Cardiovascular Devices Market Synopsis:

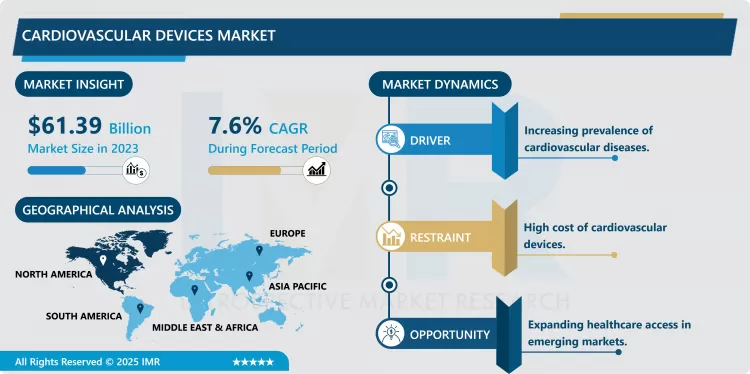

Cardiovascular Devices Market Size Was Valued at USD 61.39 Billion in 2023, and is Projected to Reach USD 117.68 Billion by 2032, Growing at a CAGR of 7.6% From 2024-2032.

The Cardiovascular Devices Market refers to a product sector that includes diagnostic, monitoring, and therapeutic cardiovascular medical equipment. This market covers diagnostic products including ECG and cardiac monitoring systems, therapeutic products including pacemakers, stents, defibrillators, and other cardiovascular surgical products. Since health diseases will continue to be common health threats in the world economy, there is a constantly high need for new cardiovascular devices to suit various needs and challenges in clinical practice.

Cardiovascular devices market size is expanding at a fast pace globally due to increasing cardiovascular diseases, innovations in medical devices products, and increasing life span populace. Hear diseases being one of the major causes of death in the world, there is a great demand for diagnostic and therapeutic equipment. Such innovations as minimally invasive devices, bioabsorbable stents, wearable cardiac monitor and many others have characterized industry in recent years and have enhanced healthcare providers’ ability to diagnose and treat cardiovascular diseases. Also, especially in the emerging economies, there is a significantly improving understanding of the preventive measures against cardiovascular diseases among the population, which also contributed to the development of the market; similarly, the perspectives of the governmental support, and the number of specialized cardiovascular hospitals.

Moreover, Asian-Pacific, Latin America and African regions show the rising investments toward the healthcare and enhancements in cardiovascular devices market. On the negative side there are requirements that limit market access and the high prices of devices might be a problem for the players. However, the industry participants are investing their efforts towards research and development for the introduction of affordable products and to fulfill the regulatory requirements stipulating that market will maintain a favorable growth in the future years.

Cardiovascular Devices Market Trend Analysis:

Technological Advancements Drive Market Growth

- The core trends of the cardiovascular devices market depend on the growth of technology with new solutions of patient safety, device reliability, and options for minimally invasive procedures.. Several organizations have been establishing future technologies in the fields of artificial intelligence, robotics, and data analysis in devices. For instance, smart diagnostics are improving the initial disease diagnosis, and robotic operations increase efficacy, thereby shortening the healing period. Further, portable ECGs, cardiac implants, and monitors give clinicians constant access to patient’s health information, making possible prompt decisions on patients’ well-being and care. Such advancements are revolutionizing the cardiovascular devices industry to meet the rising need of sophisticated equipment that can handle cardiopathy issues with better results.

- The gap that exists in the cardiovascular devices market can be viewed in the further penetration of access to treatment in the developing world where cardiovascular disease is on the rise. These firms are trying to satisfy the conditions in these markets through partnerships, pricing, and devices that they are offering to the market. A weak healthcare system in these regions has in the past been a stumbling block in many ways to cosmopolitan cardiovascular care though rising healthcare expenditure and elevating public and private investment are now turning the table. The availability and affordable devices also mean that manufacturers get access to a larger patient community and hence the additional benefit of enhancing universal health care. As the market moves to areas where there is little to no competition, companies are likely to be the primary solution providers of the global inequalities in heart disease.

