China Continuous Glucose Monitoring Devices Market Synopsis:

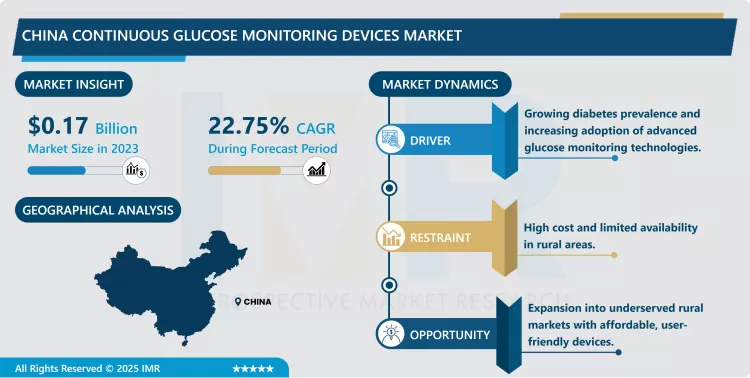

China Continuous Glucose Monitoring Devices Market Size Was Valued at USD 0.17 Billion in 2023, and is Projected to Reach USD 1.11 Billion by 2032, Growing at a CAGR of 22.75% From 2024-2032.

The China CGM Devices Market segment is a healthcare industry segment that involves the utilization of medical technology that involves the creation, manufacturing and selling of devices that offer ongoing and real time blood glucose monitoring for patients with diabetes. CGM systems consist of a glucose sensor, located in the patient’s body, which continually scans the concentration of glucose in the interstitial fluid; a transmitter – that displays the values on a receiver or a smartphone; and software for monitoring. They are most useful to diabetic patients who need to monitor their blood sugar levels very closely to avoid dreadful complications.

It can be inferred that the China Continuous Glucose Monitoring Devices Market is in a growing stage mainly due to the continually rising number of diabetics in the nation. Since China has a large population, the number of people with diabetes has increased significantly, therefore frequency of glucose checks is paramount in managing diabetes. The market for CGM devices is prompted by an increasing popularity of more intricate diabetes management instruments resulting from an improved understanding of the necessity of the individual continuous glucose monitoring for people with diabetes of Types 1 and 2. Due to the well-established health care sector and a proper government stimulating towards the innovations in health care sector, the demand for CGM devices is expected to rise at a good pace.

Another driver of the market is the development of more accurate, reliable and easy to use devices to monitor blood sugar levels through continuous glucose monitoring (CGM). Hence, bolt-on of MH apps and the sharing of cloud-based information also brings about the ability, by patients and healthcare practitioners, to monitor these real-time glucose readings from a distance; all of which has a positive implication on patient care. However, the rising health consciousness of the Chinese government towards improving the existing health infrastructure and the increased use of medical devices for curing chronic diseases like diabetes are some of the other factors that still drives the market of CGM devices in China.

China Continuous Glucose Monitoring Devices Market Trend Analysis:

Rise of Smartphone Integration and Cloud-based Solutions in CGM Devices

- A trend that is emerging strongly in the China Continuous Glucose Monitoring (CGM) Devices Market is that there is increasing use of smartphone coupled with cloud solutions with the CGM. Today, CGM devices are integration with mobile application; thus, diabetic patients can observe their blood sugar levels in real-time using their phones. This shift also holds convenience for the patients because they can monitor glucose levels at every moment of the day without necessarily visiting their healthcare providers often. It does help to increase the patient satisfaction rate but more importantly, it allows patients to better control their diabetes and prevent complications because they can make changes to their meds or diet plan at any time.

- However, the use of cloud platform has gone a notch higher to allow healthcare providers to have remote access to the patients’ information. This makes possible remote patient monitoring such that a healthcare professional can monitor, over time, a patient’s glucose level and even make necessary decisions on the same without necessarily being physically present with the patient. The technological convergence enhances the delivery of health services since patients and health care providers interact effectively to enable improved decisions to be made. Smartphones and cloud business platforms have steadily been integrated into CGM devices by societies to increase patient participation leading to better diabetes management.

