Cleanroom Gloves Market Synopsis:

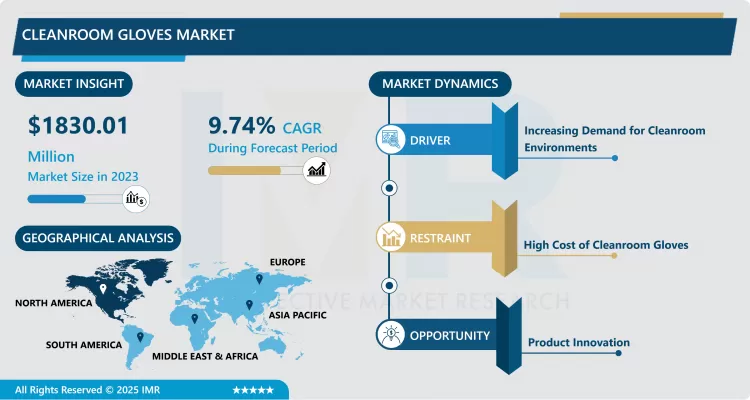

Cleanroom Gloves Market Size Was Valued at USD 1830.01 Million in 2023, and is Projected to Reach USD 4224.14 Million by 2032, Growing at a CAGR of 9.74 % From 2024-2032.

Cleanroom gloves may be defined based on the market aspect as the sub-sector of the personal protective equipment PPE that is made of gloves that are intended for use in cleanrooms where particulate matter control is of keen importance. These gloves must be used in industries that require high standards of cleanliness that includes; pharmaceutical industries, biotechnology, semiconductors and food Industries. Cleanroom gloves are articles of garments that are manufactured and made from materials such as latex, nitrile or Vinyl and which are manufactured in such a way that they are least likely to release particles and other contaminants. In various industries and particularly in clean operations they are used to enhance protection of both the products as well as the users by minimizing safety risks and conforming to governmental regulations.

Cleanroom gloves market is in high growth owing to the rising incidence of contamination in production, more in pharmaceuticals, biotechnology, electronics, and health care. These gloves especially serve an important purpose in cleanroom environments where the tiniest particles can pose risks to the product being produced. Increased awareness towards quality compliance standards and safety measures at work place is also providing the needed impetus for the use of cleanroom gloves. This type of product is still growing since more and more industries add cleanroom facilities to their production processes in order to limit the contamination of products and increase the productivity.

By product types, the nitrile and latex gloves constitutes the largest share in this industry owing to the benefits of barrier protection, comfort, and dexterity. The pharmaceutical and healthcare sectors make up the biggest market consumers because of the stringent necessity for aseptic conditions. In addition, research in glove manufacturing technology is slowly progress and super cleanroom gloves with improved characteristics including grip strength, touch sensitivity, and resistance to chemicals and punctures are being developed. Because of current trends in innovation and sustainability among the manufacturing companies cleanroom gloves that are eco-friendly and biodegradable will possibly flood the market because of high demand among customers. In summary, the market for cleanroom gloves is rising over the years due to dynamically changing rules and consistent importance of avoiding contaminants.

Cleanroom Gloves Market Trend Analysis

Demand for Contamination-Free Environments and Quality Control Expansion

- Another way that cleanroom gloves are being boosted in almost all industries is by rising need for cleaner environments or contamination-free. These gloves are important particularly in terms of controlling contamination by particles that are so vital in industries like the pharmaceutical, biotechnology, and electronics industries. As organizational management enhances recognition concerning the necessity of a controlled environment, cleanroom gloves are no longer considered luxuries. This increased emphasis on purity is due to the increasing demands for high standards of health safety and quality needed in production to eliminate chances of contamination of the final product. Thus, the market of cleanroom gloves is going to expand rapidly, as the companies focus on the safety measures’ adoption.

- In addition, increased production of medical devices has boosted the need for cleanroom gloves even further. Evaluating the trends in quality assurance measures in manufacturing industries, industries are seeking protective wearing clothes which may reduce various effects of contaminant. To this end, manufacturers are coming up with superior performance gloves that best address industry needs and specifications. By catering to the customer need with better nitrile and latex material, glove durability and user comfort have increased making them even more popular. New improvements in cleanroom technology and increasing concern for regulatory compliances are projected to boost the global cleanroom gloves market as per the dynamic and evolving needs of several markets.