Cardiovascular Devices Market Segment Analysis:

Cardiovascular Devices Market is Segmented on the basis of Type, Application, End User, and Region

By Type, Monitoring segment is expected to dominate the market during the forecast period

- The Comprehensively, monitoring segment is expected to hold the largest share for the cardiovascular devices market during the forecast years, because of the rising need for early identification and constant tracking of these medical conditions. ECG machines, heart rate monitors, and portable cardiac telemetry are all monitoring devices that help health care practitioners monitor the heart status of patients in realtime to prevent or control acute cardiac complications. Wearable and home-based monitors have also recorded higher demand, thanks to keeping tabs with cardiovascular health without going to a hospital. Such devices are becoming more advanced featuring, for instance, analytics via artificial intelligence and the possibility of connection to patient’s data when not installed remotely. Such factors as the steady innovation of sophisticated, easy-to-use monitoring systems, and increasing concern for early-stage preventive care are also expected to contribute to the further growth of this segment in the cardiovascular devices market.

By Application, Coronary Artery Diseases segment expected to held the largest share

- CAD segment is projected to dominate the CV devices market as CAD is the most widespread worldwide and the need for diagnosis and treatments increases every year.. CAD, which is one of the primary causes of morbidity and mortality, is treated through stenting, angioplasty and bypass surgery which mostly involve cardiovascular medical devices. Continued innovation in surgical techniques for minimally invasive interventions, stents, balloons and imaging has enhanced the capabilities of dealing with CAD and consequentially driving the demand within this segment. Furthermore, rising consciousness levels towards undergoing preventive procedures in conjunction with drivers such as aging population, sedentary lifestyle, hypertension and diabetes are also enhancing the CAD segment growth and hence consolidating its position as the leading segment in the cardiovascular devices market.

Cardiovascular Devices Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In 2023, North America sustains its position as the largest market accounting a significantly large share for cardiovascular devices, due to growth in healthcare services, prevention of cardiovascular diseases, and demand for new generation cardiovascular devices. The United States had the highest proportion due to a high prevalence of cardiovascular diseases and key device manufacturers. North America leads in the market share with approximately 38% in 2023 owing to its strong healthcare section as well as acceptance of new techniques. And by the way, governments all over the world are increasing their support for cardiovascular disease management programs, while reimbursement policies are aligning more positively to generate more demand within the global cardiovascular disease management market. The strong and continuous R&D performance, strategic partnerships, and distribution superiority provide further substantiation for North America’s leadership position.

Active Key Players in the Cardiovascular Devices Market:

- Abbott Laboratories (USA)

- Asahi Intecc Co., Ltd. (Japan)

- Becton, Dickinson and Company (USA)

- Biotronik SE & Co. KG (Germany)

- Boston Scientific Corporation (USA)

- Cardinal Health (USA)

- Edwards Lifesciences Corporation (USA)

- GE Healthcare (USA)

- Johnson & Johnson (USA)

- LivaNova PLC (UK)

- Medtronic Plc (Ireland)

- MicroPort Scientific Corporation (China)

- Philips Healthcare (Netherlands)

- Siemens Healthineers (Germany)

- Terumo Corporation (Japan)

- Other Active Players

|

Cardiovascular Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 61.39 Billion |

|

Forecast Period 2024-32 CAGR: |

7.6 % |

Market Size in 2032: |

USD 117.68 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cardiovascular Devices Market by By Type (2018-2032)

4.1 Cardiovascular Devices Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Electrocardiogram

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Remote Cardiac Monitoring

4.5 Therapeutic and Surgical Devices

4.6 Ventricular Assist Devices (VAD)

4.7 CRM Devices

4.8 Catheters

4.9 Stents

4.10 Heart Valves

4.11 Others

Chapter 5: Cardiovascular Devices Market by By Application (2018-2032)