Expansion of CGM Device Adoption in Rural China

- One of the main trends in the China Continuous Glucose Monitoring (CGM) Devices Market has to do with the geographic expansion of the usage of such devices in rural and underdeveloped areas. On the other hand, some of the challenges faced by the rural regions of China include the following; Despite the fact that the Chinese citizen has today’s improved disposable income, modern healthcare facilities, and easy access to medical technologies, a CGM device has only seen widespread implementation in urban areas. These include the low numbers of health care facilities available for diabetes patients, awareness of CGM technology and affordability of the equipment. However, the significance of the Chinese government to improve the access to these regions opens up more market opportunities for the firms manufacturing CGM devices. Affordable and relatively easy to operate, the devices translate into manufacturers’ access to massive untouched population in rural Chinese patients.

- For millions of people in these regions, adopting cost-effective, easy to use CGM systems could make the difference and give diabetic patients the tools they need to track their glucose levels. Through it, the healthcare deficit between the urbanites and the uncomplicated peasants would be effectively narrowed while blasting consciousness about the paramountcy of CGM. Hence, the increasing use of CGM devices by people from rural areas may, in turn, result into better diabetes glycaemic control and hence a better quality of life for diabetic patients. These markets development may thus undoubtedly play part in augmenting general health standards in China and therefore the nation’s healthcare system.

China Continuous Glucose Monitoring Devices Market Segment Analysis:

China Continuous Glucose Monitoring Devices Market is Segmented on the basis of Type, Application, End User.

By Type, Real-time Continuous Glucose Monitoring segment is expected to dominate the market during the forecast period

- The Real-time Continuous Glucose Monitoring (rt-CGM) devices are gadgets that give glucose readings at a constant basis during the day. These systems include a sensor used in detecting glucose level in the interstitial fluid; a transmitter which transmits data about the glucose level either to a receiver or a smartphone; and an alarm system used in alerting the user with fluctuating glucose level. This real time response enables the user to correct whatever is going wrong, which is important for use by people with Type 1 diabetes whose condition require continuous adjustment of the insulin level. CGMS offers a chance in tracking glucose trends at an uninterrupted way hence better control of blood glucose levels and in turn reducing on hypoglycaemia and hyperglycaemia occurrences.

- Intermittent Scanned Continuous Glucose Monitoring (is-CGM), on the other hand is where the sensors need to be scanned from time to time with a compatible device such as a smart phone or reader to pull the glucose levels. However, unlike rt-CGM, it gives intermittent data that are sufficient to enable one monitor their glucose levels without having to use fingerstick. This type of system in most cases is cheaper than rt-CGM, and is therefore suitable for those with Type 2 diabetes or for those who do not need a constant monitoring of their glucose levels, but may occasionally need to check their levels. Although there is no steady alarm, is-CGM is a less invasive, less expensive method for treating diabetes mellitus.

By Application, Type 1 Diabetes segment expected to held the largest share

- Temporizing type of diabetes is called as type 1 diabetes where the patient has little or no output of insulin and the blood glucose level needs to be checked frequently. CGM is most helpful to type 1 diabetics, especially for those patients who want real time values for their blood sugar as it enables the correction of high or low results at the soonest possible time. These devices assist patients eliminate hypoglycaemia and hyperglycaemia thereby allowing keen monitoring of blood sugar levels all day. An important feature, the ability to monitor glucose levels constantly instead of using frequent fingerstick tests, is a convenient, effective advancement in the treatment of Type 1 diabetes.

- Type 2 Diabetes is a chronic disease characterized by the body’s inability to use glucose effectively or even at all in some cases, in this case, leads to high blood glucose levels. As Type 2 diabetes can be treated by life style modifications, oral medication and occasionally insulin, the CGM devices continue to have an impact on the management of the disease. Type 2 diabetes patients find the CGM devices helpful because it is convenient to monitor glucose patterns and be in a position to take necessary action regarding diet, exercise and medication. With rising knowledge around the value of CGM to improve the management of diabetes type 2, then more patients are adopting CGM. Pregnancy diabetes or Gestational Diabetes also stands to derive advantages from using CGM. It is very important for pregnant women to closely control glucose levels so as not to harm themselves and their baby. CGM devices are safer and more effective for monitoring blood sugar levels in pregnant moms and the functioning of their body, excluding preeclampsia, and excessive birth weight baby complications. Such devices help in changes in diet as well as insulin management in real time and do enhance the results for both the mother and the child.

