Central Fill Pharmacy Automation Market Synopsis:

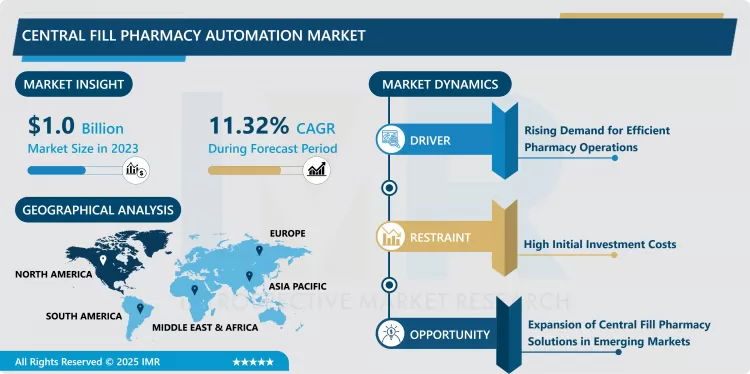

Central Fill Pharmacy Automation Market Size Was Valued at USD 1.0 Billion in 2023, and is Projected to Reach USD 2.65 Billion by 2032, Growing at a CAGR of 11.32% From 2024-2032.

The Central Fill Pharmacy Automation Market means the application of automated systems in the central pharmacy for effective processing and dispensing of the prescriptions. These systems seek to make prescriptions more accurate, faster to fill and disseminate, and diminish the human factor which may lead to errors in drug storage, labeling and retrieval.

The Central Fill Pharmacy Automation Market is growing at a fast pace as there is a realization of the need to cut costs and at the same time reduce delivering medication to patients. Automated dispensing systems are common in the central fill pharmacy where retail or independent pharmacy prescribes prescriptions in bulk. The key application areas of robotic systems such as prime prescription dispensing systems, automated packaging and labeling solutions are helping this market revolutionize pharmacy functionality, cut down staff expenses and minimize errors on prescriptions. Automation in centralized pharmacy premise also reduces the frequency of errors done in medication dispensing, inventory, and ordering of medicines.

Automation in central pharmacy settings is now normal for the big retail pharmacy organizations and moreover for the hospital pharmacies. These systems are improving operational efficiencies, creating better customer experience, cutting delivery time and ensuring that the correct medication reaches the patients. Also, the use of and automated system helps in decreasing the amount of medication errors, a big issue in healthcare increasing the safety of patrons. The need to accommodate such solutions has been occasioned by the growing trends of e-prescriptions and the general rise in the number of prescriptions made annually.

The market growth also attributed to factors that includes increased health care needs, population bulge, and need to enhance operational performance of pharmacy business. Recent technological developments like artificial intelligence and machine learning bring new possibilities in developing its automation system like better progression in predictive calculation of inventory, and precision in orders. In addition, the increased regulatory emphasis on the enhanced safety of patients and advancement of pharmaceutical action promotes the use of automatic pharmaceutical systems.

Although there are great advantages of applying automation in the handling of pharmacy operations, the adoption level differs around the world. Again, the developed nations of the world specifically the North America and Europe always head the adoption curve because of developed health systems and high technology usage. Currently, the central fill pharmacy automation market in emerging economies is in the budding stage due to increased awareness and adoption by the hospitals and pharmacies. Further, the shift toward tele pharmacy and distant pharmacy services is also the reason for increasing automation requirements.

Central Fill Pharmacy Automation Market Trend Analysis:

Integration of Artificial Intelligence in Pharmacy Automation

- The major trend that evidenced on the market of Central Fill Pharmacy Automation is the use of artificial intelligence to improve the serviceability of the systems. The use of AI in pharmacy makes it easier to come up with intelligent decisions given the fact that the system can analyze the information fed to it, apply algorithms on the results and continuously monitor the result to produce better outcomes for the pharmacy. Inventory is also another area AI is useful in forecasting the demand for medicine, monitoring stock and automating the re-ordering process thus cutting costs and stock-out. AI also enhances order processing since prescriptions are filled appropriately with limited human interferences enhancing accuracy and reducing operational hitches.

