Ceiling Spotlights Market Overview

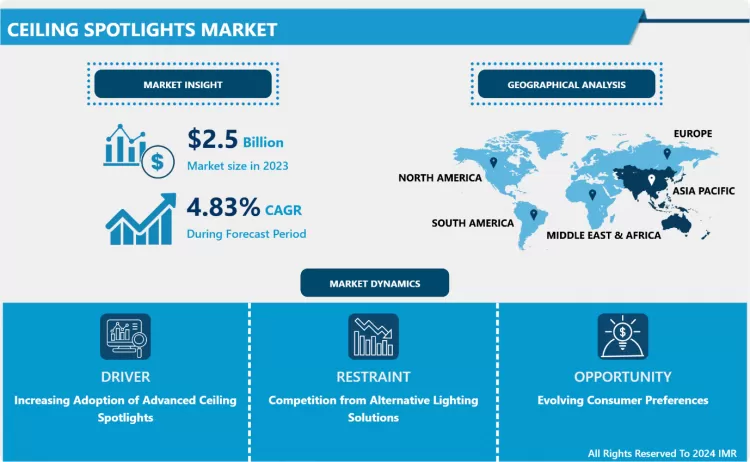

Ceiling Spotlights Market Size Was Valued at USD 2.5 Billion in 2023 and is Projected to Reach USD 3.82 Billion by 2032, Growing at a CAGR of 4.83% From 2024-2032

-

Ceiling spotlights refer to a type of lighting fixture designed for installation on ceilings, typically used to illuminate specific areas or objects within a space. These fixtures are characterized by their directional light output, which provides focused and adjustable illumination in targeted areas. Ceiling spotlights are commonly employed in residential, commercial, and architectural settings to enhance visibility, accentuate features, or create specific ambient lighting effects, offering a versatile and adaptable solution for illuminating interior spaces. A prominent trend shaping the ceiling spotlight market is the widespread embrace of LED technology. LED spotlights have garnered favour due to their notable attributes, including energy efficiency, extended lifespan, and the ability to offer a range of colour temperatures. The prioritization of energy-efficient lighting solutions has led consumers and businesses to increasingly opt for LED spotlights, surpassing traditional incandescent and halogen alternatives.

-

The market is growing in need of various types of ceiling spotlights. Fixed spotlights deliver a stationary focused beam, while adjustable and track lighting options provide flexibility in directing light to specific areas. Recessed spotlights contribute to a modern aesthetic by seamlessly integrating into the ceiling, whereas surface-mounted spotlights prove suitable for spaces where recessed installation is impractical. As the ceiling spotlight market continues to evolve, driven by urbanization, interior design trends, and sustainability considerations, ongoing innovations are anticipated. Manufacturers are poised to concentrate on developing energy-efficient technologies, offering aesthetic design choices, and incorporating smart capabilities to meet the evolving demands of consumers and businesses in this dynamic lighting sector.

Ceiling Spotlights Market Trend Analysis:

Increasing Adoption of Advanced Ceiling Spotlights

-

Ceiling Spotlights Driving the adoption of advanced ceiling spotlights is the integration of smart technology. Smart ceiling spotlights can be controlled and automated through smartphones, tablets, voice assistants, or remote controls, offering unparalleled convenience and user experience. Smart functionality enables users to adjust lighting levels, set schedules, and create personalised lighting scenes, enhancing ambience and energy efficiency. The integration of smart technology has redefined user interaction with ceiling spotlights, offering unparalleled convenience and a heightened user experience. Users can now control and automate their lighting environments with ease, adjusting lighting levels, setting schedules, and creating personalized lighting scenes.

-

The ceiling spotlights market is currently experiencing a notable upswing in the adoption of these advanced solutions, contributing significantly to its overall growth and expansion. Advanced ceiling spotlights are characterized by the integration of cutting-edge technologies that go beyond conventional lighting solutions. This infusion of technology enhances their functionality, augments versatility, and elevates aesthetic appeal, rendering them increasingly coveted among a broad spectrum of consumers and businesses alike.

