China Electric Car Market Synopsis:

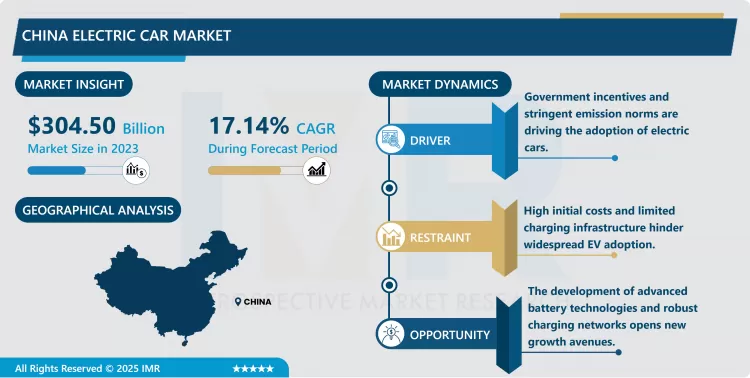

China Electric Car Market Size Was Valued at USD 304.50 Billion in 2023, and is Projected to Reach USD 1,246.54 Billion by 2032, Growing at a CAGR of 17.14% From 2024-2032.

The China Electric Car refers to the entire scope of electric vehicle production and consumption as well as the use of battery electric vehicles (BEV), plug-in electric hybrids (PHEV) and fuel cell electric vehicles (FCEV) within China. These vehicles have electric drive trains making them an environmentally friendly option to ICE vehicles. This market is driven by the governments looking for means to support adoption of green mobility vehicles; improvement in the battery technology as well as the shift of consumers to the high fuel efficiency, eco-friendly premium economy vehicles.

- China is the world’s largest market for electric car through measures that include subsidies, tax exemptions and incentives to manufacturers and users. Nevertheless, the requirement to control carbon emission and take efforts towards better air quality of the Chinese cities has been the primary catalyst to the electric vehicle market. There is a very high emission standard set and also the policies on carbon neutrality have concerned increased sale of electric cars throughout the country.

- Another factor that has supported the market is a stable local source of batteries and grid facility such as charging stations that have been deployed with large investment. Domestic enterprises are also rising up and collaborating with international companies to bring out effective and affordable electric vehicles so that the maximum number of people can get them. However, the generalized factors such as cost of batteries, absence of charging points in the rural areas, competition from normal conventional Internal Combustion Engine vehicles provide a set of problem that needs to be solved for the consistent development across the world.

China Electric Car Market Trend Analysis:

Rising Adoption of Autonomous Electric Vehicles

- Here, the kind of current trend that is evident in the china electric car market is self-driving electric cars. The continual advances of technology based on integrated AI and sensors are leading to the modification of self-driving in Automobiles and included in electric cars only. Autonomous electric cars will be safer to the passengers, traffic will be safer, and there will be an efficiency that will help support the Chinese idea of a smart city. Level 4 and Level 5 cars are being targeted by the technology giants and car makers & There is substantial demonstration and trials are happening. The cities of Shenzhen and Beijing have been at the forefront been in the vanguard of adopting AV and EVs ride-hailing and logistics. Beyond this trend demonstrates the technological progress, it also portrays the assert to a more smart, cohesive, and sustainability mobility system.

Expansion of Charging Infrastructure

- The opportunity related with the charging infrastructure could be viewed as one of the major opportunities in the sphere of China Electric Car Market. As the use of electric cars takes central stage, the public needs many and closely interconnected charging points to satisfy the growing demand. Similarly, at the central and state government levels, a fair degree of capital is being offered and non-state actors are exploring integration –quick charging points- battery swapping stations in the various parts of both the urban and rural landscapes of India. However, the fact that wireless and ultra-fast charging technologies are either a tendency shows that charging of an EV is gradually becoming easier and less time consuming. Hence, utilization of CHAdeMO allows the inclusion of additional forms of power such as solar charged stations in an electric car system.

China Electric Car Market Segment Analysis:

China Electric Car Market Segmented on the basis of vehicle type, battery type, range

By Vehicle Type, Battery Electric Vehicles (BEVs) segment is expected to dominate the market during the forecast period

- Battery Electric Vehicles’s (BEVs) is expected to show the highest market share dominating the China Electric Car Market because of the growing market demand for electric cars that emit zero emissions. Lacking any non-rechargeable battery system, BEVs are a cleaner and more efficient technology over hybrids and ICEs. First, subsidies directly from the central government, incentive prices, budgetary support to purchase, and no-bar within license plate quotas are some ways which have put BEVs to reality in China. More to that; battery energy density has improved, charging time has also reduced and many others have enhanced the features of BEV’s. Seymovu is a crossover with BEVs has already emerged as one of the lines of development for domestic automotive manufacturers providing affordable, high-performance electric vehicles with a range sufficiently long for the Chinese market.

By Battery Type, Lithium-ion segment expected to held the largest share

- It is also expected that lithium-ion segment will occupy the largest market share of the China Electric Car Market because of its high energy density, light weight and long life. Due to high energy density, faster charge rates and coming down costs of the cells, lithium-ion batteries are now widely used in electric vehicles. This is moreover, because the segment is dominated by Asia, and more particularly China, which is the world’s largest producer of lithium-ion batteries and has localized supply chains and mining solutions for the majority of the materials needed to manufacture batteries such as lithium and cobalt. New development for the future is under taken for such batteries includes a solid-state lithium-ion battery that will have higher safety feature and better performance. Lithium-ion will remain a tripod of the market because of the growing customer interest in electric vehicles across the world.