- AI also unlocks a more intelligent robotics in the aspect of pharmacy automation. Sophisticated robotic systems are coming into the market with the ability to handle more types and sizes of medications, different packaging needs, and perform the operation faster and with greater precision. Taking prescription data for instance, this systems apply artificial intelligence algorithms to predict trends and support the pharmacists to make the right decisions on the stocks of drugs in order to enhance the flow of work without much wastage. Robotics and AI are soon predicted to be strategies that vastly transform the pharmacy automation sector, with the prospect of a more individual approach to services.

Expansion of Central Fill Pharmacy Solutions in Emerging Markets

- The first major factor of growth that has been identified in the context of the Central Fill Pharmacy Automation Market is the extension of these solutions to newer markets. In Asia Pacific, Latin America as well as Middle East there is trend of enhancement in the healthcare sector and therefore there is a need to automate the pharmacies so as to meet the required demands of prescriptions and efficiency. It’s in these regions that these factors are especially evident including increasing incidences of chronic diseases, increased population aging, growing expectations for better delivery of healthcare services and therefore the push for pharmacy automation. Thus, presenting low-cost, high-velocity solutions in addition to the market necessities for pharmacy development in emerging markets.

- Furthermore, an understanding of the further enhancement of related automation, such as minimizing medication mis dispensing, effective inventory, and the simplicity of the dispensing process, presents the chance to extend market access. Such collaborations with local doctors, drugstores and authorities can also contribute to raising the popularity of automated pharmacy systems in these areas. Other developments include digital healthcare where adoption of telemedicine, e-pharmacy also creates a precondition for the demand of automated pharmacy services as a way of delivering drugs on time and accurately.

Central Fill Pharmacy Automation Market Segment Analysis:

Central Fill Pharmacy Automation Market is Segmented on the basis of Product Type, Technology, Application, End User, and Region

By Product Type, Robotic Prescription Dispensing Systems segment is expected to dominate the market during the forecast period

- Among all the implemented technologies, robotic prescription dispensing systems are quite popular in the central fill pharmacies. These systems involve prescribing-dispensing systems which select and deliver medication from prescription data minimizing human error and increasing precision. They also ensure that pharmacy operational processes are simplified through managing high volume of prescription dispensing hence increasing the rate of efficiency. They also another advantage in that they cut down on time taken to dispense medication to patients hence making patients satisfied. Robotic packaging and labeling equipment are intended for medication packing and labeling with maximum efficiency and accuracy. All of these they range from counting the pills to sealing of the bottles and even in producing accurate labels of the contents. Through the automation of these responsibilities, the growing craze of proper packaging for each drug quantity and proper labeling is well achieved as standards set by regulatory bodies are upheld. This product type is fundamental in promoting process automation in the central fill pharmacy hence minimizing manual work.

- Centralizing of pharmacy dispensing system aids towards bringing together medication dispensing processes in one central point. These systems have a central approach to address the orders for drugs, packaging and labeling; hence they are effective in terms of scalability. They can also enable large scale prescription throughput by automating many processes and minimizing mistakes made by pharmacists. Centralized systems also assist in inventory since they capture and record details effectively offering good reports on the stocks. Medication management in instituted by using automated storage and retrieval systems (ASRS) which organize themselves to carry out this function. These systems on one end maximize the available space and on the other hand play a big role in enhancing the rate and efficiency of the stock narcotics for dispensing. This is where ASRS can work wonders for pharmacy as it can greatly reduce time spent in searching for the position of the medicines on the shelves, and reduce human error in handling the stocks. Several are especially useful in chain and hospital pharmacies with large stocking of medicines or large traffic of patients.

By Application, Prescription Dispensing segment expected to held the largest share

- Central fill pharmacy automation has its most common use in prescription dispensing. Computerized systems have the ability to complete the prescription process through the identification of the particular medication, the counting of the necessary quantity and placing of the prescriptions in the right containers. This application minimizes the cases of errors in dispensing which may prove disastrous to the patient. This can be facilitated say by using a robotic system that is capable of dealing with a large number of scripts while at the same time preserving on the accuracy. Another main application of central fill pharmacy automation is inventory control. Computerized systems monitor the quantity of stocked-up drugs, they replenish in real time hence can always be restocked anytime. Inventory management systems can effectively eliminate the problems associated with stockouts and overstocking because these systems generate real-time, decision-making alerts based on historical and real-time data input coupled with order point formulas. The only way out of this puzzle is to properly manage the inventory and minimize wastage as well as maximize space use within the Pharmacies.

