Cardiac Rhythm Management Devices Market Synopsis:

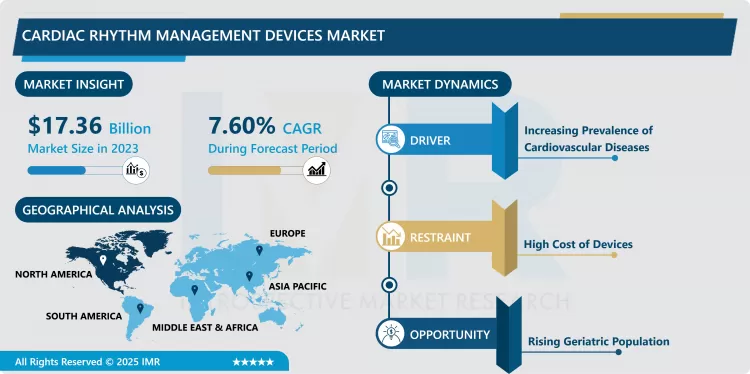

Cardiac Rhythm Management Devices Market Size Was Valued at USD 17.36 Billion in 2023, and is Projected to Reach USD 33.02 Billion by 2032, Growing at a CAGR of 7.60% From 2024-2032.

The Cardiac Rhythm Management (CRM) Devices Market is a market for medical devices that are used to diagnose, monitor, or treat arrhythmias and other heart disorders. Such devices are pacemakers, ICDs, CRT devices, and external bipole defibrillators. CRM devices are therefore important in enhancing the well-being of people with cardiac related diseases by controlling the heart rate, reducing instances of sudden cardiac arrest and heart failure.

Cardiac Rhythm Management Devices Market acquaintances the reader is an important segment of the global Medical Device market aided by the globally rising rate of CardiovascularDiseases (CVD). Since heart diseases are still highly prevalent today, there is a great need for next-generation devices to more accurately detect and treat heart rhythms. This market categorizes a range of devices like pacemakers and implantable cardioverter defibrillators to deal with different arrhythmias and other cardiac diseases.

One of the major reasons that market growth has been propelled is due to advancement in technologies that address aspects such as size, wireless capabilities, and battery life in development of CRM devices. These advancements are mutually beneficial because they modify the features of the devices and increase patients’ compliance and efficacy. Also, it is estimated that the geriatric population is on a rise and this population is more vulnerable to develop heart rhythm disorders which in turn will supplement the growth of CRM devices market.

As a result, these devices are increasingly being used by the healthcare providers with a view of giving the needed and required treatment to the patients. Further, increase in the global interest in preventive healthcare and diagnosis of cardiac diseases has led to higher sales of CRM devices, therefore driving the CRM devices market. These strategies along with government support towards cardiovascular health and increased funding on Cardiac technologies are the major factors paving the way for increased market growth.

Cardiac Rhythm Management Devices Market Trend Analysis:

Remote Monitoring Technologies

- Primarily, the Cardiac Rhythm Management Devices Market shares one emerging trend namely the use of remote monitoring. Due to developments in telehealth and wearable technology, CRM producers are gradually integrating distant observation functionalities into their line. This trend focuses on constant, real-time observation of patients’ heart rhythms, and helps cut down on hospital visits. Telemonitoring technologies enhance the patient–provider communication intervention and thus contribute to a positive health behavior change.

- Another reason for the development of remote monitoring is increasing demand on individual approach to patients and transition to the value-based medicine. Patients are obviously more comfortable when Health is managed from home thus granting providers the flexibility of centring on more important and risky patients. It is anticipated that this trend will continue to govern the overall advancements in the CRM devices market because individuals infertility due to illness and healthcare organizations seek increased effectivity in care delivery.

Rising Geriatric Population

- As highlighted in the geriatric chronological framework the rising geriatric population gives a growth opportunity to the Cardiac Rhythm Management Devices Market. CRM devices are required because people over a certain age are at an increased risk of coronary and arrhythmia disorders. Change of demographics is most felt in the developed parts of the world due to the growing life expectancy; aging and various age-related diseases.

- Leading healthcare systems across the globe are now admitting the importance of catering the needs of elderly cardiovascular health. This means that there are chances for CRM manufacturers to come up with unique products that will suit the needs of elderly patients. Thus, focusing on innovative technologies that address the issues of increased usability and accessibility, companies will be able to comprehend this developing market segment and advance the nature of care for the aging patients.

Cardiac Rhythm Management Devices Market Segment Analysis:

Cardiac Rhythm Management Devices Market is Segmented on the basis of Device Type, Application, End User, and Region

By Device Type, Pacemakers segment is expected to dominate the market during the forecast period

- The Cardiac Rhythm Management Devices Market can be classified on the basis of various product types like pacemakers, implantable cardioverter defibrillators (ICDs), cardiac resynchronization therapy (CRT) devices, external defibrillators. ICD or pacemakers are one of the most common CRM devices built to synchronize heartbeat in patients with bradycardia or other rhythm abnormalities. The recent increase in the number of people suffering from heart diseases leads to increased usage of pacemakers to address the situations, which has boosted their market share.