Growth Drivers in the Cleanroom Gloves Market

- The current market status of cleanroom gloves is rapidly growing, mainly boosted by the growing needs from industries including pharmaceuticals, biotechnology, semiconductors, and food and beverages. As these industries grows, so too does the requirement for better cleanroom gloves, equest without a doubt that continual advancement in innovation will maintain to increase the demand for these gloves. These gloves help serve this purpose by offering the protection of shielding the delicate end products from contamination by the handler, and, at the same time, protecting the handler from the risk of exposing him or her to any nasty chemicals. In addition, growth in regulatory requirements and measures regarding hygiene and safety in production processes is also fueling the growth of these protective solutions. This information alone convinces companies to look for gloves that adhere to and even surpass stringent requirement standards that are emerging within industries.

- In the current higher market demand, the manufacturers are directing their resources towards the research and development of cleanroom gloves made from superior quality materials and adding the features of higher barrier protection, comfort and dexterity. New concepts of fabrication of gloves as well as advancement in material science not only improve the Glovability and protective characteristics of the products, but also, facilitate better mobility and flexibility on the hands during precise work. Since enhanced operational efficiency is emerging as a major priority area for many organizations high performance cleanroom gloves should grow in popularity. Further, latest global factors such as COVID 19 has led to increased focus on Health and Safety, which in turn will foster greater use of single use cleanroom gloves. This trend not only minimizes the chance of contamination but also gives market players a chance to enter new products into the market which will contribute some growth to the cleanroom gloves market.

Cleanroom Gloves Market Segment Analysis:

Cleanroom Gloves Market is Segmented on the basis of Raw Material, Category, End User, and Region

By Raw Material, Nitrile Gloves segment is expected to dominate the market during the forecast period

- Nitrile gloves are fake gloves made of acrylonitrile and butadiene copolymer to provide the gloves maximum strength, resistance to puncture, and offer them chemical resistance. These properties make nitrile gloves rather versatile and efficient used in many different spheres such as, medical, scientific, and virtually any industry. They are hardy and can mix with most substances and devices, from slicing equipment to chemicals that may be dangerous. In addition, a concern of hygiene compliance and ever-developing standards and codes in the global health crises have also seen the rise of nitrile gloves in several industries.

- Another benefit of nitrile gloves is that these are made from nitrile rather than latex, which creates a perfect glove for people with latex sensitivity. This feature alone has made them famous among the healthcare providers and in all the healthcare institutions across the world especially in cases where patients are at risk of developing allergic reactions. As reusable products get supplemented to environments that necessitate protective wearing particularly due to COVID 19, market for nitrile gloves is expected to expand immensely. It is for this reason that nitrile gloves are expected to remain in vogue for the longest time because for every incremental step made in materials technology and with the growing emphasis on standards of infection control, nitrile gloves will offer assurance to both healthcare givers and recipients.

By End User, Hospital & Clinics segment expected to held the largest share

- Medical and surgical gloves are the greatest in use in most hospitals and clinics whereby these hospitals and clinics provide the largest market for gloves using them in operation theaters, intensive care units, accident and emergency departments and out patient departments among others. Gloves are mandatory in these environments to protect the individuals against contraction of communicating diseases. It is used in healthcare with a view of minimizing cross-transmission of infection between the various patients and the practitioners by providing the health practitioners with protective barrier during examinations, treatments and operations on patients. This critical need for protective wear is due to strict health considerations, and rising health consciousness among the general public by prompting constant demand for better quality gloves.

- Healthcare industry is moving from a static to dynamic form and is rapidly growing in terms of patient traffic, increasing surgical disposals, and an added focus to health care related to preventive checkups, each according to their own specific potential requirements of sterile and non-sterile gloves. This constant emphasis on patient safety as well as proper quality patient care enhances the use of gloves in all the outlets of the healthcare sector. Due to new emergent illnesses and outbreaks around the world, there has been a rise in the demand of availability of Personal Protective Equipment (PPEs) within hospitals and clinics in order to adhere to safety measures. This not only improves the currently implemented safeguarding systems but also boosts the efficiency in the accomplishment of the healthcare missions and objectives – to provide services that medical workers can deliver with confidence and compassion.

Cleanroom Gloves Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is Expected to have the highest market share and is expected to dominate the market over the forecast period. In North America region, the cleanroom gloves market has fairly been boosted or majorly boosted by stringent regulatory standards and existence of many drug manufacturing companies. The FDA and OSHA have provided strict standards concerning cleanliness in any environment and hence, the need to wear quality gloves in cleanrooms. These regulations require manufacturers to purchase better glove technologies that will conform to compliance regulations. As the size of the pharmaceuticals market increases, and especially with the rising profile of “bio-pharmaceuticals”, there has also been a corresponding increase in the requirement for Cleanroom gloves due to an emphasis on contamination-free environments to preserve product quality and, where relevant, patient health.

