Casino Gaming Equipment Market Synopsis

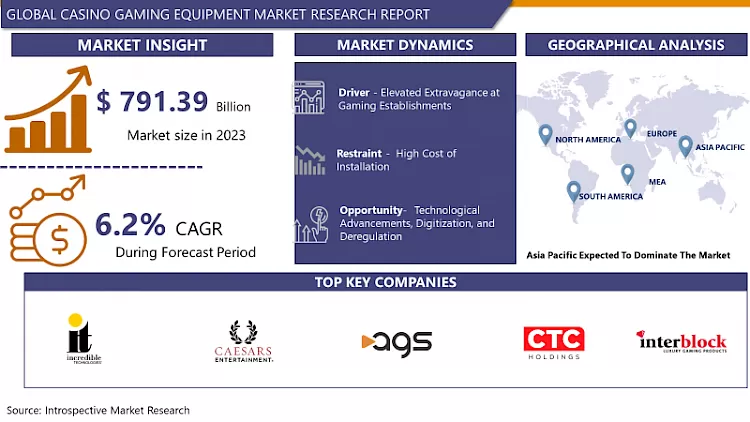

Global Casino Gaming Equipment Market size is expected to grow from USD 791.39 Billion in 2023 to USD 1359.91 Billion by 2032, at a CAGR of 6.2% during the forecast period (2024-2032)

Casino gaming equipment encompasses the tools and apparatus essential for operating casino games. It includes specialized tables for games like blackjack and roulette, slot machines ranging from traditional reels to digital variants, and necessary accessories such as playing cards and card shufflers. These elements collectively create a comprehensive gaming environment, ensuring the integrity, fairness, and excitement of casino activities.

- Casino gaming equipment encompasses a wide range of tools and machines essential to the success of the casino industry. Specialized tables, such as those designed for blackjack and roulette, act as platforms for classic games, creating a central point for player interaction. Slot machines, available in both traditional mechanical reels and advanced digital formats, offer a diverse array of gaming experiences. These machines not only entertain but also play a significant role in a casino's revenue generation, especially when linked to progressive jackpots that can reach substantial amounts. Playing cards and card shufflers play a crucial role in ensuring the fairness and transparency of card games like poker and blackjack, enhancing the overall gaming experience.

- The significance of casino gaming equipment goes beyond entertainment; it is pivotal in establishing an immersive and secure gaming environment. Advanced technologies, such as RFID-enabled chips and electronic tracking systems, bolster security measures, mitigating the risk of fraud and ensuring the integrity of casino operations. The precision and efficiency of card shufflers streamline gameplay, minimizing downtime between rounds and maximizing player engagement.

- Furthermore, the diverse range of gaming equipment caters to various player preferences, attracting a broad audience and cultivating a dynamic gaming atmosphere. Ultimately, the strategic deployment of casino gaming equipment not only enhances the entertainment factor but also contributes to the economic viability and sustainability of the casino industry.

Casino Gaming Equipment Market Trend Analysis:

Elevated Extravagance at Gaming Establishments

- The substantial engagement in casinos plays a crucial role in propelling the remarkable expansion of the market for casino gaming equipment. With an escalating demand for immersive and lavish gaming experiences, casinos are making significant investments in cutting-edge gaming equipment to meet the expectations of discerning patrons. Lavish casinos often showcase opulent table games, featuring intricate detailing and state-of-the-art technology to attract high-stakes players seeking a refined atmosphere. The appeal of high-stakes games, facilitated by specialized tables for blackjack, poker, and roulette, is driving the need for premium gaming equipment designed for durability and to deliver an unmatched gaming experience.

- Slot machines, fundamental to any casino, have evolved to incorporate advanced graphics, sound systems, and interactive features, creating a sensory-rich environment that captivates players. The desire for exclusivity and distinctive gaming experiences has led to the development of custom-designed slot machines, contributing to the overall opulence of the casino floor. Additionally, the integration of progressive jackpot systems in high-end slot machines adds an extra layer of excitement, attracting affluent players in search of substantial winnings.

- In this competitive landscape, casinos understand that investing in cutting-edge gaming equipment not only enhances the customer experience but also correlates directly with increased patronage and revenue. Technological advancements, such as touch-screen interfaces and mobile connectivity, further enhance the gaming experience, catering to the preferences of a tech-savvy clientele. As casinos strive to set themselves apart in the market, the high level of engagement from players becomes a driving force behind the sustained growth of the casino gaming equipment market, creating an environment characterized by luxury, entertainment, and heightened gaming sophistication.