5.1 Cardiovascular Devices Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Coronary Artery Diseases

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cardiac Arrhythmia

5.5 Heart Failure

5.6 Others

5.7 End Users

5.8 Hospitals

5.9 Specialty Clinics

5.10 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Cardiovascular Devices Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABBOTT LABORATORIES (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ASAHI INTECC CO. LTD. (JAPAN)

6.4 BECTON

6.5 DICKINSON AND COMPANY (USA)

6.6 BIOTRONIK SE & CO. KG (GERMANY)

6.7 BOSTON SCIENTIFIC CORPORATION (USA)

6.8 CARDINAL HEALTH (USA)

6.9 EDWARDS LIFESCIENCES CORPORATION (USA)

6.10 GE HEALTHCARE (USA)

6.11 JOHNSON & JOHNSON (USA)

6.12 LIVANOVA PLC (UK)

6.13 MEDTRONIC PLC (IRELAND)

6.14 MICROPORT SCIENTIFIC CORPORATION (CHINA)

6.15 PHILIPS HEALTHCARE (NETHERLANDS)

6.16 SIEMENS HEALTHINEERS (GERMANY)

6.17 TERUMO CORPORATION (JAPAN)

6.18 OTHER ACTIVE PLAYERS

Chapter 7: Global Cardiovascular Devices Market By Region

7.1 Overview

7.2. North America Cardiovascular Devices Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By By Type

7.2.4.1 Electrocardiogram

7.2.4.2 Remote Cardiac Monitoring

7.2.4.3 Therapeutic and Surgical Devices

7.2.4.4 Ventricular Assist Devices (VAD)

7.2.4.5 CRM Devices

7.2.4.6 Catheters

7.2.4.7 Stents

7.2.4.8 Heart Valves

7.2.4.9 Others

7.2.5 Historic and Forecasted Market Size By By Application

7.2.5.1 Coronary Artery Diseases

7.2.5.2 Cardiac Arrhythmia

7.2.5.3 Heart Failure

7.2.5.4 Others

7.2.5.5 End Users

7.2.5.6 Hospitals

7.2.5.7 Specialty Clinics

7.2.5.8 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Cardiovascular Devices Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By By Type

7.3.4.1 Electrocardiogram

7.3.4.2 Remote Cardiac Monitoring

7.3.4.3 Therapeutic and Surgical Devices

7.3.4.4 Ventricular Assist Devices (VAD)

7.3.4.5 CRM Devices

7.3.4.6 Catheters

7.3.4.7 Stents

7.3.4.8 Heart Valves

7.3.4.9 Others

7.3.5 Historic and Forecasted Market Size By By Application

7.3.5.1 Coronary Artery Diseases

7.3.5.2 Cardiac Arrhythmia

7.3.5.3 Heart Failure

7.3.5.4 Others

7.3.5.5 End Users

7.3.5.6 Hospitals

7.3.5.7 Specialty Clinics

7.3.5.8 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Cardiovascular Devices Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By By Type

7.4.4.1 Electrocardiogram

7.4.4.2 Remote Cardiac Monitoring

7.4.4.3 Therapeutic and Surgical Devices

7.4.4.4 Ventricular Assist Devices (VAD)

7.4.4.5 CRM Devices

7.4.4.6 Catheters

7.4.4.7 Stents

7.4.4.8 Heart Valves

7.4.4.9 Others

7.4.5 Historic and Forecasted Market Size By By Application

7.4.5.1 Coronary Artery Diseases

7.4.5.2 Cardiac Arrhythmia

7.4.5.3 Heart Failure

7.4.5.4 Others

7.4.5.5 End Users

7.4.5.6 Hospitals

7.4.5.7 Specialty Clinics

7.4.5.8 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Cardiovascular Devices Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By By Type

