China Dental Service Market Synopsis:

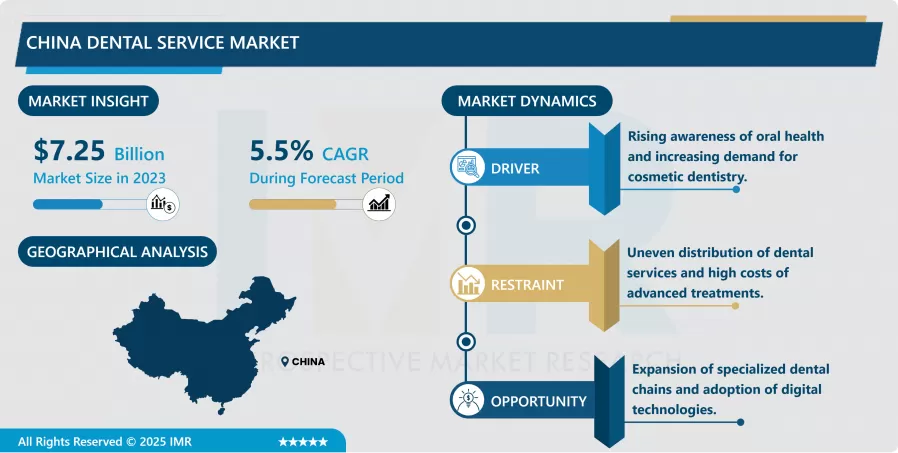

China Dental Service Market Size Was Valued at USD 7.25 Billion in 2023, and is Projected to Reach USD 11.74 Billion by 2032, Growing at a CAGR of 5.5% From 2024-2032.

The China Dental Service will encompass oral health care and hygiene industry in China that includes diagnosis, treatment, and prevention of oral diseases; cosmetic surgery, filling, braces, and dentures. Dental, clinic, hospital, and any other specialized center contributing to the general oral health improvement, disease treatment, teeth, and other related aesthetic procedures are also included. The factors that have made this market to grow include: increasing customer awareness of dental care, a population that is ever aging more, and the development of advanced dental care solutions.

- Due to demographic, economic and societal elements, the China Dental Service Market has grown at a healthy progress rate. The key reason is that since today’s people live longer there is a great number of people who require both preventative and curative dental care. Other factors that have been helping the growth of this market, include development of cities to increase access to dental products and services, and people realizing the worth to value of dental services. However, cosmetic dental treatment is especially out-growing because of the increasing concern concerning looks and as a result of effects from the social media platforms.

- In addition, the health care facilities and fund provided by the government and private investment on dental chains have enhanced the supply and the quality of the dental service in China. Digital science, 3D imaging systems, Artificial intelligence diagnostic methods have revolutionized the fields yielding high patient satisfaction and organizational efficiency. However, the market includes matters like; inadequate geographical distribution of dental services especially in rural areas and scarcity of professional human resource.

China Dental Service Market Trend Analysis

Growing Popularity of Cosmetic Dentistry

- One of the factors that has been seen to be on the rise within the China Dental Service Market is the concern with the cosmetic services. This has been preferred for the decor of heart throbbing which has changed over the years and as such many go for cosmetic surgery through process like teeth whitening, placing veneer or having an orthodontist done. Apparently, the youth has regarded the impact of the following aspects as most significant; social networks and celebrity adoration. There is also a possibility that perhaps more and new material technologies in dentistry have made the cost of these aesthetic interventional cheaper. This has been occasioned by factors such as minimal invasiveness procedures; shorter treatment time; and longer lasting aesthetic outcomes.

Expansion of Dental Chains and Clinics

- Among the factors which indicate one of the biggest potentials in China Dental Service Market we can distinguish both dental chains and the number of specialized clinics in the country. To satisfy newly required improved cheaper and more available dental care these large dental enterprises are fitting new and more luxurious offices and outfitting them with such equipment and technology as patients might desire. These chains offer sundry related services without employing the services of other centres, ranging from minor checkups to treatment, and are thus welcome by the consumer. Also, the growth of the usage of franchisee concepts, as well as cooperation of private investors with healthcare organizations are offering the opportunity to develop clinics in the large and the small city.

China Dental Service Market Segment Analysis:

China Dental Service Market Segmented on the basis of service, end user.

By Service, Dental Implants segment is expected to dominate the market during the forecast period

- It is forecasted that the dental implants segment will have the largest market share from the China Dental Service Market due to the higher prevalences of periodontal diseases leading to tooth loss and other factors including aging. More natural looking and straighter than the other and other interventions in edentulous situations, dental implants are highly sought by patients requiring reconstructive dentistry. Implant materials are available in Titanium and zirconium technologies; they prove excellence through enhanced performance and biocompatibility. However, because of the improvement of 3D printing as well as better pre-operative planning due to technology, the need to do an implant has had the difficulty taken away and the time needed, significantly reduced. In the case of dental implants procedures people are now more aware of the given service while rising affordability will let this segment continues to have the greatest share on the market.