Technological Advancements, Digitization, and Deregulation

- The significant expansion of the casino gaming equipment market is propelled by key factors such as technological advancements, digitization, and deregulation. The incorporation of cutting-edge technologies has brought about a paradigm shift in traditional gaming equipment, ushering in an era of innovation and sophistication. Modern features like high-definition displays, immersive sound systems, and interactive interfaces contribute to an enhanced gaming experience, appealing to a tech-savvy audience seeking contemporary and captivating entertainment.

- The rise of digitization has played a pivotal role in reshaping the casino gaming landscape. Increasingly popular online and mobile platforms enable users to access a diverse array of casino games from the comfort of their homes. This digital transformation has led to a growing demand for electronic gaming equipment, including digital slot machines and virtual reality (VR) experiences, as casinos adapt to the changing preferences of a diverse and globally-connected player base.

- Deregulation in various regions has created opportunities for market growth by relaxing restrictions on the establishment and operation of casinos. As regulatory barriers are lifted, both new entrants and existing players can expand their operations, fueling the demand for a broad spectrum of gaming equipment. The combination of deregulation and technological advancements also facilitates the adoption of cashless payment systems, providing added convenience for players and streamlining financial transactions within the casino ecosystem.

Casino Gaming Equipment Market Segment Analysis:

Casino Gaming Equipment Market Segmented on the basis of Type, Installation, Mode of Operation, and Distribution Channel.

By Type, Slot Machines segment is expected to dominate the market during the forecast period

- The casino gaming equipment market is witnessing a notable surge in the dominance of the Slot Machines segment, showcasing robust growth. This increasing demand can be attributed to various factors, including the enduring popularity of slot machines among casino enthusiasts and ongoing technological advancements within this category. Slot machines have evolved from traditional mechanical reels to sophisticated digital platforms, offering a wide range of themes, interactive features, and visually captivating graphics.

- The lasting appeal of slot machines lies in their simplicity, accessibility, and the potential for substantial payouts, making them a preferred choice for a diverse range of players. Additionally, the introduction of progressive jackpot systems, where potential winnings accumulate across a network of machines, adds an element of excitement and allure for patrons seeking significant prizes. The continual innovation in slot machine technology, incorporating features such as touch-screen interfaces, augmented reality (AR), and virtual reality (VR), enhances the gaming experience, attracting both traditional slot enthusiasts and a new generation of players seeking immersive and engaging gameplay.

- Recognizing the financial potential of the Slot Machines segment, casinos are increasingly investing in a diverse range of these gaming devices to meet varied player preferences. This strategic emphasis on expanding and upgrading slot machine offerings positions this segment as a prominent force within the broader casino gaming equipment market, shaping the industry's landscape and contributing to sustained growth.

By Installation, Indoor Casino segment held the largest share of 87.6% % in 2022

- The Indoor Casino segment has emerged as the leading force in the casino gaming equipment market, holding the largest share. This dominance is attributed to the enduring popularity of traditional brick-and-mortar casinos, which continue to be central hubs for the gaming experience. These indoor establishments offer a comprehensive range of gaming equipment, including various table games, slot machines, and additional amenities, creating an immersive and social environment for patrons. The allure of the indoor casino experience, marked by glamorous interiors, live entertainment, and a lively atmosphere, consistently attracts a diverse audience.

- Despite the rise of online and mobile gaming platforms, the appeal of the physical casino setting remains unparalleled, contributing to the sustained demand for gaming equipment in indoor casino spaces. Investments in advanced technologies, thematic designs, and customer-centric services within the indoor casino segment further affirm its status as the primary contributor to the overall market share. This underscores the enduring charm and profitability of traditional casino experiences.

Casino Gaming Equipment Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is positioned to take a leading role in the casino gaming equipment market, emerging as a significant contributor to the industry's growth. This anticipated prominence is driven by factors such as the growing middle class, increasing disposable incomes, and a rising interest in leisure and entertainment activities. Governments in the region have been gradually easing regulations related to the casino industry, creating a favorable environment for market expansion.

- The proliferation of integrated resorts and large-scale casino complexes, particularly in countries like Macau and Singapore, has led to a notable increase in the demand for advanced gaming equipment. The cultural inclination towards gaming in various countries across Asia Pacific, combined with ongoing urbanization trends, further reinforces the region's significance in the casino gaming equipment market. This positions it as a focal point for industry stakeholders and a key driving force behind the sustained growth of the market.

Key Players Covered in The Casino Gaming Equipment Market:

- Incredible Technologies Inc. (U.S.)

- Gaming Partners International, Inc. (U.S.)

- Caesars Entertainment, Inc. (U.S.)

- Playags (U.S.)

- Ctc Holdings (U.S.)

- Interblock (U.S.)

- Ags (U.S.)