Active Key Players in the China Electric Car Market

- BAIC Group (China)

- BMW Group (Germany)

- BYD Auto Co., Ltd. (China)

- Changan Automobile (China)

- Chery Automobile Co., Ltd. (China)

- Daimler AG (Germany)

- Geely Automobile Holdings Ltd. (China)

- General Motors Company (USA)

- Great Wall Motors (China)

- Hyundai Motor Company (South Korea)

- NIO Inc. (China)

- SAIC Motor Corporation Limited (China)

- Tesla, Inc. (USA)

- Toyota Motor Corporation (Japan)

- Volkswagen AG (Germany), and Other Active Players.

Key Industry Development in the China Electric Car Market:

- In April 2024, Chinese automaker Chery has chosen Barcelona for its first European electric car plant, marking a €400 million investment in partnership with Catalan firm Ebro EV-Motors. The plant, located at the former Nissan site in Zona Franca, will manufacture Chery's Omoda and Ebro vehicles, targeting 150,000 units by 2029. This milestone, supported by Catalan and Spanish governments, positions Spain as a hub for electric mobility, leveraging Chery's expertise as China’s leading vehicle exporter.

- In March 2024, Xiaomi, China's fifth-largest smartphone maker, has entered the electric car market with the launch of its first EV, the Speed Ultra 7 (SU7), with deliveries starting this month. Backed by a $10 billion investment over the next decade, the SU7, built in collaboration with BAIC Group, features advanced "super electric motor" technology and a shared operating system with Xiaomi devices. Amid a price war involving Tesla and BYD, Xiaomi aims to become a global top-five automaker, producing up to 200,000 units annually, and saw its shares rise over 10% in Hong Kong.

- In March 2024, China's electric car market sees intensified competition as Xiaomi announces the delivery of its first electric vehicle (EV), the Speed Ultra 7 (SU7), set to begin this month. Priced to be revealed on 28 March, the SU7 features advanced "super electric motor" technology and integrates seamlessly with Xiaomi's devices. Manufactured by a BAIC Group unit in Beijing with an annual capacity of 200,000 vehicles, Xiaomi plans to invest $10 billion in its EV business over the next decade, aiming for a top-five global position. Amidst a price war involving Tesla and BYD, Xiaomi shares surged over 10% in Hong Kong.

China Electric Car Market Scope:

|

Global China Electric Car Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 304.50 Billion |

|

Forecast Period 2024-32 CAGR: |

17.14 % |

Market Size in 2032: |

USD 1,264.54 Billion |

|

Segments Covered: |

By Vehicle Type |

|

|

|

By Battery Type |

|

||

|

|

By Range |

|

|

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: China Electric Car Market by By Vehicle Type (2018-2032)

4.1 China Electric Car Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Battery Electric Vehicles (BEVs)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Plug-in Hybrid Electric Vehicles (PHEVs)

4.5 Hybrid Electric Vehicles (HEVs)

Chapter 5: China Electric Car Market by By Battery Type (2018-2032)

5.1 China Electric Car Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Lithium-Ion

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Solid-State

5.5 Nickel-Metal Hydride

Chapter 6: China Electric Car Market by By Range (2018-2032)

6.1 China Electric Car Market Snapshot and Growth Engine

6.2 Market Overview

6.3 150-300 miles

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Below 150 miles

6.5 Above 300 miles

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 China Electric Car Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ALEXION PHARMACEUTICALS (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 AMGEN INC. (USA)

7.4 BIOGEN INC. (USA)

7.5 CADENCE PHARMACEUTICALS (USA)

7.6 CSL BEHRING (USA)

7.7 ELI LILLY AND CO. (USA)

7.8 GENZYME CORPORATION (USA)

7.9 GLENMARK PHARMACEUTICALS (INDIA)

7.10 HORIZON THERAPEUTICS (IRELAND)

7.11 IONIS PHARMACEUTICALS (USA)

7.12 JOHNSON & JOHNSON (USA)

7.13 MEDDAY PHARMACEUTICALS (FRANCE)

7.14 MYLAN PHARMACEUTICALS (USA)

7.15 PFIZER INC. (USA)

7.16 SANOFI (FRANCE)

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

China Electric Car Market Scope:

|

Global China Electric Car Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 304.50 Billion |

|

Forecast Period 2024-32 CAGR: |

17.14 % |

Market Size in 2032: |

USD 1,264.54 Billion |

|

Segments Covered: |

By Vehicle Type |

|

|

|

By Battery Type |

|

||

|

|

By Range |

|

|

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the China Electric Car Market research report is 2024-2032.

BYD Auto Co., Ltd., NIO Inc., SAIC Motor Corporation Limited, Tesla, Inc., Volkswagen AG, and Other Active Players

The China Electric Car Market is segmented into Vehicle Type, Battery Type, Range and Region. By Vehicle Type, the market is categorized into Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Hybrid Electric Vehicles (HEVs). By Battery Type, the market is categorized into Lithium-Ion Solid-State Nickel-Metal Hydride. By Range, the market is categorized into 150-300 miles Below 150 miles Above 300 miles.

The China Electric Car refers to the entire scope of electric vehicle production and consumption as well as the use of battery electric vehicles (BEV), plug-in electric hybrids (PHEV) and fuel cell electric vehicles (FCEV) within China. These vehicles have electric drive trains making them an environmentally friendly option to ICE vehicles. This market is driven by the governments looking for means to support the adoption of green mobility vehicles; improvement in the battery technology as well as the shift of consumers to the high fuel efficiency, eco-friendly premium economy vehicles.

China Electric Car Market Size Was Valued at USD 304.50 Billion in 2023, and is Projected to Reach USD 1,246.54 Billion by 2032, Growing at a CAGR of 17.14% From 2024-2032.