7.5.4.1 Electrocardiogram

7.5.4.2 Remote Cardiac Monitoring

7.5.4.3 Therapeutic and Surgical Devices

7.5.4.4 Ventricular Assist Devices (VAD)

7.5.4.5 CRM Devices

7.5.4.6 Catheters

7.5.4.7 Stents

7.5.4.8 Heart Valves

7.5.4.9 Others

7.5.5 Historic and Forecasted Market Size By By Application

7.5.5.1 Coronary Artery Diseases

7.5.5.2 Cardiac Arrhythmia

7.5.5.3 Heart Failure

7.5.5.4 Others

7.5.5.5 End Users

7.5.5.6 Hospitals

7.5.5.7 Specialty Clinics

7.5.5.8 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Cardiovascular Devices Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By By Type

7.6.4.1 Electrocardiogram

7.6.4.2 Remote Cardiac Monitoring

7.6.4.3 Therapeutic and Surgical Devices

7.6.4.4 Ventricular Assist Devices (VAD)

7.6.4.5 CRM Devices

7.6.4.6 Catheters

7.6.4.7 Stents

7.6.4.8 Heart Valves

7.6.4.9 Others

7.6.5 Historic and Forecasted Market Size By By Application

7.6.5.1 Coronary Artery Diseases

7.6.5.2 Cardiac Arrhythmia

7.6.5.3 Heart Failure

7.6.5.4 Others

7.6.5.5 End Users

7.6.5.6 Hospitals

7.6.5.7 Specialty Clinics

7.6.5.8 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Cardiovascular Devices Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By By Type

7.7.4.1 Electrocardiogram

7.7.4.2 Remote Cardiac Monitoring

7.7.4.3 Therapeutic and Surgical Devices

7.7.4.4 Ventricular Assist Devices (VAD)

7.7.4.5 CRM Devices

7.7.4.6 Catheters

7.7.4.7 Stents

7.7.4.8 Heart Valves

7.7.4.9 Others

7.7.5 Historic and Forecasted Market Size By By Application

7.7.5.1 Coronary Artery Diseases

7.7.5.2 Cardiac Arrhythmia

7.7.5.3 Heart Failure

7.7.5.4 Others

7.7.5.5 End Users

7.7.5.6 Hospitals

7.7.5.7 Specialty Clinics

7.7.5.8 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Cardiovascular Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 61.39 Billion |

|

Forecast Period 2024-32 CAGR: |

7.6 % |

Market Size in 2032: |

USD 117.68 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Cardiovascular Devices Market research report is 2024-2032.

Abbott Laboratories (USA), Asahi Intecc Co., Ltd. (Japan), Becton, Dickinson and Company (USA), Biotronik SE & Co. KG (Germany), Boston Scientific Corporation (USA), Cardinal Health (USA), Edwards Lifesciences Corporation (USA), GE Healthcare (USA), Johnson & Johnson (USA), LivaNova PLC (UK), Medtronic Plc (Ireland), MicroPort Scientific Corporation (China), Philips Healthcare (Netherlands), Siemens Healthineers (Germany), Terumo Corporation (Japan), and Other Active Players.

The Cardiovascular Devices Market is segmented into Type, Application, End User and region. By Type, the market is categorized into Diagnostic and Monitoring Devices {Electrocardiogram, Remote Cardiac Monitoring, and Others}, and Therapeutic and Surgical Devices {Ventricular Assist Devices (VAD), CRM Devices, Catheters, Stents, Heart Valves, and Others. By Application, the market is categorized into Coronary Artery Diseases, Cardiac Arrhythmia, Heart Failure, and Others. By End User, the market is categorized into Hospitals, Specialty Clinics, and Others. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The Cardiovascular Devices Market refers to a product sector that includes diagnostic, monitoring, and therapeutic cardiovascular medical equipment. This market covers diagnostic products including ECG and cardiac monitoring systems, therapeutic products including pacemakers, stents, defibrillators, and other cardiovascular surgical products. Since health diseases will continue to be common health threats in the world economy, there is a constantly high need for new cardiovascular devices to suit various needs and challenges in clinical practice.

Cardiovascular Devices Market Size Was Valued at USD 61.39 Billion in 2023, and is Projected to Reach USD 117.68 Billion by 2032, Growing at a CAGR of 7.6% From 2024-2032.