- Jackpot Digital Inc (Canada)

- Everi Holdings Inc (Nevada)

- Novomatic (Austria)

- IGT (UK)

- Cammegh (UK)

- Tcsjohnhuxley (UK)

- Gamebridge Casino Equipment (Ukraine)

- Abbiati Casino Equipment S.R.L. (Italy)

- Apex Gaming Technology (Austria)

- Amatic Industries (Austria)

- Konami Group Corporation (Japan)

- Ainsworth Game Technology Limited (Australia)

- Hanxin Industry Co., Ltd (China)

- Gamebridge Casino Equipment (Ukraine)

- Atomic Gaming (South Africa)

- Game Smart (Pty) Ltd (South Africa)

- Merkur Gaming Africa (Pty)Ltd (South Africa)

- 3 Point Gaming (Pty) Ltd (South Africa), and Other Major players.

Key Industry Developments in the Casino Gaming Equipment Market:

- In July 2023, Novomatic signed an agreement with Tecnet Asia for the distribution rights for Novomatic products in the Philippines. Tecnet is under contract for both the sales and after-sales service of the gaming technology products by Novomatic. It will include electronic table games, video slot cabinets, and games, as well as casino management tools and solutions.

- In June 2023, Incredible Technologies announced the installation of True Pick Roulette, the latest Class II product innovation, in the State of Washington. True Pick Roulette is an Electronic Table Game (ETG) approved for use in Class II jurisdictions. It is the first bingo-based ETG to offer a roulette experience with a physical wheel and ball.

|

Global Casino Gaming Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 791.39 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.2% |

Market Size in 2032: |

USD 1359.91 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Installation |

|

||

|

By Mode of Operation |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Casino Gaming Equipment Market by By Type (2018-2032)

4.1 Casino Gaming Equipment Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Slot Machine

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Casino Tables Gaming

4.5 Chips Video

4.6 Poker Machine

Chapter 5: Casino Gaming Equipment Market by By Installation (2018-2032)

5.1 Casino Gaming Equipment Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Indoor Casino

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Outdoor Casino

Chapter 6: Casino Gaming Equipment Market by By Mode of Operation (2018-2032)

6.1 Casino Gaming Equipment Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Floor Mounted

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Portable

Chapter 7: Casino Gaming Equipment Market by By Distribution Channel (2018-2032)

7.1 Casino Gaming Equipment Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Online

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Offline

7.5 Direct Sales

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Casino Gaming Equipment Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 ANDERSEN CORPORATION(US)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 MILGARD MANUFACTURING

8.4 LLC (US)

8.5 KOLBE WINDOWS AND DOORS (US)

8.6 PELLA CORPORATION (US)

8.7 JELD-WEN (US)

8.8 ALSIDES (US)

8.9 PGT INNOVATIONS(US)

8.10 CORNERSTONE BUILDING BRANDS (US)

8.11 HARVEY WINDOWS (US)

8.12 VYTEX WINDOWS (US)

8.13 BURRIS WINDOWS (US)

8.14 STARLINE WINDOWS (CANADA)

8.15 ALUMIL (GREECE)

8.16 SGM WINDOWS (UK)

8.17 BRADNAM'S WINDOWS & DOORS (AUSTRALIA)

8.18 YKK CORPORATION (JAPAN)

8.19 MANGALAM TIMBERS (INDIA)

8.20 CENTURY PLY PLYWOOD (INDIA)

8.21 TATA (INDIA)

8.22 WINDOWS MART (INDIA)

8.23

Chapter 9: Global Casino Gaming Equipment Market By Region

9.1 Overview

9.2. North America Casino Gaming Equipment Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Type

9.2.4.1 Slot Machine

9.2.4.2 Casino Tables Gaming

9.2.4.3 Chips Video

9.2.4.4 Poker Machine

9.2.5 Historic and Forecasted Market Size By By Installation

9.2.5.1 Indoor Casino

9.2.5.2 Outdoor Casino

9.2.6 Historic and Forecasted Market Size By By Mode of Operation

9.2.6.1 Floor Mounted

9.2.6.2 Portable

9.2.7 Historic and Forecasted Market Size By By Distribution Channel

9.2.7.1 Online

9.2.7.2 Offline

9.2.7.3 Direct Sales

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Casino Gaming Equipment Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Type

9.3.4.1 Slot Machine

9.3.4.2 Casino Tables Gaming

9.3.4.3 Chips Video

9.3.4.4 Poker Machine

9.3.5 Historic and Forecasted Market Size By By Installation

9.3.5.1 Indoor Casino

9.3.5.2 Outdoor Casino

9.3.6 Historic and Forecasted Market Size By By Mode of Operation

9.3.6.1 Floor Mounted

9.3.6.2 Portable

9.3.7 Historic and Forecasted Market Size By By Distribution Channel

9.3.7.1 Online

9.3.7.2 Offline

9.3.7.3 Direct Sales

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Casino Gaming Equipment Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Type