Active Key Players in the China Continuous Glucose Monitoring Devices Market:

- Abbott Laboratories (USA)

- Acon Laboratories, Inc. (USA)

- Dexcom, Inc. (USA)

- Echo Therapeutics, Inc. (USA)

- GlySens Incorporated (USA)

- Insulet Corporation (USA)

- Medtronic Plc (Ireland)

- Mendor (Finland)

- Nipro Corporation (Japan)

- Nova Biomedical (USA)

- Roche Diagnostics (Switzerland)

- Senseonics Holdings, Inc. (USA)

- Shenzhen Yuwell Technology Co., Ltd. (China)

- Tandem Diabetes Care, Inc. (USA)

- Ypsomed AG (Switzerland)

- Other Active Players

|

China Continuous Glucose Monitoring Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.17 Billion |

|

Forecast Period 2024-32 CAGR: |

22.75 % |

Market Size in 2032: |

USD 1.11 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: China Continuous Glucose Monitoring Devices Market by By Type (2018-2032)

4.1 China Continuous Glucose Monitoring Devices Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Real-time Continuous Glucose Monitoring (rt-CGM)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Intermittently Scanned Continuous Glucose Monitoring (is-CGM)

Chapter 5: China Continuous Glucose Monitoring Devices Market by By Application (2018-2032)

5.1 China Continuous Glucose Monitoring Devices Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Type 1 Diabetes

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Type 2 Diabetes

5.5 Gestational Diabetes

Chapter 6: China Continuous Glucose Monitoring Devices Market by By End User (2018-2032)

6.1 China Continuous Glucose Monitoring Devices Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals & Diabetes Care Centers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Homecare Settings

6.5 Ambulatory Care Centers

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 China Continuous Glucose Monitoring Devices Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABBOTT LABORATORIES (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ACON LABORATORIES INC. (USA)

7.4 DEXCOM INC. (USA)

7.5 ECHO THERAPEUTICS INC. (USA)

7.6 GLYSENS INCORPORATED (USA)

7.7 INSULET CORPORATION (USA)

7.8 MEDTRONIC PLC (IRELAND)

7.9 MENDOR (FINLAND)

7.10 NIPRO CORPORATION (JAPAN)

7.11 NOVA BIOMEDICAL (USA)

7.12 ROCHE DIAGNOSTICS (SWITZERLAND)

7.13 SENSEONICS HOLDINGS INC. (USA)

7.14 SHENZHEN YUWELL TECHNOLOGY CO. LTD. (CHINA)

7.15 TANDEM DIABETES CARE INC. (USA)

7.16 YPSOMED AG (SWITZERLAND)

7.17 OTHER ACTIVE PLAYERS

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

China Continuous Glucose Monitoring Devices Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 0.17 Billion |

|

Forecast Period 2024-32 CAGR: |

22.75 % |

Market Size in 2032: |

USD 1.11 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the China Continuous Glucose Monitoring Devices Market research report is 2024-2032.

Abbott Laboratories (USA), Acon Laboratories, Inc. (USA), Dexcom, Inc. (USA), Echo Therapeutics, Inc. (USA), GlySens Incorporated (USA), Insulet Corporation (USA), Medtronic Plc (Ireland), Mendor (Finland), Nipro Corporation (Japan), Nova Biomedical (USA), Roche Diagnostics (Switzerland), Senseonics Holdings, Inc. (USA), Shenzhen Yuwell Technology Co., Ltd. (China), Tandem Diabetes Care, Inc. (USA), Ypsomed AG (Switzerland), and Other Active Players.

The China Continuous Glucose Monitoring Devices Market is segmented into Type, Application, End User and region. By Type, the market is categorized into Real-time Continuous Glucose Monitoring (rt-CGM), Intermittently Scanned Continuous Glucose Monitoring (is-CGM. By Application, the market is categorized into Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes. By End User, the market is categorized into Hospitals & Diabetes Care Centers, Homecare Settings, Ambulatory Care Centers.

The China CGM Devices Market segment is a healthcare industry segment that involves the utilization of medical technology that involves the creation, manufacturing and selling of devices that offer ongoing and real time blood glucose monitoring for patients with diabetes. CGM systems consist of a glucose sensor, located in the patient’s body, which continually scans the concentration of glucose in the interstitial fluid; a transmitter – that displays the values on a receiver or a smartphone; and software for monitoring. They are most useful to diabetic patients who need to monitor their blood sugar levels very closely to avoid dreadful complications.

China Continuous Glucose Monitoring Devices Market Size Was Valued at USD 0.17 Billion in 2023, and is Projected to Reach USD 1.11 Billion by 2032, Growing at a CAGR of 22.75% From 2024-2032.