-

A noticeable feature empowers users to seamlessly transition between warm, neutral, and cool white light tones, allowing for customization to suit various moods, activities, and décor styles. The inherent versatility of these advanced spotlights positions them as fitting solutions for a diverse array of applications. Whether providing focused task lighting in workspaces or contributing to ambient accent lighting in living areas, the adaptability of advanced ceiling spotlights adds a layer of versatility that resonates with the preferences of a wide-ranging audience.

Evolving Consumer Preferences

-

Evolving consumer preferences stand as a significant opportunity factor in the ceiling spotlight market, reflecting a dynamic landscape shaped by changing tastes, lifestyles, and expectations. Modern consumers seek lighting solutions that seamlessly integrate with their personal style and décor preferences. Ceiling spotlights offer a wide range of customization options, including design variations, finish choices, and beam angle adjustments. This flexibility allows consumers to personalize their lighting choices, enhancing the ambience and aesthetics of their living spaces.

-

Smart ceiling spotlights, controllable through smartphones, tablets, voice assistants, or remote controls, provide an unparalleled level of convenience and user experience. This smart functionality allows users to dynamically adjust lighting levels, schedule illumination according to their routines, and even craft personalized lighting scenes. The result is an elevated ambience coupled with heightened energy efficiency, aligning with the modern consumer's desire for seamless integration of technology into their living spaces.

-

The market for ceiling spotlights is not limited to traditional residential and commercial spaces. Emerging applications across various sectors showcase the adaptability of these fixtures. In hospitality, ceiling spotlights contribute to creating ambience and enhancing guest experiences. In healthcare settings, they provide focused illumination for treatment areas. In retail environments, they play a crucial role in highlighting products and improving the overall shopping experience. Even in industrial settings, ceiling spotlights are gaining traction for their durability and energy-efficient task lighting. Evolving consumer preferences, encompassing energy efficiency, sustainability, customization, smart technology integration, versatility, and exploration of emerging applications, present a wealth of opportunities for the ceiling spotlight market. Manufacturers and retailers attuned to these preferences and committed to continuous innovation can effectively tap into this growing market, ensuring sustained success by meeting the diverse and evolving needs of consumers.

Ceiling Spotlights Market Segment Analysis:

Ceiling Spotlights Market Segmented on the basis of type, Application and Distribution Channels.

By Type, LED is expected to dominate the market during the forecast Period

-

LED technology has become the most popular choice for ceiling spotlights due to its superior energy efficiency, long lifespan, and adaptability. LED ceiling spotlights use significantly less energy than traditional incandescent and halogen spotlights, resulting in substantial energy savings and lower electricity costs. This energy efficiency aligns with growing environmental concerns and sustainability initiatives, making LED spotlights an eco-friendly option.

-

LED ceiling spotlights seamlessly integrate with smart home technology, allowing for control and automation through smartphones, tablets, voice assistants, or remote controls. This smart functionality enhances convenience, promotes energy efficiency, and enables personalized lighting experiences. LED ceiling spotlights offer a wide range of colour temperatures, from warm white to cool white, giving users the ability to customize the ambiance of their spaces. This versatility caters to various décor styles and personal preferences, making LED spotlights suitable for a wide range of applications.

Ceiling Spotlights Market Regional Insights:

Asia-Pacific is expected to dominate the Market over the Forecast period

-

The Asia Pacific region is growing to establish its supremacy in the ceiling spotlight market during the forecast period, demonstrating robust growth and emerging as a pivotal player in shaping the industry landscape. The anticipated dominance is attributed to various factors that position the region strategically within the market. The Asia-Pacific region is undergoing rapid urbanization and economic expansion, driving demand for residential and commercial spaces. There is a requirement for contemporary and visually appealing lighting solutions, specifically ceiling spotlights, to augment interior spaces. The growing middle class in the region's emerging economies is fueling the increasing demand, which in turn is creating a favourable climate for the ceiling spotlight industry.

-

Governments across the Asia Pacific are increasingly prioritizing energy efficiency and sustainability in their urban development initiatives. Ceiling spotlights, often incorporating energy-efficient LED technology, align seamlessly with these objectives, making them the preferred choice in the region. This focus on sustainable solutions not only adheres to regulatory requirements but also resonates with the growing awareness and preference for environmentally friendly products among consumers.