9.4.4.1 Slot Machine

9.4.4.2 Casino Tables Gaming

9.4.4.3 Chips Video

9.4.4.4 Poker Machine

9.4.5 Historic and Forecasted Market Size By By Installation

9.4.5.1 Indoor Casino

9.4.5.2 Outdoor Casino

9.4.6 Historic and Forecasted Market Size By By Mode of Operation

9.4.6.1 Floor Mounted

9.4.6.2 Portable

9.4.7 Historic and Forecasted Market Size By By Distribution Channel

9.4.7.1 Online

9.4.7.2 Offline

9.4.7.3 Direct Sales

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Casino Gaming Equipment Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Type

9.5.4.1 Slot Machine

9.5.4.2 Casino Tables Gaming

9.5.4.3 Chips Video

9.5.4.4 Poker Machine

9.5.5 Historic and Forecasted Market Size By By Installation

9.5.5.1 Indoor Casino

9.5.5.2 Outdoor Casino

9.5.6 Historic and Forecasted Market Size By By Mode of Operation

9.5.6.1 Floor Mounted

9.5.6.2 Portable

9.5.7 Historic and Forecasted Market Size By By Distribution Channel

9.5.7.1 Online

9.5.7.2 Offline

9.5.7.3 Direct Sales

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Casino Gaming Equipment Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Type

9.6.4.1 Slot Machine

9.6.4.2 Casino Tables Gaming

9.6.4.3 Chips Video

9.6.4.4 Poker Machine

9.6.5 Historic and Forecasted Market Size By By Installation

9.6.5.1 Indoor Casino

9.6.5.2 Outdoor Casino

9.6.6 Historic and Forecasted Market Size By By Mode of Operation

9.6.6.1 Floor Mounted

9.6.6.2 Portable

9.6.7 Historic and Forecasted Market Size By By Distribution Channel

9.6.7.1 Online

9.6.7.2 Offline

9.6.7.3 Direct Sales

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Casino Gaming Equipment Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Type

9.7.4.1 Slot Machine

9.7.4.2 Casino Tables Gaming

9.7.4.3 Chips Video

9.7.4.4 Poker Machine

9.7.5 Historic and Forecasted Market Size By By Installation

9.7.5.1 Indoor Casino

9.7.5.2 Outdoor Casino

9.7.6 Historic and Forecasted Market Size By By Mode of Operation

9.7.6.1 Floor Mounted

9.7.6.2 Portable

9.7.7 Historic and Forecasted Market Size By By Distribution Channel

9.7.7.1 Online

9.7.7.2 Offline

9.7.7.3 Direct Sales

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Casino Gaming Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 791.39 Bn. |

|

Forecast Period 2024-32 CAGR: |

6.2% |

Market Size in 2032: |

USD 1359.91 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Installation |

|

||

|

By Mode of Operation |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Casino Gaming Equipment Market research report is 2024-2032.

Incredible Technologies Inc. (U.S.), Gaming Partners International, Inc. (U.S.), Caesars Entertainment, Inc. (U.S.), Playags (U.S.), CTC Holdings (U.S.), Interblock (U.S.), AGS (U.S.), Jackpot Digital Inc (Canada), Everi Holdings Inc (Nevada), Novomatic (Austria), IGT (UK), Cammegh (UK), Tcsjohnhuxley (UK), Gamebridge Casino Equipment (Ukraine), Abbiati Casino Equipment S.R.L. (Italy), Apex Gaming Technology (Austria), Amatic Industries (Austria), Konami Group Corporation (Japan), Ainsworth Game Technology Limited (Australia), Hanxin Industry Co., Ltd (China), Atomic Gaming (South Africa), Game Smart (Pty) Ltd (South Africa), Merkur Gaming Africa (Pty)Ltd (South Africa), 3 Point Gaming (Pty) Ltd (South Africa), and other major players

The Casino Gaming Equipment Market is segmented into Type, Installation, Mode of Operation, Distribution Channel, and region. By Type, the market is categorized as Slot Machine, Casino table gaming, Chips Video, and Poker Machine. By Installation, the market is categorized as Inside Casino and Outside Casino. By Mode of Operation, the market is categorized as Floor Mounted and Portable. By Distribution Channel, the market is categorized as Online, Offline, and Direct Sales. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Casino gaming equipment encompasses the tools and apparatus essential for operating casino games. It includes specialized tables for games like blackjack and roulette, slot machines ranging from traditional reels to digital variants, and necessary accessories such as playing cards and card shufflers. These elements collectively create a comprehensive gaming environment, ensuring the integrity, fairness, and excitement of casino activities.

Global Casino Gaming Equipment Market size is expected to grow from USD 791.39 Billion in 2023 to USD 1359.91 Billion by 2032, at a CAGR of 6.2% during the forecast period (2024-2032)