Centers

8.7.6.3 Other End Users

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Cardiac Implants Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 41.98 Billion |

|

Forecast Period 2024-32 CAGR: |

8.53% |

Market Size in 2032: |

USD 74.45 Billion |

|

Segments Covered: |

By Product |

|

|

|

By Application |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Cardiac Implants Market research report is 2024-2032.

Medtronic, Boston Scientific Corporation, Stryker (Physio-Control Inc.), Biotronik, Asahi Kasei Corporation (ZOLL Medical Corporation), Pacetronix.com, Schiller AG, Koninklijke Philips N.V., LivaNova PLC, Abbott., Impulse Dynamics, Angel Medical Systems, Inc. and Other Active Players.

The Cardiac Implants Market is segmented into By Product, By Application, By End Users and region. By Product, the market is categorized into Implantable Cardioverter-defibrillators (ICDs), Pacemakers, Coronary Stents, Implantable Heart Rhythm Monitors, Implantable Hemodynamic Monitors and Other Products. By Application, the market is categorized into Arrhythmias, Acute Myocardial Infarction, Myocardial Ischemia and Other Applications. By, the market is categorized into Hospitals, Cardiology Centers and Other End Users. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The cardiac implants market encompasses a range of medical devices designed to support, replace, or enhance the function of the heart. This market includes products such as pacemakers, implantable cardioverter-defibrillators (ICDs), cardiac resynchronization therapy (CRT) devices, and various types of stents and heart valves. These devices are utilized in the diagnosis and treatment of various cardiac conditions, including arrhythmias, heart failure, and coronary artery disease. The growth of the cardiac implants market is driven by factors such as the rising prevalence of cardiovascular diseases, advancements in implant technology, and an increasing aging population requiring long-term cardiac management solutions.

Cardiac Implants Market Size Was Valued at USD 41.98 Billion in 2023, and is Projected to Reach USD 74.45 Billion by 2032, Growing at a CAGR of 8.53% From 2024-2032.