- Central fill pharmacies have automated order processing systems which enhance order dispatch, thereby minimizing the need for human centered order dispatching. These systems are capable of understanding orders and dispensing several prescriptions for one patient correctly. Online order entry improves order accuracy and reduces service time, which is advantageous in environments that produce a large amount of orders. There is a growing importance of automation in various aspects of pharmacy, and an important usage that automation finds is medication storage. Automated storage systems help to arrange medicines properly to avoid misplacement or loss since it would be hard for someone to keep track when the medicines were placed around the facility. Such systems enable tracking and management of position of every single medication so one can easily recover them whenever the need arises. Automated medication storage systems also maintain pharmacies adhere to regulations put in place that concern medication storage and security.

Central Fill Pharmacy Automation Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- As of now, to be specific, the North America region holds the largest share in Central Fill Pharmacy Automation Market due to the development in the healthcare sector in United States and Canada. The extent to which pharmacy automation has been adopted in these countries has been enhanced by the following area of concern: Also, advances in technology, changing demographics ornament, a rising aging population and increased incidences of chronic diseases have promoted the prescription distribution volumes which has created need for more automation in the pharmacies.

- It enjoys greater investment in healthcare software, the support from the government to adopt automated efficient systems, and emphasis on patients’ safety and on containing the costs of healthcare. Key stake holders of major manufacturers involved in the development of pharmacy automation are located in North America and hence this region is likely to continue to dominate the market as more pharmacy embrace automation to improve their operations.

Active Key Players in the Central Fill Pharmacy Automation Market:

- McKesson Corporation (USA)

- Baxter International Inc. (USA)

- Omnicell, Inc. (USA)

- Cerner Corporation (USA)

- Swisslog Healthcare (Switzerland)

- ScriptPro LLC (USA)

- Parata Systems (USA)

- KUKA AG (Germany)

- Medi-Dose, Inc. (USA)

- Willach Pharmacy Solutions (Germany)

- Accu-Chart Plus Healthcare Systems, Inc. (USA)

- Asteres Inc. (USA), and Other Active Players.

|

Global Central Fill Pharmacy Automation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.0 Billion |

|

Forecast Period 2024-32 CAGR: |

11.32% |

Market Size in 2032: |

USD 2.65 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Central Fill Pharmacy Automation Market by By Product Type (2018-2032)

4.1 Central Fill Pharmacy Automation Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Robotic Prescription Dispensing Systems

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Automated Packaging and Labeling Systems

4.5 Centralized Pharmacy Dispensing Systems

4.6 Automated Storage and Retrieval Systems

Chapter 5: Central Fill Pharmacy Automation Market by By Application (2018-2032)

5.1 Central Fill Pharmacy Automation Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Prescription Dispensing

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Inventory Management

5.5 Order Processing

5.6 Medication Storage

Chapter 6: Central Fill Pharmacy Automation Market by By End User (2018-2032)

6.1 Central Fill Pharmacy Automation Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Retail Pharmacies

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Hospital Pharmacies

6.5 Mail Order Pharmacies

6.6 Long-Term Care Pharmacies

Chapter 7: Central Fill Pharmacy Automation Market by By Technology (2018-2032)

7.1 Central Fill Pharmacy Automation Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Robotics Technology

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Conveyor Technology

7.5 Barcode Scanning Technology

7.6 Vision Inspection Systems

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Central Fill Pharmacy Automation Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 PRODUCT TYPE::ROBOTIC PRESCRIPTION DISPENSING SYSTEMS

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 AUTOMATED PACKAGING AND LABELING SYSTEMS

8.4 CENTRALIZED PHARMACY DISPENSING SYSTEMS

8.5 AUTOMATED STORAGE AND RETRIEVAL SYSTEMS#END USER::RETAIL PHARMACIES

8.6 HOSPITAL PHARMACIES

8.7 MAIL ORDER PHARMACIES

8.8 LONG-TERM CARE PHARMACIES#APPLICATION::PRESCRIPTION DISPENSING

8.9 INVENTORY MANAGEMENT

8.10 ORDER PROCESSING

8.11 MEDICATION STORAGE#TECHNOLOGY::ROBOTICS TECHNOLOGY

8.12 CONVEYOR TECHNOLOGY

8.13 BARCODE SCANNING TECHNOLOGY

8.14 VISION INSPECTION SYSTEMS

8.15 OTHER ACTIVE PLAYERS

Chapter 9: Global Central Fill Pharmacy Automation Market By Region

9.1 Overview

9.2. North America Central Fill Pharmacy Automation Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size By By Product Type