-

The technological prowess and robust manufacturing capabilities of countries in the Asia-Pacific region also play a pivotal role in their dominance in the ceiling spotlight market. With a substantial presence of key market players and a resilient supply chain, the region is strategically positioned to meet the escalating demand for innovative and high-quality ceiling lighting solutions.

Key Players Covered in Ceiling Spotlights Market:

- Amerlux Lighting Solutions (US)

- DGA (US)

- ACDC Lighting Systems (US)

- Lucifer Lighting (US)

- Prolicht GmbH (Austria)

- Atelier Sedap (France)

- Lival (Finland)

- Onok Luz Tecnica (Spain)

- Reggiani Illuminazione (Italy)

- Targetti Sankey (Italy)

- Doxis Lighting Factory N.V. (Belgium)

- Spittler Lichttechnik (Germany)

- Brumberg Leuchten (Germany)

- Ansorg (Germany)

- TAL (Australia), and Other Major Players

Key Industry Developments in the Ceiling Spotlights Market:

- In February 2024, Amerlux, an award-winning design-and-manufacture lighting company, announced today that it has released the largest 1? family of architectural cylinders and downlights in the market for interior and exterior applications, each providing industry-leading lumen output for beautifully illuminating sophisticated spaces.

- In September 2023, Brumberg Leuchten GmbH & Co KG, one of the leading German companies in the lighting industry, announced an exclusive partnership with Siblik Elektrik GmbH & Co. KG, a supplier with a wide range of electrical and building services, many years of experience, and four branches in Austria.

|

Ceiling Spotlights Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

2.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.83% |

Market Size in 2032: |

3.82 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Ceiling Spotlights Market by By Type (2018-2032)

4.1 Ceiling Spotlights Market Snapshot and Growth Engine

4.2 Market Overview

4.3 LED

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Halogen

4.5 Incandescent Spotlights

4.6 Smart Spotlights

4.7 Decorative Spotlights

Chapter 5: Ceiling Spotlights Market by By Application (2018-2032)

5.1 Ceiling Spotlights Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Residential Buildings

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Commercial Buildings

5.5 Hospitality Applications

Chapter 6: Ceiling Spotlights Market by By Distribution Channels (2018-2032)

6.1 Ceiling Spotlights Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Retail Stores

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Online Retail

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Ceiling Spotlights Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 AMBU A/S (DENMARK)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ARMSTRONG MEDICAL LTD. (UNITED KINGDOM)

7.4 BD (BECTON DICKINSON AND COMPANY) (UNITED STATES)

7.5 BIO-MED DEVICES (UNITED STATES)

7.6 DRÄGERWERK AG & CO. KGAA (GERMANY)

7.7 FISHER & PAYKEL HEALTHCARE (NEW ZEALAND)

7.8 SMITHS GROUP PLC (UNITED KINGDOM)

7.9 TELEFLEX INCORPORATED (UNITED STATES)

7.10 WILMARC LLC (UNITED STATES)

7.11

Chapter 8: Global Ceiling Spotlights Market By Region

8.1 Overview

8.2. North America Ceiling Spotlights Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Type

8.2.4.1 LED

8.2.4.2 Halogen

8.2.4.3 Incandescent Spotlights

8.2.4.4 Smart Spotlights

8.2.4.5 Decorative Spotlights

8.2.5 Historic and Forecasted Market Size By By Application

8.2.5.1 Residential Buildings

8.2.5.2 Commercial Buildings

8.2.5.3 Hospitality Applications

8.2.6 Historic and Forecasted Market Size By By Distribution Channels

8.2.6.1 Retail Stores

8.2.6.2 Online Retail

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Ceiling Spotlights Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Type

8.3.4.1 LED

8.3.4.2 Halogen

8.3.4.3 Incandescent Spotlights

8.3.4.4 Smart Spotlights

8.3.4.5 Decorative Spotlights

8.3.5 Historic and Forecasted Market Size By By Application

8.3.5.1 Residential Buildings

8.3.5.2 Commercial Buildings

8.3.5.3 Hospitality Applications

8.3.6 Historic and Forecasted Market Size By By Distribution Channels

8.3.6.1 Retail Stores

8.3.6.2 Online Retail

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Ceiling Spotlights Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Type