By End User, Dental Clinic segment expected to held the largest share

- The dental clinic segment will therefore continue to be the largest Market segment in China Dental Service Market. Thus, dental clinics are initial contact points at which people turn to for oral health care and from which they are referred for simple prophylactic care and to complex reconstructive surgery. This is due to their availability, cheap as compared to hospital-based dentistry services thus making the patient’s choice. They have received more support that other segments especially with the new specialized dental clinics currently offering different treatments such as Orthodontics, endodontics and aesthetic dentistry. The clinics are even venturing into new modes of technology in their activities including intraoral scanners and retention of electronic records. It is also satisfactory for this segment’s hegemony the tendency to expand the number of multi-specialty dental chains.

Active Key Players in the China Dental Service Market:

- Angelalign Technology Inc. (China)

- Arrail Group (China)

- Beijing Bybo Dental Group (China)

- Carestream Dental (USA)

- Colgate-Palmolive Company (USA)

- Danaher Corporation (USA)

- Dentsply Sirona (USA)

- Foshan Anle Dental Material Co., Ltd. (China)

- GC Corporation (Japan)

- Henry Schein, Inc. (USA)

- Ivoclar Vivadent AG (Liechtenstein)

- New Tom (Italy)

- Osstem Implant (South Korea)

- Straumann Group (Switzerland)

- W&H Dentalwerk Bürmoos GmbH (Austria), and Other Active Players

China Dental Service Market Scope:

|

China Dental Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.25 Billion |

|

Forecast Period 2024-32 CAGR: |

5.5% |

Market Size in 2032: |

USD 11.74 Billion |

|

Segments Covered: |

By Service |

|

|

|

By End User |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: China Dental Service Market by By Service (2018-2032)

4.1 China Dental Service Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Dental Implants

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Orthodontics

4.5 Periodontics

4.6 Endodontics

4.7 Cosmetic Dentistry

4.8 Laser Dentistry

4.9 Dentures

4.10 Oral & Maxillofacial Surgery

4.11 Others

Chapter 5: China Dental Service Market by By End User (2018-2032)

5.1 China Dental Service Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Hospitals

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Dental Clinics

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 China Dental Service Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ABBVIE (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BAYER AG (GERMANY)

6.4 BOEHRINGER INGELHEIM (GERMANY)

6.5 CHEMO GROUP (SPAIN)

6.6 DRUG FOR NEGLECTED DISEASES INITIATIVE (DNDI) (SWITZERLAND)

6.7 EISAI CO. LTD. (JAPAN)

6.8 GLAXOSMITHKLINE (UK)

6.9 INOVIO PHARMACEUTICALS (USA)

6.10 LUMOS PHARMA (USA)

6.11 MERCK & CO. (USA)

6.12 NOVARTIS AG (SWITZERLAND)

6.13 PFIZER INC. (USA)

6.14 SANOFI (FRANCE)

6.15 TAKEDA PHARMACEUTICAL COMPANY (JAPAN)

6.16 TEVA PHARMACEUTICAL INDUSTRIES LTD. (ISRAEL)

Chapter 7 Analyst Viewpoint and Conclusion

7.1 Recommendations and Concluding Analysis

7.2 Potential Market Strategies

Chapter 8 Research Methodology

8.1 Research Process

8.2 Primary Research

8.3 Secondary Research

China Dental Service Market Scope:

|

China Dental Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.25 Billion |

|

Forecast Period 2024-32 CAGR: |

5.5% |

Market Size in 2032: |

USD 11.74 Billion |

|

Segments Covered: |

By Service |

|

|

|

By End User |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the China Dental Service Market research report is 2024-2032.

Angelalign Technology Inc., Arrail Group, Carestream Dental, Dentsply Sirona, Straumann Group, and Other Active Players.

The China Dental Service Market is segmented into Service, End User and Region. By Service, the market is categorized into Dental Implants Orthodontics Periodontics Endodontics Cosmetic DentistryLaser Dentistry Dentures Oral & Maxillofacial Surgery Others. By End User, the market is categorized into Hospitals Dental Clinics.

The China Dental Service will encompass the oral health care and hygiene industry in China that includes diagnosis, treatment, and prevention of oral diseases; cosmetic surgery, filling, braces, and dentures. Dental, clinics, hospitals, and any other specialized centre contributing to general oral health improvement, disease treatment, teeth, and other related aesthetic procedures are also included. The factors that have made this market grow include: increasing customer awareness of dental care, a population that is ever aging more, and the development of advanced dental care solutions.

China Dental Service Market Size Was Valued at USD 7.25 Billion in 2023, and is Projected to Reach USD 11.74 Billion by 2032, Growing at a CAGR of 5.5% From 2024-2032.