9.2.4.1 Robotic Prescription Dispensing Systems

9.2.4.2 Automated Packaging and Labeling Systems

9.2.4.3 Centralized Pharmacy Dispensing Systems

9.2.4.4 Automated Storage and Retrieval Systems

9.2.5 Historic and Forecasted Market Size By By Application

9.2.5.1 Prescription Dispensing

9.2.5.2 Inventory Management

9.2.5.3 Order Processing

9.2.5.4 Medication Storage

9.2.6 Historic and Forecasted Market Size By By End User

9.2.6.1 Retail Pharmacies

9.2.6.2 Hospital Pharmacies

9.2.6.3 Mail Order Pharmacies

9.2.6.4 Long-Term Care Pharmacies

9.2.7 Historic and Forecasted Market Size By By Technology

9.2.7.1 Robotics Technology

9.2.7.2 Conveyor Technology

9.2.7.3 Barcode Scanning Technology

9.2.7.4 Vision Inspection Systems

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Central Fill Pharmacy Automation Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size By By Product Type

9.3.4.1 Robotic Prescription Dispensing Systems

9.3.4.2 Automated Packaging and Labeling Systems

9.3.4.3 Centralized Pharmacy Dispensing Systems

9.3.4.4 Automated Storage and Retrieval Systems

9.3.5 Historic and Forecasted Market Size By By Application

9.3.5.1 Prescription Dispensing

9.3.5.2 Inventory Management

9.3.5.3 Order Processing

9.3.5.4 Medication Storage

9.3.6 Historic and Forecasted Market Size By By End User

9.3.6.1 Retail Pharmacies

9.3.6.2 Hospital Pharmacies

9.3.6.3 Mail Order Pharmacies

9.3.6.4 Long-Term Care Pharmacies

9.3.7 Historic and Forecasted Market Size By By Technology

9.3.7.1 Robotics Technology

9.3.7.2 Conveyor Technology

9.3.7.3 Barcode Scanning Technology

9.3.7.4 Vision Inspection Systems

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Central Fill Pharmacy Automation Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size By By Product Type

9.4.4.1 Robotic Prescription Dispensing Systems

9.4.4.2 Automated Packaging and Labeling Systems

9.4.4.3 Centralized Pharmacy Dispensing Systems

9.4.4.4 Automated Storage and Retrieval Systems

9.4.5 Historic and Forecasted Market Size By By Application

9.4.5.1 Prescription Dispensing

9.4.5.2 Inventory Management

9.4.5.3 Order Processing

9.4.5.4 Medication Storage

9.4.6 Historic and Forecasted Market Size By By End User

9.4.6.1 Retail Pharmacies

9.4.6.2 Hospital Pharmacies

9.4.6.3 Mail Order Pharmacies

9.4.6.4 Long-Term Care Pharmacies

9.4.7 Historic and Forecasted Market Size By By Technology

9.4.7.1 Robotics Technology

9.4.7.2 Conveyor Technology

9.4.7.3 Barcode Scanning Technology

9.4.7.4 Vision Inspection Systems

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Central Fill Pharmacy Automation Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size By By Product Type

9.5.4.1 Robotic Prescription Dispensing Systems

9.5.4.2 Automated Packaging and Labeling Systems

9.5.4.3 Centralized Pharmacy Dispensing Systems

9.5.4.4 Automated Storage and Retrieval Systems

9.5.5 Historic and Forecasted Market Size By By Application

9.5.5.1 Prescription Dispensing

9.5.5.2 Inventory Management

9.5.5.3 Order Processing

9.5.5.4 Medication Storage

9.5.6 Historic and Forecasted Market Size By By End User

9.5.6.1 Retail Pharmacies

9.5.6.2 Hospital Pharmacies

9.5.6.3 Mail Order Pharmacies

9.5.6.4 Long-Term Care Pharmacies

9.5.7 Historic and Forecasted Market Size By By Technology

9.5.7.1 Robotics Technology

9.5.7.2 Conveyor Technology

9.5.7.3 Barcode Scanning Technology

9.5.7.4 Vision Inspection Systems

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Central Fill Pharmacy Automation Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size By By Product Type