- Cohort studies have demonstrated that ICDs and CRT devices are very important in treating lethal arrhythmias and heart failure. Given the emerging focus on prompt diagnosis of severe cardiac diseases, the market for ICDs and CRT devices should expand steadily. Further, portable defibrillators that are applied in cases when a person experienced a cardiac arrest and needs his heart rhythms to be restored remain to be one of the critical tools of preventive interventions and response initiatives in population health.

By Application, Arrhythmia Management segment expected to held the largest share

- The Cardiac Rhythm Management Devices Market can also be segmented on the basis of its application which are arrhythmia management, heart failure, syncope management and others. The management of arrhythmias form the basis of the focus, with growing incidences of conditions such as atrial fibrillation. They significantly contribute to continuous pace maker and ICD technology helping the doctor to have effective tools on dealing with these disorders.

- Another large application area of CRM devices is in the treatment of heart failure, especially CRT that is used to coordinate contractions in heart failure patients. This is the reason why as the global population overall is growing older the incidence of heart failure is on the rise and therefore the need for these types of devices also. Also, innovations in technology and in the ways that treatment is delivered and administered are increasing the potential uses for CRM devices and are also helping to push forward the market.

Cardiac Rhythm Management Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- At present, North America is the largest market in the Cardiac Rhythm Management Devices Market due to better health care facilities and increased number of patients suffering from cardiovascular diseases. Early detection of heart diseases and successful treatment in the region has become easy with the enhanced health care sector hence leading to the high use of CRM devices. Moreover, huge research and development along with advance technologies have made North America a vast space of CRM market.

- The increasing focus on the heart and increased attention to the need to prevent diseases also play a part in North America’s superiority. Industries supplying sophisticated strategies to advance client’s recovery as well as integrating superior quality of treatment in healthcare have made this region incorporated advanced CRM technologies. As the trend of cardiac treatment is growing high in demand so North America is believed to remain the major position in CRM devices market.

Active Key Players in the Cardiac Rhythm Management Devices Market:

- Medtronic (Ireland)

- Boston Scientific (United States)

- Abbott Laboratories (United States)

- Biotronik (Germany)

- St. Jude Medical (United States)

- Philips (Netherlands)

- Zoll Medical Corporation (United States)

- B. Braun Melsungen AG (Germany)

- Sorin Group (Italy)

- Johnson & Johnson (United States)

- Merit Medical Systems (United States)

- Nuvectra Corporation (United States)

- Other Active Players

Key Industry Developments in the Cardiac Rhythm Management Devices Market:

- In December 2023, Medtronic officially introduced its Penditure Left Atrial Appendage (LAA) Exclusion System in the U.S.

- In October 2023, MicroPort CRM announced the introduction of the ULYS Implantable Cardioverter Defibrillator (ICDs) and the INVICTA defibrillation lead in the Japanese market, aiming to strengthen their product portfolio across the globe.

- In October 2023, Boston Scientific has recently unveiled its latest innovation, the LUX-Dx II+ insertable cardiac monitor (ICM) system. This advanced system provides extended monitoring for arrhythmias linked to conditions such as atrial fibrillation (AFib), cryptogenic stroke, and syncope.

|

Cardiac Rhythm Management Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.36 Billion |

|

Forecast Period 2024-32 CAGR: |

7.60% |

Market Size in 2032: |

USD 33.02 Billion |

|

Segments Covered: |

By Device Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cardiac Rhythm Management Devices Market by By Device Type (2018-2032)

4.1 Cardiac Rhythm Management Devices Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Pacemakers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Implantable Cardioverter Defibrillators (ICDs)

4.5 Cardiac Resynchronization Therapy (CRT) Devices

4.6 External Defibrillators

Chapter 5: Cardiac Rhythm Management Devices Market by By Application (2018-2032)

5.1 Cardiac Rhythm Management Devices Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Arrhythmia Management

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Heart Failure Treatment

5.5 Syncope Management

5.6 Others

Chapter 6: Cardiac Rhythm Management Devices Market by By End User (2018-2032)

6.1 Cardiac Rhythm Management Devices Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Cardiac Centers

6.5 Home Healthcare

6.6 Ambulatory Surgical Centers

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cardiac Rhythm Management Devices Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT LABORATORIES (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 B. BRAUN MELSUNGEN AG (GERMANY)

7.4 BOSTON SCIENTIFIC (UNITED STATES)

7.5 COOK MEDICAL (UNITED STATES)

7.6 EDWARDS LIFESCIENCES (UNITED STATES)

7.7 JOHNSON & JOHNSON (UNITED STATES)

7.8 LIVANOVA PLC (UNITED KINGDOM)

7.9 MEDTRONIC (UNITED STATES)

7.10 STRYKER CORPORATION (UNITED STATES)

7.11 TERUMO CORPORATION (JAPAN)

7.12 OTHER ACTIVE PLAYERS

Chapter 8: Global Cardiac Rhythm Management Devices Market By Region

8.1 Overview

8.2. North America Cardiac Rhythm Management Devices Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Device Type

8.2.4.1 Pacemakers

8.2.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.2.4.3 Cardiac Resynchronization Therapy (CRT) Devices