8.4.4.1 LED

8.4.4.2 Halogen

8.4.4.3 Incandescent Spotlights

8.4.4.4 Smart Spotlights

8.4.4.5 Decorative Spotlights

8.4.5 Historic and Forecasted Market Size By By Application

8.4.5.1 Residential Buildings

8.4.5.2 Commercial Buildings

8.4.5.3 Hospitality Applications

8.4.6 Historic and Forecasted Market Size By By Distribution Channels

8.4.6.1 Retail Stores

8.4.6.2 Online Retail

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Ceiling Spotlights Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Type

8.5.4.1 LED

8.5.4.2 Halogen

8.5.4.3 Incandescent Spotlights

8.5.4.4 Smart Spotlights

8.5.4.5 Decorative Spotlights

8.5.5 Historic and Forecasted Market Size By By Application

8.5.5.1 Residential Buildings

8.5.5.2 Commercial Buildings

8.5.5.3 Hospitality Applications

8.5.6 Historic and Forecasted Market Size By By Distribution Channels

8.5.6.1 Retail Stores

8.5.6.2 Online Retail

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Ceiling Spotlights Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Type

8.6.4.1 LED

8.6.4.2 Halogen

8.6.4.3 Incandescent Spotlights

8.6.4.4 Smart Spotlights

8.6.4.5 Decorative Spotlights

8.6.5 Historic and Forecasted Market Size By By Application

8.6.5.1 Residential Buildings

8.6.5.2 Commercial Buildings

8.6.5.3 Hospitality Applications

8.6.6 Historic and Forecasted Market Size By By Distribution Channels

8.6.6.1 Retail Stores

8.6.6.2 Online Retail

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Ceiling Spotlights Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Type

8.7.4.1 LED

8.7.4.2 Halogen

8.7.4.3 Incandescent Spotlights

8.7.4.4 Smart Spotlights

8.7.4.5 Decorative Spotlights

8.7.5 Historic and Forecasted Market Size By By Application

8.7.5.1 Residential Buildings

8.7.5.2 Commercial Buildings

8.7.5.3 Hospitality Applications

8.7.6 Historic and Forecasted Market Size By By Distribution Channels

8.7.6.1 Retail Stores

8.7.6.2 Online Retail

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Ceiling Spotlights Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

2.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.83% |

Market Size in 2032: |

3.82 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Distribution Channels |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the market research report is 2024–2032.

Amerlux Lighting Solutions (US), DGA (US), ACDC Lighting Systems (US), Lucifer Lighting (US), Prolicht GmbH (Austria), Atelier Sedap (France), Lival (Finland), Onok Luz Tecnica (Spain), Reggiani Illuminazione (Italy), Targetti Sankey (Italy), Doxis Lighting Factory N.V. (Belgium), Spittler Lichttechnik (Germany), Brumberg Leuchten (Germany), Ansorg (Germany), TAL (Australia), and Other Major Players

The Ceiling Spotlights Market is segmented into Type, Application, Distribution Channels and region. By Type, the market is categorized into LED, Halogen, Incandescent Spotlights, Smart Spotlights and Decorative Spotlights. By Application, the market is categorized into Residential Buildings, Commercial Buildings and Hospitality Applications. By Distribution Channels, the market is categorized into Retail Stores and Online Retail. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Ceiling spotlights refer to a type of lighting fixture designed for installation on ceilings, typically used to illuminate specific areas or objects within a space. These fixtures are characterized by their directional light output, which provides focused and adjustable illumination in targeted areas. Ceiling spotlights are commonly employed in residential, commercial, and architectural settings to enhance visibility, accentuate features, or create specific ambient lighting effects, offering a versatile and adaptable solution for illuminating interior spaces.

Ceiling Spotlights Market Size Was Valued at USD 2.5 Billion in 2023 and is Projected to Reach USD 3.82 Billion by 2032, Growing at a CAGR of 4.83% From 2024-2032