9.6.4.1 Robotic Prescription Dispensing Systems

9.6.4.2 Automated Packaging and Labeling Systems

9.6.4.3 Centralized Pharmacy Dispensing Systems

9.6.4.4 Automated Storage and Retrieval Systems

9.6.5 Historic and Forecasted Market Size By By Application

9.6.5.1 Prescription Dispensing

9.6.5.2 Inventory Management

9.6.5.3 Order Processing

9.6.5.4 Medication Storage

9.6.6 Historic and Forecasted Market Size By By End User

9.6.6.1 Retail Pharmacies

9.6.6.2 Hospital Pharmacies

9.6.6.3 Mail Order Pharmacies

9.6.6.4 Long-Term Care Pharmacies

9.6.7 Historic and Forecasted Market Size By By Technology

9.6.7.1 Robotics Technology

9.6.7.2 Conveyor Technology

9.6.7.3 Barcode Scanning Technology

9.6.7.4 Vision Inspection Systems

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Central Fill Pharmacy Automation Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size By By Product Type

9.7.4.1 Robotic Prescription Dispensing Systems

9.7.4.2 Automated Packaging and Labeling Systems

9.7.4.3 Centralized Pharmacy Dispensing Systems

9.7.4.4 Automated Storage and Retrieval Systems

9.7.5 Historic and Forecasted Market Size By By Application

9.7.5.1 Prescription Dispensing

9.7.5.2 Inventory Management

9.7.5.3 Order Processing

9.7.5.4 Medication Storage

9.7.6 Historic and Forecasted Market Size By By End User

9.7.6.1 Retail Pharmacies

9.7.6.2 Hospital Pharmacies

9.7.6.3 Mail Order Pharmacies

9.7.6.4 Long-Term Care Pharmacies

9.7.7 Historic and Forecasted Market Size By By Technology

9.7.7.1 Robotics Technology

9.7.7.2 Conveyor Technology

9.7.7.3 Barcode Scanning Technology

9.7.7.4 Vision Inspection Systems

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Central Fill Pharmacy Automation Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.0 Billion |

|

Forecast Period 2024-32 CAGR: |

11.32% |

Market Size in 2032: |

USD 2.65 Billion |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Technology |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Central Fill Pharmacy Automation Market research report is 2024-2032.

McKesson Corporation (USA), Baxter International Inc. (USA), Omnicell, Inc. (USA), Cerner Corporation (USA), Swisslog Healthcare (Switzerland), ScriptPro LLC (USA), Parata Systems (USA), KUKA AG (Germany), Medi-Dose, Inc. (USA), Willach Pharmacy Solutions (Germany), Accu-Chart Plus Healthcare Systems, Inc. (USA), Asteres Inc. (USA), and Other Active Players.

The Central Fill Pharmacy Automation Market is segmented into Product Type, Technology, Application, End User and region. By Product Type, the market is categorized into Robotic Prescription Dispensing Systems, Automated Packaging and Labeling Systems, Centralized Pharmacy Dispensing Systems, Automated Storage and Retrieval Systems. By End User, the market is categorized into Retail Pharmacies, Hospital Pharmacies, Mail Order Pharmacies, Long-Term Care Pharmacies. By Application, the market is categorized into Prescription Dispensing, Inventory Management, Order Processing, Medication Storage. By Technology, the market is categorized into Robotics Technology, Conveyor Technology, Barcode Scanning Technology, Vision Inspection Systems. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA)

The Central Fill Pharmacy Automation Market means the application of automated systems in the central pharmacy for effective processing and dispensing of the prescriptions. These systems seek to make prescriptions more accurate, faster to fill and disseminate, and diminish the human factor which may lead to errors in drug storage, labeling and retrieval.

Central Fill Pharmacy Automation Market Size Was Valued at USD 1.0 Billion in 2023, and is Projected to Reach USD 2.65 Billion by 2032, Growing at a CAGR of 11.32% From 2024-2032.