8.2.4.4 External Defibrillators

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Arrhythmia Management

8.2.5.2 Heart Failure Treatment

8.2.5.3 Syncope Management

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Hospitals

8.2.6.2 Cardiac Centers

8.2.6.3 Home Healthcare

8.2.6.4 Ambulatory Surgical Centers

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cardiac Rhythm Management Devices Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Device Type

8.3.4.1 Pacemakers

8.3.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.3.4.3 Cardiac Resynchronization Therapy (CRT) Devices

8.3.4.4 External Defibrillators

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Arrhythmia Management

8.3.5.2 Heart Failure Treatment

8.3.5.3 Syncope Management

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Hospitals

8.3.6.2 Cardiac Centers

8.3.6.3 Home Healthcare

8.3.6.4 Ambulatory Surgical Centers

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cardiac Rhythm Management Devices Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Device Type

8.4.4.1 Pacemakers

8.4.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.4.4.3 Cardiac Resynchronization Therapy (CRT) Devices

8.4.4.4 External Defibrillators

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Arrhythmia Management

8.4.5.2 Heart Failure Treatment

8.4.5.3 Syncope Management

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Hospitals

8.4.6.2 Cardiac Centers

8.4.6.3 Home Healthcare

8.4.6.4 Ambulatory Surgical Centers

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cardiac Rhythm Management Devices Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Device Type

8.5.4.1 Pacemakers

8.5.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.5.4.3 Cardiac Resynchronization Therapy (CRT) Devices

8.5.4.4 External Defibrillators

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Arrhythmia Management

8.5.5.2 Heart Failure Treatment

8.5.5.3 Syncope Management

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Hospitals

8.5.6.2 Cardiac Centers

8.5.6.3 Home Healthcare

8.5.6.4 Ambulatory Surgical Centers

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cardiac Rhythm Management Devices Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Device Type

8.6.4.1 Pacemakers

8.6.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.6.4.3 Cardiac Resynchronization Therapy (CRT) Devices

8.6.4.4 External Defibrillators

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Arrhythmia Management

8.6.5.2 Heart Failure Treatment

8.6.5.3 Syncope Management

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Hospitals

8.6.6.2 Cardiac Centers

8.6.6.3 Home Healthcare

8.6.6.4 Ambulatory Surgical Centers

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cardiac Rhythm Management Devices Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Device Type

8.7.4.1 Pacemakers

8.7.4.2 Implantable Cardioverter Defibrillators (ICDs)

8.7.4.3 Cardiac Resynchronization Therapy (CRT) Devices

8.7.4.4 External Defibrillators

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Arrhythmia Management

8.7.5.2 Heart Failure Treatment

8.7.5.3 Syncope Management

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Hospitals

8.7.6.2 Cardiac Centers

8.7.6.3 Home Healthcare

8.7.6.4 Ambulatory Surgical Centers

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Cardiac Rhythm Management Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 17.36 Billion |

|

Forecast Period 2024-32 CAGR: |

7.60% |

Market Size in 2032: |

USD 33.02 Billion |

|

Segments Covered: |

By Device Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Cardiac Rhythm Management Devices Market research report is 2024-2032.

Medtronic (Ireland), Boston Scientific (United States), Abbott Laboratories (United States), Biotronik (Germany), St. Jude Medical (United States), Philips (Netherlands), Zoll Medical Corporation (United States), B. Braun Melsungen AG (Germany), Sorin Group (Italy), Johnson & Johnson (United States), Merit Medical Systems (United States), Nuvectra Corporation (United States), and Other Active Players.

The Cardiac Rhythm Management Devices Market is segmented into Device Type, Application, End User and region. By Device Type, the market is categorized into Pacemakers, Implantable Cardioverter Defibrillators (ICDs), Cardiac Resynchronization Therapy (CRT) Devices, External Defibrillators. By Application, the market is categorized into Arrhythmia Management, Heart Failure Treatment, Syncope Management, Others. By End User, the market is categorized into Hospitals, Cardiac Centers, Home Healthcare, Ambulatory Surgical Centers. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA)

The Cardiac Rhythm Management (CRM) Devices Market is a market for medical devices that are used to diagnose, monitor, or treat arrhythmias and other heart disorders. Such devices are pacemakers, ICDs, CRT devices, and external bipole defibrillators. CRM devices are therefore important in enhancing the well being of people with cardiac related diseases by controlling the heart rate, reducing instances of sudden cardiac arrest and heart failure.

Cardiac Rhythm Management Devices Market Size Was Valued at USD 17.36 Billion in 2023, and is Projected to Reach USD 33.02 Billion by 2032, Growing at a CAGR of 7.60% From 2024-2032.