- Also, new development of sustainable cleanroom gloves of high-tech is stimulating the market in North America. Advances in materials including nitrile and latex as materials of construction for gloves are making the gloves more durable, flexible and improving their barrier to contaminants. Thus, it is quite anticipated that as manufacturers still invest time in improving its products, the market will have a long time growth. The application of the automated production process and implementing quality assurance activities have provided that cleanroom gloves adhere to the best quality safety measures and efficacy. In all, the factors such as regulatory pressures, technologies and developing sector of pharmaceutical set North America as the prominent market for cleanroom gloves in global market.

Active Key Players in the Cleanroom Gloves Market:

- Semperit AG Holding,

- Dia Rubber Co. Ltd.,

- Asiatic Fiber Corporation,

- Woojin ACT Co. Ltd.,

- Kimberly-Clark Corporation,

- Riverstone Holdings,

- Careplus Group Berhad,

- UG Healthcare Corporation,

- Nitritex Limited,

- Valutek, Jiujiang Haorui Industry & Trade Co. Ltd.,

- Ansell Healthcare

- Other Active Players

|

Cleanroom Gloves Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1830.01 Billion |

|

Forecast Period 2024-32 CAGR: |

9.74% |

Market Size in 2032: |

USD 4224.14 Billion |

|

Segments Covered: |

By Raw Material |

|

|

|

By Category |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Cleanroom Gloves Market by By Raw Material (2018-2032)

4.1 Cleanroom Gloves Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Nitrile Gloves

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Vinyl Gloves

4.5 Polyisoprene Gloves

4.6 Latex Gloves

4.7 Neoprene Gloves

4.8 Others

Chapter 5: Cleanroom Gloves Market by By Category (2018-2032)

5.1 Cleanroom Gloves Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Sterile

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Non-Sterile

Chapter 6: Cleanroom Gloves Market by By End User (2018-2032)

6.1 Cleanroom Gloves Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospital & Clinics

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Pharmaceutical &

6.5 Biotechnological

6.6 Medical Device Companies

6.7 Diagnostic

6.8 Laboratories

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Cleanroom Gloves Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 SEMPERIT AG HOLDING

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 DIA RUBBER CO. LTD.

7.4 ASIATIC FIBER CORPORATION

7.5 WOOJIN ACT CO. LTD.

7.6 KIMBERLY-CLARK CORPORATION

7.7 RIVERSTONE HOLDINGS

7.8 CAREPLUS GROUP BERHAD

7.9 UG HEALTHCARE CORPORATION

7.10 NITRITEX LIMITED

7.11 VALUTEK

7.12 JIUJIANG HAORUI INDUSTRY & TRADE CO. LTD.

7.13 ANSELL HEALTHCARE

7.14 OTHER ACTIVE PLAYERS

Chapter 8: Global Cleanroom Gloves Market By Region

8.1 Overview

8.2. North America Cleanroom Gloves Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By By Raw Material

8.2.4.1 Nitrile Gloves

8.2.4.2 Vinyl Gloves

8.2.4.3 Polyisoprene Gloves

8.2.4.4 Latex Gloves

8.2.4.5 Neoprene Gloves

8.2.4.6 Others

8.2.5 Historic and Forecasted Market Size By By Category

8.2.5.1 Sterile

8.2.5.2 Non-Sterile

8.2.6 Historic and Forecasted Market Size By By End User

8.2.6.1 Hospital & Clinics

8.2.6.2 Pharmaceutical &

8.2.6.3 Biotechnological

8.2.6.4 Medical Device Companies

8.2.6.5 Diagnostic

8.2.6.6 Laboratories

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Cleanroom Gloves Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By By Raw Material

8.3.4.1 Nitrile Gloves

8.3.4.2 Vinyl Gloves

8.3.4.3 Polyisoprene Gloves

8.3.4.4 Latex Gloves

8.3.4.5 Neoprene Gloves

8.3.4.6 Others

8.3.5 Historic and Forecasted Market Size By By Category

8.3.5.1 Sterile

8.3.5.2 Non-Sterile

8.3.6 Historic and Forecasted Market Size By By End User

8.3.6.1 Hospital & Clinics

8.3.6.2 Pharmaceutical &

8.3.6.3 Biotechnological

8.3.6.4 Medical Device Companies

8.3.6.5 Diagnostic

8.3.6.6 Laboratories

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Cleanroom Gloves Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By By Raw Material

8.4.4.1 Nitrile Gloves

8.4.4.2 Vinyl Gloves

8.4.4.3 Polyisoprene Gloves

8.4.4.4 Latex Gloves

8.4.4.5 Neoprene Gloves

8.4.4.6 Others

8.4.5 Historic and Forecasted Market Size By By Category

8.4.5.1 Sterile

8.4.5.2 Non-Sterile

8.4.6 Historic and Forecasted Market Size By By End User

8.4.6.1 Hospital & Clinics

8.4.6.2 Pharmaceutical &

8.4.6.3 Biotechnological

8.4.6.4 Medical Device Companies

8.4.6.5 Diagnostic

8.4.6.6 Laboratories

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Cleanroom Gloves Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By By Raw Material

8.5.4.1 Nitrile Gloves

8.5.4.2 Vinyl Gloves

8.5.4.3 Polyisoprene Gloves

8.5.4.4 Latex Gloves

8.5.4.5 Neoprene Gloves

8.5.4.6 Others

8.5.5 Historic and Forecasted Market Size By By Category

8.5.5.1 Sterile

8.5.5.2 Non-Sterile

8.5.6 Historic and Forecasted Market Size By By End User

8.5.6.1 Hospital & Clinics

8.5.6.2 Pharmaceutical &

8.5.6.3 Biotechnological

8.5.6.4 Medical Device Companies

8.5.6.5 Diagnostic

8.5.6.6 Laboratories

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Cleanroom Gloves Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By By Raw Material

8.6.4.1 Nitrile Gloves

8.6.4.2 Vinyl Gloves

8.6.4.3 Polyisoprene Gloves

8.6.4.4 Latex Gloves

8.6.4.5 Neoprene Gloves

8.6.4.6 Others

8.6.5 Historic and Forecasted Market Size By By Category

8.6.5.1 Sterile

8.6.5.2 Non-Sterile

8.6.6 Historic and Forecasted Market Size By By End User

8.6.6.1 Hospital & Clinics

8.6.6.2 Pharmaceutical &

8.6.6.3 Biotechnological

8.6.6.4 Medical Device Companies

8.6.6.5 Diagnostic

8.6.6.6 Laboratories

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Cleanroom Gloves Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By By Raw Material

8.7.4.1 Nitrile Gloves

8.7.4.2 Vinyl Gloves

8.7.4.3 Polyisoprene Gloves

8.7.4.4 Latex Gloves

8.7.4.5 Neoprene Gloves

8.7.4.6 Others

8.7.5 Historic and Forecasted Market Size By By Category

8.7.5.1 Sterile

8.7.5.2 Non-Sterile

8.7.6 Historic and Forecasted Market Size By By End User

8.7.6.1 Hospital & Clinics

8.7.6.2 Pharmaceutical &

8.7.6.3 Biotechnological

8.7.6.4 Medical Device Companies

8.7.6.5 Diagnostic

8.7.6.6 Laboratories

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Cleanroom Gloves Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1830.01 Billion |

|

Forecast Period 2024-32 CAGR: |

9.74% |

Market Size in 2032: |

USD 4224.14 Billion |

|

Segments Covered: |

By Raw Material |

|

|

|

By Category |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Cleanroom Gloves Market research report is 2024-2032.

Semperit AG Holding, Dia Rubber Co. Ltd., Asiatic Fiber Corporation, Woojin ACT Co. Ltd., Kimberly-Clark Corporation, Riverstone Holdings, Careplus Group Berhad, UG Healthcare Corporation, Nitritex Limited, Valutek, Jiujiang Haorui Industry & Trade Co. Ltd., Ansell Healthcare and Other Active Players

The Cleanroom Gloves Market is segmented into By Raw Material, By Category, By End User and region. By Raw Material, the market is categorized into Nitrile Gloves, Vinyl Gloves, Polyisoprene Gloves, Latex Gloves, Neoprene Gloves, Others. By Category, the market is categorized into Sterile and non-sterile. By End User, the market is categorized into Hospital & Clinics, Pharmaceutical & Biotechnological, Medical Device Companies, and Diagnostic Laboratories. By region, it is analyzed across North America (U.S., Canada, Mexico), Eastern Europe (Russia, Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, The Netherlands, Italy, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New-Zealand, Rest of APAC), Middle East & Africa (Turkiye, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

The cleanroom gloves market refers to the segment of the personal protective equipment (PPE) industry that specializes in gloves designed for use in cleanroom environments, where the control of particulate contamination is crucial. These gloves are essential in industries such as pharmaceuticals, biotechnology, semiconductors, and food processing, where stringent cleanliness and hygiene standards must be maintained. Cleanroom gloves are typically made from materials like latex, nitrile, or vinyl and are manufactured to minimize the release of particles and contaminants. They play a critical role in protecting both the products being handled and the individuals using them, ensuring compliance with regulatory standards and maintaining the integrity of cleanroom operations.

Cleanroom Gloves Market Size Was Valued at USD 1830.01 Million in 2023, and is Projected to Reach USD 4224.14 Million by 2032, Growing at a CAGR of 9.74 % From 2024-2032.